The CAD/JPY market continues to show bullish strength, forming a clear sequence of higher highs and higher lows. On the daily timeframe, an inside bar pattern has emerged, indicating a period of consolidation that may lead to a bullish continuation, especially with the candle closing above the 105.000 level. At the moment, the price is testing Monday’s high, and...

The LINK/USDT pair has shown strong bullish momentum on the 1-hour timeframe, breaking above both the 15.00 level and a downward trendline. On the daily chart, four consecutive bullish candles reflect persistent buying pressure. Recent movements suggest an ABC pattern is unfolding, hinting at a potential push toward the 17.00 resistance level. With momentum...

The TRX/USDT market recently saw a false breakout below a key support level, followed by a rebound toward the upper boundary of the channel. On the broader timeframe, the price has been in a two-month consolidation, forming a range near the 0.2200 support, which has held firm through multiple tests. This consistent rebound highlights the significance of the...

The GBP/JPY market is currently developing an ABC pattern, with point C forming near the 196.000 level. Recently, the price broke above both a downward trendline and the 194.000 support, signaling a potential shift in momentum. At present, the pair is testing last week’s high, which aligns with the 195.000 psychological level. A strong bullish candle has emerged...

XAU/USD closed its third straight bullish week, with price testing Tuesday’s low before rebounding and closing near the 50% mark of the weekly range. Despite a brief dip, the candle closed above last week’s high, showing continued strength. A breakout above the 3,000 level raises the potential for further gains, especially if the market opens with a gap up. On...

The EUR/USD market remains in a consolidation phase just below the November 2024 low. Recently, the price experienced false breakouts beneath both a key support level and last week's low, followed by a strong bullish rebound. This pattern suggests a likelihood of continued sideways movement in the near term. At present, the price is testing the previous day’s...

On the 1-hour timeframe, the BTC/USDT market is exhibiting a clear uptrend, marked by higher highs and higher lows. The recent break above a downward trendline led to an extended move upward, bringing the price to a test of last week’s high, where a potential pullback could emerge. Zooming out, the broader structure reveals the formation of an ABC pattern, with...

The TON/USDT market experienced a 20% surge following unexpected news that Telegram founder Pavel Durov had regained his passport, enabling unrestricted travel. This bullish momentum led the price to rebound from support and approach the 4.00 resistance zone. However, as the price neared this key resistance, momentum began to slow, and signs of a bearish...

After a bearish move, the USD/CAD pair staged a pullback, forming a long-tailed candle on the daily timeframe that points to a potential retest of the zone above the 1.4200 level. Currently, the market is trading sideways, positioned just above the previous day's low. If the price breaks and closes below this low, it may attempt to retest the support zone...

AVAXUSDT has been steadily climbing after rebounding from a crucial support level and is now testing last week's high, a level that has repeatedly held firm. Additionally, the price continues to respect the established upward trendline. However, on higher timeframes, the overall market sentiment remains strongly bearish, with prices falling below the August 2024...

The NZD/JPY pair has been in a bullish trend for the past two weeks but has now encountered resistance, leading to sideways movement around this level. On the daily timeframe, a rejection candle has formed, though the price has yet to retest the February high, where liquidity remains. There is a possibility that the price may attempt to capture this liquidity...

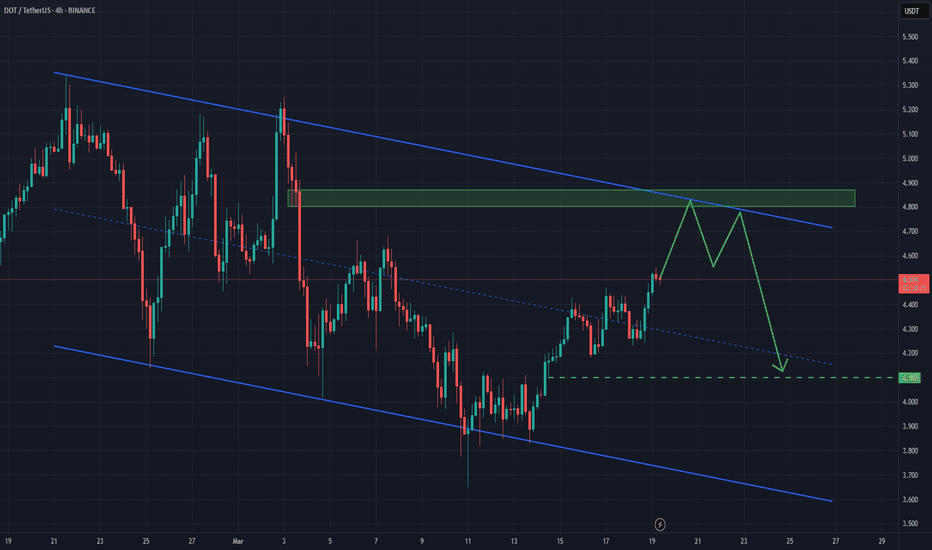

The DOT/USDT market has recently rebounded from a previously tested level from November. Following this bounce, the price appears to be forming an ABC pullback, moving towards the channel boundary. Historical price action shows that the market has consistently respected the resistance zone, reinforcing the prevailing bearish trend. Given this setup, the market is...

The AUD/CHF pair continues to oscillate within a range between 0.56550 and 0.55000, recently reaching the upper boundary. Following a rebound from the support level, the price has developed an ABC move, which often precedes a pullback. Currently, the market has approached the upper boundary of the channel and trendline, a level where price has previously faced...

The ETH/USDT pair continues to decline, approaching a key support level last tested in October 2023. Historically, similar price movements were observed in 2021, when the price dropped from the 4,300 level before rebounding from the 1,700 support zone, ultimately leading to new all-time highs. Currently, the price has broken above a downward trendline that had...

The EUR/USD pair continues to consolidate after experiencing strong bullish momentum. Since Tuesday, the price has primarily been moving sideways, remaining within a defined range. The market is currently positioned at a key resistance zone, yet no significant pullback was observed last week. At this stage, the price appears likely to continue ranging before...

The BTC/USDT market is currently consolidating above the 80,000 level after breaking below February's low. Recently, a large weekly doji candle has emerged, signaling ongoing sideways movement. At present, the price remains within this week's trading range. From a broader perspective, price action appears to be narrowing, forming a falling wedge pattern. With the...

The EURGBP market recently tested the November high, creating a false breakout on the 4-hour timeframe after sweeping liquidity above the 0.84500 level. Following five consecutive bullish days, a retracement may be on the horizon. Despite the price continuing to register higher highs, a bearish divergence has emerged, signaling a potential loss of upward...

The SHIBUSDT market has moved lower, forming an ABCD pullback. A false breakout occurred below the lows of the last three weeks, resulting in a long-tailed bar on the weekly timeframe. The market has adhered to the downward trendline and recently rebounded from it. With the price now climbing back above the previous weekly lows (PWLs), there is a potential for it...