Hey everyone! Welcome back to the TradingView Weekly Digest. In today’s edition, we’re highlighting the top ideas from our community, which includes a write-up on Tesla, an informative post about Keltner channels and Bollinger bands, a hot script on trailing stop management, and all the latest headlines, earnings, and economic events.

We hope you find this week's edition exciting and engaging. Let's dive in! 😀

💡 Tesla Stock Down 30% This Year. What Happened to the EV King? - by TradingView

The electric-car maker is in dire need of charging after losing more than $260 billion this year and turning Elon Musk into the biggest loser among the world’s wealthiest. Tesla stepped into 2024 as the world’s largest EV seller with a valuation of more than $780 billion. None of that is true today.

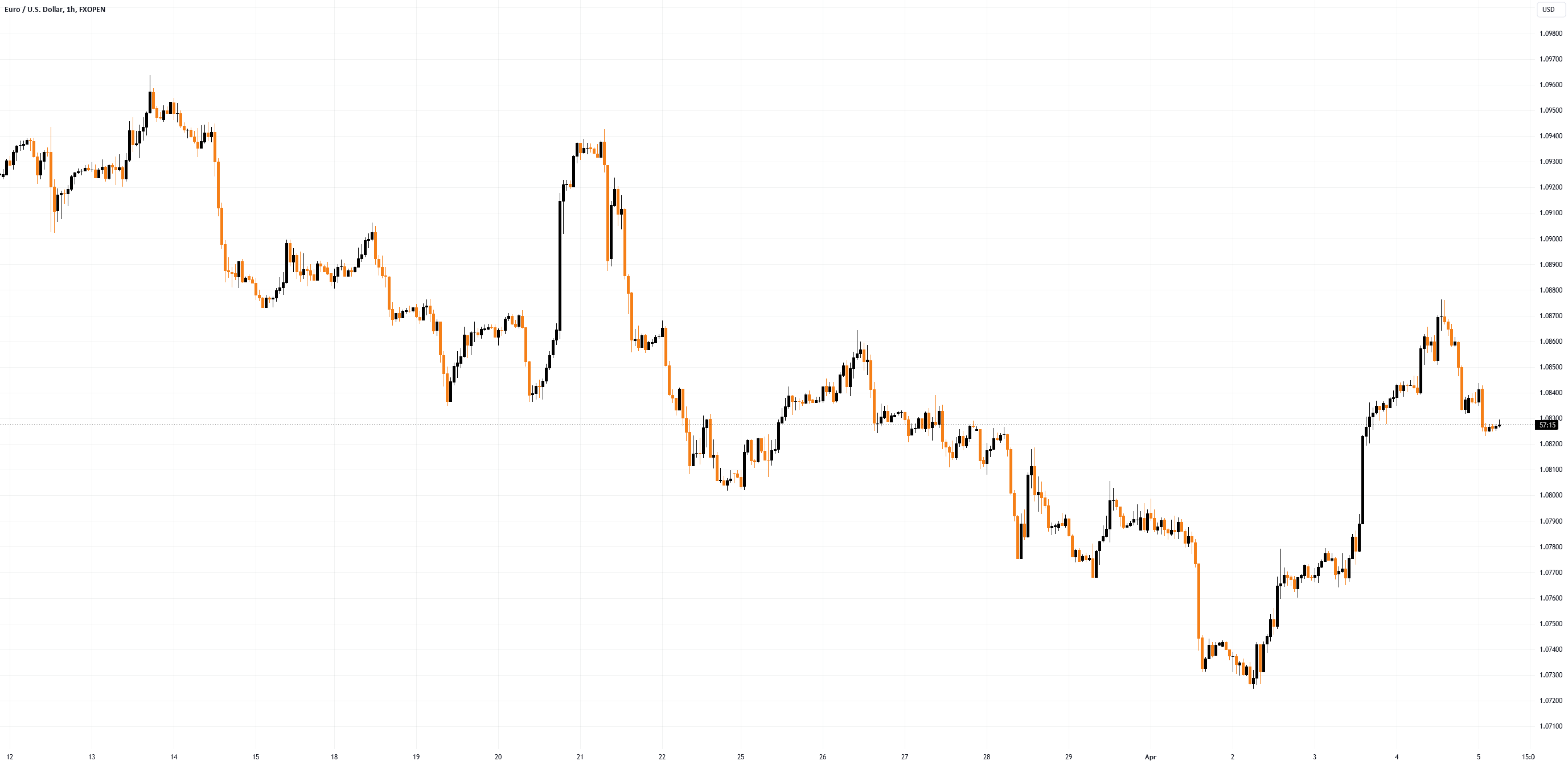

💡 Keltner Channels vs Bollinger Bands - by FXOpen

If you're a trader, you likely know that indicators are valuable tools for identifying trends and determining entry and exit points. Two popular indicators are Keltner Channels and Bollinger Bands. Both help measure volatility, but which one is better? In this article, we'll delve into the differences between the two, explain their components, and discuss which one is best.

🔝 Top Stories

📰U.S. March Nonfarm Payrolls +303K; Unemployment Rate 3.8%

📰Johnson & Johnson to Buy Shockwave Medical in $13.1 Billion Deal

📰Gold Shines Above $2,300, Ends Another Week At Record High

📰Solar Eclipse On April 8 Could Give Whopping $1.5 Billion Boost To Businesses

📰New users flock to Ethereum while long-term holders are less active than ever

💵 Earnings highlights from the previous week:

💲Levi Strauss (LEVI) Q1 Earnings and Revenues Surpass Estimates

💲BlackBerry reports surprise profit on demand for cybersecurity services

💲Conagra (CAG) Q3 Earnings Beat, Organic Sales Decline Y/Y

💲Lamb Weston (LW) Q3 Earnings Lag Estimates, Guidance Lowered

💲Greenbrier 2Q Revenue Declines But Beats Wall Street's Forecast

💡 Nvidia - Entering a Bear Phase! - by basictradingtv

For more than 6 years, Nvidia stock has been trading in a long-term rising channel formation. The last retest of support occurred in 2021, followed by a +650% rally to the upside. As of now, Nvidia stock is retesting the upper resistance of the channel, and we might see a short-term correction towards the downside to retest the previous all-time high.

💡 Don't Get Duped by the RSI - by ParabolicP

The Relative Strength Index (RSI) is a common technical analysis tool used by traders to gauge whether an asset is overbought (priced too high) or oversold (priced too low). It analyzes price movements over a specific period (often 14 days) and displays a score between 0 and 100. Generally, an RSI above 70 suggests an overbought condition, while an RSI below 30 suggests an oversold condition.

📆 Economic Calendar

⚡️ April 10th (United States) — Core Inflation Rate YoY

⚡️ April 10th (United States) — Inflation Rate YoY

⚡️ April 10th (United States) — FOMC Minutes

⚡️ April 12th (United States) — Michigan Consumer Sentiment Prel

⚡️ April 16th (China) — GDP Growth Rate YoY

🔥 What's New?

✅ New chart type — Volume candles

🌟 Script of the Week

📜 Trailing Management - by Zeiierman

This tool provides an automated and visual approach to trailing stop management, aiding in systematic decision-making for trade entries and exits based on risk-reward metrics.

💭 Our Weekly Thought:

“The trend is your friend.”

We hope you found this helpful. Please share your feedback, remarks, or suggestions with us in the comments below.

💖 TradingView Team

📣 Want to be among the first to know all the news? Give us a follow!

We hope you find this week's edition exciting and engaging. Let's dive in! 😀

💡 Tesla Stock Down 30% This Year. What Happened to the EV King? - by TradingView

The electric-car maker is in dire need of charging after losing more than $260 billion this year and turning Elon Musk into the biggest loser among the world’s wealthiest. Tesla stepped into 2024 as the world’s largest EV seller with a valuation of more than $780 billion. None of that is true today.

💡 Keltner Channels vs Bollinger Bands - by FXOpen

If you're a trader, you likely know that indicators are valuable tools for identifying trends and determining entry and exit points. Two popular indicators are Keltner Channels and Bollinger Bands. Both help measure volatility, but which one is better? In this article, we'll delve into the differences between the two, explain their components, and discuss which one is best.

🔝 Top Stories

📰U.S. March Nonfarm Payrolls +303K; Unemployment Rate 3.8%

📰Johnson & Johnson to Buy Shockwave Medical in $13.1 Billion Deal

📰Gold Shines Above $2,300, Ends Another Week At Record High

📰Solar Eclipse On April 8 Could Give Whopping $1.5 Billion Boost To Businesses

📰New users flock to Ethereum while long-term holders are less active than ever

💵 Earnings highlights from the previous week:

💲Levi Strauss (LEVI) Q1 Earnings and Revenues Surpass Estimates

💲BlackBerry reports surprise profit on demand for cybersecurity services

💲Conagra (CAG) Q3 Earnings Beat, Organic Sales Decline Y/Y

💲Lamb Weston (LW) Q3 Earnings Lag Estimates, Guidance Lowered

💲Greenbrier 2Q Revenue Declines But Beats Wall Street's Forecast

💡 Nvidia - Entering a Bear Phase! - by basictradingtv

For more than 6 years, Nvidia stock has been trading in a long-term rising channel formation. The last retest of support occurred in 2021, followed by a +650% rally to the upside. As of now, Nvidia stock is retesting the upper resistance of the channel, and we might see a short-term correction towards the downside to retest the previous all-time high.

💡 Don't Get Duped by the RSI - by ParabolicP

The Relative Strength Index (RSI) is a common technical analysis tool used by traders to gauge whether an asset is overbought (priced too high) or oversold (priced too low). It analyzes price movements over a specific period (often 14 days) and displays a score between 0 and 100. Generally, an RSI above 70 suggests an overbought condition, while an RSI below 30 suggests an oversold condition.

📆 Economic Calendar

⚡️ April 10th (United States) — Core Inflation Rate YoY

⚡️ April 10th (United States) — Inflation Rate YoY

⚡️ April 10th (United States) — FOMC Minutes

⚡️ April 12th (United States) — Michigan Consumer Sentiment Prel

⚡️ April 16th (China) — GDP Growth Rate YoY

🔥 What's New?

✅ New chart type — Volume candles

🌟 Script of the Week

📜 Trailing Management - by Zeiierman

This tool provides an automated and visual approach to trailing stop management, aiding in systematic decision-making for trade entries and exits based on risk-reward metrics.

💭 Our Weekly Thought:

“The trend is your friend.”

We hope you found this helpful. Please share your feedback, remarks, or suggestions with us in the comments below.

💖 TradingView Team

📣 Want to be among the first to know all the news? Give us a follow!

Get $15 worth of TradingView Coins for you and a friend: www.tradingview.com/share-your-love/

Read more about the new tools and features we're building for you: www.tradingview.com/blog/en/

Read more about the new tools and features we're building for you: www.tradingview.com/blog/en/