Khainen

Price rejecting and breaking out the support at 60 with good volume. Target 1 will be the bottom of the short term trend channel at 55 and Target 2 at the bottom of the main trend channel at 50. Stops above the piercing pattern at 62.

Price is at an area of previous resistance and has almost completed a bearish flag pattern. If it completes the flag and breaks down, it might go till around 80 which is the all time low and it confirms with the 1.27 fibonacci extension. Stop loss could be placed at 130. Intermediate targets would be at 111 and 100. In short, SL : 130 Targets: 111 / 100 / 80

Entry above 165 Stops at 161.70 or 157.70 Target 183

Entry above 1104 Stops at 1060 Target 1220 Partial profit booking at 1180

Entry at or above 779 Stop loss = 704 Target 1 = 839 Target 2 = 878

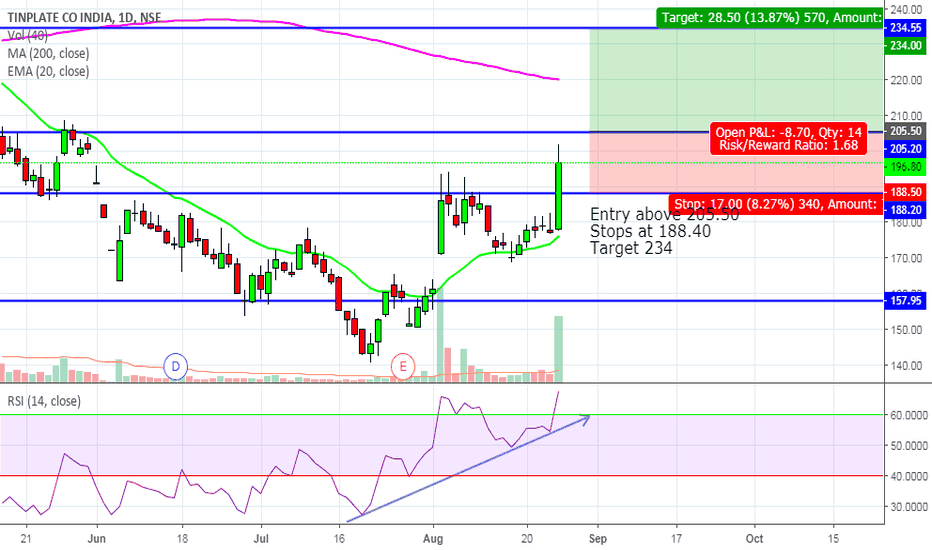

Close above the month high with more than 5 times the average volume. The latest price has closed above 50ema and is expected to cross 200ema soon with RSI showing a clear positive divergence and value of 67.61. Entry above 205.50 Stops at 188.40 Target 234

Enter at or above 38 Stop loss 33.30 Target 1 = 40 Target 2 = 48

Buy at or above 30.80 Stop loss 28 Target 1 = 34.20 Target 2 = 38

Price closed above previous 3 months high with almost double the average volume. Price crossed above 200 ema line with a positive divergence on RSI, standing above 60 indicating a bullish momentum. Entry above 76 Stops at 73 Target 83.40