I'm looking for the ongoing precious metal rally to take Silver to the $19.75 level, above where we can expect some resistance and possible shorting opportunities. The midpoint for this setup is circled, a clear breakout point. In addition, there is a supporting setup in the gold/silver ratio chart which may validate the case I'm making for the silver...

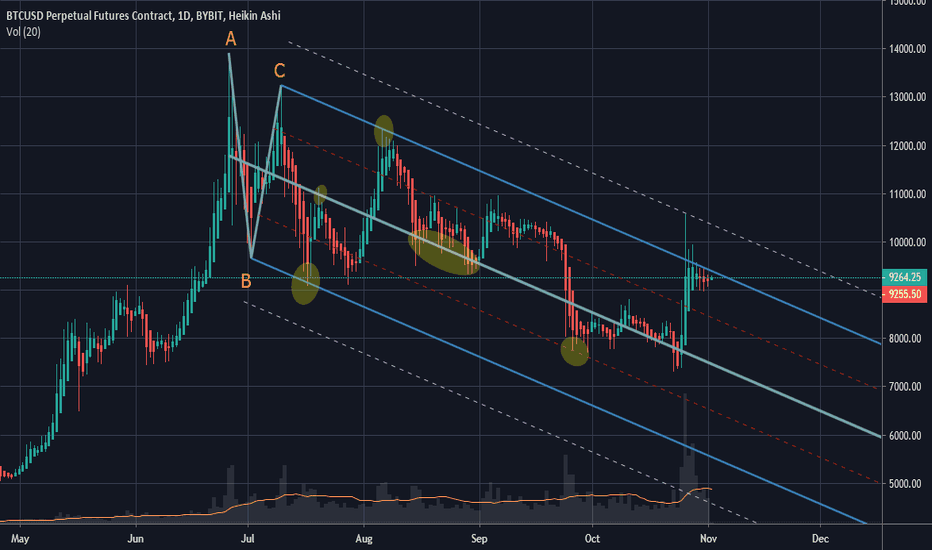

Using anchor points A,B, and C, this Schiff fork has guided price action well since the June high. A solid daily close above the upper parallel would put us back into a bullish scenario... but not until that happens!! If we drop back lower, I'm looking for lower parallels to act as support.

Despite a brief pullback from the 7400 zone posted in my previous idea, bitcoin is putting in another leg higher. Here is an updated scenario with a more bullish midpoint at the 5755 level - the level where the gradual rally since the 3100's lows went parabolic. I'm looking for topping action and a bearish reversal in the 8400-8700 zone

Current price action qualifies as a blow-off top rally. Anywhere above 7400 is a good level to consider selling longs and getting short. Midpoint is highlighted - 50% fib level goes here. It's also a doji bar on the weekly although there's some slight variation between different exchanges. This setup is lining up nicely with my XRPBTC bottoming chart posted...

XRP has been underperforming compared to BTC for all of 2019. On April 2, a sudden sharp sell-off increased the decline to an even steeper rate than beforehand - this level of about 7540.5 sats is an excellent midpoint candidate and suggests we'll bottom soon with brief spikes possible below the 4358 sats level. If this plays out I suspect it'll mark a turning...

Since anticipating a bottom on Dec. 25, we have seen a significant and vicious bear market rally - enough to scare many bears and draw some bulls back in. I'm seeing some setups now that this rally is near the end, so I'm selling longs and will be opening shorts into any further rallies this week. Here we have the Russel2000 where a significant breakout midpoint...

Pitchforks are great in that they'll tell you whether they're working or not if you're patient! Here we see multiple points where price reversed off a pitchfork level, so I'll definitely be watching this moving forward and if we approach some of the upper levels. I will have new midpoint projections re. cryptos posted soon as well. Spoiler: starting to see BTC...

Probability of a midpoint projecting a valid future reversal point is increased if multiple midpoints show confluence at the same zone. Case in point, here the Swing low A, followed by midpoint E (breakout midpoint), projected a swing high at F. However, there was a smaller swing along the way which also hinted at swing high F: Swing high B, followed by...

A somewhat more bearish scenario than the previous idea (linked) may be completing as we speak. The adjusted midpoint here is on Dec. 13 where the previous down move suddenly accelerated downward in a steep panic-selling type of move. Nevertheless this setup suggests that this selloff should be about done anywhere under the 2350 level and we should see a...

If ES can close this week above 2495 I wouldn't want to be short anymore! Here the midpoint is the split between the two consecutive green up weeks we had on Oct. 29 and Nov. 6 (circled). Price also bounced off the 2460 zone today (also circled), which was an important zone in Sept. last year - it was the launch point for a significant rally. I'm cautiously...

Is Ripple repeating a similar downmove as in early October? The October 6 bar (circled) is a midpoint candidate because all nearby price action to it's left is higher, while all nearby price action to it's right is lower - it was a significant "step down". Indeed, this midpoint projected the 0.38 significant low. The Nov. 24 bar (also circled) is a midpoint...

Please take a quick look at my previous longer-term ETHUSD chart (linked) which shows the importance of the red trendline. Price is now approaching this trendline at last. We want to see a quick waterfall sell-off over the next few days that will seriously test this trendline and form some nice V-bottom type price action to bring this bear market to an end...

A nice high-probability midpoint here (circled) - the midpoint here is the price level where strong upwards momentum suddenly erupted (50% fib level goes here). Target zone is roughly 121'05 and up. Looking for stocks to put in at least a swing low when bonds hit this level.

In my previous crypto idea (linked), I updated and mentioned the critical 3900 level I was watching which needed to hold to have a chance for bitcoin to prove that a major bottom was put in on Nov. 25. It was not to be - the 3900 zone has failed and I'm currently looking for the 3530 level as an initial bearish target given by the highlighted midpoint here (50%...

The big Sunday night gap saw the Russel blow past my target and actually top out at the 127% extension of 1560 rather than the previously posted (linked) 1540 level. Stock indeces are currently filling much of this major gap, in fact the Russel has already filled it while the S&P500 and DOW and especially the NASDAQ have seen more strength keeping their gaps...

There was no further significant sell-off after the Nov. 25 bottom and we currently have what appears to be a double bottom. Swing 1 was an initial bounce off the lows putting a halt to the bearish trend. Much more importantly, we are currently in swing 2 which put in a double bottom and has exceeded the highs of swing 1 in a 20%+ move. This puts "the bottom is...

Looking for Russel 2000 to rally into 1540+ zone before any interest in shorts. Midpoint highlighted at the 1501 level. 50% fib goes here.

As the crypto descent continues, this chart has more of my attention than anything else right now. First published on Oct. 29 (linked), price was around $200 at the time and I thought a %50 drop to $100 was unlikely. But with the recent carnage and current price of $125, this setup is very much in play. Expecting a final down wave to test below $100. I'll be...