Trade Idea: US30 Short ( MARKET ) Daily Chart (Macro View):

• Bearish divergence: RSI is at 47.38 and turning down — no strong bullish momentum.

• Recent bounce is sharp but came after a massive drop, suggesting a dead cat bounce or retracement.

• MACD remains heavily bearish (-836), showing underlying weakness despite the current bounce.

• Price recently rejected a key resistance near 40,850, aligning with previous support-turned-resistance levels.

15-Min Chart (Medium-Term):

• RSI is at 78.76 — overbought territory.

• Price surged parabolically, forming potential exhaustion.

• MACD shows very high positive values (672.341), usually precedes a correction.

• Potential bearish divergence between price and MACD.

3-Min Chart (Entry Timing):

• Price has stalled at the top, consolidating after an extreme spike.

• MACD and RSI are curling down.

• Ideal for timing a short entry.

⸻

Trade Idea: SHORT US30

• Entry: 40,850 (current resistance zone + psychological level)

• Stop Loss: 41,200 (above key recent highs / invalidation of setup)

• Take Profit: 39,450 (near broken structure & moving average support on lower timeframes)

Risk-to-Reward Ratio (RRR):

• Risk: 350 points

• Reward: 1,400 points

• RRR: 4:1 (excellent)

⸻

Fundamental Context (Supporting the Short Bias):

• Dow is rebounding amid broader market uncertainty (e.g., Fed rate trajectory, inflation prints).

• No strong economic catalyst justifying a sustained breakout to new highs — suggests technical bounce rather than trend reversal.

• Rising yields or a hawkish Fed outlook could reintroduce selling pressure.

FUSIONMARKETS:US30

US30 trade ideas

Falling towards pullback support?Dow Jones (US30) is falling towards the pivot and could bounce to the 50% Fibonacci resistance.

Pivot: 37,575.10

1st Support: 36,424.90

1st Resistance: 39,614.90

Risk Warning:

Trading Forex and CFDs carries a high level of risk to your capital and you should only trade with money you can afford to lose. Trading Forex and CFDs may not be suitable for all investors, so please ensure that you fully understand the risks involved and seek independent advice if necessary.

Disclaimer:

The above opinions given constitute general market commentary, and do not constitute the opinion or advice of IC Markets or any form of personal or investment advice.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, are intended only to be informative, is not an advice nor a recommendation, nor research, or a record of our trading prices, or an offer of, or solicitation for a transaction in any financial instrument and thus should not be treated as such. The information provided does not involve any specific investment objectives, financial situation and needs of any specific person who may receive it. Please be aware, that past performance is not a reliable indicator of future performance and/or results. Past Performance or Forward-looking scenarios based upon the reasonable beliefs of the third-party provider are not a guarantee of future performance. Actual results may differ materially from those anticipated in forward-looking or past performance statements. IC Markets makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast or any information supplied by any third-party.

Easy tricks to master you mind during correctionsHello,

The markets have been correcting, and fear seems to be creeping in. What most investors fail to understand is that big corrections such as this are the best opportunities handed to them. This is the best time to buy since markets are trading at the bottom. Additionally, for this time earnings season is about to kick in while this time the market is trading at the bottom. We compiled a few things that can help you remain composed in the current market environment.

A transformative book I would recommend is Trading in the Zone by Mark Douglas. Douglas brilliantly compares elite traders to world-class athletes, revealing that both achieve greatness not through luck, but through rigorous mental discipline and robust, repeatable systems. To guide you toward this coveted "zone" of peak performance, here are four indispensable strategies:

Craft a Rock-Solid Trading Plan

A well-defined trading plan is your compass in the chaotic wilderness of the markets. It spells out precise conditions for entering trades, selecting opportunities, and exiting positions. By faithfully following this blueprint, you anchor yourself in accountability, sidestepping the pitfalls of reckless, emotion-driven moves.

Maintain a Detailed Trading Journal

Think of your trading journal as a mirror reflecting your journey. Record every trade, emotion, and market insight. This disciplined habit empowers you to evaluate your performance, pinpoint weaknesses, and sharpen your approach—unlocking a deeper understanding of your own psychological triggers.

Cultivate Confidence Through Realistic Goals

Confidence isn’t bravado—it’s the quiet strength to take calculated risks and embrace the results. Build it by practicing on a demo account with the seriousness of real stakes, setting attainable targets, and celebrating small wins. This foundation turns uncertainty into opportunity.

Master the Art of Risk Management

In trading, protecting your capital is paramount. Embrace proven techniques like setting risk/reward ratios, deploying stop losses, and sizing positions sensibly. These habits don’t just shield you from ruin—they pave the way for consistent, long-term gains.

With the above rules we believe you should be able to invest or remain invested during these volatile moments. Again, remember the tariffs that have been set are the ceiling and we expect concessions to come once negotiations between countries begin.

Good luck and stay invested. As shown in the chart, this is not the first time the market is undergoing a significant correction. What's clear is that markets always recover from corrections and continue pushing higher. This further reinforces our conviction that this are the best times to begin buying.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

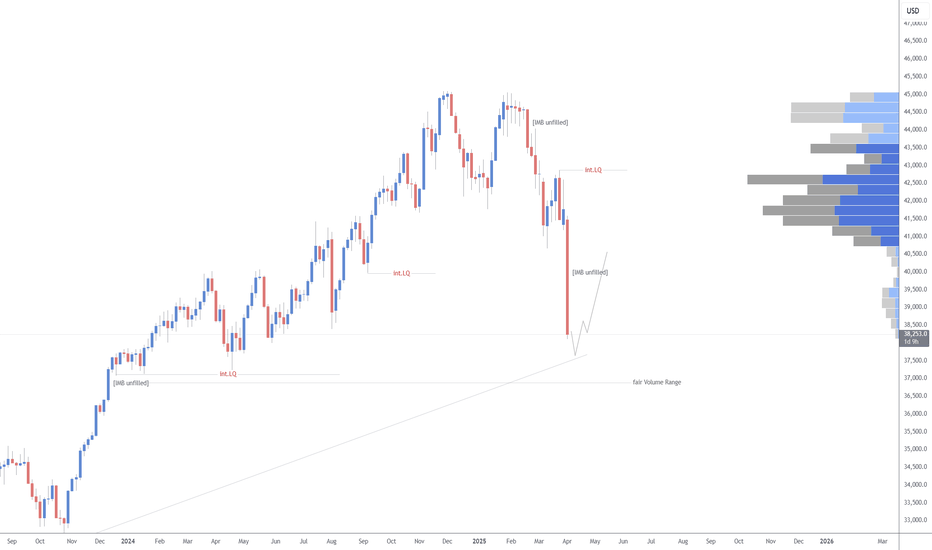

DJ is setting up for a SLINGSHOT to the upside!The "crash" in the DJ could potentially bottom out by late April or early May, at least from a cyclical standpoint. That said, there's still a risk of a further decline into June, as a panic cycle is approaching.

However, from a technical perspective, the weekly chart of the DJ reveals a significant demand imbalance that aligns with cyclical support, suggesting the potential for a major low.

Regardless, the stage is being set for a SLINGSHOT to the upside, as capital begins to flee Europe and flow into the U.S. amid rising global tensions and uncertainty.

Both the DJ and Gold are poised to reach new all-time highs ahead!

Hanzo | US30 15 min Breaks – Will Confirm the Next Move🆚 US30

The Path of Precision – Hanzo’s Market Strike

🔥 Key Levels & Breakout Strategy – 15M TF

🔥 Deep market insight – no random moves, only calculated execution.

☄️ Bullish Setup After Break Out – 40800 Zone

Price must break liquidity with high volume to confirm the move.

☄️ Bearish Setup After Break Out – 40400 Zone

Price must break liquidity with high volume to confirm the move.

🩸 15M Time Frame Confluence

————

CHoCH & Liquidity Grab @ 4850

Key Level / Equal lows Formation - 40400

Strong Rejection from 40790 – The Ultimate Pivot

Strong Rejection from 39900 – The Ultimate Pivot

🔥 1H Time Frame Confirmation

Twin Wicks @ 40500 – Liquidity Engineered

Twin Wicks @ 39850 – Liquidity Engineered

Twin Wicks @ 40800 zone – Liquidity Engineered

☄️ 4H Historical Market Memory

——

💯 2024 – Bearish Retest 38000

💯 2024 – Bearish Retest 37600

👌 The Market Has Spoken – Are You Ready to Strike?

TRADE IDEA: US30 LONG ( BUY LIMIT )

Daily Chart:

• RSI: At 24.33, it’s in oversold territory — potential for a reversal.

• MACD: Strong bearish momentum, but the histogram may be bottoming out, signaling a potential bullish divergence forming.

• Price Action: Testing key support zone near 38300, which was previously a resistance-turned-support area.

15-Minute Chart:

• RSI: At 60.68, indicating early bullish momentum.

• MACD: Bullish crossover recently occurred; histogram rising — confirming short-term upward trend.

• Price Action: Clear bounce from recent lows with higher highs and higher lows forming.

3-Minute Chart:

• Momentum clearly shifting up.

• Price moving above short-term moving average, showing intraday strength.

⸻

Fundamental Context:

• US economic data has recently shown mixed signals, but dovish Fed tone and potential rate cuts in the near future favor equity indices recovery.

• No major bearish macro headlines present at this time to sustain the steep drop.

⸻

Trade Parameters:

• Entry: 38,390 (current price zone, confirming strength above local consolidation)

• Stop Loss (SL): 38,000 (below recent lows and psychological level)

• Take Profit (TP): 39,190 (previous supply zone, daily EMA resistance area)

• Risk: 390 points

• Reward: 800 points

• RRR: 2.05:1

FUSIONMARKETS:US30

Dow Jones INTRADAY reaction to China Tariffs HikeKey Support and Resistance Levels

Resistance Level 1: 41100

Resistance Level 2: 42170

Resistance Level 3: 42800

Support Level 1: 37554

Support Level 2: 36620

Support Level 3: 35125

This communication is for informational purposes only and should not be viewed as any form of recommendation as to a particular course of action or as investment advice. It is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction. Opinions, estimates and assumptions expressed herein are made as of the date of this communication and are subject to change without notice. This communication has been prepared based upon information, including market prices, data and other information, believed to be reliable; however, Trade Nation does not warrant its completeness or accuracy. All market prices and market data contained in or attached to this communication are indicative and subject to change without notice.

#US30 – Bearish Breakdown from Rectangle Pattern | 1D AnalysisThe Dow Jones Industrial Average (DJIA) has completed a breakdown from a rectangle consolidation pattern, signaling a potential bearish continuation. The index is currently trading around 41,790, with downside momentum increasing.

Technical Analysis:

Rectangle Pattern Breakout – Bearish continuation after range-bound movement

Double Top Formation – Confirmed rejection near 45,000 resistance

Projected Target: 38,000 (as per the pattern breakdown)

Immediate Resistance: 42,000 - 43,200

Fundamental Outlook:

Market sentiment affected by interest rate policy & economic uncertainty

Weak earnings reports and recession fears could add further downside pressure

If DJIA remains below resistance, we could see further declines toward 38,000. However, a break back above 43,200 could invalidate the bearish setup. Watch for volume confirmation and macroeconomic developments!

Beyond the Noise: US30 Analysis and Actionable Trade Ideas.Technical Analysis: US30 (Dow Jones)

📊 The US30 index is currently displaying a bearish trend on the weekly timeframe. We're observing a strong rally followed by a pullback into equilibrium when measured against the previous price swing range.

🔍 At present, the index sits in a premium zone, creating conditions where short positions may be accumulating for potential downside movement. However, market sentiment remains highly susceptible to external factors, particularly political statements and social media activity from key figures like Donald Trump.

⚠️ Given this unpredictability, a more prudent approach involves shifting focus to lower timeframes and following price action signals directly. The 30-minute chart presents a defined range that offers potential trade opportunities.

💡 Trade Idea: Monitor the current range on the 30-minute timeframe. A decisive break above the range could signal a long entry opportunity, while a break below may indicate a short entry position.

📈 This range-breakout strategy allows traders to adapt to market conditions rather than attempting to predict overall market direction, which has proven increasingly challenging in the current economic and political climate.

Not financial advice.

Moustafa! My analysis and view for US 30! on 16.03.2025!- I expected a huge bearish wave would hit the index by end of December and also in January and I sat an idea for it and it was right and that is the new idea

- On the weekly frame, you would notice that the index is in a rising channel

- Formed a double top pattern and even broke the neckline of it and is supposed to go to minimum the Take profit 2 then after the retrace towards the take profit 3

- The index retraced to the upside due to the uptrend line in green and there is a possibility that it could continue the bullish run but I do not expect here that a weekly candle would close above the neckline before reaching to the below TPs

- The lower weekly candles wicks from 15.04.2024 and 05.08.2024 must be filled anyway, which is giving another confirmation to the validation of this idea concept and the continuation of the bearish wave on the weekly chart! we could see on the way some retracements on the daily frame and the lower frames, but that will not have any influence on the bigger bearish image!

- The index had broken already the uptrend line (in red) which was not broken from October 2023! and the last week candle closed under the moving average 50!

- By reaching to the TP3, means that the index would go to the lower line of the rising channel

-- Conclusion is that we are in a bearish market on the weekly chart and the real target is exactly when the index will reach to the line (in yellow)

I sat also another idea for Nasdaq

which I see also there the continuation of the big bearish wave on the weekly chart! so feel free to have a look on too! so all is going in harmony together!

Dowjones Short AnalysisDow is in downtrend now. I have used various technique in analysis. Sl is the rectangle top. And target is below arrow.

❤️ If you find this helpful and want more FREE forecasts in TradingView

. . . . . Please show your support back,

. . . . . . . . Hit the 👍 LIKE button,

. . . . . . . . . . Drop some feedback below in the comment!

❤️ Your support is very much 🙏 appreciated!❤️

Update to Dow Jones Industrials Time At Mode Back in 2015 I had published a chart with annual data for the Dow Jones Industrials. I will provide a link at the bottom.

The research for this patterning is something I did myself by hand using pencil and paper back in the 1980's. These patterns show up in all time frames.

There is plenty of room to enhance the research on this technique and a group of us gather in the chat rooms here at TradingView to discuss new trades that set up and point out when trades expire.

Notice how these two grey boxes (which are both 50% drops in price) that expand wider in time from the 1960's to the 1980's and the 2000-2010's had a multi-year trend, followed by a monster crash (1987 was 40% and 2000 was 37%) and then just two+ years later there was a secondary bear market of 20% in 1990 and 22% in 2022. Keep in mind this is just for the DJ:DJI and not the Nasdaq Composite or S&P500 which were greater corrections.

The 11-year time frame of the 1999-2011 pattern allows for an 11-year rally from 2012 (which was year 1 of the 11-year rally) shows that time expired. As you can see from the 1943-1962 trend, a smaller 5-year mode formed at the end of the 20 year trend and then the market peaked in 1972-1973 when time expired for the second, smaller mode.

I had to reconstruct this chart after the data for the previous chart changed symbol. See the link below to see the original.

I look forward to your additional research onto this pattern and its implications to the idea that we are in a similar period to 1993-1994 with rally years of 1996, 1997, 1998, 1999 and 2000 ahead of us.

All the best,

Tim

October 19, 2024 3:31PM EST

US30 — Support Holding or Further Drop? Key Levels To WatchUS30 (Dow Jones) — 4H Chart

Price is currently hovering around a key support zone near 37,000 after a strong bearish impulse.

Scenarios I'm Watching:

▸ Bullish Scenario:

If the support zone holds and price reclaims 37,500 — I would look for price to retest the 38,300-38,800 zone.

A clean break and hold above 39,500 could open doors towards the 40,000-41,000 resistance area.

▸ Bearish Scenario:

If price fails to hold this support, and breaks below 36,850 — I expect further downside towards the next key supports:

35,800

34,500

33,000

Trading Plan:

Waiting for clear price action confirmation at this support zone.

Will avoid trading in the middle of the range — prefer breakout or retest setups.

Levels marked on chart for clarity.

If you found this analysis valuable, kindly consider boosting and following for more updates.

Disclaimer: This content is intended for educational purposes only and does not constitute financial advice.

Dow Jones INTRADAY oversold bounce back Key Support and Resistance Levels

Resistance Level 1: 41100

Resistance Level 2: 42170

Resistance Level 3: 42800

Support Level 1: 37554

Support Level 2: 36620

Support Level 3: 35125

This communication is for informational purposes only and should not be viewed as any form of recommendation as to a particular course of action or as investment advice. It is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction. Opinions, estimates and assumptions expressed herein are made as of the date of this communication and are subject to change without notice. This communication has been prepared based upon information, including market prices, data and other information, believed to be reliable; however, Trade Nation does not warrant its completeness or accuracy. All market prices and market data contained in or attached to this communication are indicative and subject to change without notice.

US30: Will the Channel Hold? Trading the Intraday StructureUS30 1-Hour Analysis - Potential Trading Setup

Technical Outlook — 11 April 2025

Current Market Condition:

US30 on the 1-hour timeframe is currently trading within a short-term ascending channel, showing a recent test of the upper trendline. The price is now exhibiting signs of potential bearish pullback within this channel.

Potential Trading Setup:

Bearish Pullback Setup (Primary Scenario):

Entry: Look for confirmation of bearish rejection from the upper ascending channel trendline. This could be in the form of bearish candlestick patterns (e.g., bearish engulfing, pin bar) on the 15-minute or 30-minute timeframe after testing the channel top.

Stop Loss: Place a stop loss above the high of the rejection candle or above the upper channel trendline to protect against a potential channel breakout.

Take Profit Targets:

TP1: The middle of the ascending channel (currently around 40,600).

TP2: The lower trendline of the ascending channel (currently around 40,300 - 40,400).

Potential TP3: If the channel breaks down, the next support zone around 39,800 - 39,900.

Rationale: Trading within an ascending channel often involves buying at the lower trendline and selling at the upper trendline. The recent rejection at the channel top provides a potential short opportunity for a pullback towards the lower trendline.

Bullish Breakout Setup (Lower Probability, Requires Strong Confirmation):

Entry: Consider a long entry only upon a strong and sustained break above the upper ascending channel trendline (around 41,000). Look for strong bullish candlestick patterns and increasing volume on the breakout.

Stop Loss: Place a stop loss below the low of the breakout candle or below the upper channel trendline after it has been broken.

Take Profit Targets:

TP1: Previous swing highs or resistance levels above the channel (refer to the chart for specific levels).

Rationale: A breakout from the ascending channel could signal a continuation of bullish momentum, but requires strong confirmation to avoid false breakouts.

If you found this analysis valuable, kindly consider boosting and following for more updates.

Disclaimer: This content is intended for educational purposes only and does not constitute financial advice.