Other than a liquidity crunch provoking a US Dollar spike, a long term sustained US Dollar implies rising Fed fund rates. Will that happen? #usdollar #dxy #gold #fedfundrate #debt #inflation

Which setup is most likely? Looks like 2004-05 wins! But since current arc is tighter than the one 2004-05 was breaking out above, the consolidation should resolve faster. Note, all resolved UPWARDS!

34-51 months for GSR to reach 47 once 81 is breached from above. 6 months in now...

Sep 2022 or Nov 2024... GSR will touch 47! Now 6 months in. Note, there is the 2016 case where 81 was touched from below, and didn't go back to 47 straight away.

M2's distance from 1 year moving average is closing in... which signals possible bottom for gold.

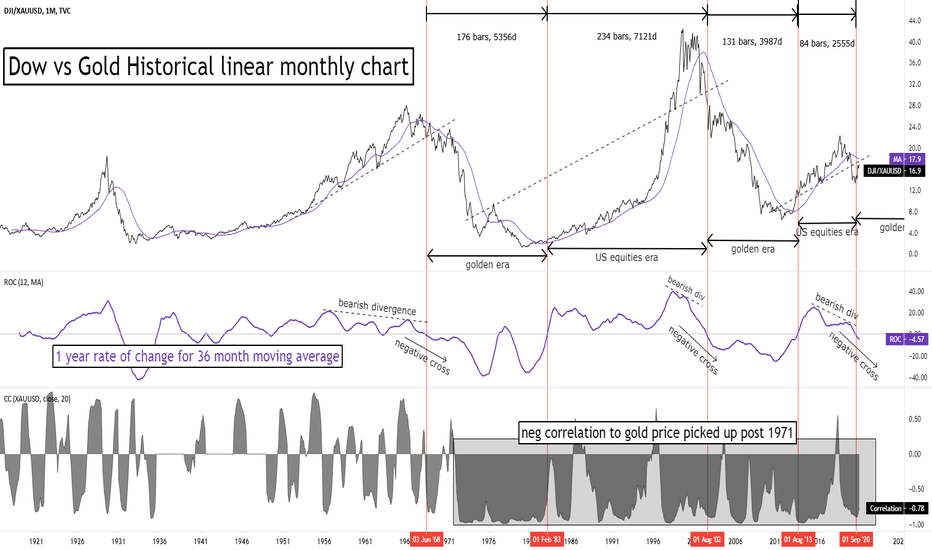

Another challenge for gold bears out there to debunk this chart... Stay civilized please!

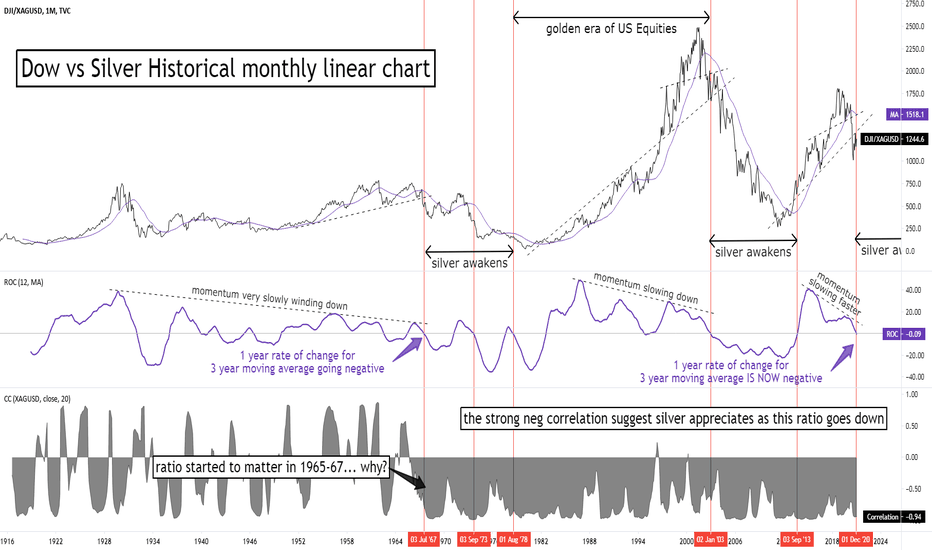

Silver bears, please debunk this.

Patience is a key. Not blind patience, smart patience. Let the market tell you when the show is over. #gold #silver #fintwit $slv $gld Is gold 5 months in or 116 months in this bull market? Also consider we corrected for 7 years. No more energy left?

Holy smokes! Most bearish chart I've shown yet!

Need more time... again!

... silver will have 2 more monster waves coming up... jacked up on fiat "end-game" debasement steroids!

Australian Dollar vs US Dollar's Quarterly Chart... a very few saw this coming... now here we are at an important breakout level. Still crickets outside of our small circle.

TSX Venture's 6 month log chart's arc complete. Confirmed breakout on 6 month candle chart. Target 2300$ in 2023-24.

45$ min target for silver... now or later.