xx808Traderz

Cannibis stocks have been beat down heavily in the past year. To be safe, the ETF of cannibis stocks is a safe investment for a multi year long term buy.

Consolidations down, with triggered Bull flags by news, we should be selling off but everytime we flag and another tweet comes out over night.

Caution where we are right now. We are currently in extreme greed.

From a long term perspective, CVS is definitely a mover to watch. $70 is a big level for them to reclaim. I am buying some shares at $70 and holding for now. I expect further growth that will push us out of this channel in the upcoming year

MCD has been beat up from earnings and news. Value buyers are going to come in soon, I'm thinking tomorrow.

INTRA-DAY PLAY When the 14 EMA crosses below the 30 EMA on the daily, I call it a "death cross" as it is indicative of more downside. Look for a small push up at open to get a better position, then short. Maintain a tight risk/reward and trade wisely.

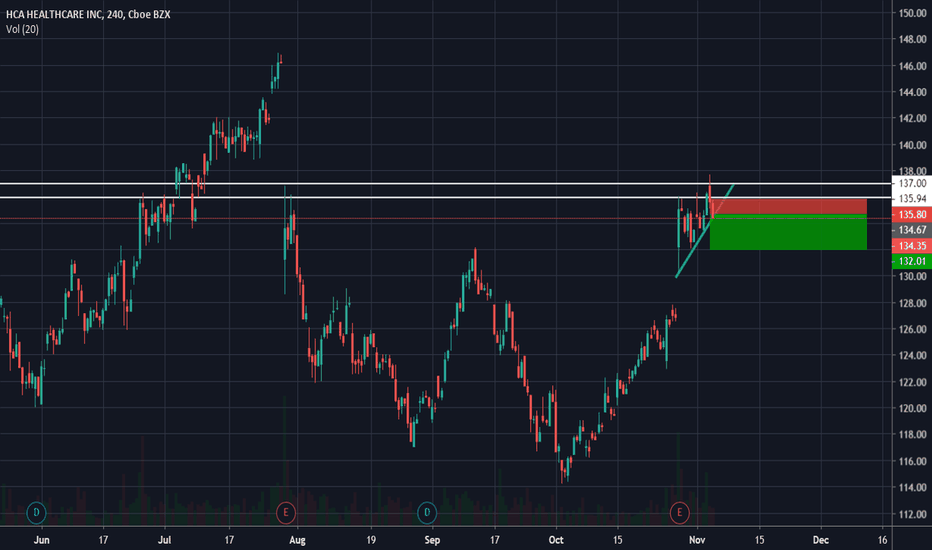

INTRA-DAY PLAY Again, all based off of weakness in XLV - healthcare sector. With market looking to open lower, I will be shorting HCA to complete the bear flag. First profit target at 132.

XHB double top. The market may be at all time highs, but it is not perfect. With the market expecting to pull back eventually and the homebuilder sector looking weak, the risk is very low.

I think people are being very subjective to the market at this moment. Caution the news coming out. That being said, healthcare sectors from a long term perspective is overbought. I will be shorting UNH for this week. I think there is a good risk reward. I will also be shorting XLV for the long term.