UnknownUnicorn462803

As you can see last months correlations between Yuan-Ruble pair with gold spot prices present good levels to take long and short positions to hold them for a month. To do this look at the bottom of the chart where are prices of commodities and pairs which play role in current geopolitics related to the said arbitrage opportunities. Look for big upside swings to...

Earlier in the late summer we predicted S&P 500 drop and this worked out well. This autumn we see futher fall in the S&P 500 through the important psychological level. We see no roots for the US economy to produce more profits while China is openly against it. Military spending cut could be only solution to the problem if this won't happen we see further fall this autumn.

We think BIST 100 is going to drop in coming weeks.

We think upheaval battle for high wheat prices has been lost and investors taking out their capital from long positions.

We believe RTS could go 500 points higher in two weeks.

We think Coffee might rise 15$ in price in coming weeks. It presents good opportunity for buying with a tight stop.

We see small opportunistic trade in IMOEX. Stop is 3000 points psychological level and the target is recent high level of 3288.40 points. Current price before the opening bell is 3051.90. As always it is better to take money from the trade if something goes wrong.

We see Stock Market is heading to the Crash in the next week. Market could fall off the cliff starting next week because of the weakness in the last two months. Recent rally has ended with the red week after Market has proved to be too expensive at the point where investors tried push it higher to the start of the 2022 levels. Participants acting carelessly...

Double bottom in the Shorts indicates no further downside.

Look at how spread between Aerospace and Defense ETF and overal S&P is at all time highs.

If 1340 pivot would be passed ATR could go up and we can see 1400 on RTS. Oil is bouncing from key technical level MOEX:RTSI

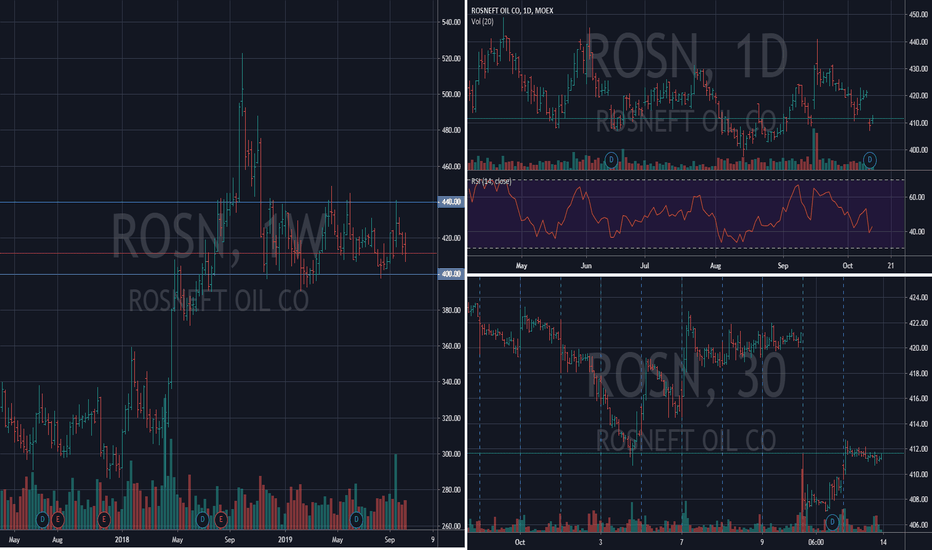

MOEX:ROSN The stock is in the range. Stop target is 400 Take profit is on 440. Or higher if oil would start trending to higher levels in coming months.

NASDAQ:NVDA nVidia is about to launch "nvidia geforce now" project. Their Stock already corrected from september highs wich was pushed by Crypto Pharming on their hardware. And seems they push it into solid new project. Wich by subscription would give any notebook or pc digital power to play any games on ultra high graphics without upgrading hardware. Upside if...

Oil short is always a bluff. Why? Because those who play downside are always underdogs in the big scheme.

MOEX:SIBN After big Dividend Spike in GAZPROM NEFT we saw its shares bounce down to the lower bollinger band resistance. Would we see closing the gap to the upper band where it was before Dividends?

Largely short term overbought stock MOEX:SNGS Perhaps going down to sane levels (R5 pivot on 30 min chart)

Possible buy at this level.