mafole4x

EssentialWe anticipated gold to dump heavily, during either London or New York Session. Yes, it dumped during New York Session. Entry was taken on 1 minute after FVA got disrespect/run through.

We can clearly see the overall trend of Gold, which is bearish. As the price action we see bearish FVA (Fair Value Areas/Swing Lows) being run. The anticipation is to wait for the latest Swing low to be ran, before looking for entries. Why? Because, the path towards our nearest POI (Point Of Interest) will have a low resistance. Meaning price might expand lower smoothly.

In this video, I quickly go through how I managed to secure the dump on GOLD during the New York Session. It's not easy but it's simple.

In this video I have deep dive into a top down analysis on Gold. Which shows that gold is heavily dumping. Be cautious when going long on Gold.

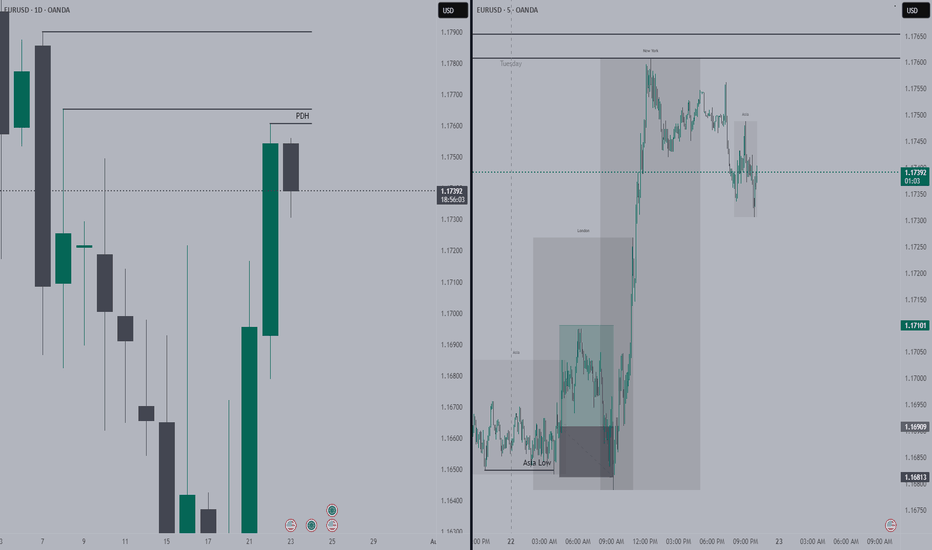

On this quick video I share my past trade I took using the London protocol. And the anticipation of the next day and how I will look to take my setup, if it will form.

Mind you about Risk Reward its 5RR forgot, I don't take entries in New York Session.

This is the quickest way to understand daily bias using swing points, FVA, FVG and order flow.

The answer to the above question is explained within the video, hope it clears any misunderstandings.

I have incorperated chart sample on how you can avoid losing trades and increase win rate.

In this video I explain when to start looking for entries once, price has reached reversal areas.

DXY Looks good to look for longs. Arguably, I will be looking for scalping longs only on Friday. This is due to no high impact news to drive price, hence, we might face consolidation on higher timeframe.

Could it be because I have a Weekly and Daily FVG further down which are not yet confirmed? Could it be because there is no news today? Was my entry time wrong? Or what else could it be?

Price respected Weekly's bearish imbalance to continue lower. Still price is within the weekly's context area to which is suitable to look for entries in lower timeframes targeting weekly's swing low (POI). Once, the Weekly POI get's tagged we might look to continue to the next POI (Point of Interest). Likely, the daily swing lows. What's Next? Pontetial target...

Price respected Weekly's bearish imbalance to continue lower. Still price is within the weekly's context area to which is suitable to look for entries in lower timeframes targeting weekly's swing low (POI). Once, the Weekly POI get's tagged we might look to continue to the next POI (Point of Interest). Likely, the daily swing lows. What's Next? Potential target...

probability: High Position: Short Context/Boundary: 4H Bearish imbalance

Probability: High Position: Long Context/Boundary: 1H

Probability: High Position: Short Context/Boundary: Daily

Probability: Low Position: Short Context/Boundary: Daily