quantsignals

Premium### 🔥 RDDT Earnings Setup (2025-07-31) 📈 **Bullish Bias | Confidence: 75%** 🎯 Target: \$165+ | 🔒 Resistance: \$155.58 --- ### 📊 FUNDAMENTALS * 📈 **Revenue Growth (TTM): +61.5%** * 💰 **Gross Margin**: 90.8% * ⚠️ **Op Margin**: 1.0% (Thin runway) * 💥 EPS Surprise Avg: **+191% (5/5 beat streak!)** * 📉 EPS Growth Est: **-86.6%** → low bar = potential upside **🧠...

### 🍏 AAPL EARNINGS TRADE SIGNAL (JULY 31) 🚀 📊 **AAPL Call Play** — Earnings Strategy 🧠 Multi-model conviction: **75% Bullish Bias** --- ### 🔍 Fundamental Drivers ✅ TTM Revenue: +5.1% ✅ Gross Margin: 46.6% ✅ 8 straight earnings beats ⚠️ Sector shift: growth → value = caution 📉 TTM EPS Est: \$8.31 (+29.4% growth est.) 🧮 **Score**: 8/10 --- ### 💰 Options...

### 🚨 CRCL WEEKLY TRADE SIGNAL (JULY 31) 🚨 **Call Option Setup – Based on Multi-Model Consensus** 📈 **Momentum**: 🟡 RSI Daily: 46.7 (Neutral) 🟥 Volume: 0.4x last week = 🚨 Weak participation 🟢 Options Flow: Bullish (C/P Ratio = 1.42) 🌤️ VIX: Low (15.4) → Low volatility = 💰 opportunity 🔍 **Model Summary**: ✅ **Grok**: Bullish setup → RECOMMENDED TRADE ❌ Claude,...

### 🚀 AMD WEEKLY TRADE SIGNAL (7/31/25) 📈 **MARKET SNAPSHOT** 🟢 Daily RSI: **86.0** 🔥 🟢 Weekly RSI: **80.4** 📊 Volume: 🔺 1.5x (Institutional surge) 💬 Call/Put Ratio: **1.90** 🌪 Gamma Risk: **HIGH (1DTE)** 🧠 Sentiment: **Extremely Bullish** across all models --- 💥 **TRADE IDEA** 📍 Ticker: **\ NASDAQ:AMD ** 📈 Direction: **CALL (LONG)** 🎯 Strike: **\$190.00** 💵...

### ⚡️HOOD WEEKLY OPTIONS TRADE (7/31/25) 📈 **Setup Summary** → Weekly RSI: ✅ Rising → Daily RSI: ❌ Falling (⚠️ Short-term pullback risk) → Call/Put Ratio: 🔥 **1.89** (Bullish flow) → Volume: 📉 Weak — fading conviction → Gamma Risk: 🔥 High (1DTE) --- 💥 **TRADE IDEA** 🟢 Direction: **CALL** 🎯 Strike: **\$110.00** 💰 Entry: **\$0.82** 🚀 Target: **\$1.62**...

### 🚨 ALAB WEEKLY TRADE IDEA (2025-07-31) 🧠 **Smart Money Snapshot** → RSI: **76+** = Strong Momentum → Call/Put Ratio: **2.19** = Bullish Bias → Volume: 📉 **0.6x last week** = Momentum may fade → Gamma Risk: ⚠️ High = Expect **fireworks** --- 📈 **TRADE SETUP** 💥 Ticker: **\ NASDAQ:ALAB ** 🟢 Strategy: **Buy Call** 🎯 Strike: **\$149.00** 💰 Entry: **\$0.65** 🎯...

## 🚀 RDDT Earnings Play — July 30 (BMO) **🎯 Bullish Call Trade | 75% Confidence | High Momentum Setup** --- ### 📈 REDDIT, INC. (RDDT) – EARNINGS SNAPSHOT 🧠 **Revenue Growth**: +61.5% TTM — AI + Ads combo paying off 💸 **Margins**: • Gross: 90.8% ✅ • Op: 1.0% 🚩 • Profit: 8.1% 👍 🧾 **EPS Surprise Streak**: ✅ 5 for 5 | Avg. +191% 🎯 **Target Price**: \$155.58...

## 🚀 AMZN Earnings Play — July 30 (AMC) **💵 High Conviction Call Trade | 85% Confidence** 📈 **Amazon (AMZN)** — Cloud + Consumer Power Combo 🧠 Setup driven by earnings momentum, bullish flow, and macro strength. --- ### 🔍 FUNDAMENTALS SNAPSHOT ✅ **Revenue Growth**: +8.6% TTM ✅ **Margins**: Profit 10.1%, Op 11.8%, Gross 49.2% 🎯 **EPS Beat Streak**: 8/8 with...

## 🧠 META Earnings Trade Setup — July 30 (AMC) 📈 **META (Meta Platforms Inc.)** 💥 **Confidence**: 85% Bullish 💡 **Play Type**: Pre-earnings call option 📊 **Fundamentals + Flow + Setup = High Conviction Swing** --- ### 📊 FUNDAMENTALS SNAPSHOT ✅ **Revenue Growth**: +16.1% YoY ✅ **Profit Margin**: 39.1% ✅ **Gross Margin**: 81.8% 📈 **8/8 EPS Beats** — Avg...

## 🚗 CVNA EARNINGS TRADE IDEA — July 30 (AMC) **Carvana (CVNA)** 📊 **Bullish Confidence**: 85% 📈 **Earnings Play Setup** 💣 Big Volatility + Strong History = Explosive Potential --- ### ⚙️ FUNDAMENTALS SNAPSHOT ✅ **Revenue Growth**: +38.3% YoY 🔁 **8/8 EPS Beats** (114.5% avg surprise) 🟡 **Profit Margin**: 2.7% (Thin but improving) ⚠️ **Debt-to-Equity**: 344.78...

🚨 **EARNINGS TRADE SETUP: APLD (Applied Digital)** 🗓️ Earnings: **July 31 (AMC)** 💥 Confidence: **65% Moderate Bullish** 🔥 Recent Run: **+94% past 3 months** 🧠 AI Infrastructure Hype + High IV = Opportunity --- ### 📊 FUNDAMENTALS SNAPSHOT 🟢 **Revenue Growth**: +22.1% YoY 🔴 **Profit Margin**: -110.4% 🔴 **Operating Margin**: -34.7% ⚠️ Historical EPS Beat Rate:...

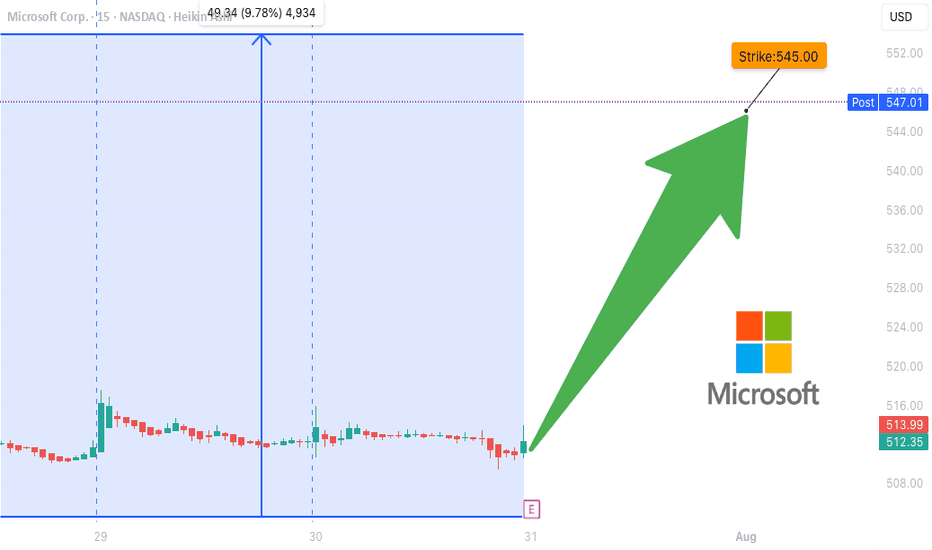

**🚨 MSFT Earnings Play (2025-07-31) — STRONG BULLISH SETUP 🚨** **Microsoft \ NASDAQ:MSFT Pre-Earnings Trade Idea — 545C (Aug 1)** --- ### 🧠 **Earnings Thesis (🔥 80% Conviction)** MSFT is set to report **BMO July 31**, and all signs point *bullish*: 📈 **Revenue Growth**: +13.3% YoY, driven by **AI + Cloud** momentum 💰 **Margins**: Profit 35.8%, Op 45.7%,...

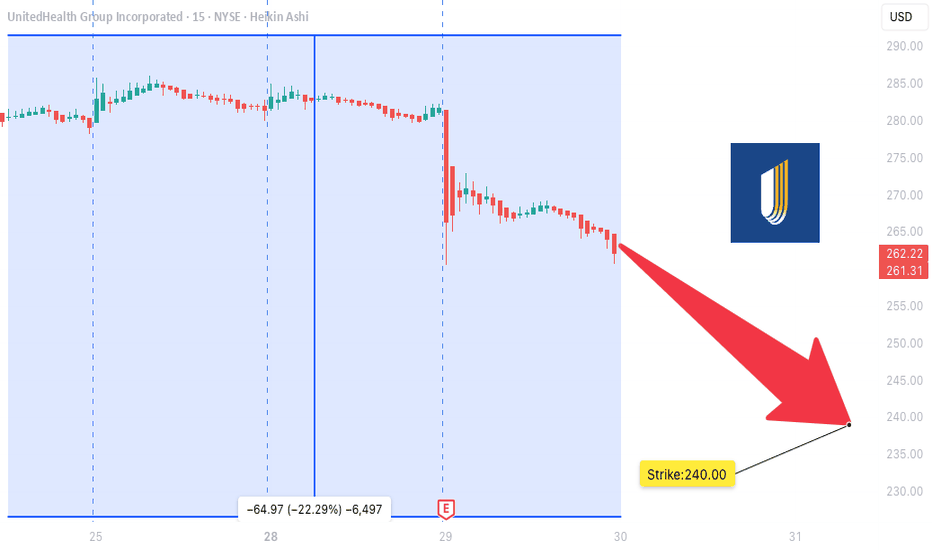

### 🩻 UNH SWING TRADE IDEA (2025-07-29) **UnitedHealth Group – Bearish Setup** 📉 **Sentiment:** Moderately Bearish 📊 **Daily RSI:** 28.9 (Oversold!) 📉 **Momentum:** 5D/10D bearish 🔇 **Volume:** Weak (1.0x avg = low conviction) 💬 **Options Flow:** Neutral (C/P = 1.00) 🌬️ **VIX:** 15.71 — calm, tradable --- ### 🔻 Trade Setup * **Play Type:** Naked PUT *...

### 🚀 MU WEEKLY TRADE IDEA (2025-07-29) **Micron Technology (MU) – Bullish Call Play** 🔹 **Sentiment:** Moderate Bullish 🔹 **C/P Ratio:** 2.91 (Bullish Flow) 🔹 **RSI (Weekly):** 53.6 📈 🔹 **Volume:** Weak (⚠️ caution — low conviction) --- ### 🎯 Trade Setup * **Strike:** \$116.00 * **Type:** CALL (LONG) * **Expiry:** 2025-08-01 * **Entry:** \$0.62 * **Target:**...

**💊 HIMS WEEKLY TRADE IDEA (7/29/25)** **🔥 Bullish Flow + Rising RSI + Institutional Volume** **📈 Trade Setup** • **Stock**: \ NYSE:HIMS • **Direction**: CALL (LONG) • **Strike**: \$64.00 • **Entry**: \$0.92 • **Target**: \$1.38 • **Stop**: \$0.46 • **Size**: 2 contracts • **Expiry**: Aug 1, 2025 (3DTE) • **Confidence**: 80% • **Entry Timing**: Market...

**🍗 WING Earnings Play (2025-07-29)** **🔥 Oversold Setup + 88% Beat Rate = Opportunity** **🎯 Trade Plan** • **Stock**: \ NASDAQ:WING • **Type**: Call Option (LONG) • **Strike**: \$290 • **Entry**: \$19.20 • **Target**: \$38.40 • **Stop**: \$9.60 • **Expiry**: Aug 15, 2025 • **Entry Time**: Before earnings (AMC 7/30) • **Confidence**: 72% • **Expected Move**:...

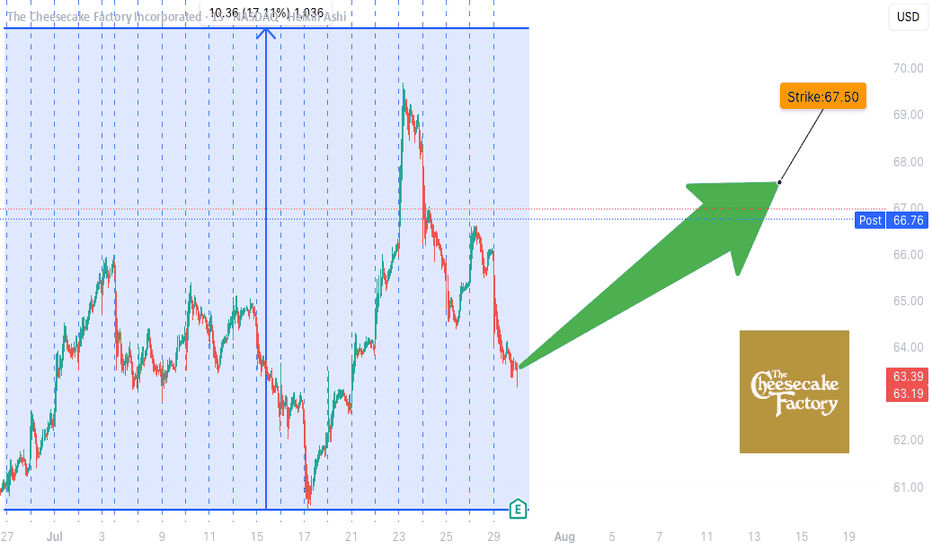

**🍰 CAKE Earnings Trade Setup (2025-07-29)** 🎯 **Bullish Bias** | Confidence: **72%** 💡 **Historical Beat Rate: 88%** | Strong pre-earnings drift **📊 TRADE DETAILS** • **Instrument**: \ NASDAQ:CAKE • **Strategy**: Buy CALL • **Strike**: 67.50 • **Entry**: \$1.45 • **Target**: \$2.90+ • **Stop**: \$0.72 • **Expiry**: 2025-08-15 • **Timing**: Pre-earnings close...

🚨 **MARA Earnings Setup – TradingView Breakdown** 🚨 📅 *Earnings Play for 07/29/2025* 🎯 *Strike: \$17.00 Call | Exp: 08/01/2025* 💰 *Premium: \$0.59 | Target: \$1.18* 📈 *Conviction: 75% Bullish* 🔹 --- 🧠 **What’s the Setup?** MARA just raised \$950M to expand BTC holdings 💥 Revenue YoY growth: **+29.5%** 📊 Margins still rough: **-46.7% profit**, but potential...