Platinum mini Futures

4,359.0JPYD

−51.0−1.16%

Last update at May 5, 23:45 GMT

JPY

No trades

No news here

Looks like there's nothing to report right now

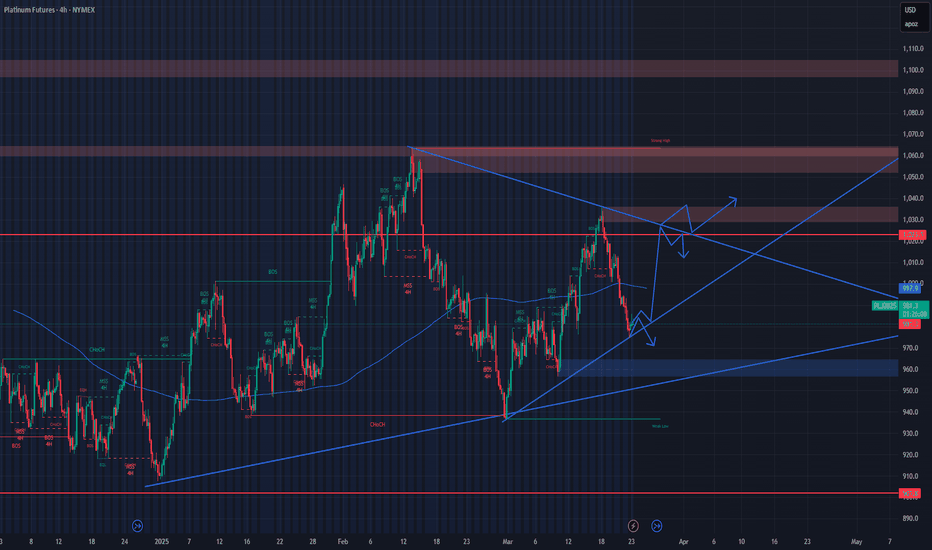

Is Platinum About to Explode? Imminent Rally!Platinum (PL1!) is currently in a technically and macroeconomically compelling setup. After a prolonged consolidation between 872–921, price has reacted strongly, forming a clear accumulation pattern supported by institutional positioning and favorable seasonality.

📈 1. Technical Analysis: Accumula

NLong

it may be a huge sell coming up from the trade entry, stop loss it may be a huge sell coming up from the trade entry, stop loss and my poteniel TP shown on the analyse as I would prefer do not marking a TP and use a trailing SL and keep my SL and TP fllowing up the trade as I keep my capital safe and put my SL on BE entry to avoid LOSSES ^_^

NShort

Platinum 4h Breaking KUMOBullish sentiment on Platinum taking into consideration options and present price action.

1st Target: 971

2nd 1004

NLong

Platinum Futures (PLN2025) Platinum Futures (PLN2025), I identified a powerful tactical insight: the 10:00–11:30 AM CST window, known as the “Decision Block.” This 90-minute stretch is when institutions often confirm their morning positions—either continuing trends or reversing moves to trap retail traders. During this time,

PL, Mar 21, 2025If NYMEX:PL1! can displace below Monthly Avg Sweep area, I will be looking to enter shorts on a retracement with Monthly Open as a target.

NShort

Platinum LongReason For Trade:

Trading in downtrend but its time for reversal

Near the daily support

Last lower high broke

Trend line broke

Above EMA 33

EP:975

SL: 962

TP: 1000

NLong

Bollinger Bands Signal Potential Breakdown in Platinum Futures

Price is currently testing the midline of the Bollinger Bands (blue line), which often acts as dynamic support/resistance.

The recent price rejection at the upper band and subsequent drop toward the midline suggests a potential continuation to the lower Bollinger Band (~940-950 range) if bearish

NShort

Acw platinum analysis for week starting 23rd Feb 2025Using previous price action 2020 Feb

We use the acw bar pattern strategy to future forecast price action in platinum

‘Should the market break previous lows and continue downward pressure, this hints that price might repeat Covid crash scenario

That said history doesn’t repeat itself but it rhym

NShort

See all ideas

Summarizing what the indicators are suggesting.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

A representation of what an asset is worth today and what the market thinks it will be worth in the future.

Displays a symbol's price movements over previous years to identify recurring trends.

TPLMM2025

Jun 2025DMarket open

4,489.0JPY+1.81%

TPLMQ2025

Aug 2025DMarket open

4,471.0JPY+1.20%

TPLMV2025

Oct 2025DMarket open

4,472.0JPY+1.89%

TPLMZ2025

Dec 2025DMarket open

4,464.5JPY−0.28%

TPLMG2026

Feb 2026DMarket open

4,371.5JPY−1.21%

TPLMJ2026

Apr 2026DMarket open

4,359.0JPY−1.16%

See all TPLM1! contracts

Frequently Asked Questions

The current price of Platinum mini Futures is 4,359.0 JPY — it has fallen −1.16% in the past 24 hours. Watch Platinum mini Futures price in more detail on the chart.

The volume of Platinum mini Futures is 490.00. Track more important stats on the Platinum mini Futures chart.

Open interest is the number of contracts held by traders in active positions — they're not closed or expired. For Platinum mini Futures this number is 470.00. You can use it to track a prevailing market trend and adjust your own strategy: declining open interest for Platinum mini Futures shows that traders are closing their positions, which means a weakening trend.

Buying or selling futures contracts depends on many factors: season, underlying commodity, your own trading strategy. So mostly it's up to you, but if you look for some certain calculations to take into account, you can study technical analysis for Platinum mini Futures. Today its technical rating is sell, but remember that market conditions change all the time, so it's always crucial to do your own research. See more of Platinum mini Futures technicals for a more comprehensive analysis.