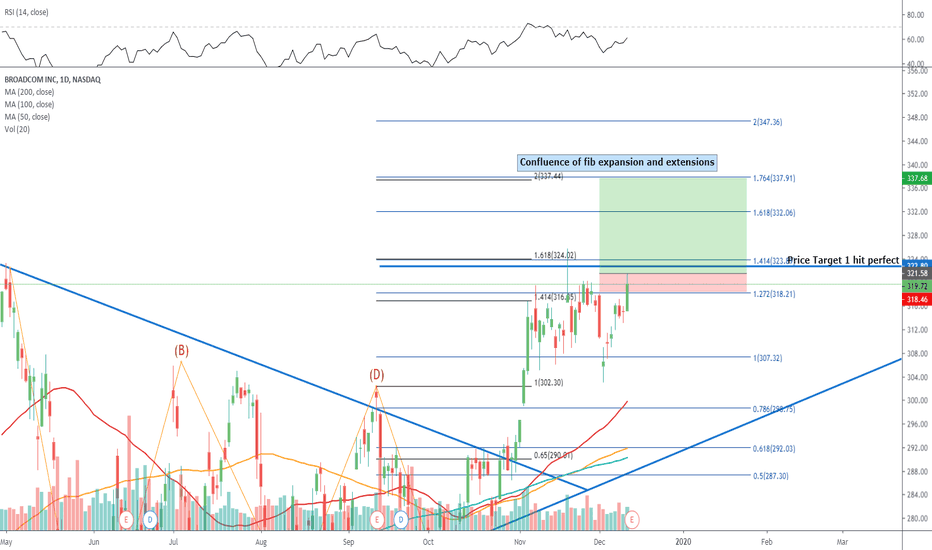

$AVGO Broadcom pre earnings trade setupEntry level $321.58 = Target price $337.68 = Stop loss $318.46

Previous target hit and now ready to break to All time highs

It is expected that a massive buyback will be announced after earnings.

Price action is bullish and sentiment great as the SEMi's signal a turnaround in the world economy.

Broadcom, Inc., is a holding company, which engages in the design, development, and supply of analog and digital semiconductor connectivity solutions. It operates through the following segments: Wired Infrastructure, Wireless Communications, Enterprise Storage, and Industrial and Other. The Wired Infrastructure segment provides semiconductor solutions for enabling the Set-top Box and broadband access markets. The Wireless Communications segment includes mobile handsets and tablets. The Enterprise Storage segment offers storage products the enable secure movement of digital data to and from host machines such as servers, personal computers, and storage systems to the underlying storage devices. The Industrial and Other segment consists of a variety of products for the general industrial and automotive markets. The company was founded in 1961 and is headquartered in San Jose, CA.

BROA trade ideas

AVGO - DAILY CHARTHi, today we are going to talk about the Broadcom Inc and its current landscape.

Huawei and its suppliers received exciting news, as the U.S. Commerce Department renewed a 90-day period extension, that grants to American companies’ permission to continue to do business with the giant Chinese telecom companies. Commerce Secretary Wilbur Ross's announcement included that the need for extension was also due to the necessity of some rural communities of the Huawei 3G and 4G networks. The extension should keep the supplying chain going, principally of the Americans ones like Broadcom Inc that have its revenues highly exposed to Huawei demand (6% of its revenue, represent by ¥2.09 billons) and have now another quarter of relief from the tension of loose a so significant company like Huawei. The concerning aspect it’s if this extension doesn't lift the results of its supplier on the next quarter, considering that the Chinese company might already be restructuring its supply chain, as the uncertainty created by the ongoing Trade War that ended blacklisting the company on the U.S. The Huawei CEO Ren Zhengfei also already have been clearly vocal that isn't concerned with the U.S decisions and said that Huawei could grow without the U.S markets.

Thank you for reading and leave your comments if you like.

To have access to our exclusive contents, join the Traders Heaven today! Link Below.

Disclaimer: All content of Golden Dragon has only educational and informational purposes, and never should be used or take it as financial advice.

AVGO - DAILY CHART Hi, today we are going to talk about AVGO

We observe a D1, some important points. The details are highlighted above.

Thank you for reading and leave your comments if you like.

Join the Traders Heaven today, for more exclusive contents!

Link bellow!

Disclaimer: All content of Golden Dragon has only educational and informational purposes, and never should use it as financial advice

$AVGO Broadcom breaking out $316 is the next resistance zone for AVGO above which will set a new All time high.

Indicators are getting a little tired and overbought so a pullback very possible.

Volume is great and indicative with a breakout.

AVGO has massive potential and is extremely well diversified as a result of aggressive acquisitions in the past decade.

Broadcom correction possibly completeBullish reversal on all indicators.

Sell side decreasing.

Lower trendline support. Approaching apex.

Elliott wave correction possibly complete.

Price target $322 13% upside to resistance.

Average analysts price target $321

Average analysts recommendation Overweight

P/E ratio 39

Yield 3.77%

Short interest 1.24%

Company profile

Broadcom, Inc., is a holding company, which engages in the design, development, and supply of analog and digital semiconductor connectivity solutions. It operates through the following segments: Wired Infrastructure, Wireless Communications, Enterprise Storage, and Industrial and Other. The Wired Infrastructure segment provides semiconductor solutions for enabling the Set-top Box and broadband access markets. The Wireless Communications segment includes mobile handsets and tablets. The Enterprise Storage segment offers storage products the enable secure movement of digital data to and from host machines such as servers, personal computers, and storage systems to the underlying storage devices. The Industrial and Other segment consists of a variety of products for the general industrial and automotive markets. The company was founded in 1961 and is headquartered in San Jose, CA.

Buying Broadcom(AVGO) bullish trend Hey guys,

Now is a great to buy the recent dip in Broadcom as the upward trend is still in place and is holding support not too far below at the 50day & 200 day moving average. The company just released earnings and the stock didn't have much of a reaction (besides selling off just like the majority of the market). I like to trade these steady/slow winners with stock options because a small % percentage win can be worth alot more with long call options.

For today, we can buy the January 2020 strike 280 call for $23.60 per contract. That contract will allow us to trade 100 shares of AVGO for $2,360 investment. If the stock returns to the $300 per share, this option will make atleast 10% in 1.5 months, and if the stock jumps within the next two weeks, we can make 20%-30%. As with all investments, their is risk. The immediate risk is that the stock could retest the 50/200 day moving average which would be a minimum of -20%. However, with our option we have 4 months for the stock to move approximately 5.5% in our direction. That 5.5% is deceiving though because you can choose to sell your option at any point. If the stock jumps 3% tomorrow, you'll be making a nice profit. You may want to sell/ hold or trade for the big trade if your trading a breakout to all time highs.

The big trade can work, although the odds are against you. But with good timing, you can make good, medium gains in the 30%-35% which are my favorite. For example, for me to make 30% and giving my options less than 2 months, I need the stock to reach $305 per share. Just 3 days ago, the stock was at $301 and all I will need is a bounce back to retest its high and go up just 1%. So in essence, it could go to $305 within weeks and not months.

Other info:

1) RSI for the stock is at 56 which is slightly bullish, but not overbought. So it has room to go higher.

2) Volatility of the stock options just sold off because of stock earnings. With volatility being cut almost in half, buying calls are preferred. Currently, IV rank is at 28%.

3) Stock touched the 50 day moving average yesterday. So in essence, we're buying it cheap over the lasts 50days.

4) Lastly, Broadcom may have a technical wedge breakout. With a breakout, the stock could easily break higher to retest all time highs at $320 a share. If that happened over the next 4 months, this option would be worth + 85%. Now I don't try to hit the big winners, but if I do, I will gladly take it.

Thanks for reading.

AVGO share prices broke through a critical trend lineAVGO - Broadcom share prices broke through a critical trend line in the previous session at 284.70 highlighted in my earlier post and pushed it further out on Thursday's trading session to 291.02 up by 2.83%. Share prices managed to close above 289.20 resistance level and will be looking to have a go at 295.45 price target. If it is successful at 295.45, then we might see a test at 303.50. The support price level remains at 289.20 and 284.70

AVGO shares jumped on hopes of a U.S.-China trade settlementAVGO- Broadcom share prices jumped from its previous close at 276.15 and opened today's session at 281.85. AVGO shares maintained its position well above 280.20 support level and finished the trading session at 283.37 up 2.65%.

The share prices currently rest at around 284.70 support level and a crucial long term resistance trend line which could determine its next move. AVGO share prices need to break and hold above the long term resistance trend line to proceed to its next target at 289.20. Share prices could retreat to 280.20 if it fails at 284.70. Price targets are estimated at 289.20, 295.45, and 300.00

AVGO Ascending Triangle ContinuationAVGO is in an ascending triangle pattern and seems to be breaking to the upside. Price closed above a key resistance point and 100dma a previous level that was rejected upon multiple gap ups. Consolidation is also above the price volume profile pivot which acted as support the last 2 pull backs. Natural extension and 1.618 fib is around the double top. I have a bullish outlook on the semi conductor sector which AVGO is a large component of so they should go up together.