inkicho_exness

Japanese equities extended their rally last week, supported by strong economic data and expectations of Fed rate cuts. Notably, Japan’s Q2 GDP exceeded consensus, helping propel the market to fresh highs. GDP grew 1.0% YoY (prev. 0.6%, cons. 0.4%), easing recession fears despite lingering uncertainty over Japan-US tariff negotiations throughout the quarter. The...

Despite the risk-on mood, silver prices are holding their uptrend. Overall risk-appetite mood is widespread in the market as expectations for a September Fed rate cut surge. Reports that President Trump may appoint a dovish candidate as the next Fed chair have bolstered the risk-appetite sentiment, alongside Treasury Secretary Besant’s remarks that a 50bp cut at...

July CPI showed little inflationary impact from tariffs, amplifying expectations for a September Fed cut. Optimism also returned for small-cap firms, previously seen as most vulnerable to tariff pressures. Headline CPI rose 2.7% YoY in July, 0.1% lower than a year earlier, with a 1.1% MoM drop in energy prices contributing to the overall decline. BlackRock CIO...

While risk-off sentiment persists, renewed US tariff threats have continued to draw demand for gold. Prices spiked on concerns over global supply chain disruptions after reports that the US could impose country-specific import tariffs on the most widely traded gold bar standard, but later pared gains after news that President Trump may issue an emergency order...

US equity gains paused amid President Trump’s renewed tariff threats and weakening economic data. Trump warned of steep tariff hikes on India and a potential 35% levy on the EU if obligations are not met. Meanwhile, the US July Services PMI fell from 50.8 to 50.1, missing the 51.5 consensus. New orders dropped to 50.3, while employment declined to 46.4—the...

Gold staged a rebound as markets reacted to weaker US labor data and escalating trade tensions. Despite a solid Q2 GDP reading of 3.0% QoQ (prev. -0.5%, cons. 2.3%), the disappointing July NFP figure of 73k (prev. 140k, cons. 110k) raised fresh concerns about labor market softness. Meanwhile, recession risks were further fueled by President Trump’s approval of...

The euro weakened sharply against the dollar amid views that the US-EU tariff deal favors the US. European leaders voiced mixed reactions. Germany’s Chancellor Merz welcomed the agreement as a safeguard against economic damage, while Hungary’s PM Orbán criticized it as a one-sided win for the US. Meanwhile, the IMF raised its eurozone growth forecast from 0.8%...

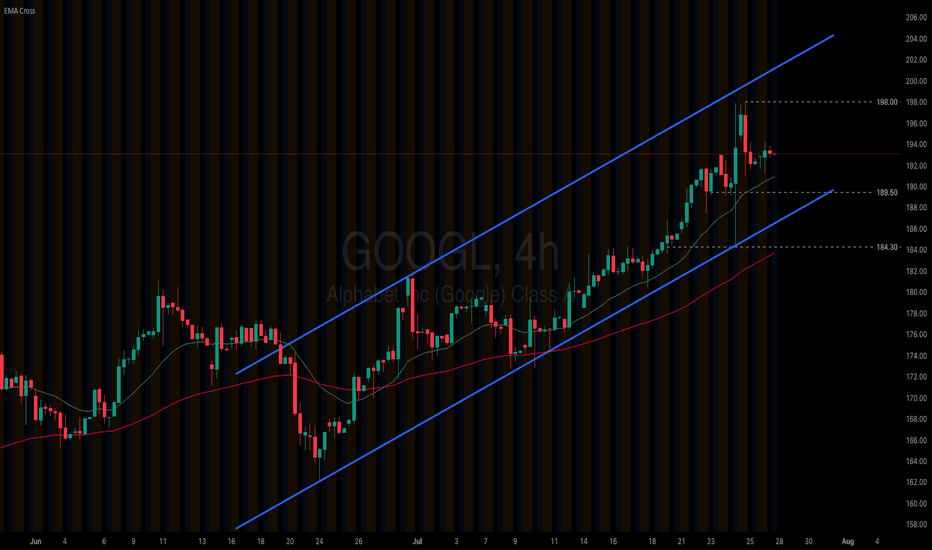

US equities continue to post record highs, driven by stronger-than-expected 2Q earnings and optimism over ongoing trade agreements. Alphabet’s (GOOGL) Q2 results reaffirmed the accelerating pace of AI-led growth. The company’s cloud revenue surged 32% YoY, up from 28% in 1Q, and it raised its full-year capex guidance from $75B to $85B. Alphabet (GOOGL)...

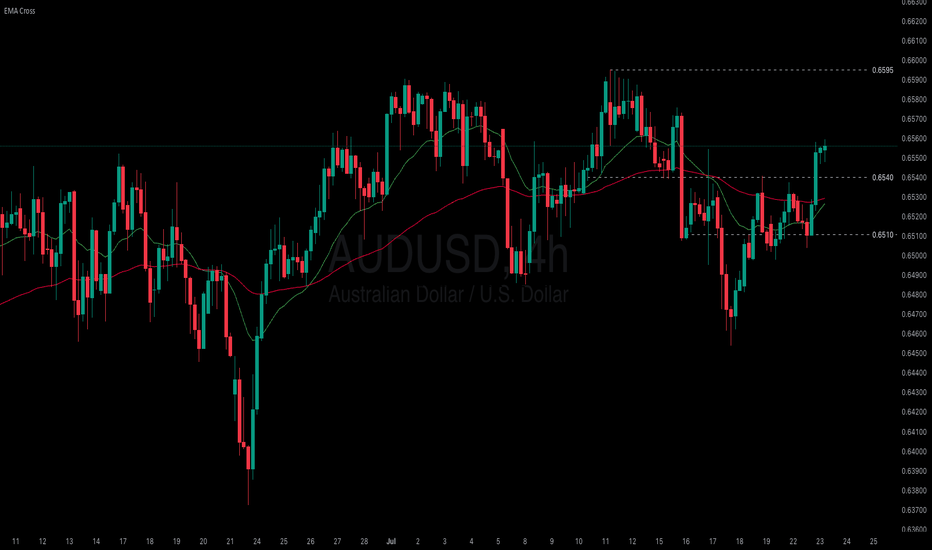

The RBA, in its latest meeting minutes, emphasized that the recent rate hold reflects a cautious and gradual approach toward achieving its inflation target. While the central bank noted the need for further data to confirm a decline in inflation, some Board members flagged rising unemployment as a signal of potential labor market softening. Bloomberg added that...

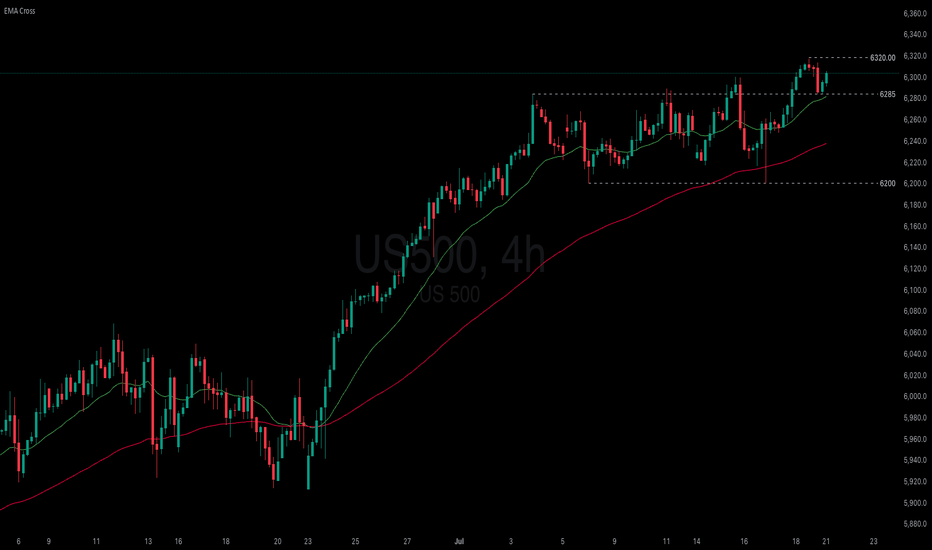

Despite elevated valuation pressures, US equities remain near all-time highs. While tariff concerns persist, resilient US economic data continues to support the market's upward momentum. United Airlines reported a 1.7% YoY increase in 2Q revenue, citing easing geopolitical and macroeconomic uncertainties and a double-digit rebound in corporate demand....

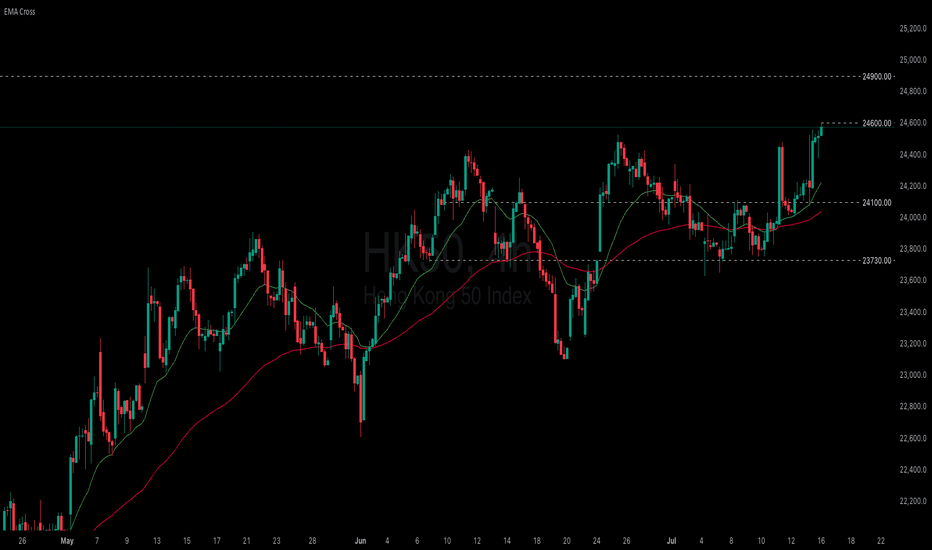

Despite US-China trade tensions and weak domestic demand, China’s GDP growth has surpassed its 5% target for the first half of the year. According to the National Bureau of Statistics, Q2 GDP grew 5.2% YoY, with authorities noting that stimulus measures aimed at boosting consumption had some effect. Reflecting this momentum, Morgan Stanley raised its 2024 China...

President Trump announced a 30% tariff on imports from both the EU and Mexico, a hike from the 20% previously imposed on the EU in April. He also warned that if no agreement is reached on the Ukraine war within 50 days, countries trading with Russia could face a 100% tariff. Meanwhile, market volatility is being amplified by speculation over Fed Chair Powell’s...

Tariff tensions are flaring once more ahead of the scheduled end to mutual tariff suspensions. President Trump has announced that tariff rates on countries such as South Korea and Japan will increase to 25% starting in August. This renewed threat has stoked concerns about inflation, pushing up Treasury yields. As trade war risks resurface, US Treasury prices...

Safe-haven demand for gold eased slightly as geopolitical risks in the Middle East subsided. However, the downside was limited by a weaker dollar. Market sentiment around a potential escalation in regional tensions also softened, particularly as the likelihood of a Strait of Hormuz blockade declined despite preemptive US strikes. Looking ahead, gold prices may...

Geopolitical risks in the Middle East have eased slightly amid signs of potential negotiations, prompting markets to shift their focus back to the upcoming FOMC and tariffs. Following talks with Canadian Prime Minister Carney, President Trump stated that a trade deal with Canada could be reached within weeks, and also confirmed that a trade agreement with the UK...

US-China tensions deepened as President Trump criticized China’s rare earth exports and threatened broader tech restrictions and visa cancellations for Chinese students. He also vowed to double tariffs on foreign steel to 50% to strengthen the US steel industry. April headline PCE inflation eased to 2.1% (prev. 2.3%, cons. 2.2%), partly soothing tariff-related...

President Trump stated that he is open to reducing tariffs on China and that negotiations with key partner countries are progressing smoothly. However, he also revealed via social media that he has ordered a 100% tariff on certain foreign-produced films, signaling that tariff risks remain. The ISM Services PMI for April came in at 51.6. New orders rose to 52.3,...

The Trump administration announced a 90-day tariff reprieve and reciprocal exemptions on smartphones and semiconductors. However, President Trump denied that this constitutes a tariff exemption, stressing that duties on items such as semiconductors and pharmaceuticals will be reimposed. Amid growing concerns over the impact of US tariff hikes on Eurozone...