YTD 4 HR chart and the planets are aligned. Looks or if 20,142 is rejection zone, we may retest 19,400. Long above 20,142 and Short below. 17,027 is 2024 Open Price, FYI. Follower's, I am taking a few weeks off and will Post what I can. Do not chase, remind yourself the O/N is The BOSS and has magical powers. Why is there a -7% limit down and NO limit UP? 30M Chart

I may be early (or excited) with the call, it is on the way. O/N lift play is loosing the effectiveness, NAZ needs that for stability (and drop offsets). Anyway, should be on the way tomorrow. Any drop will have to get in front of the Friday-Monday long play (longer overnight trick). Under 19,665 is the express freight train lower and a hold will try another U Turn.

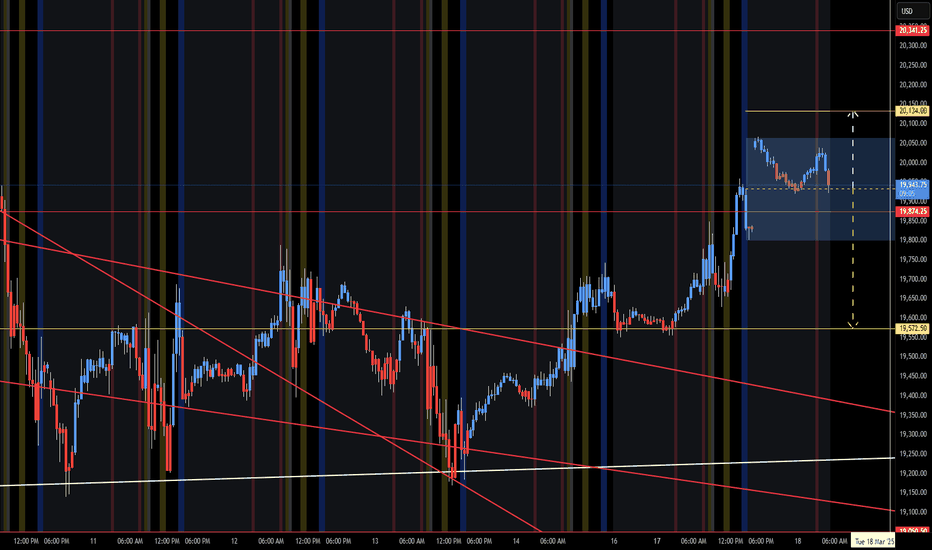

NAZ TLX 19,767 is long above and short below, Scalp inside yellow vertical arrow range until break out. Garbage Day #2 (recycle). We may need some media, spin, etc. to lift it or lower we go. O/N seems to be loosing upward rig force and Reg Session seems to sell off. Today should be interesting.

Contract change gap, notice how most overnight moves are mostly up (including contract changes). Arrows are the range for break out and next move. U Turn move from low is being held up with tricks/games, get ready for the drop. NAZ staying in white arrow range on 4 HR Chart below.

Monday and 2nd half of Long Play from Friday. Arrow is range and not expecting much. Sideways to snail move higher or Monday pop stall out and drop to lower yellow arrow or below. FYI, the weaker and slower the NAZ moves the higher is can just snail/inchworm higher into the next O/N safe zone. Careful Shorting 1st, wait for the fake/dirty move higher to fizzle out.

Wall Street will try and fix Washington Street's bad money manager (Your Fired). S/P at -10 and the NAZ was in front at -14% (from ATH). The NAZ will be used to help hold the it all together as we approach the true Danger Zone level (of NAZ and S/P). Look for the old Long side tricks to be played, starting with the Friday-Monday Long Rally and overnight weekend...

Long at 3-4am in O/N, Long still Mopping out. Under Shaded Zone is strong Short and above is Long.

Staying with the Long and U Turn Pop up retest higher. Bigger move after Pop Stall out. Yesterday's Post Scalp trades in the range did show the build or positioning for a Long move next. Will update as we go, the BTD/FOMO's showing up from Spring Break but may be hungover so give then a day or so.

NAZ is at U Turn #2 and third triangle Key Level. You would think we would see a bounce as we are 13% from ATH and 13% from 2024 Open Price. Follow KL's lower for support or look for any bounce 1st, then to stall and drop. NAZ has no strength and much of the prior strength (past few years) came in the O/N (overnight). BTD/FOMO's are on at the Tiki Bar on Spring...

Going back to Daily Post updates from weekly, during these very fun times (selling is back). I would not count of a Gap move at Sunday O/N open. No gap, look for 1st move set up with counter move as larger move. KL's to watch 20,470 Upper & 19,874 Lower. Blue shaded zone is sideways or Upper KL rejection pull back zone / Lower KL support lift zone. White SZ (near...

NAZ Triangle, things may get scary under KL 695. Looking back at previous Post's will help with the forward forecast. The NAZ has been slowly (since 11/24) setting up the drop/test to the "Turd Zone" 20,695 (1st yellow circle). The drop is a correction at -10%, the next move may be an 85% retracement back up (2nd yellow circle) and if the KL 695 rejects the NAZ...

The NAZ did hit the 20,695 "Turd" Target in last week's Post. Nearly a 2,000 point drop when you look at 2/21 (Friday) to the low of 2/28 (Friday). From late Friday we have a 500 point move up (normal), need to see if the Monday Long push (2nd half of typical Friday) takes place. NAZ is falling in a Diablo, Yellow arrows are KL's (long to and short from), Whites...

NQ 2/18 Post was playing off the Gap Fill & Drop (white arrow to the left). KL 20,695 just sticks out like "Turd in a Punchbowl", also near Box bottom. KL 21,400 is medium Danger Zone level and expect a U Turn should we get there, no U Turn then 20,695 express 1 way NAZ freight train (trains only go 1 way, Freight's move with heavy FORCE). Notice how many...

NAZ took road to upper Target of my (2/10/25) Post. I am looking Short and may be early since we have a Holiday (O/N) session which usually leads to low volume Long only air balloon rides. Chart for this week: Shaded Zone (SZ) is Gap Fill (December contract change) with yellow dash as mid level. NAZ will need to get above SZ, ML SZ and mid level of long term...

NQ Range has been the play since 11/24, range range range. Breakout already, we have seen three Friday's in a row where the NAZ sells off (the opposite of past 2 years). Unless Monday redirects this one (will need off session O/N Mystery Magic), we could break range and move to the Yellow Brick Arrow. NAZ is on Danger Zone TL now, 21,250 is 1st lower retest, then...

Another Friday high to Sunday/Monday O/N low of 1,000 points or more, new pattern? The drops are in the off session with gaps. BTD/FOMO's are trapped (is what I see). NAZ at 21,256 (2025 Open Price), under Danger Zone TL (Orange TL above) and near channel bottom. White arrow is range for break out and 20,695 is TLX Spoke level that is the Danger Zone Express Lane...

Final week of the 1st month, so far not much has changed with intraday Price Action. The original Danger Zone TL (Orange) now has a lower long term TL that may be an indication that the Danger Zone is dropping (NAZ may start to experience lower lows and start a decline). Short below 22,200 and Long above. 19,200 is Strong Long Zone, we did retest U Turn Zone #1...

Basically we are 2 weeks into 2025 and 2 weeks until month end. The games have not changed and are still working, just fine. The battle continues to be between the Overnight (O/N) and Regular Session price action. O/N moves up and Reg Session is sideways to lower (struggling lower). Yellow arrow is 12/18 and a Reg Session route. This was after 11 trading days with...