Market analysis from FOREX.com

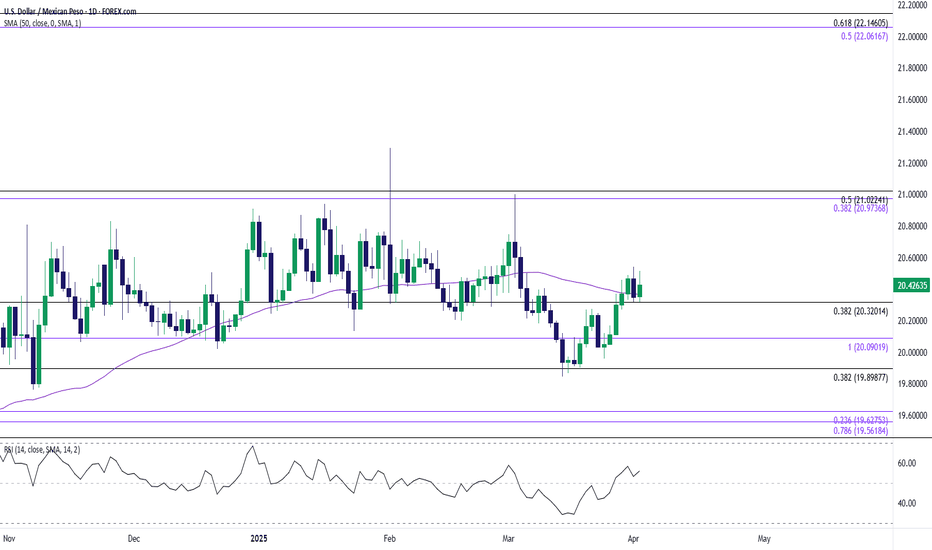

The recent rebound in USD/MXN appears to be stalling ahead of the March high (20.9997) as it fails to extend the series of higher highs and lows carried over from last week. In turn, USD/MXN may consolidate over the coming days as it holds below the weekly high (20.5430), and a close below 20.3200 (38.2% Fibonacci retracement) may push the exchange rate towards...

Volatility was again the name of the game in equity markets as investors braced for President Donald Trump’s impending tariff announcement, which promises to reshape global trade dynamics. With uncertainty swirling around the scope and impact of his so-called reciprocal tariffs, there remains little consensus on how markets will react as the final deliberations...

With uncertainty surrounding U.S. trade policy about to be resolved and price signals turning bullish, the ingredients for a squeeze in Russell 2000 futures are now in place. Unlike other stock indices with far larger constituents, U.S. small caps have lagged this week’s rebound—potentially due to recession concerns, which wouldn’t help unprofitable cyclical...

Since touching the key support level at $67 , WTI crude oil has posted a notable recovery of more than 7% in recent weeks, and is now hovering slightly above the $70 per barrel mark. For now, the bullish bias remains intact as comments from the White House suggest potential tariffs ranging from 25% to 50% on countries that choose to trade Russian oil. According...

The CADJPY rebounded alongside risk assets, but its now testing key resistance at 104.50, where the recovery might falter. This level was prior support and resistance, and where the 21-day exponential moving average comes into play. Given an overall bearish structure, I wouldn't be surprised if the selling resumes here. By Fawad Razaqzada, market analyst with...

The Kiwi is clinging to uptrend support within a broader rising wedge, with selling pressure reemerging at .5680 despite Monday’s late recovery. A clean break below the uptrend could see bears target .5650, the low from Monday. A move through that level would put .5600 in focus as the next downside target. Momentum signals reinforce the bearish case—RSI (14) and...

The Nasdaq has been one of the indices showing the strongest selling bias in recent sessions. Over the past four trading days, it has fallen by more than 7% , as the market remains gripped by uncertainty surrounding White House trade policies and the threat of a new trade war. The proposed 25% tariffs on several countries are expected to take effect on April 2,...

Thursday’s bullish engulfing candle and rising risk aversion have GBP/AUD knocking on the door of a bullish breakout, with the pair testing resistance at 2.0627 in early Asian trade on Monday. Stepping back, GBP/AUD remains within an ascending triangle pattern, bouncing off uptrend support on four separate occasions this month. While convention suggests traders...

The monthly movements of Tesla's stock continue to reflect persistent downward pressure, with a decline of just over 10% since the beginning of March, showing steady selling interest. The bearish sentiment has remained in place as growing discontent over Elon Musk's political positioning has damaged the brand's image, while concerns over a potential trade war have...

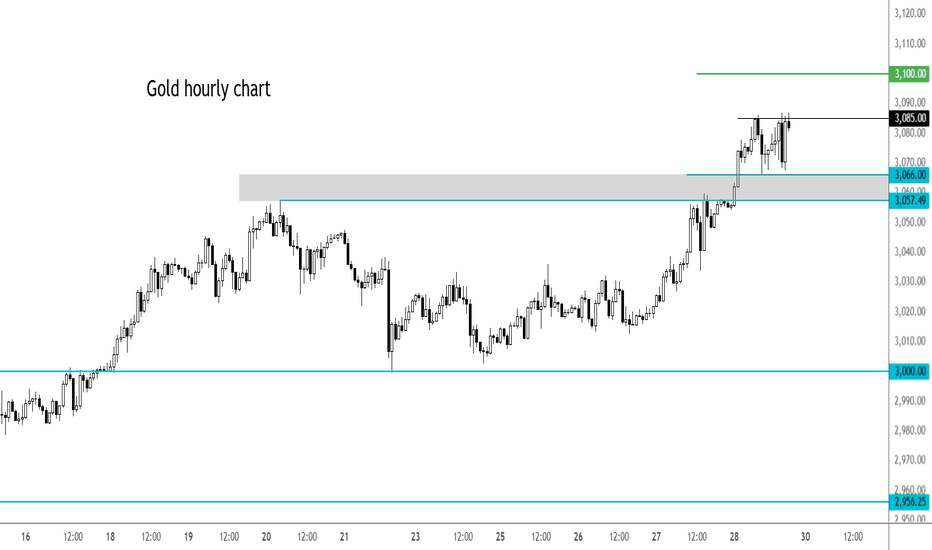

Gold continues to find support amid haven flows as equities tumble on trade war concerns. But how much further can gold rise? Well I think a lot of people had $3K+ pencilled in as their target. We are obviously well above the $3K level now at $3085, which may trigger some profit taking. While dip buyers are lurking, a rug pull is becoming increasingly likely...

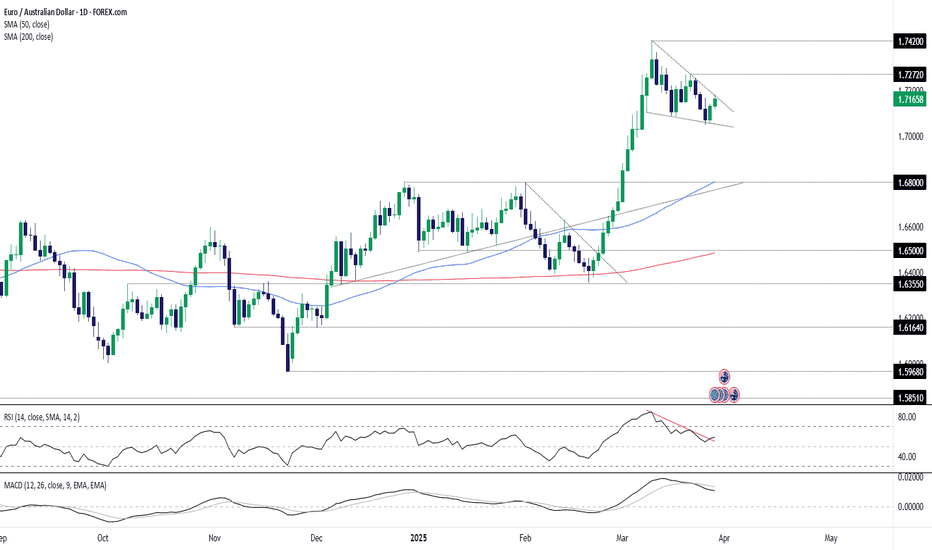

Traders should be alert to the risk of a resumption of the bullish trend in EUR/AUD. It’s been coiling within a falling wedge for much of March, with the price rebound over the past two sessions leaving the pair testing downtrend resistance. A bullish wedge break would put 1.7272 on the radar. If that were to give way it would open the door for a run towards the...

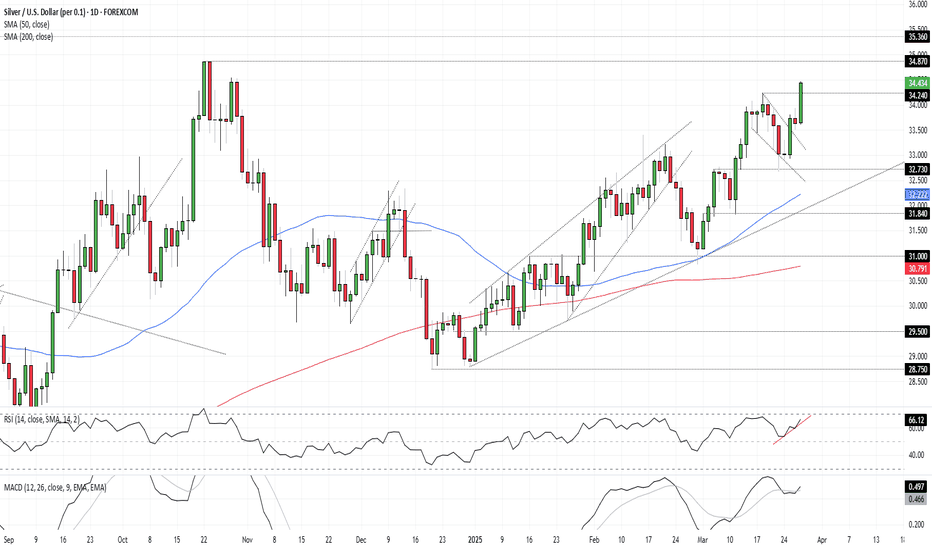

The bullish move in silver we anticipated has played out nicely following the break of wedge resistance earlier this week, with the price squeezing above $34.24 on Thursday. Bulls will now be eyeing a retest of the October 24 swing high of $34.87. Momentum indicators such as RSI (14) and MACD are trending higher, reinforcing the bullish setup and favouring buying...

The last four trading sessions for Bitcoin (BTC) have been fairly neutral, with the cryptocurrency fluctuating by around 2% , staying just below the critical $90,000 resistance level. The current uncertainty in the market is mainly driven by the renewed trade war narrative, following Trump’s recent comments about imposing tariffs on cars and auto parts. These...

USD/JPY has continued to snag bears with several bear traps so far this year. While there was a series of lower-lows in the first part of March, as the USD was plummeting against most major currencies, USD/JPY has turned around over the past three weeks, and is now nearing a re-test of the 200-day moving average. The 150.77 Fibonacci level held the highs on...

GBP/USD could be a compelling pair for those looking for USD-weakness. While EUR/USD has strung together six consecutive down days and USD/JPY continues to surge-higher even with USD-weakness showing in DXY, GBP/USD has held up fairly well, all factors considered. Also of interest is the big figures at play, with the 1.3000 level back in the equation on GBP/USD....

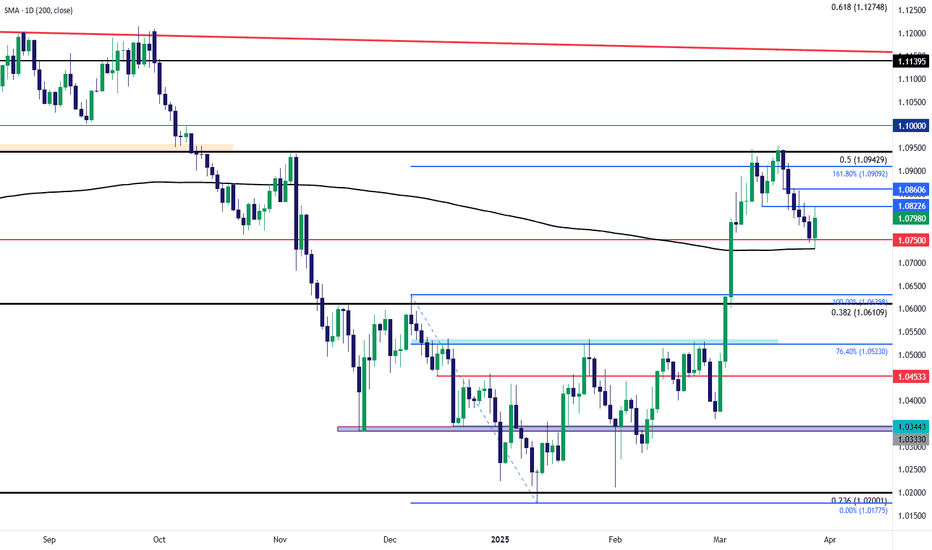

EUR/USD is looking to break a streak of six consecutive down days after running into Fibonacci resistance at 1.0943. That pullback spanned more than 200 pips at its peak, with support finally showing up yesterday in the 1.0730-1.0750 zone previously highlighted. The question now is which trend will take over - as the prior bullish trend had quickly went...

Gold prices surged once again toward the record high of 3,057, driven by safe-haven demand ahead of April, which brings renewed tariff threats and unfolds amid intensifying geopolitical tensions involving Russia, Ukraine, the U.S., Yemen, Israel, and Gaza. Should gold prices retreat below this level, we may witness the formation of a potential double top pattern,...

Russell 2000 futures may resume the bearish trend established earlier this year, trading below wedge support following the completion of an evening star reversal pattern on Wednesday. Shorts could be established on the break with a stop above the former uptrend for protection. Support may be encountered around 2050, although 1994.8 looms as a more appropriate...