JWL (Swing): JWL is getting ready for an up move by breaking the past supply levels. Script is consolidating and have formed a strong base. Trade offers a RR of more than 1:5. Check out my earlier views for a better understanding. Note: Do your own due diligence before taking any action.

Swiggy (Swing): Swiggy is well placed for a significant up move by breaking the recent resistance levels. Trade offers a RR of more than 1:4. Check out my earlier views for a better understanding. Note: Do your own due diligence before taking any action.

Nifty Capital Market Index: This index is showing signs of strength among the broader markets. Focus on sectors where there is strength. PSU, PVT Banks, NBFCs, Housing Finance and AMCs all are yet to outshine in the upcoming quarters. Net NPA is at significant low and RBI could go for a rate cut in the upcoming quarter. Wait for pullbacks to increase ur...

Tokyo Plast: (Swing) Watchout for the breakout and trade using the marked levels as SL and TGT. The trade has a potential to offer a RR of 1:5. Keep Learning. Note: Do your own due diligence before taking any action.

APL Apollo Tubes: On the verge of a breakout. Watch for the closing to get a clear signal. This trade has a higher profitability if well taken. Keep Learning. Note: Do your own due diligence before taking any action.

Bliss Pharma (Swing): Bliss Pharma is getting accumulated near the supply zones, meaning the script is set for a probable and significant up move via breaking the crucial supply area. The ideal entry, SL and TGT zones are highlighted. Bliss Pharma offers a trade with RR of more than 1:6. Note: Do your own due diligence before taking any action.

Bank of India (Swing): BOI is on a nice setup. Here the present position offers a trade with RR of more than 1:4. Script is also well set for a significant up move by breaking the previous supply zone. Appropriate buying and profit booking zones are highlighted. Check out my earlier views for a better understanding. Note: Do your own due diligence before taking...

Orient Cement (Long): Despite the volatility in the broader and small cap indices this script has setup well for a significant up move by breaking the crucial supply area. OC present position also offers a trade with RR of more than 1:4. Note: Do your own due diligence before taking any action.

Nifty FMCG (Weekly Chart): Though this index has given a 800 point rally today, a significant resistance lies ahead. Watch out for a retracement in the upcoming days. Cheers Keep Learning

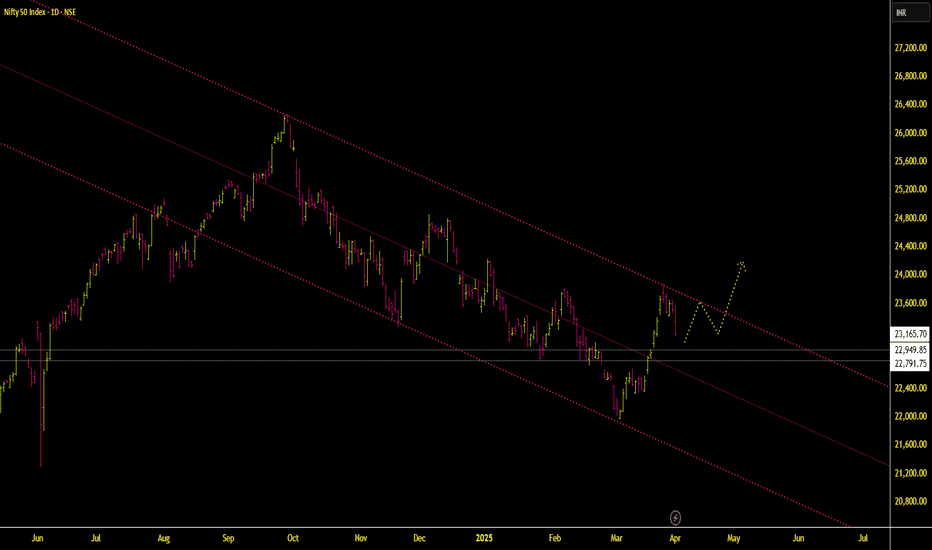

Nifty 50: The index has failed to hold our previously mentioned support @ 22300. A gap of 575 points has also been left down. What happened? The previous support @ 21700 was bought in. Followed by the short covering which also led to the formation of a strong bullish candle. What next? We have to wait for the next few days candle to verify the volume and...

Nifty 50: As mentioned in our earlier posts Nifty 50 index has come down from 23875 to 23165 in the last 3 days. The immediate resistance lies @23600-23700, while the support @ 22300. What's possible next? Nifty 50 has to come down over the next few days to 200-300 points to continue its possible upward trajectory. Buy on dip market is on hold until...

Nifty 50: As mentioned in our earlier posts Nifty 50 index has confirmed its reversal trend through its 1500 points rally over the last 5-7 days. The immediate resistance lies @23850-23950, while the support @ 22300. What Next? Nifty 50 has to come down over the next few days to 22900-23100 to continue its upward trajectory. From here on its a buy on dip...

Gift Nifty: The index is at crossroads and waiting for a clear decision to be taken. Its so far not clear who will keep going bulls or bears.

Veto Switchgears (Swing): Script is also well set for a significant up move by breaking the crucial supply area. Veto with the present position also offers a trade with RR of more than 1:6. Appropriate supply, demand and target zones are highlighted. Check out my earlier views for a better understanding. Note: Do your own due diligence before taking any action.

Gateway Distriparks (Swing): Gateway is on a nice setup. Here the present position offers a trade with RR of more than 1:7. Script is also well set for a significant up move by breaking the all time high. Appropriate demand and target zones are highlighted. Check out my earlier views for a better understanding. Note: Do your own due diligence before taking any action.

PTC India (Swing): PTC is on a nice setup. Here the present position offers a trade with RR of more than 1:5. PTC is also well set for a significant up move by breaking the all time high. Appropriate supply and demand zones are highlighted. Check out my earlier views for a better understanding. Note: Do your own due diligence before taking any action.

TPL Plastech (Swing): TPL is well set for a significant up move by breaking the all time high. Appropriate support and resistance are highlighted. Trade offers a RR of more than 1:5. Check out my earlier views for a better understanding. Note: Do your own due diligence before taking any action.

Muthoot Microfin (Swing): This script is well set for a significant up move by breaking the IPO base . Appropriate supply, demand, resistance and target zones are highlighted. Trade offers a RR of more than 1:9. Check out my earlier views for a better understanding. Note: Do your own due diligence before taking any action.