GOLDFXCC

Premium💡Why Gold Pulled Back - Gold pulled back today after hitting $3439.04, just below resistance at $3451.53. Traders took profits ahead of key Fed and trade headlines. Right now, it’s trading around $3414.48, down 0.50%. - The dip came after the U.S.-Japan trade deal eased geopolitical tension, cutting safe-haven demand. Plus, U.S. bond yields are climbing (10-year...

Gold Prices: Bearish Engulfing Pattern Challenges Short-Term Uptrend - Gold continues to face downward pressure after failing to break above the 20-day moving average for the sixth consecutive session. Tuesday’s price action formed a bearish engulfing candlestick, engulfing Monday’s body and closing in the lower half of the day’s range. This signals growing...

Potential for a bullish pullback on the USDCHF which could lead to a price movement towards the resistance level at 0.85600. BUY levels from 0.79600

Potential for a bullish pullback on the CADCHF 1D which could lead to a price movement towards the resistance level at 0.61200. BUY levels from 0.58400

Potential for a bullish pullback on the GBPUSD M30 which could lead to a price movement towards the resistance level at 1.37200. BUY levels from 1.36400

Potential for a bullish pullback on the USDCAD H4 which could lead to a price movement towards the resistance level at 1.13800. BUY levels from 1.13600

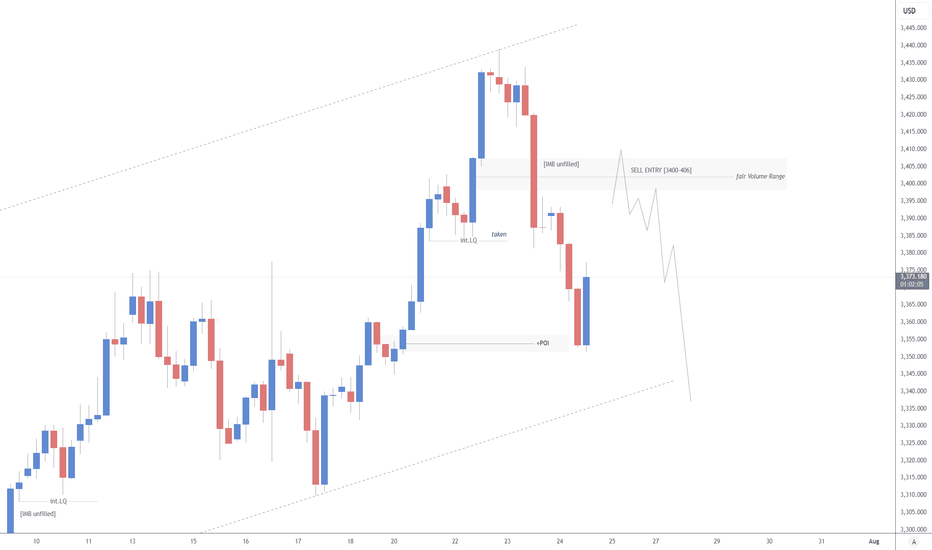

Potential for a bearish pullback on the XAUEUR H9 which could lead to a price movement towards the support level at 2800. SELL levels from 2918

Gold Holds Steady as Focus Shifts to Fed Policy Over Geopolitical Risk - Gold prices remained resilient. The US Dollar Index slipped 0.23% to 97.74, while U.S. equities ended mixed as markets braced for Federal Reserve policy signals. - The Israel-Iran ceasefire has eased geopolitical concerns, typically a bearish signal for gold. However, the metal’s continued...

Gold, Silver, Platinum Outlook – Gold Eyes Breakout as Dollar Weakens - Gold is gaining momentum and approaching a major breakout level near $3,350, supported by a weakening U.S. dollar, rising Treasury yields, and renewed safe-haven demand. A recent U.S. credit downgrade, driven by fiscal concerns, has added pressure on the dollar and boosted interest in hard...

Gold Surges Amid Escalating Trade Tensions and Geopolitical Uncertainty - Gold prices rose sharply as investors reacted to rising global uncertainties. This is the highest level gold has reached in the past three weeks. - The rally was mainly driven by two major developments. First, trade tensions between the United States and China worsened. President Trump...

Potential for a bullish pullback on the GBPCHF H4 which could lead to a price movement towards the resistance level at 1.13400. BUY levels from 1.10300

Potential for a bearish pullback on the EURUSD H12 which could lead to a price movement towards the support level at 1.08900. SELL levels from 1.13200

Potential for a bullish pullback on the AUDNZD H8 which could lead to a price movement towards the resistance level at 1.09000. BUY levels from 1.08300

Potential for a bearish pullback on the XAGUSD H4 which could lead to a price movement towards the support level at 30.600. SELL levels from 33.600

XAUUSD& SILVER—Risk-On Mood Pressures Prices, Fed Easing Eyed - Gold and silver prices experienced downward pressure during Friday’s Asian trading session, as a resurgence in risk appetite prompted investors to move away from safe-haven assets. Gold (XAU/USD) fell from an early high of $3,370 to $3,316, while silver (XAG/USD) dipped near $33.44, though it...

Potential for a bullish pullback on the SP500 H4 which could lead to a price movement towards the resistance level at 5620. BUY levels from 5500

Potential for a bullish pullback on the US30 1D which could lead to a price movement towards the resistance level at 42200. BUY levels from 39600

Gold prices have soared to a new record high of $3,500 per ounce, fueled by a weakening U.S. dollar and escalating concerns over Federal Reserve policies and trade tensions. The dollar index has fallen to 98.164, prompting investors to seek refuge in gold as a safe-haven asset. This surge reflects a strong bullish sentiment, with traders buying into the rally...