TheTechnicalTraders

These are this week top three stock plays with a custom chart showing how they all move going forward. These are expected to rally within a 21 day window.

Natural Gas Still Forming Buy Pattern

Nat gas strong season is here and bull flag

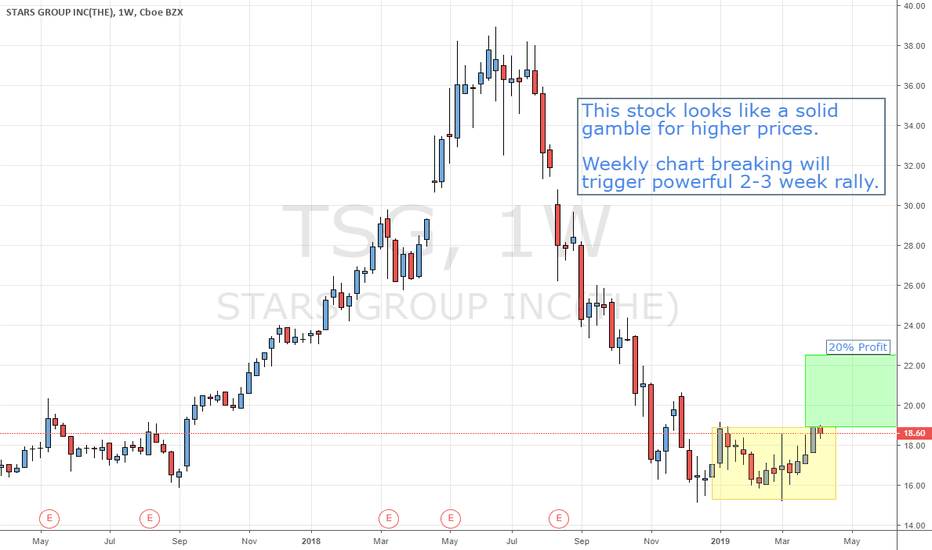

Bit money has been moving into these stop options looking for higher prices in the next 10 days! This stock looks like a solid gamble for higher prices. Weekly chart breaking will trigger powerful 2-3 week rally.

This stock looks like a solid gamble for higher prices. Weekly chart breaking will trigger powerful 2-3 week rally.

$AAPL shares still have room to run in this momentum rally. It should be a quick final move up then snap back reversal once the target is tagged.

$AAPL shares still have room to run in this momentum rally. It should be a quick final move up then snap back reversal once the target is tagged.

Fib extension target is $6000 even. This high momentum pattern should be reached within a few days.

Fib extension target is $6000 even. This high momentum pattern should be reached within a few days.

Seasonality wise nat gas should rally towards $3.00 over the next few weeks.

This video shows a few simple and clear trade setups unfolding in the market for three very different sectors. Take a look, and if you like be sure to follow me here on TradingView!

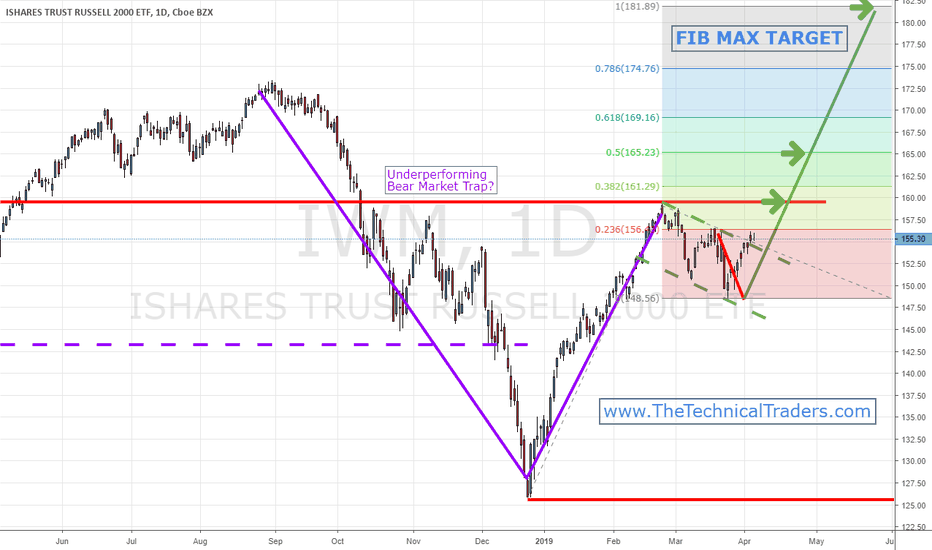

While the large-cap stock indexes like the $SPY $SPX $QQQ $DIA have been running higher, they are now at resistance and should stall out or at least slowdown. Small-cap stocks have been building a base for a mega rally that could make the large-cap run look like chump change! See more analysis on the small-cap sector: Click Here

While the large-cap stock indexes like the $SPY $SPX $QQQ $DIA have been running higher, they are now at resistance and should stall out or at least slowdown. Small-cap stocks have been building a base for a mega rally that could make the large-cap run look like chump change! See more analysis on the small cap sector: www.thetechnicaltraders.com

These morning gap trades happen nearly every week providing a steady stream of winning trades.

Lots of intraday pivot lows that will trigger strong sell-off today if price starts to breakdown.

Gold and gold stocks breaking down as expected

$jnug $nugt $dust $gdxj Gold miners threaten Breakout

Recently, we warned that Natural Gas may set up another opportunity for traders to buy into a support zone below $2.70 with a selling range near or above $3.00. Our upside target zone is between $3.25 and $3.45. The price of Natural Gas has recently fallen below $2.69 and we believe this could be the start of a setup for skilled traders to identify key buying...