Bitcoin’s price action has been relatively stagnant over the past couple of days, hovering around a key resistance region. The market is at a critical juncture where either more distribution is occurring or accumulation is taking place on the lower time frames. A key observation is that price has been consistently rejecting a dynamic SI resistance, forming...

In today’s analysis, we are focusing on Bitcoin’s intraday price action, where a potential triangle formation appears to be taking shape. However, more data is needed to confirm this pattern. From a non-biased perspective, price action is still projecting lower highs, and for a bullish shift to occur, we need to see a transition into higher lows. Currently,...

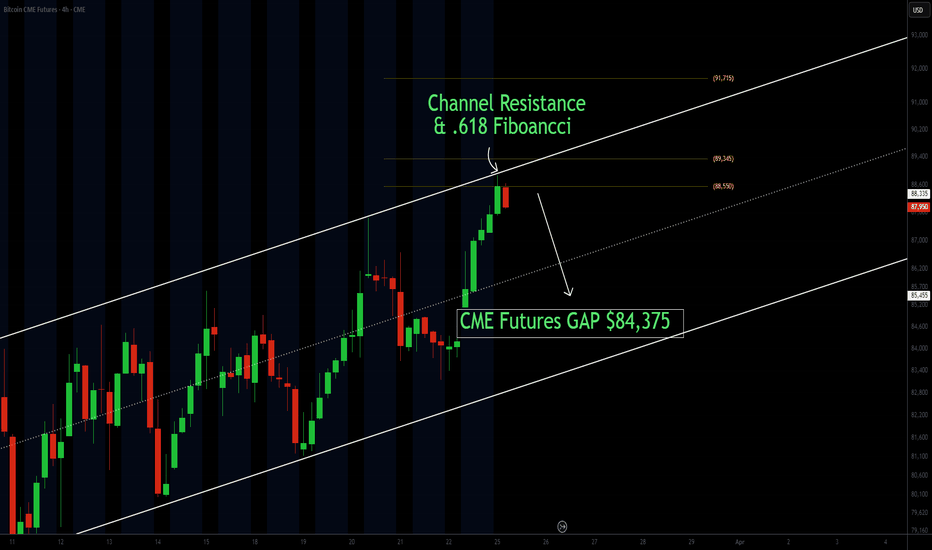

In today’s analysis, we are focusing on the CME futures chart, which has been open for trading over the past 24 hours. A key observation is the gap at $84,375, which remains unfilled despite Bitcoin’s bullish expansion on Monday. Historically, CME gaps have a high probability of being backfilled, making this an important technical level to watch. Currently,...

Fatcoin is currently testing a key technical zone on the daily timeframe, with a wick into the 0.618 Fibonacci retracement level, which aligns with both the VWAP and the value area high. A rejection at this level could lead to a retest of lower support, particularly around the bullish order block, which also confluences with the VWAP and another 0.618 Fibonacci...

Bitcoin has been trading within a rising channel formation since January 2024. The initial bullish expansion led to a breakout above this channel, where price traded for a while before ultimately breaking back below. This rejection back into the channel is a bearish signal, increasing the probability of Bitcoin testing the lower boundary of this structure....

Tesla has recently experienced a strong bearish expansion, retracing toward previous value areas and currently trading below the value area high. It is finding support at a key daily support/resistance (SR) level of $217. At this stage, Tesla is approaching a potential reversal zone, but for a long trade setup to be confirmed, we need to see consolidation on the...

Ethereum’s recent price action suggests a potential short trade if resistance holds. The market has seen an impulse move into the 0.618 Fibonacci retracement and VWAP SR support, aligning with a lower high and lower low structure. Key Points: • Testing Key Resistance: Ethereum is currently trading at the 0.618 Fibonacci level and VWAP SR support, both acting as...

Bitcoin’s recent price action remains within a defined trading channel, with most closes near the range high. This level aligns with the value area high, a major liquidity zone, and the 0.618 Fibonacci retracement, making it a critical area to monitor for potential reversals. Key Points: • Liquidity at Range High: Bitcoin is trading near the value area high,...

HyperLiquid (HYPEUSDT) has faced a sharp sell-off, leaving price action extremely oversold on the daily time frame. This sets up the potential for a relief bounce into key resistance levels. Points to Consider: • Price has formed a new daily SR level with two strong bullish closes, but the key wick remains untapped. • The swing low at $11.62 has not been...

Bitcoin remains in a local trading range as we head into the weekend, with price action showing signs of rotation and liquidity grabs. Points to Consider: • Bitcoin deviated above the range high, potentially signaling a liquidity grab or fake breakout. • A confirmed rejection back below the range high could target $76,600. • Price defended the current low and...

Hello Traders, Bitcoin remains in a local trading range, with price rejecting from the range high after a liquidity sweep. An oversold bounce is now testing resistance, and failure to reclaim the range high could trigger a move toward the range low. • Price tapped the range high, swept liquidity, and dropped back into the range. • An oversold bounce is...

The S&P 500 Index has been experiencing a sharp downturn, heavily influenced by broader macroeconomic factors such as President Trump’s tariff policies. This has had a ripple effect across risk assets, including the cryptocurrency market, which has been closely correlated with traditional markets. In this update, we analyze whether 5400 points could serve as a key...

Solana has broken below $135 support, confirming a bearish shift in market structure. The next key level is $96.85, a high-timeframe monthly support that could provide a reaction. If the Market Auction Theory plays out, a full rotation to $19 is possible, aligning with the Point of Control (POC) and value area low—a major confluence zone for...

In Today’s analysis -METISUSDT-rejecting from a clean Daily Resistance, now resting above its local Value Area High with a lower support projection. Points to consider ✍️ - Value Area High - Daily S/R Resistance - Point of Control - .618 Fibonacci S/R Support - Swing High Objective METISUSDT bouncing from Value Area High after first test, loosing this area...

In Today’s analysis -ETHBTC- bottoming around a support region that has multiple technical confluences. Points to consider ✍️ Point of Control Support - Dynamic S/R Support - Bullish Order Block Support - .618 Fibonacci Confluence - Swing High Objective ETHBTC’s market structure has been bearish for a considerable period of time, price action is currently...

In today’s analysis -ADAUSDT - trading in a high-time-frame channel with multiple confluence at an approaching resistance region allowing for a short bias. Technical Points to consider ✍️ - All-Time High VWAP Resistance - Daily S/R Support - Channel High Resistance - .618 Fibonacci/ SFP Entry - Channel Low Support - Bullish Order Block The current price action...

In today’s analysis -WIFUSDT - correcting from a strong bullish expansion, confirming a S/R Flip retest at key support will allow for a long trade. Points to consider ✍️ - Value Area High S/R Support - Declining Volume - .618 Fibonacci Support - Daily S/R Support - Swing High Objective The immediate price action is correcting, it is trading towards a region of...

In today’s analysis - PNUTUSDT - trading in a local corrective phase, an acceleration towards a key low will allow for a long trade entry. Points to consider ✍️ - Falling Wedge Pattern - Value Area Low - Value Area High -Point of Control S/R - Swing High Objective The current price action is at Value Area Low, here a bottoming structure will signify...