Gold is trading around 2778 while we were analyzing he charts. Bulls have initiated a supper bullish cycle started from 2600/2585 range towards the critical level 2782.xx - 2790.xx that can pause the aggressions on temporary basis but please note if gold sustained above 27900 it would entered into no man's land where it would become very difficult to trade for...

During pre-NFP analysis we have suggested few levels where sell & buy risk can be taken for at least 60- 120 pips favorable move. By recalling that 2680/2681 sell pre-NFP given 160 pips quick profitable move. 2690/2696 post-NFP Sell Given 160+ pips favorable move. Coming towards todays/current week stance, we are considering 2695/2708/2733 levels as resistance...

Gold Pre-NFP Analysis - As Simple as Possible I have 4 levels on upside to watch as Sell levels ➡️15m level 2684ish (high risk) ➡️H1 level 2690ish (medium risk) ➡️H4 level 2708ish (low risk) ➡️ Day/week level 2733ish (extremely low risk) I would prefer start taking sell risk form H1 levels with 70 to 100 pips SL, depending on the entry I got. For buy Risk...

Gold is almost reached to year end with great bullish move throughout the year that make it really a precision metal. On technical prospect for today/current week, we have marked some levels on charts with white lines that can act as support and resistance. Waiting for these levels to enter on trade have the ability to give you 50/120 pips quick profits. Please...

Intraday fall towards 2447/2445 is very likely. Sell is my stance

BTC is trading in channel from couple of months that is forcing BTC to trade between consolidation phase between a ranging channel that is acting as support and resistance. Further price movement is forming bullish flag pattern and also cup and handle price formation on longer term charts that suggest channel support is likely to act as support and bounce towards...

Gold (XAUUSD) trading near falling channel top without any breakout confirmation that suggest indecisive trading is likely to continue with breakout/retest buy setup or rejection/confirmation sell setup. There are equal chances of being fall or rise at current levels that also suggest better to adopt watch and wait for confirmation to trade. However, any...

hello friends, EURUSD reached to short term resistance 1.0963 - 1.010 and from here a fall to 1.08650 - 1.8580 is likely an possible. Would you agree and sell here

USOIL spot possibly forming head and sholder formation which has support aroung 83 - 82, rejection on these levels from bulls can open 75 - 74 range where head and sholder leg is likely to complete. On the upside 89 - 90 is forming resistance and bulls need to hold above that to form a good bullish move towards 93 - 96

Hello Friends GBPCAD trading within bearish channel on bigger time frame with rising wedge on shorter time frame suggest bears are in controll. Look for price rejection around 1.6930 on dialy time frame for sell opperutnities. My Idea is that it can retest around 1.6530 and 1.6360 in case of failing 1.6530. Good luck Friends

Hey Hey Friend, Our last idea of gold achieved our target 1914 and moved around 1910 that move was about 160 to 200 pips. Now we expect a bounce towards 1918 - 1923 range before setting a new direction.

Hey Hey Friends, This FS with you with gold analysis. Yesterday we have witnssed a steap fall in gold 1914 and that was expected too but I was expecting a bounce to 1937 - 1942 1st before the fall. Now XAUUSD trading below green channel in 2 hours chart seen between 1930 - 1938 that range is likely to act as resistance now and fall towards 1907 - 1900 can be...

Hello Friends, EURUSD is likely to face resistance on upside zone 1.0935 - 1.0945 that is where ST trend line and consolidation breakout down can trigger fall towards our target zone 1.0815 - 1.0800

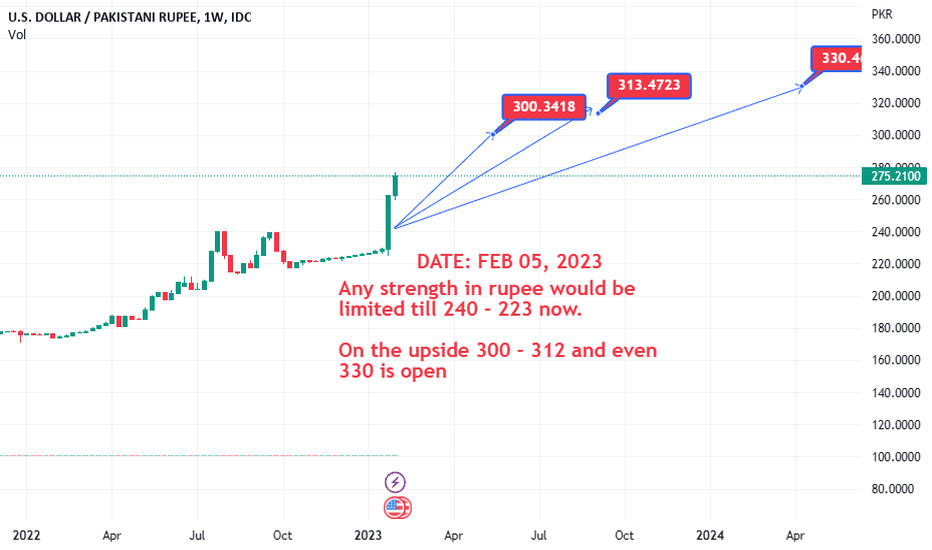

USDPKR Trading at 275 Review: As per last analsys dated Oct 27, 2022 it was expected that move towards 264 - 275 can be witnessed that has been done now. What Next: Any fall to 240 - 223 would be limited We are also expecting it can move to 300 - 313 followed by 330 gradually.

#GBPJPY NewForcast It moving in bullish trend and likely to maintain the bullish implusive toward channel resistance at 187.40 that suggest from current risk to reward ratio is 1:1.50

Hello Friends, On my last analysis it was suggested 2048 - 2050 can bring bears on charts till 1980 - 1970. Today we have witnessed 1970 now this is a support, an important support infect. So those who are shorts should look to book gains or at least adopt risk management. For details of That analysis please go though my previous research on GOLD. I believe...

Gold is trading in bullish channel since Sep 22 and channel top is seen around 2050 - 2070 from now of after testing wave top corrective fall till 1990 -1985 is expected. Failing to hold 1980 - 1970 can bring aggressive bears for extend fall to channel bottom around 1930 - 1920 can open. Mid to long term strategy should be sell on strength with money management...

USDJPY analysis Hey Friends Multiple analysis and chart patterns suggest fall to 127.20 - 125.80 is possible. Short positions with reasonable sl can make your investment double. work with risk management and trade your levels accordingly. Good luck