quickshiftinn

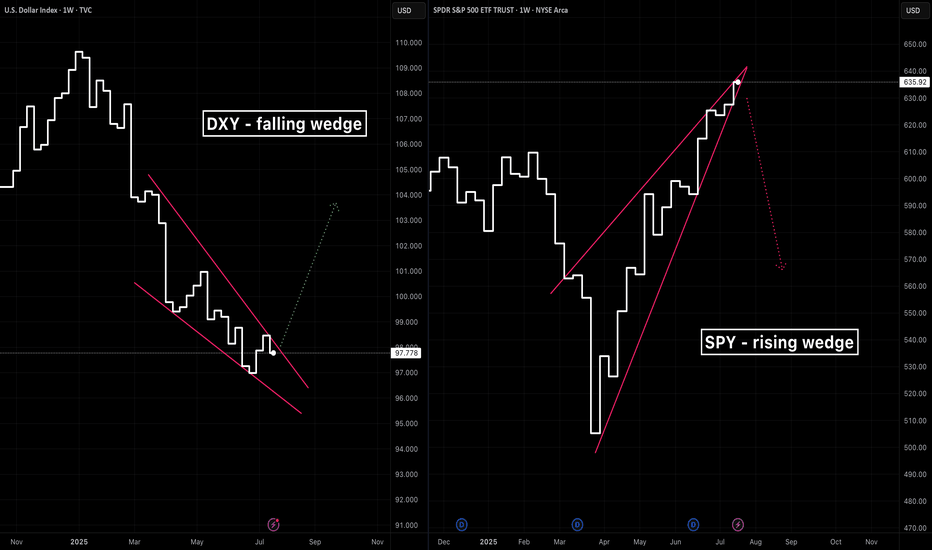

UltimateIn early 2025 we’ve seen two classic wedge patterns on two of the market’s most watched charts: a falling wedge on the U.S. Dollar Index ( TVC:DXY ) and a rising wedge on the S&P 500 ETF ( AMEX:SPY ). Alone each tells its own tale—but together they sketch a tug‑of‑war between a fading dollar and resilient equities. The Falling Wedge on DXY A falling wedge ...

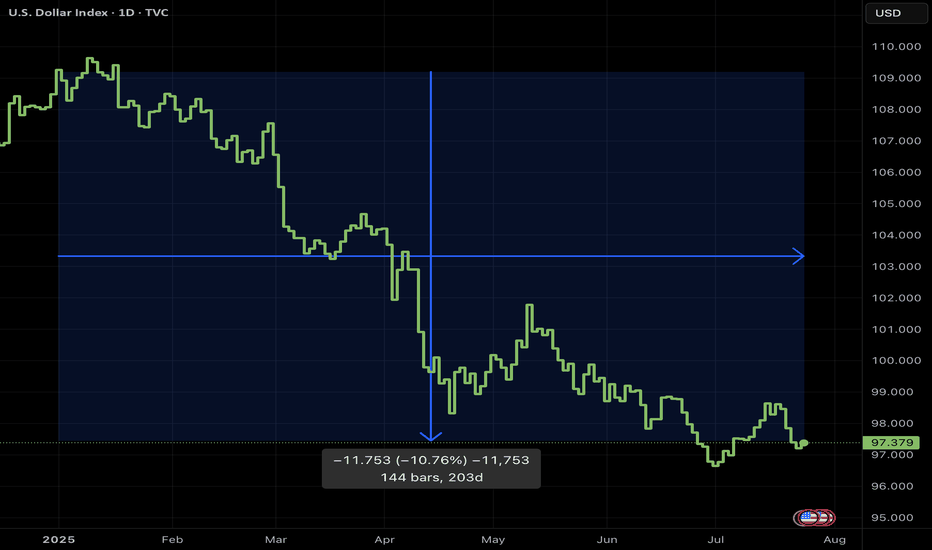

The US Dollar has faced brutal selling during the first half of 2025. Some are even questioning whether the Dollar’s global hegemony is at risk. Early in the year the US stock market AMEX:SPY sold off aggressively, falling 19% from mid‑March to early April. Since then stocks have more than regained their losses and the Dollar is still in the tank. So where does...

Last month I shared a chart of an equal-weight crypto basket suggesting crypto may be on the cusp of fresh All Time Highs -- those highs have arrived! While that is certainly exciting for crypto holders one should take note of other aspects of the rally. The US Dollar has depreciated substantially against foreign currencies this year (2025) Bitcoin has yet...

With US equity markets closed for Juneteenth, I'm checking in on an equal weight basket of cryptos. Recently I said crypto looked to be heating up for a run at new highs. As I look today, prices appear range bound on the daily chart. There's a bearish double-top formation, beside declining momentum. The bottom of the range resting at the 200 Day Moving Average,...

🧠 TL;DR Albemarle ( NYSE:ALB ), a global lithium heavyweight, has seen its stock price collapse over 70% from its 2022 highs, closely tracking the decline in lithium spot prices. With lithium carbonate plunging from ~$80,000/ton to under $15,000/ton, many investors assume a rebound in the commodity is a precondition for a meaningful recovery in $ALB. But what...

Intel NASDAQ:INTC is quite possibly poised for a breakout, as we look at a triangle formation here on the 3W chart, roughly ten months in the making, beside consolidating momentum. Longer term timeframes are good for determining the main trend in a stock's price. On the short term 4H timeframe, better suited for trade entry and exit signals, an inverted head &...

NYSE:LMND broke dramatically into overbought territory on the weekly chart earlier this year. It's taken understandable time to digest those gains and now looks like it could be building steam to revisit prices reached during that breakout. The shorter term 4H chart, more suitable for entry and exit signals, illustrates a recent break above a cup and handle...

Overview Volatility represents how greatly an asset’s prices swing around the mean price. Historically there are rarely brief volatility flare-ups that present trading opportunities. Trying to anticipate volatile events can be costly, because other market participants generally expect the same well known events, and one never knows how big a volatility spike...

Is it a fluke or did lithium futures just make a germane gap up? It would align with the rising momentum. Let's see if the new prices hold, and if corresponding stocks like AMEX:LIT & NYSE:ALB respond in coming weeks.

Whenever I want a decent understanding of what crypto is doing on aggregate, I consult an equal weight portfolio of 10 of the top cryptos by market cap. The sector has been building another pennant, trying for a push to fresh highs, but momentum is flagging. The last time this happened, not too long back, there was a solid drawdown before the pump. By the look...

With this week's announcement of 25% duties on MX & CA one would do well to survey the markets for opportunities. What better way to push through a trade of this nature than the FX markets?! The first thing to check in any FX trade is rate differentials: CA 10Y: 3.22% US 10Y: 4.27% MX 10Y: 9.99% The carry trade dictates we want to be long the currency with...

Here's a better chart than the one shared in October, showing that energy has been consolidating above an upward sloping triangle formation, over 900 days in the making . With just under 4% remaining to reach prior highs set in April, fresh highs could be just weeks away. Looking at the height of the triangle to project potential gains, there could be a whopping...

The XRP weekly chart staged a crazy upward breakout through a longstanding triangle formation. The price exploded above the 200 week moving average, and now we can realistically start thinking about the height of that triangle formation to project price targets. $3.00 looks a likely target using this sort of projection, and is conservatively well below the all...

After breaking down from a falling wedge, ALB undercut a long term support line and things looked precarious. Recent weeks have thrown a lifeline to the beleaguered shares with news of China's CATL cutting lithium production and now Rio Tinto's Arcadium takeover bid . The Rio Tinto bid could have gone another way, since the bid in ALB's stock late last week...

Energy stocks (XLE) have been in a clear ascending triangle for some months now on the weekly chart. There was a false breakout not too long back, but the pattern held up after breaking down and price is again pushing up against resistance at the top of the triangle. Having recently posted a massive green candle with the angst in the Middle East, coming weeks and...

The SEC has until October 7th to file an appeal in their securities case against Ripple. Some suspect the recent debut of the Grayscale XRP Trust suggests there won't be one. The XRP price has shown sensitivity to big dates in the case, and the SEC seems bent on pushing further action in new forms. Closure of the securities case itself though could be the...

Risk assets are in the green today, notably the small cap Russel 2000 up over 2% and Bitcoin a whopping 6% against the Dollar. XRP has been consolidating across timeframes from the daily all the way through monthly and beyond. Back in 2021 Bitcoin and Ethereum were rallying whilst XRP was asleep at the wheel. Suddenly it almost tripled in just 2 days! Varying...

Once again there had been a crazy pump in XRP transaction volume far beyond other prevailing L1 competitors. Will price follow this time??