Key facts today

Next report date

—

Report period

—

EPS estimate

—

Revenue estimate

—

23.8 EUR

60.24 B EUR

158.90 B EUR

2.18 B

About Meta Platforms

Sector

Industry

CEO

Mark Elliot Zuckerberg

Website

Headquarters

Menlo Park

Founded

2004

FIGI

BBG002Z340H7

Meta Platforms, Inc. engages in the development of social media applications. It builds technology that helps people connect and share, find communities, and grow businesses. It operates through the Family of Apps (FoA) and Reality Labs (RL) segments. The FoA segment consists of Facebook, Instagram, Messenger, WhatsApp, and other services. The RL segment includes augmented, mixed and virtual reality related consumer hardware, software, and content. The company was founded by Mark Elliot Zuckerberg, Dustin Moskovitz, Chris R. Hughes, Andrew McCollum, and Eduardo P. Saverin on February 4, 2004, and is headquartered in Menlo Park, CA.

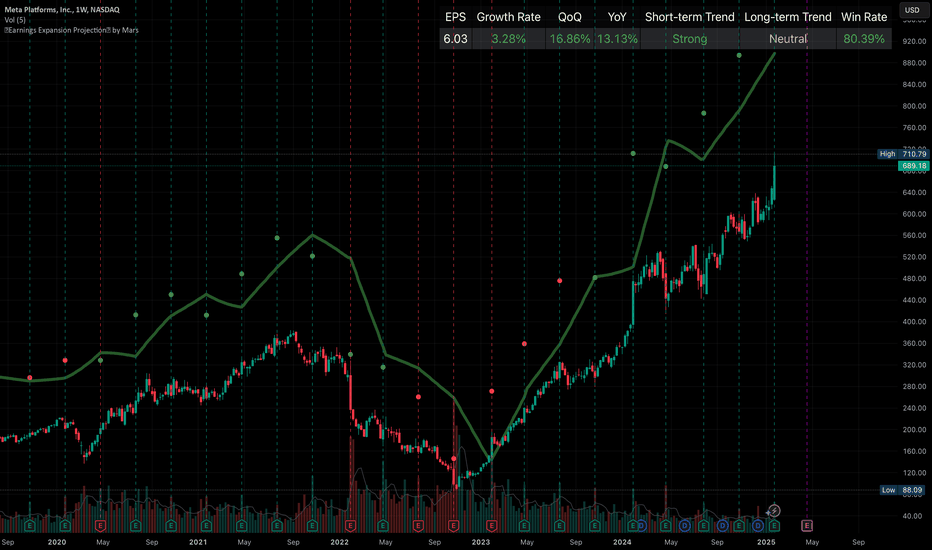

Meta Platforms - The Breakout Rally To $1.000!Meta Platforms ( NASDAQ:META ) is about to break out:

Click chart above to see the detailed analysis👆🏻

Ever since Meta Platforms - formerly known as Facebook - was listed on the Nasdaq, this stock has been creating new all time highs over and over again. Also over the past couple of months, m

I missed my entry; I will participate if....Super enjoying missing this great entry presented today. I do feel like it's to late now, we got earnings soon, and entering this high is just asking for a drawdown. Earnings can present a good entry point if earnings respect the expansion trend. No red numbers

SHORT META Ahead of Earnings Report Based on Insider Selling"Meta Platforms Insider Sold Shares Worth $22,132,922"

Mark Zuckerberg, 10% Owner, Director, Chair of Board and Chief Executive Officer, on January 15, 2025, sold 35,921 shares in [eta Platforms. Following the Form 4 filing with the SEC, Zuckerberg has control over a total of 353,696 shares of

See all ideas

An aggregate view of professional's ratings.

Displays a symbol's price movements over previous years to identify recurring trends.

Curated watchlists where FB2A is featured.

Frequently Asked Questions

The current price of FB2A is 673.0 EUR — it has increased by 1.85% in the past 24 hours. Watch META PLATFORMS INC. stock price performance more closely on the chart.

Depending on the exchange, the stock ticker may vary. For instance, on XETR exchange META PLATFORMS INC. stocks are traded under the ticker FB2A.

FB2A stock has risen by 10.35% compared to the previous week, the month change is a 17.82% rise, over the last year META PLATFORMS INC. has showed a 84.66% increase.

We've gathered analysts' opinions on META PLATFORMS INC. future price: according to them, FB2A price has a max estimate of 842.33 EUR and a min estimate of 457.26 EUR. Watch FB2A chart and read a more detailed META PLATFORMS INC. stock forecast: see what analysts think of META PLATFORMS INC. and suggest that you do with its stocks.

FB2A reached its all-time high on Jan 30, 2025 with the price of 681.8 EUR, and its all-time low was 14.0 EUR and was reached on Sep 4, 2012. View more price dynamics on FB2A chart.

See other stocks reaching their highest and lowest prices.

See other stocks reaching their highest and lowest prices.

FB2A stock is 2.69% volatile and has beta coefficient of 0.93. Track META PLATFORMS INC. stock price on the chart and check out the list of the most volatile stocks — is META PLATFORMS INC. there?

Today META PLATFORMS INC. has the market capitalization of 1.68 T, it has increased by 7.94% over the last week.

Yes, you can track META PLATFORMS INC. financials in yearly and quarterly reports right on TradingView.

META PLATFORMS INC. is going to release the next earnings report on Apr 23, 2025. Keep track of upcoming events with our Earnings Calendar.

FB2A earnings for the last quarter are 7.75 EUR per share, whereas the estimation was 6.53 EUR resulting in a 18.71% surprise. The estimated earnings for the next quarter are 5.06 EUR per share. See more details about META PLATFORMS INC. earnings.

META PLATFORMS INC. revenue for the last quarter amounts to 46.74 B EUR, despite the estimated figure of 45.40 B EUR. In the next quarter, revenue is expected to reach 40.03 B EUR.

FB2A net income for the last quarter is 20.13 B EUR, while the quarter before that showed 14.09 B EUR of net income which accounts for 42.86% change. Track more META PLATFORMS INC. financial stats to get the full picture.

Yes, FB2A dividends are paid quarterly. The last dividend per share was 0.48 EUR. As of today, Dividend Yield (TTM)% is 0.29%. Tracking META PLATFORMS INC. dividends might help you take more informed decisions.

META PLATFORMS INC. dividend yield was 0.34% in 2024, and payout ratio reached 8.38%. The year before the numbers were 0.00% and 0.00% correspondingly. See high-dividend stocks and find more opportunities for your portfolio.

As of Feb 3, 2025, the company has 74.07 K employees. See our rating of the largest employees — is META PLATFORMS INC. on this list?

EBITDA measures a company's operating performance, its growth signifies an improvement in the efficiency of a company. META PLATFORMS INC. EBITDA is 89.00 B EUR, and current EBITDA margin is 56.01%. See more stats in META PLATFORMS INC. financial statements.

Like other stocks, FB2A shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To do this, you need to open an account and follow a broker's procedures, then start trading. You can trade META PLATFORMS INC. stock right from TradingView charts — choose your broker and connect to your account.

Investing in stocks requires a comprehensive research: you should carefully study all the available data, e.g. company's financials, related news, and its technical analysis. So META PLATFORMS INC. technincal analysis shows the strong buy rating today, and its 1 week rating is strong buy. Since market conditions are prone to changes, it's worth looking a bit further into the future — according to the 1 month rating META PLATFORMS INC. stock shows the strong buy signal. See more of META PLATFORMS INC. technicals for a more comprehensive analysis.

If you're still not sure, try looking for inspiration in our curated watchlists.

If you're still not sure, try looking for inspiration in our curated watchlists.