Brent Crude bullish trend breakout ahead?The BRENT crude oil remains in a bullish trend, with recent price action showing signs of a breakout within the broader uptrend.

Support Zone: 6508 – a key level from previous consolidation. Price is currently testing or approaching this level.

A bullish rebound from 6508 would confirm ongoing ups

About CFDs on Brent Crude Oil

The Brent Сrude oil was originally produced from the Brent oilfield in the North Sea. About 2/3rds of all crude oil contracts around the globe include Brent Сrude oil, making it the most popular marker. Its relatively low density and sulphur content are the reasons why it’s described as light and sweet. One of the advantages is transportation since this type of oil is waterborne. The Brent Crude oil marker is also known as Brent Blend, London Brent and Brent petroleum and has a UKOIL ticker symbol.

The Silence Before the $70 Storm in Brent OilThe Silence Before the $70 Storm in Brent Oil

Look at the chart.

The energy market is holding its breath.

We are witnessing a classic standoff in Brent Crude.

A battle between two massive forces. And right now, nobody is winning.

🤔 On one side, we have the bears. Look at the yellow line

Oil is Boiling! 1/23/2026

After CRYPTOCAP:BTC ’s big run to $126K (now cooling off in corrective mode), Silver and Gold are pushing into new highs and closing in on their projected targets. Meanwhile, Oil popped +2.45% today and the chart is heating up — technically it looks primed for a major upside move.

With rising geo

BRENT Oil → Bullish Breakout | Capital Flow Confirmed🛢️ BRENT CRUDE OIL (UKOIL) - Energy Market Capital Flow Blueprint ⚡

Swing/Day Trade | Bullish Triangular Breakout Strategy

📊 ASSET OVERVIEW

Asset Ticker: BRENT CRUDE / UKOIL (ICE Futures Europe)

Current Price Zone: $64.12 USD/BBL (As of Jan 26, 2026)

Market Status: 📈 Bullish Formation Testing Resis

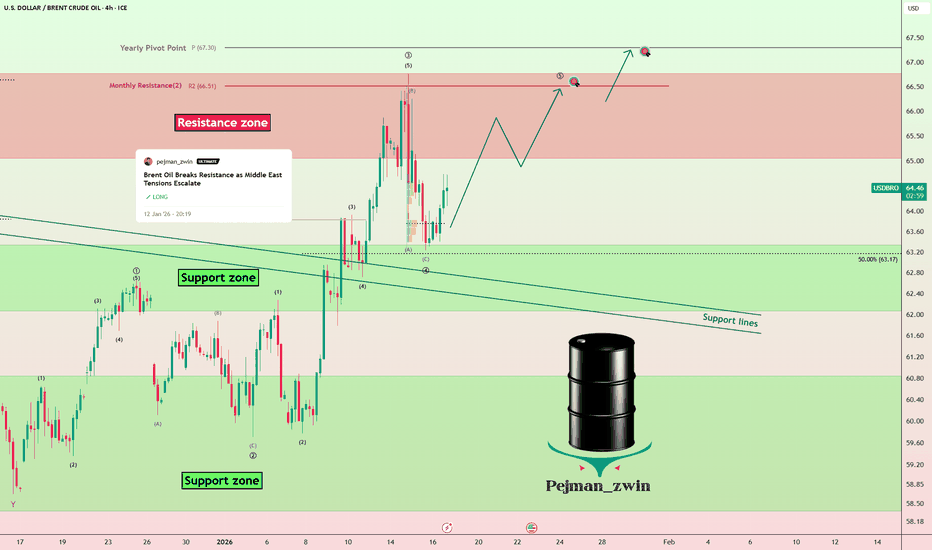

Middle East Risks Keep Brent Oil Bullish — Higher TargetsAs I expected in the previous idea , Brent Crude OIL( BLACKBULL:BRENT ) has risen and reached its targets, with a Risk-To-Reward: 2:01 (full target).

Brent Crude OIL is currently trading near the support zone($63.30-$62.00) and the support lines.

From an Elliott Wave perspective, it appears that

Brent Oil M30 HTF Discount Reaction and Bullish Continuation📝 Description

BLACKBULL:BRENT crude oil has completed a corrective pullback after a strong impulsive rally and is now stabilizing above a key short-term demand zone. Price has reacted cleanly from the SSL and lower boundary of the recent range, suggesting buyers are defending this area and prepari

UKOIL/BRENT Chart Shows That OIL Can RallyI am using UKOIL/BRENT chart because there is a direct correlation between this and any other USOIL/WTI chart.

What we have are:

1. It has been falling in a wedge pattern and is coiling. Hence a breakout sooner or later is expected.

2. It has reached an FCO zone which is acting as a good support.

Brent Crude resistance at 6758The BRENT crude oil remains in a bullish trend, with recent price action showing signs of a breakout within the broader uptrend.

Support Zone: 6508 – a key level from previous consolidation. Price is currently testing or approaching this level.

A bullish rebound from 6508 would confirm ongoing ups

Brent Oil — H4 | Bullish Continuation ScenarioBrent Oil — H4 | Bullish Continuation Scenario

Price is holding above key support after a corrective pullback, with structure favoring continuation to the upside.

🧩 Technical Overview

• On the higher timeframe, the market is forming a potential 5th wave, indicating the final impulsive phase of th

See all ideas

Displays a symbol's price movements over previous years to identify recurring trends.