Another short idea we entered today on the S&P. Appears to be in an unconfirmed descending triangle. Target zone is around 3575 mark

We are seeing a double top formation on XAUUSD weekly chart. The price has broken below the support, where we expect it to retrace to on a re-test before breaking down lower. Targeting 1450-1500

Short on S&P500. Hit top of channel on shorter time frames and not able to break through recently broken support, now resistance. Entered at 3689.

ABCDE fomration on S&P with potential to hit 3400 before starting to see a longer-term recovery

Gold gained 1.17% following weakness in the USD due to risk-on momentum. Broke above recent highs and now showing signs for further momentum to the upside towards the 1900 mark.

Double top being formed on EURAUD. We are seeing a risk on sentiment following Janet Yellens remarks which have strengthened the Aussie. Potential shorts coming up

Price is trying to breakout above resistance. We can see a buildup in momentum so we just need to wait for confirmation with closed candle above this level.

EURUSD has been seeing a sell off over the past two weeks in the market however we believe given its current level it may start to show bullishness from this week. It is trading at the bottom of a falling wedge , a strong support area , and a key fibonacci level

The rising wedge off a strong rally Eurostoxx50 shows us that the momentum on the higher is declining and inability to push to higher highs as easily. Market closed below support signalling to further bearishness in the market. This is a good entry however a pullback is also likely

USDCAD is seeing some upward momentum on the back of risk leaving the market. Oil has also seen some profit taking which is contributing to this rise. MACD also seeing crossover to add to our confluence. We will look for positions at 1.2711 (above previous high) STOP - 1.2675

Gold saw profit taking since the second week of Jan bringing to 61.8% to find support and on top of resistance of previous resistance. From here we are expecting some inflationary hedging to take place as well towards the upside towards 1900

AUDUSD has been trading within a triangle formation during this weeks consolidation. We are seeing somewhat of a risk on appetite due to expectations that J Biden will roll out a $2tn stimulus package according to investing .com We are looking for a break of 0.7772 level and look for positions on retest

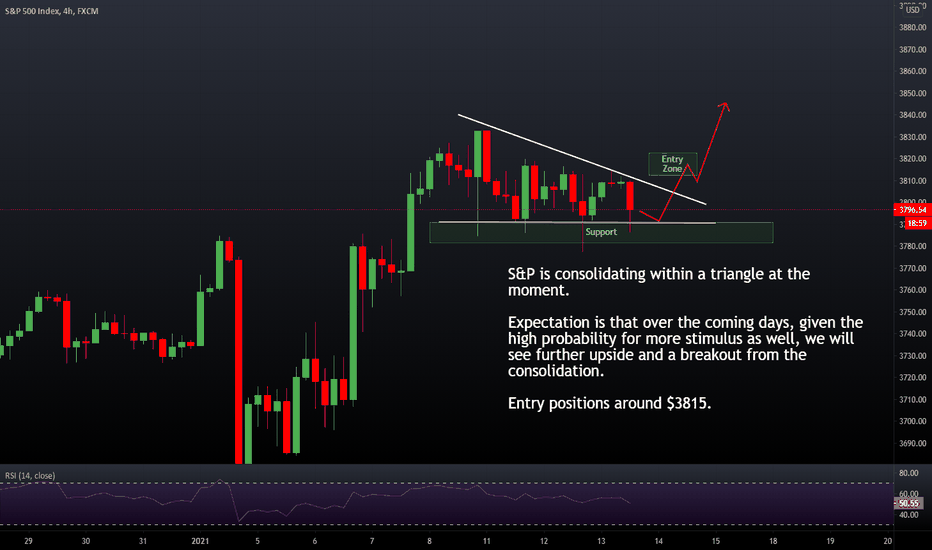

S&P is consolidating within a triangle at the moment. Expectation is that over the coming days, given the high probability for more stimulus as well, we will see further upside and a breakout from the consolidation. Entry positions around $3815.

Aussie recent broke higher from decending channel and has been gaining strength. Currently is it facing resistance at long term resistance of 0.7770. We see higher highs and higher lows and a signal towards the aussie gaining momentum. We would like to enter at new highs at 0.7785. Stop - 0.7755 Target 0.7827

EURCHF consolidating in a triangle formation. We expect the market to continue higher and break above in the coming days as well.

Trading on support of channel at the moment. Expecting the market to start seeing some risk on sentiment soon enough and JPY to be dropped in favour of EUR

NZDUSD broke above level of 0.7175, and is finding support at retest. We enter here with STOP at 0.7155. AT 0.7190 we will look to add to our position at the successful retest as seen here

DXY is at the support of a double top, signalling to further weakness in the USD to be expected.