Two4One4

Silver may likely retest the top of the structure if it remains above the 29.000 zone. Currently price, is bouncing of the 31.000 and 31.500 area and may likely aim for 32.600, 33.500 and 34.500, if it remains above this zone.

Crude oil is on a bearish trend based on higher timeframes but is currently showing bullish pressure as a potential pullback. The potential upward pullback may try to retest the 70.0 barrier. Breaking further and settling above the 70.0, may see a rise towards resistance barriers between 71.00 and 73.00 as potential bearish sell zones.

Nasdaq is struggling to move past the 19200 and 19000 barriers, and this may lead to a bearish correction aiming for 17,886 and 17,333 support. If price action does fall, the 17k region will be the likely barrier, which may spearhead the bullish continuation targeting 19,700 and 20,200. Currently, price action is rising from 18,500, trying to reach 19,200 and...

Bitcoin maybe transitioning from a bearish trend into a bullish one within the coming weeks. Currently the price is bullish from the lower time frames, but may experience a bearish correction aiming for 83k, 81k, and 80k. As long as price reacts corrects and remains above 80k, the crypto may likely find more bullish pressure to continue rising. Conversely, if...

Dax is currently in a bearish phase, where price action moving between 23200 and 22500. As of now, price action may garner bullish strength if it remains above 22500 to retest the nearest resistance barriers in red and maroon. Conversely, if it passes 22700-22800, the bullish rise may be intact because of breaking the smaller bearish channel from 22700 to 22500....

Dollar Rand is in a downward trajectory, but has found bullish interest which may lead to a rise towards the above resistance. Price action may move between 18.4000 and 18.0000, upon a major breaking to determine the intended direction.

US30 broke through a bearish channel last week and has continued to show bullish pressure. However, as long as the price is under 42,000, the indice may correct a bit, towards the 41,550, 41,200, and 41,000 barriers. Price action is currently oscillating between 42,000 and 40,600. A break of either side, will be the intended direction from a long term perspective.

The Euro Dollar is struggling to to break through the 1.09600 barrier, and failure to break above with an attitude of continuing up, the price action will go down. The immediate barriers below may be essential support structures were price action can find bullish pressure again. However, settling above the 1.09600 zone will suggest a bullish continuation,...

Euro Dollar broke through a bearish channel and seems to have stabilised above the last low of the 1.01000 region and is transitioning into a bullish phase. Price action is currently within the 1.04000 and is aiming for the 1.05000 barriers. Passing through and settling above may likely lead a growth to the pair to retest further established highs.

Pound Cad, may correct after having in a bull-run, since the beginning of the year until now. If price action remains under 1.88000, the pair may correct towards the halfway mark or even lower in preparation for another bull run. Conversely, if the price manages to move above the 1.88000 region, continued growth would be expected.

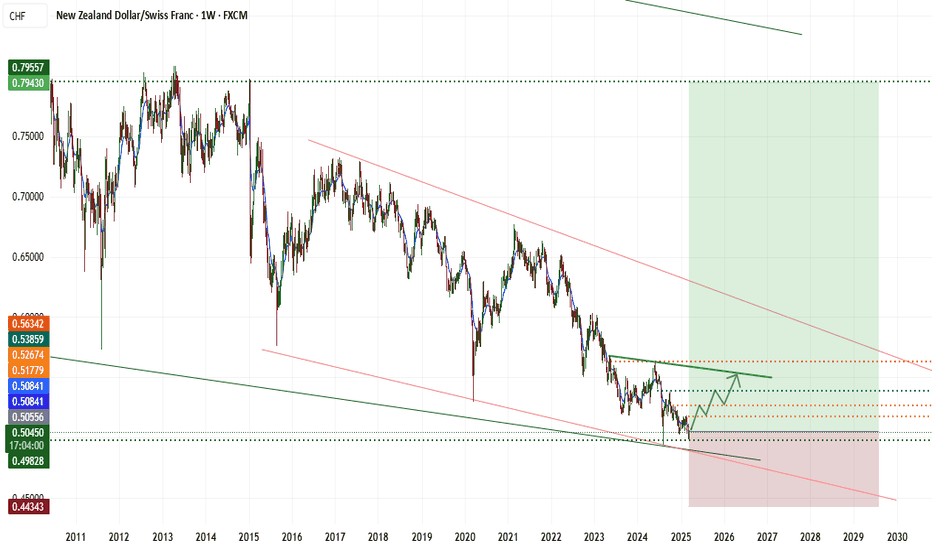

Kiwi Franc is reacted on the 0.49900 barrier, and the price is aiming to settle into the 0.5000's. As long as the price is above the two barriers, momentum will likely lead to growth within the pair as price is correcting within the structure.

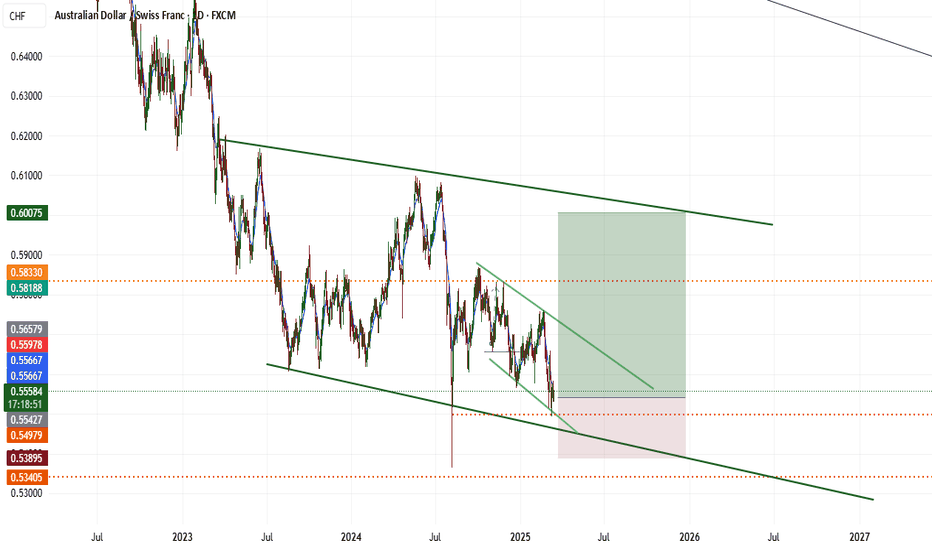

Aussi Franc is currently bearish in a correction phase but may be headed to the top of the consolidation structure due to how price action is reacting to the 0.55000 zone. If the price remains above 0.55000, it might probably rise and aim to the touch the top of structure in the coming days or weeks. With failure and settling below 0.55000, price action may...

Bitocin managed to react again by bouncing off the 78,000 barrier and settled above it. Price action is now trying to gather upward momentum. If the crypto manages to rise and rest above 84,000, the bullish move may be towards the 93,000 and 95,000 resistance barriers. Failure to rise and stabilise above 84,000 may lead to a continuation of the bearish move.

US100 has been bearish for the past weeks but might transition into a bull-run if price action remains above 19,000 and settles above 19,750. If the price rises and stabilises above 19,750 barrier, the indice may start erasing the sells aiming to target the above resistance barriers and established higher highs. Failure to pass through 19750 might indicate a...

Gold is currently en route to retest the 2950 barrier, but is currently struggling to settle above 2925 and continue to the top. If price action remains under the mentioned figures, the metal might drop towards the immediate support structures to reignite bullish pressure. However, breaking free of the 2925 zone and settling above may see continued growth.

US30 may find bullish pressure from the 41,500, as it was a previous resistance turning into support. As long as price action is below 41,500 - 41,000 region, the indice will likely continue it's downward trajectory. Remaining above the 41,500 may lead to a rise aiming for the above resistance barriers.

Bitcoin is still in a bearish correction, but may be headed to retest the upper resistance barriers with the channel. As long as price action is above 85,000, the crypto may try to touch 94,000 and maybe further up.

Nasdaq is still in a bearish trend, but price action may rise and retest the 20700-20900 barriers to reignite the continuation of the bearish move. If price action remains under 20900-20700, the bearish pressure may still be possible. However, if the indice goes above 20900-20700, a bullish growth may happen.