RupinGoh

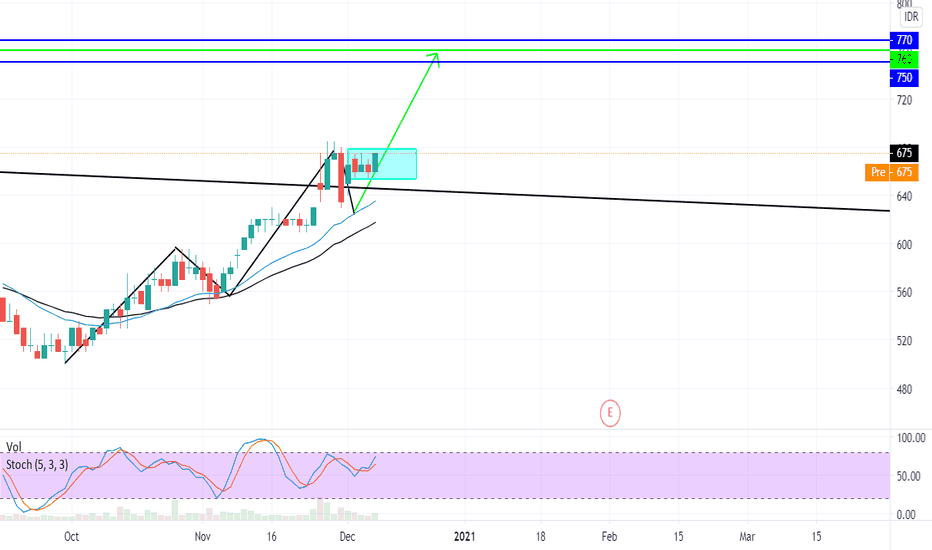

WE KNOW THAT DOW THEORY IS PRIMARY SECONDARY AND PRIMARY AGAIN THE MARKET ALREADY SECONDARY REACTION AND NOW BJTM IS MAKING A BASE, A BASE IS LIKE A CAGE WHICH THE PRICE TRAP INSIDE THE CAGE, WE HAVE TO WAIT THE CONFIRMATION OF THE BREAKOUT OF THE CAGE, IF BREAKOUT THAN THE PRICE WILL RALLY MAKING HIS PRIMARY REACTION AGAIN, THE TARGET PRICE AREA WILL BE 750 -...

ELLIOTT WAVE HAVE 5 WAVE BEFORE DO HIS CORRECTIVE WAVE, PGAS CURRENTLY IN WAVE 3 TO 4 ELLIOTT WAVE, WAVE 1 - 2 ALREADY VALID @0.618 ELLIOT WAVE, WAVE 2-3 VALID 1.618 WE HAVE TO WAIT THE SECONDARY REACTION OF WAVE 3 - 4 @0.382 AND WE CAN ENTER AT THAT POINT WITH BULLISH HARAMI CANDLESTICK (THE INSIDE BAR) OR HAMMER, ENGULFING WHATEVER IT IS FOR THE ENTRY AND...

BTPS FORMING A PATTERN CALLED BULLISH FLAG, THIS PATTERN CAN LEAD BTPS TO @4790 (BUT HAVE TO BREAK THE FLAG TRENDLINE FIRST!) AFTER BREAK AND THAT DAY THE CANDLE CLOSED ABOVE THE TRENDLINE IS THE KEY TO 4790 AFTER BREAK AND RALLY, PRICE HAVE TO RE-TEST (PULLBACK/SECONDARY REACTION) TO THE TRENDLINE. CUTLOSS AREA @ 3930 OR BREAK THE LOWER TRENDLINE OF THE BTPS....

A BULLISH PENNANT IS A PATTERN OF CONTINUATION, KAEF ALREADY FORMED AND BREAK THE PENNANT TRENDLINE, WHICH WILL LEAD KAEF TO AROUND 3750-3800 FOR THE FIRST TARGET PRICE. BEFORE START BULLISH IT MIGHT BE A PULL BACK TO THE AREA I MARK WITH A BLUE RECTANGLE (@3300~) IDX:KAEF THE FIRST TARGET PRICE IS 3750 - 3950 (REASON: PENNANT TARGET PRICE) THE SECOND TARGET...

TLKM BULLISH REVERSAL AFTER SEVERAL ROUGH MONTHS OF ITS BEARISHNESS, TLKM START REVERSE TO BULLISH, FROM DOW THEORY WE KNOW THAT MARKET MOVE IN A PRIMARY, SECONDARY AND FOLLOWED BY PRIMARY AGAIN JUST LIKE AB = CD, TLKM ALREADY DO HIS PRIMARY AND SECONDARY BULLISH REACTION, NOW TLKM START TO FORMING HIS PRIMARY REACTION WHICH WILL LEAD TLKM TO AROUND 3700 -...

BBKP IS FORMING A PATTERN CALLED THE RISING WEDGE, THIS PATTERN CAN DRAG DOWN BBKP TO 248 - 220 248 IS THE TARGET WHERE THE PAST GOT CONSOLIDATE AND BREAK UPSIDE AFTER RETEST THE PRICE STOP AT THE CONSOLIDATE SUPPORT. 220 IS THE RISING WEDGE ITSELF LAST TARGET SO WHOEVER HOLD BBKP CAN MAKE A TRADING PLAN AVG AT BOTTOM? (WAIT THE NEXT UPDATE) DISCLAIMER ON! -RUPIN

AFTER THE RISING WEDGE PATTERN FAILED AND THE PRICE IMPULSIVELY RISE AND BREAK THE ALL TIME HIGH PRICE WHERE IS THE RESISTANCE? WHERE WILL BITCOIN STOP AND DO HIS SECONDARY REACTION? (DOW THEORY) IN HERE I WILL USE THE GOLDEN RATIO 2.618 OF XAY FIBONACCI EXTERNAL RETRACEMENT AND THE PRICE WILLBE STOP AT 371.707B DISCLAIMER ON!

WKST IS MAKING AN ABCD PATTERN OR PRIMARY - SECONDARY -PRIMARY AND NOW SHOULD MAKE A SECONDARY REACTION BEFORE GOING UP TO ITS TARGET PRICE AT 940 ~ 1010 AREA.EVEN THOUGH THE WEEKLY CHART IS BEARISH TREND, WE CAN PLAN A SHORT TERM TRADE (AFTER THE SECONDARY REACTION IS CREATED OR WE HAVE TO DECIDE WILL THE MARKET DIRECTLY GO TO 940 - 1010 AREA?, WE CAN USE...

BBRI FORMING A CUP AND HANDLE PATTERN WHICH MEAN THIS PATTERN CAN BRING BBRI TO 4130 FOR THE FIRST TARGET PRICE AND THE SECOND TARGET PRICE WILL BE AT 4460 BUT BBRI WILL DO HIS 2NDARY REACTION DUE TO 1. STOCHASTIC OVERBOUGHT AREA, 2. DOW THEORY WHICH EVERY MARKET MOVE HAVE PRIMARY AND SECONDARY REACTION, 3. GAP AREA HAVE TO BE CLOSED! 4. CUP AND HANDLE PATTERN!

EN : WE CAN SEE THAT ADRO IS MAKING A BULLISH CONTINUATION AND NOW IS THE SECONDARY REACTION, BUT IF WE CONNECT BOTH UP AND DOWN TRENDLINE WE CAN SEE ADRO IS FORMING A PATTERN CALLED RISING WEDGE WHICH IS THIS PATTERN CAN MAKE THE PRICE TO A BEARISH MOVEMENT (EITHER SHORT TERM BEARISH OR A LONG TERM BEARISH) ADRO PROBABLY WILL DOWN TO @1000 THIS IS THE FIBONACCI...

EN : After breaking the pattern called (DESCENDING TRIANGLE) GOLD (XAUUSD) just making a harmonic pattern for ABCD (AB = CD) we can see clearly the secondary reaction for B - C already formed and ready for C - D and around this area 1817 -1790 in the past we got a base support and C - D fibonacci area also hit the harmonic ratio of 1.618(1817 - 1790 area),the AB...

GGRM IS FORMING A PATTERN CALLED THE DOUBLE BOTTOM PROBABLY THE FIRST TARGET OF THE PRICE WILL RISE UNTIL 45050 ID : GGRM SEDANG MEMBUAT PATTERN DOUBLE BOTTOM DAN AKAN MENGEJAR TARGET PERTAMANYA DI ANGKA 45050

DOW JONES INDEX READ BEFORE U TRADE / INVEST!! EN : DJI will start forming a secondary reaction after several day of his bullishness, we can see a small gap still hasnt close at 27449 - 27247 and i analyze that this secondary reaction will close this gap first before moving upward also the stochastic already at overbought area also the fibonacci internal...

INDONESIA STOCKS MARKET BMRI (BANKING SECTOR) En : The red candle on 30 Sept shows us that already hit fibonacci external retracement on 1.272 (False break area) that means Double bottom in on the way, And if we put a trendline it shows us the chart formed a pattern called falling wedge so this 2 strong patterns will lead BMRI to minimum : 5450 the reason is...

BANK OF AMERICA : BAC DESCENDING BROADENING WEDGE EN : WE CAN SEE THAT BAC IS FORMING A PATTERN CALLED DESCENDING BROADENING WEDGE THIS PATTERN IS A STRONG BULLISH PATTERN, WE HAVE TO WAIT UNTIL CANDLE BREAKOUT FROM THE PATTERN, THERES GOT A CHANCE THAT BAC WILL DO HIS DOWN MOVEMENT TO AROUND 23.95 - 22.58 AREA THE REASON IS SIMPLE 1. STOCHASTIC OSCILLATOR HIT...

EN : THE HARMONIC PATTERN BULLISH BAT SHOWS HIS BULLISHNESS, After making a harmonic pattern of the "BAT" pattern, BRIS start to continue his pattern to around 955 and the bullish bat already confirmed and after several day of making a short sideways or usually we call it a base around EMA 90 and today (05Oct) shows us the closing candle with full body...