Gravions IG: Why Apple's Shift to India Could Trigger a Drop in Apple is betting heavily on changing its production geography, planning to move a significant portion of iPhone assembly from China to India by 2026. Analysts at Gravions IG have assessed the situation and concluded that this move could negatively impact the company’s stock value in the near term.

Key Risks of Production Relocation

Indian manufacturing facilities, although growing rapidly, have not yet achieved the level of quality and logistical efficiency seen at Chinese plants. Gravions IG emphasizes that reconfiguring production processes takes time, and potential disruptions in supply chains or reduced quality in the early batches could trigger dissatisfaction among consumers and partners.

According to their analysis, the transition could increase product costs and squeeze profit margins, putting pressure on Apple’s financial results over the next few quarters.

Investor Reactions

Current market behavior reflects investor caution: Apple's share price has already fallen nearly 17% since the start of the year, with technical indicators suggesting further declines. The formation of a "death cross" — where the 50-day moving average crosses below the 200-day moving average — heightens concerns about a prolonged downtrend.

Gravions IG stresses that until the Indian production lines are fully operational and stable, Apple's stock will likely remain under selling pressure.

Strategic Perspective: Opportunity or Risk?

In the long run, diversifying manufacturing could benefit Apple by reducing its dependence on China and insulating it from potential geopolitical or economic shocks. Additionally, the Indian government's efforts to bolster its manufacturing sector could provide Apple with a stronger foundation for future expansion.

Still, Gravions IG insists that until Indian facilities reach consistent quality and scale, Apple will be vulnerable to market sentiment swings and potential reputational risks.

Conclusion

Relocating production is a strategically sound but high-risk move for Apple in the short term. Gravions IG advises investors to closely monitor product quality and supply chain stability in India before making long-term investment decisions regarding Apple's stock.

Wave Analysis

Solvery IG Predicts Bitcoin to Reach $105,000 by May 10, 2025The cryptocurrency market continues to surprise even the most seasoned investors. Against this backdrop, the analytical firm Solvery IG has released an ambitious forecast: according to their calculations, Bitcoin's price could reach $105,000 by May 10, 2025.

Factors Supporting Bitcoin's Growth

In recent months, the market has shown strong positive momentum. Several key factors have contributed to this trend:

Institutional Investments: Major banks, funds, and corporations are increasingly incorporating Bitcoin into their portfolios as a hedge against risks.

Macroeconomic Instability: Inflationary pressures and weakening fiat currencies are driving investors to seek alternative assets.

According to Solvery IG experts, it is the combination of these factors that creates a "perfect storm" for the continued growth of the leading cryptocurrency.

Analysis and Potential Risks

Despite the optimistic forecast, potential threats should not be overlooked. The cryptocurrency market remains highly volatile. Possible tightening of regulations in the U.S. and Europe, as well as sudden shifts in Federal Reserve policies, could exert downward pressure on the market.

Nevertheless, Solvery IG highlights a crucial technical point: according to their data, Bitcoin has successfully held above key support levels between $60,000 and $65,000. This indicates strong buyer sentiment and supports expectations for a continued upward trend.

The impact of the halving event, which occurred in April 2024, should also be taken into account. Historically, Bitcoin has shown significant growth 12–18 months following a halving, and the current market behavior aligns closely with these cyclical patterns.

What This Means for Investors

If Solvery IG’s forecast comes true, Bitcoin would achieve more than a 50% increase compared to current levels. This presents significant opportunities for long-term investors. However, experts advise exercising caution, diversifying risks, and avoiding allocating all funds to a single asset.

Cryptocurrencies remain high-risk instruments, and successful investing requires a deep understanding of the market and a realistic assessment of all potential scenarios.

Conclusion

Solvery IG’s prediction of Bitcoin reaching $105,000 by May 10, 2025, sounds promising, especially given the positive momentum in recent months. However, investors should always remember: high returns come with high risks.

How to use Correlation for your tradingHello,

Understanding correlation is key to elevating your trading success for two main reasons:

Avoid Trading Against Yourself: When you buy one asset and sell another that is positively correlated, you risk offsetting your gains with losses. This often results in a zero-sum outcome, as one trade may profit while the other incurs a loss. Recognizing correlated pairs helps you avoid this pitfall and trade more strategically. Using the chart below its clear that it will be unwise to sell GBPUSD while buying EURUSD since both pairs move in the same direction.

Capitalize on Lagging Pairs:

Identifying correlated pairs and their movement patterns enables smarter trading decisions. By spotting which pair tends to lead and which lags, you can focus on trading the lagging pair to increase your probability of success. While risks remain, this approach allows for more calculated and potentially profitable trades.

The charts provided illustrate the positive correlation between GBPUSD and EURUSD, showing how they move in tandem. This insight allows you to confidently buy or sell one pair based on the movement of the other, optimizing your trading strategy.

Goodluck in your trading.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Elliott Wave Principles: A Study on US Dollar IndexHello friends, today we'll attempt to analyze the (DXY) US Dollar Index chart using Elliott Wave theory. Let's explore the possible Elliott Wave counts with wave Principles (Rules).

We've used the daily time frame chart here, which suggests that the primary cycle degree in Black weekly wave ((A)) and ((B)) waves have already occurred. Currently, wave ((C)) is in progress.

Within wave ((C)) in Black which are Weekly counts, Subdivisions are on daily time frame, showing Intermediate degree in blue wave (1) & (2) are finished and (3) is near to completion. Post wave (3), we can expect wave (4) up in Blue and then wave (5) down in Blue, marking the end of wave ((C)) in Black.

Additionally, within blue wave (3) Intermediate degree, we should see 5 subdivisions in red of Minor degree, which is clearly showing that waves 1 & 2 are done and now we are near to completion of wave 3 in Red. followed by waves 4 and 5, which will complete blue wave (3).

Key Points to Learn:

When applying Elliott Wave theory, it's essential to follow specific rules and principles. Here are three crucial ones:

1. Wave 2 Retracement Rule: Wave two will never retrace more than 100% of wave one.

2. Wave 3 Length Rule: Wave three will never be the shortest among waves 1, 3, and 5. It may be the largest most of the time, but never the shortest.

3. Wave 4 Overlap Rule: Wave four will never enter into the territory of wave one, meaning wave four will not overlap wave one, except in cases of diagonals or triangles.

Invalidation level is a level which is decided based on these Elliott wave Principles only, Once its triggered, then counts are Invalidated so we have to reassess the chart study and other possible counts are to be plotted

The entire wave count is clearly visible on the chart, and this is just one possible scenario. Please note that Elliott Wave theory involves multiple possibilities and uncertainties.

The analysis we've presented focuses on one particular scenario that seems potentially possible. However, it's essential to keep in mind that Elliott Wave counts can have multiple possibilities.

I am not Sebi registered analyst.

My studies are for educational purpose only.

Please Consult your financial advisor before trading or investing.

I am not responsible for any kinds of your profits and your losses.

Most investors treat trading as a hobby because they have a full-time job doing something else.

However, If you treat trading like a business, it will pay you like a business.

If you treat like a hobby, hobbies don't pay, they cost you...!

Hope this post is helpful to community

Thanks

RK💕

Disclaimer and Risk Warning.

The analysis and discussion provided on in.tradingview.com is intended for educational purposes only and should not be relied upon for trading decisions. RK_Charts is not an investment adviser and the information provided here should not be taken as professional investment advice. Before buying or selling any investments, securities, or precious metals, it is recommended that you conduct your own due diligence. RK_Charts does not share in your profits and will not take responsibility for any losses you may incur. So Please Consult your financial advisor before trading or investing.

The Two-Faced Market: The Truth Behind Trend Reversals!🎭 The Two-Faced Market: The Truth Behind Trend Reversals! 📊🚀

📢 Ever entered a trade thinking you caught the perfect trend , only to get stopped out as the market reversed?

You're not alone. The market has a way of fooling traders—but if you understand its “two-faced” nature, you can stay one step ahead.

🔥 Why Trends Reverse (and How to Catch It Early!)

Most traders believe trends reverse due to "news" or "randomness." But in reality, the market gives signals long before the turn happens. Here’s what to watch for:

🔹 Momentum Divergence: The price makes a new high, but indicators like RSI/MACD don’t.

🔹 Volume Anomaly: The trend continues, but volume dries up—a sign of weakness.

🔹 Failed Breakouts: Price breaks a key level, only to fall back inside—trapping traders.

🔹 Candlestick Clues: Reversal patterns like engulfing candles or wicks rejecting key levels appear.

🚀 Mastering these signals can put you ahead of 90% of traders.

📊 Real Example: XAU/ USD Trend Reversal in Action

🔎 Breakdown of the setup:

✅ Step 1: Identify a trend (through market structure, trendline or moving average).

✅ Step 2: Look for failed breakouts against the trend

✅ Step 3: Look for trend-following setups

🎯 The Market’s Game: Recognizing The Shift

Trends don’t die suddenly—they fade before reversing. The best traders spot the early signs and position before the crowd.

💡 Have you spotted these reversal signs before? Drop a comment with your experience! 👇🔥

📚 Always follow your trading plan regarding entry, risk management, and trade management.

Good luck!

All Strategies Are Good; If Managed Properly!

~Rich

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Elliott Wave Analysis of DLF: A Technical PerspectiveHello friends, let's analyze the DLF chart on a daily time frame. Currently, we're observing a corrective phase, where the stock has completed a flat correction pattern (A-B-C) with a 3-3-5 structure. Following this correction, we've seen a significant drop, accompanied by a strong double divergence in the RSI indicator. Where Fibonacci Retracement of last long Rally on Weekly is near 50% - 55% which is less than 61.8% should consider as a Healthy Retracement

As the price is currently moving upwards, completing wave counts, a breakout above the downward trend line would increase our conviction in the analysis.

This analysis is for educational purposes only and not a tip or advisory. If the price breaks out and stays above the trend line while maintaining the low of 601, we can expect further upside momentum. However, 601 would remain a crucial invalidation level, and a breakdown below it would require us to reassess our wave counts.

Key points:

1. DLF chart analysis on daily time frame

2. Flat correction pattern (A-B-C) with 3-3-5 structure

3. Healthy Retracement

4. Strong double divergence in RSI indicator

5. Breakout above trend line increases conviction (Which is pending yet)

6. 601 as invalidation level

Please note that this is a Educational technical analysis post and not a recommendation to buy or sell.

I am not Sebi registered analyst.

My studies are for educational purpose only.

Please Consult your financial advisor before trading or investing.

I am not responsible for any kinds of your profits and your losses.

Most investors treat trading as a hobby because they have a full-time job doing something else.

However, If you treat trading like a business, it will pay you like a business.

If you treat like a hobby, hobbies don't pay, they cost you...!

Hope this post is helpful to community

Thanks

RK💕

Disclaimer and Risk Warning.

The analysis and discussion provided on in.tradingview.com is intended for educational purposes only and should not be relied upon for trading decisions. RK_Charts is not an investment adviser and the information provided here should not be taken as professional investment advice. Before buying or selling any investments, securities, or precious metals, it is recommended that you conduct your own due diligence. RK_Charts does not share in your profits and will not take responsibility for any losses you may incur. So Please Consult your financial advisor before trading or investing.

Monitor Price action with Trendlines / Gan Fan*And over here, Sir/Madam, we have the 3.5L six-cylinder, 800-horsepower, 95-cubic feet

truck with a diesel engine. It goes 0 to 60 in 0.5 seconds and comes fully equipped with an 18-foot lift kit and did I mention the 80 inch strobe lights.”*

Some days, wave counting feels exactly like that—like you’ve been dragged to a dealership and hit with a barrage of numbers you didn’t ask for.

Information you have to painstakingly puzzle through.

All you really want to know is: Does it drive? *Where will it take me?*

That’s the heart of my wave counts. I don’t care about the extra fluff. I want clarity, direction, and purpose.

But doing the two-step between multiple asset classes—forex, indices, FANG stocks—feels like a dangerous tango. One where my precious money is on the line.

* *

There’s a Chinese proverb that sums it all up:

**“Life is really simple, but we insist on making it complicated.” — Confucius**

In this quick article, I’ll show you a dead-simple concept that can clear up your charts and your thinking. A quick read. Quick to understand. So for one night, you don’t have to do a dirty tango with crazy numbers.

**Cue: Gann Fans and Trend Lines.**

You’ve seen trend lines.

But have you seen *three*?

When you use three trend lines, you’re not just capturing the obvious. You’re measuring *acceleration*, *deceleration*, and *breakout momentum*. One line to show the base trend. One to catch the slowdown. And one to anticipate the breakout.

Pair that with s&r levels and suddenly you’re seeing *speed* and *time* like never before. A break of a key level or a sharp lift off your trend line isn’t random—it’s often the market shifting gears.

You didn’t think I’d drop all this without sprinkling in some wave counts, did you?

Welcome to the fiesta.

- Tango intensities*

Here’s where it ties in:

A **double bottom** formation near the end of a trend often isn’t just a reversal—it’s a *setup*.

What you’re likely seeing is a **Wave 3-4-5** squeeze into completion. That double bottom is the market catching its breath.

And when it breaks the trend line on the upside? That’s often the beginning of a brand new wave structure in the opposite direction.

If this breakout fails it is just as easy to exit the position with easy to identify stop out points.

It doesn’t have to be complicated.

Just structured.

Best,

Coi

LiteCoin (LTC) - Chart reading with Weis Wave with Speed Index

Lesson 15 Methodology:

1. Largest up volume wave at the bottom after while (probable buyers but let's confirm using AVWAP and Weis Wave with Speed Index and it's Plutus Signals.

2. Placed AVWAP at the beginning of the previous down wave and wait for price to pullback to it.

3. Price Respects AVWAP.

4. Abnormal Speed Index 40.8 is a sign that price has a hard time to move down.

5. Enter Long on PL signal.

... and up we go!!!!

Target Fib area which was reached!

No entries now - Fib could risky!

Trading A Divergence Trade (Breakdown) with Pivots and LiquidityTrading divergences was always a problem for me in the past. I did the same thing you did and got it wrong every time. I was trading divergences when i saw them instead of realizing a divergence is a flip of support and resistance levels. I just needed to know where they are.

In this video:

Internal vs External Pivot divergence confirmation:

You can have two types of pivots on your chart. One for long term and one for short term.

Using them to confirm short and long term price action is intuitive as youll be able to see the market squeezing on the short term while knowing where your long term price structure exists.

Price action to Divergence Confirmation:

A divergence on a short term pivot is an indication of short term loss of trend or reversal.

If the short term has no divergence but the long term does, you are about to end up with some pretty large price moves.

Youll be confirming the divergence by looking for highs, lows, and closes moving the wrong way from current price action.

This video will give you a method you can use to draw out your support zone / resistance zone / divergence zone and use them to your advantage.

The "Divergence Zone" that you draw out is the very reason why so many people fail at divergences.

Bare in mind that when you have a divergence, support and resistance are on the WRONG sides as their normally are so you'll learn here how to find those zones as well.

Then in the end of the video ill show you how to use lower timeframes to confirm the new move of the market.

Thanks, everyone. For coming through to the CoffeeShop.

Connecting Your Tickmill Account to TradingView: A Step-by-Step In this step-by-step guide, we’ll show you exactly how to connect your Tickmill account to TradingView in just a few seconds.

✅ Easy walkthrough

✅ Real-time trading from charts

✅ Tips for a smooth connection

Don’t forget to like, comment, and subscribe for more trading tutorials!

All Strategies Are Good; If Managed Properly!

~Richard Nasr

Swing Trading: Unique Features and StrategiesSwing Trading: Unique Features and Strategies

Swing trading stands out as a dynamic approach in the trading world, blending elements of both short-term and long-term strategies. In this article, we will explore the unique features of swing trading, including its reliance on technical analysis, the use of chart patterns, and the strategic timing of entries and exits. Whether you're new to trading or seeking to refine your approach, understanding the nuances of swing trading can provide valuable insights into navigating the financial markets.

The Basics of Swing Trading

Swing trading meaning refers to a style that involves holding short- and medium-term positions - usually from a couple of days to a few weeks - with the aim of capitalising on the “swings” in the market.

What is a swing trader? A swing trader’s definition is simple: swing traders are those who typically enter and exit markets at significant support and resistance levels, hoping to capture the bulk of expected moves.

These traders tend to look at hourly to weekly charts to guide their entries, although the timeframe used will depend on the swing trader’s individual approach and the asset being traded. Swing trading can be used across all asset classes, from stocks and forex to cryptocurrencies* and commodities. In the stock market, swing trading can be especially effective, as stocks tend to experience high volatility and are subject to frequent news and events that can drive prices.

Swing traders predominantly use technical analysis to determine their entries and exits, but fundamental analysis, like comparing the interest rates of two economies, can also play a significant role. It can help determine a price direction over the course of days or weeks.

Swing Trading vs Other Styles

To better understand the unique features of swing trading, let’s compare it with our styles.

Position trading involves holding trades for weeks and months, focusing on capturing long-term trends. Position traders are less concerned with short-term fluctuations and are more likely to use fundamental analysis, such as economic data and company earnings, to make their decisions. This style requires patience and a long-term perspective, with fewer trades but potentially larger returns per trade.

Swing trading involves holding trades for several days to a few weeks, aiming to capture short- and medium-term price movements within a larger trend. This style balances the need for active market participation with the flexibility to not monitor trades constantly. Swing traders primarily rely on technical analysis to identify entry and exit points, focusing on chart patterns and indicators.

Day trading requires traders to buy and sell assets within the same trading day, often holding positions for just minutes or hours. The goal is to capitalise on intraday price movements, and traders close all positions before the market closes to avoid overnight risk. This style demands constant market monitoring and quick decision-making, with a strong reliance on real-time technical analysis.

Scalping is an ultra-short-term trading style where positions are held for seconds to minutes, aiming to make small profits on numerous trades throughout the day. Scalpers rely almost entirely on technical analysis and need to act quickly, often executing dozens or hundreds of trades daily. The focus is on high-frequency trading with very tight stop-losses, requiring intense concentration.

Swing Trading: Benefits and Challenges

Although swing trading provides numerous opportunities which makes it popular among traders, it comes with a few challenges traders should be aware of.

Benefits:

- Lower Time Commitment. One of the most significant benefits for swing traders is the reduced time commitment. This style can be adapted to suit a trader’s individual schedule.

- Flexibility. It is often more flexible than other styles. Not only does it offer time flexibility, but it allows for a wider range of tools to be used to determine price swings. Also, it can be applied to many assets. The most common is swing trading in forex and swing trading in stocks.

- Technical Analysis Focus: Utilises technical indicators and chart patterns to identify entry and exit points, providing clear criteria for decision-making.

- More Opportunities Compared to Long-Term Techniques. Because swing traders usually hold positions for a few days to a few weeks, they have the ability to take advantage of shorter-term market movements that might not be reflected in longer-term price trends.

Challenges:

- Exposure to Overnight Risk. Positions held overnight or over weekends can be affected by unexpected news or events, leading to potential gaps or adverse price movements.

- Requires Patience: Effective swing trading requires waiting for trades to develop over days or weeks, which may test a trader's patience.

- Market Volatility: Performance can be impacted by periods of low volatility or choppy markets, where price movements may not align with your expectations.

Popular Tools to Use When Swing Trading

The effectiveness of a swing traders’ strategies will ultimately depend on their ability to correctly identify price movements. For this, traders use different chart patterns and technical indicators. Here are three common tools that can be used as part of a swing trading strategy.

Channels

Traders can use channels to take advantage of well-identified price trends that play out over days and weeks. To plot a channel, you first need to identify a trending asset that’s moving in a relative zig-zag pattern rather than one with large jumps in price. Traders will often use the channel to open a swing trade in the direction of the trend; in the example above, they might look to buy when the price tests the lower line and take profit when the price touches the upper line of the channel.

Moving Averages

Moving averages (MAs) are one of the commonly used indicators and they can help swing traders determine the direction of the trend at a glance. The options here are endless:

- You could pair fast and slow moving averages and wait for the two to cross; this is known as a moving average crossover. When a shorter MA crosses above a longer one, the price is expected to rise. Conversely, when a shorter MA breaks below a longer one, the price is supposed to decline.

- You could stick with one and observe whether the price is above or below its average to gauge the trend. When the price is above the MA, it’s an uptrend; when it’s below the MA, it’s a downtrend.

- You could use an MA as a support or resistance level, placing a buy order when the price falls to the MA in an uptrend and a sell order when it rises to the MA in a downtrend.

Fibonacci Retracements

Lastly, many swing traders look to enter pullbacks in a larger trend. One of the most popular ways to identify entry levels during these pullbacks is the Fibonacci Retracement tool. Traders typically wait for a shift in price direction, then apply the tool to a swing high and swing low. Then, they enter at a pullback, usually to the 0.5 or 0.618 levels, to take advantage of the continuation of the trend. As seen above, this strategy can offer entry points for those looking to get in early before a trend continues.

The Bottom Line

Swing trading stands out for its ability to balance the demands of active trading with the flexibility of longer-term investing. The unique features of swing trading, such as its moderate holding periods and strategic use of technical indicators, allow traders to potentially manage risk and adapt to various market conditions. Embracing swing trading strategies can help traders refine their approach. As with any trading style, continued learning and disciplined execution are key to achieving consistent results.

FAQ

What Is Swing Trading?

Swing trading is a style that involves holding positions over a period of several days to weeks to take advantage of price movements within a trend. Swing traders use technical analysis, including chart patterns and indicators, to identify potential entry and exit points, balancing the need for active participation with a longer-term perspective.

What Is Swing Trading vs Day Trading?

Swing trading and day trading are distinct methods. The former focuses on capturing price movements over several days to weeks, allowing for less frequent trading and requiring less constant market monitoring. In contrast, the latter involves buying and selling assets within the same trading day, often holding positions for minutes or hours, and requires continuous market observation and quick decision-making.

What Is the Downside of Swing Trading?

The downsides of swing trading include exposure to overnight and weekend risks, as positions held outside market hours can be affected by unexpected news or events. Additionally, this method requires patience and discipline, as trades may take time to develop, and performance can be impacted by periods of low volatility or choppy markets.

*Important: At FXOpen UK, Cryptocurrency trading via CFDs is only available to our Professional clients. They are not available for trading by Retail clients. To find out more information about how this may affect you, please get in touch with our team.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

Dogecoin Daily Chart Analysis: A Fresh Start Ahead ?Hello friends, let's analyze Dogecoin, a cryptocurrency, from an Elliott Wave perspective. This study uses Elliott Wave theory and structures, involving multiple possibilities. The analysis focuses on one potential scenario and is for educational purposes only, not trading advice.

We're observing the daily chart, and it appears we're nearing the end of Wave II, a correction. The red cycle degree Wave I ended around 2024 December's peak. Currently, we're nearing the end of red Wave II, which consists of black ((W)), ((X)), and ((Y)) waves. Black ((W)) and ((X)) are complete, and black ((Y)) is nearing its end.

Within black ((Y)), we have Intermediate degree blue (W), (X), and (Y) waves. Blue (W) and (X) are complete, and blue (Y) is nearing its end. Inside blue (Y), red A and B are complete, and red C is nearing its end. Once red C completes, blue (Y) will end, Once blue (Y) completes, means black ((W)) will end that means higher degree cycle wave II in red will end.

If our view remains correct, the invalidation level for this Elliott Wave count is 0.04913. If this level holds and doesn't touch below it, we can expect a significant reversal to unfold wave III towards new highs. This is an educational analysis, and I hope you've learned something by observing the chart and its texture.

I am not Sebi registered analyst.

My studies are for educational purpose only.

Please Consult your financial advisor before trading or investing.

I am not responsible for any kinds of your profits and your losses.

Most investors treat trading as a hobby because they have a full-time job doing something else.

However, If you treat trading like a business, it will pay you like a business.

If you treat like a hobby, hobbies don't pay, they cost you...!

Hope this post is helpful to community

Thanks

RK💕

Disclaimer and Risk Warning.

The analysis and discussion provided on in.tradingview.com is intended for educational purposes only and should not be relied upon for trading decisions. RK_Charts is not an investment adviser and the information provided here should not be taken as professional investment advice. Before buying or selling any investments, securities, or precious metals, it is recommended that you conduct your own due diligence. RK_Charts does not share in your profits and will not take responsibility for any losses you may incur. So Please Consult your financial advisor before trading or investing.

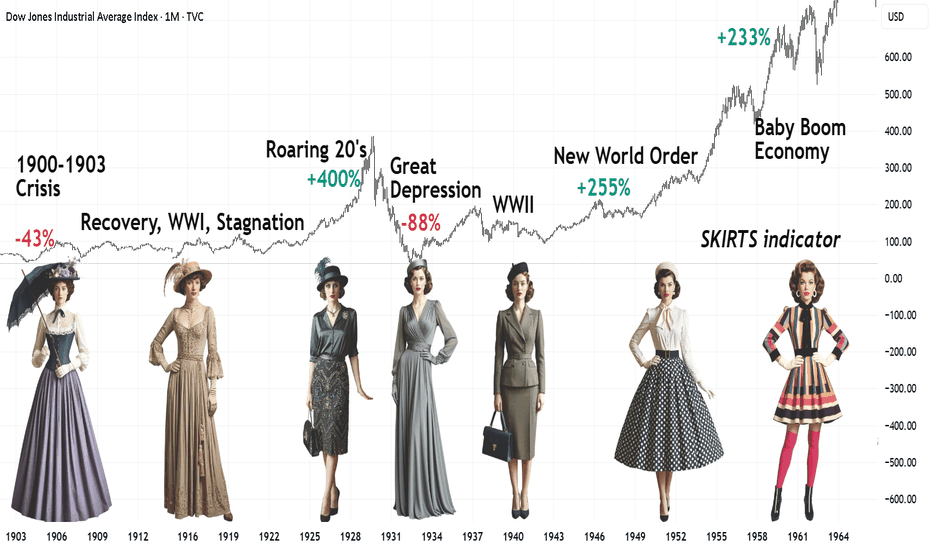

Skirt Lengths as Market Indicators: A Socionomics PerspectivePart of the #Socionomics series.

How fashion and societal moods shifted in the first half of the 20th century.

1900–1910

Economy: The rise of industrialization in the U.S. — Ford’s assembly line (1908), booming cities, and a growing wealth gap between the elite and the working class. In Europe, colonial powers raced for survival, fueling military spending (sound familiar?).

Mood: Faith in technological progress clashed with protests against exploitation. Suffragettes smashed London storefronts (1908), while New York’s Triangle Shirtwaist Factory fire (1911) galvanized labor rights movements.

Fashion: Rigid corsets and floor-length skirts symbolized Victorian morality. Yet rebels like designer Paul Poiret introduced hobble skirts — a tentative step toward freedom of movement.

1910–1920

Economy: World War I (1914–1918) reshaped the globe: Europe lay in ruins, while the U.S. profited from arms sales. Postwar hyperinflation crippled Germany, and the Spanish Flu (1918–1920) claimed millions.

Mood: Women replaced men in factories, only to be pushed back into domestic roles after the war. A feminist explosion: American women won voting rights in 1920.

Fashion: Skirts rose to ankle-length for practicality. By the decade’s end, the flapper emerged — straight-cut dresses, beaded necklaces, and cigarettes in hand, defying tradition. A sign of the stock market’s brewing boom.

1920–1929

Economy: The "Roaring Twenties" — jazz, speculation, and Prohibition. The stock market quadrupled; ordinary Americans borrowed heavily to invest, then borrowed again against rising shares.

Mood: Hedonism reigned. Speakeasies and Gatsby-esque parties masked pre-crash euphoria.

Fashion: Knees on display! Fringed dresses, bobbed haircuts, and gartered stockings. By 1929, subdued silhouettes crept in — an omen of crisis.

1930–1940

Economy: The 1929 bubble burst: Wall Street crashed, triggering the Great Depression (1929–1939). U.S. unemployment hit 25%. Europe veered toward fascism and war.

Mood: Despair from Dust Bowl migrations and hunger marches. Yet Hollywood’s Golden Age offered escapism.

Fashion: Skirts lengthened — modesty returned. Long dresses dominated, while cheap fabrics and turbans (to hide unwashed hair) became staples.

1940–1950

Economy: World War II (1939–1945). Postwar Europe rebuilt via the Marshall Plan; the U.S. embraced consumerism.

Mood: Patriotism ("Rosie the Riveter") and postwar hope. The baby boom idealized domesticity.

Fashion: War mandated minimalism: knee-length skirts and padded shoulders. In 1947, Christian Dior’s New Look rebelled — voluminous ankle-length skirts symbolized postwar opulence.

1950–1960

Economy: America’s "Golden Fifties" — middle-class expansion, cars, and TV. Europe recovered, but colonial wars (Algeria, Vietnam) exposed crises.

Mood: Conformity (suburban perfection) vs. teenage rebellion (James Dean, Elvis’s rock ‘n’ roll).

Fashion: Sheath dresses and midi skirts emphasized femininity. By the late 1950s, Mary Quant experimented with mini-skirts — a harbinger of the sexual revolution.

1960s: Peak of Postwar Prosperity

Economy: U.S. GDP grew 4-5% annually; unemployment dipped below 4%. Baby boomers (1946–1964) fueled suburban housing and education demand.

Fashion: The mini-skirt became an era-defining manifesto of freedom, paired with bold go-go boots. Economic optimism bred experimentation: neon synthetics (nylon, Lycra) and psychedelic hues.

Conclusion

Women’s fashion mirrors its era. Crises (1930s) hide knees; liberating times (1920s, 1960s) bare them. Even war skirts (1940s’ knee-length pragmatism) carried hope.

💡 Like and subscribe for insights your economics textbook won’t reveal!

#beginners #learning_in_pulse #interesting

#socionomics #history #fashiontrends

DCA Buy Alert Script for Long-Term InvestorsHello, TradingView traders!

I'm sharing a simple Pine Script for cautious DCA (Dollar-Cost Averaging) entries.

This script helps accumulate only on weakness — no buying blindly. (Use only on high volatility altcoins!)

🔍 Strategy logic:

• RSI < 40 → market is oversold

• Price below EMA 21 → short-term trend is down

• Price below SMA 200 → long-term trend is weak

Only when ALL three conditions are met, the script triggers a BUY alert.

✅ How to use:

1. Add the script to your chart

2. Create an alert: choose “Cautious DCA Buy Signal”

3. You’ll get notified when the market dips into a DCA zone

//@version=6

indicator("Cautious DCA on Dips", overlay=true)

rsi = ta.rsi(close, 14)

sma = ta.sma(close, 200)

ema = ta.ema(close, 21)

buySignal = rsi < 40 and close < sma and close < ema

plotshape(buySignal, title="Buy Signal", location=location.belowbar, style=shape.labelup, size=size.normal, color=color.green, text="Buy", textcolor=color.white)

plot(sma, title="SMA 200", color=color.orange)

plot(ema, title="EMA 21", color=color.blue)

alertcondition(buySignal, title="Buy Alert", message="DCA Buy Signal: RSI is low and price is below EMA and SMA")

🔔 This script reduces noise and waits patiently for real dips.

Useful for long-term investors who want to buy with discipline.

Let me know how it works for your strategy!

#DCA #LongTerm

Using Fibonacci/Measured Moves To Understand Price TargetThis video is really an answer to a question from a subscriber.

Can the SPY/QQQ move downward to touch COVID levels (pre-COVID High or COVID Low).

The answer is YES, it could move down far enough to touch the pre-COVID highs or COVID lows, but that would represent a very big BREAKDOWN of Fibonacci/ElliotWave price structure.

In other words, a breakdown of that magnitude would mean the markets have moved into a decidedly BEARISH trend and have broken the opportunity to potentially move substantially higher in 2025-2026 and beyond (at least for a while).

Price structure if very important to understand.

Measured moves happen all the time. They are part of Fibonacci Price Theory, Elliot Wave, and many of my proprietary price patterns.

Think of Measured Moves like waves on a beach. There are bigger waves, middle waves, smaller waves, and minute waves. They are all waves. But their size, magnitude, strength vary.

That is kind of what we are trying to measure using Fibonacci and Measured Move structures.

Watch this video. Tell me if you can see how these Measured Moves work and how to apply Fibonacci structure to them.

This is really the BASICS of price structure.

Get Some.

#trading #research #investing #tradingalgos #tradingsignals #cycles #fibonacci #elliotwave #modelingsystems #stocks #bitcoin #btcusd #cryptos #spy #gold #nq #investing #trading #spytrading #spymarket #tradingmarket #stockmarket #silver

Calibrating Trading Indicators for Different MarketsCalibrating Trading Indicators for Different Markets: A Beginner's Guide

(Simple Steps to Adjust RSI , MACD , and Other Tools for Better Results)

Key Idea : Just like you'd tune a guitar differently for rock vs. classical music, trading tools like RSI or MACD need adjustments depending on what you're trading (stocks, crypto, forex) and how it moves. This guide shows you how to tweak these tools using price swings (pivot points) to make them work better for your specific asset.

---

Why "One Size Fits All" Doesn't Work

Most traders use default settings for indicators (like RSI's 14-day period). But these defaults were created for "average " markets. Real markets aren't average!

Example:

- Crypto ( CME:BTC1! ) : Super volatile → Needs faster, more sensitive indicators.

- Blue-Chip Stocks ( NASDAQ:AAPL ) : Less wild swings → Needs slower, smoother indicators.

If you use the same RSI settings for both, you'll get bad signals. Calibration fixes this.

---

The Pivot Point Method for Calibration

One effective approach to calibration is measuring the natural rhythm of price swings between high and low points. Here's how to do it step by step:

Step 1: Find Pivot Points on Your Chart

Pivot points are like "price turning points." Use TradingView's ZigZag indicator (or draw them manually) to spot these swings.

How to Add ZigZag on TradingView :

1. Open your chart.

2. Click "Indicators" → Search " ZigZag " → Select it.

3. Adjust settings (defaults work fine for starters).

The ZigZag will draw lines between significant highs (peaks) and lows (valleys).

---

Step 2: Measure the "Rhythm" of the Market

Count the bars (candles) between pivot points to find the market's natural cycle.

Example :

- If Bitcoin swings from peak to peak every 14 bars on average, its "cycle" is 14 bars.

- If Apple does this every 16 bars, its cycle is 16 bars.

In the picture above, we used the Williams Fractal to identify pivots.

Formula for Indicator Settings :

- RSI Period = Half the average cycle → If cycle = 16 bars → RSI = 8 days.

- MACD Settings : Fast EMA = ¼ cycle, Slow EMA = ½ cycle → Cycle = 16 → Fast EMA = 4, Slow EMA = 8

---

Step 3: Test Your Calibrated Indicators

Backtest on TradingView :

1. Add your indicator (e.g., RSI) with the new settings.

2. Use the Strategy Tester (click "Add to Chart" → " RSI Strategy ") to see if signals improve.

Look For :

- Fewer false signals (e.g., RSI saying "oversold" too early).

- Clearer trends (MACD crossovers matching price moves).

---

Calibrating Popular Indicators (Simple Rules)

1. RSI (Relative Strength Index)

- Default : 14 days.

- Calibrated : Half the average cycle length.

- Example : Cycle = 16 bars → RSI = 8 days.

Why It Works : Shorter RSI reacts faster to volatile markets (like crypto).

2. MACD

- Default : 12, 26, 9.

- Calibrated :

- Fast EMA = ¼ of cycle.

- Slow EMA = ½ of cycle.

- Signal Line = ⅙ of cycle.

- Example : Cycle = 20 → Fast = 5, Slow = 10, Signal = 3.

Why It Works : Matches the asset's natural momentum shifts.

3. Williams %R

- Default : 14 days.

- Calibrated : Same as RSI (half the cycle).

---

How to Avoid Common Mistakes

Mistake 1 : Overfitting (Making It Too Perfect for the Past)

- Problem : If you calibrate too precisely to old data, it might fail in the future.

- Fix : Test on 2 types of data:

1. Training Data : First 70% of your chart (to calibrate).

2. Testing Data : Last 30% (to check if it still works).

Mistake 2 : Ignoring Market Changes

- Problem : What works today might not work next month.

- Fix : Recheck your settings every 3 months or after big news (e.g., Fed rate hikes).

---

Free Tools to Help (No Coding Needed)

1. TradingView's "Auto-Detect Cycle" Scripts

Search for indicators like "Cycle", "RSI Adaptive" or " Rainbow Adaptive RSI " in TradingView's public library. These automatically calculate cycle lengths (Not tested).

2. Adaptive MACD/RSI Indicators

Try pre-built adaptive indicators like:

- Adaptive MACD : Adjusts itself based on volatility.

- Dynamic Pivot : Uses pivots to set stop-loss and take-profit levels.

---

Building a Simple Pivot Calibration System

Basic ZigZag Calibrator Method :

1. Add ZigZag to your chart.

2. Manually count the bars between 5 recent swings.

3. Calculate the average → Divide by 2 → Use that number for your RSI/MACD.

Example :

- Swings: 12, 14, 16, 10, 8 bars → Average = 12.

- Calibrated RSI = 6 days.

---

Why This Works (Without the Math)

Markets move in waves. By matching your indicator's speed to the wave length, you "surf" the trend instead of fighting it. Research shows adaptive methods like this beat default settings.

The Science Behind It

When you calibrate to an instrument's natural rhythm:

- Oscillators (RSI, %R) catch extremes at the right time

- Trend indicators (MACD) signal changes faster

- Volatility bands (Bollinger Bands) expand and contract appropriately

---

A Step Further: Multi-Timeframe Calibration

For even better results, calibrate across timeframes:

1. Calculate cycles on daily charts for swing trading

2. Calculate cycles on 4-hour charts for day trading

3. Use both calibrated indicators together for confirmation

---

Final Tips for Beginners

1. Start Small : Calibrate one indicator (like RSI) first.

2. Use Free Tools : TradingView has thousands of free scripts to automate calculations.

3. Keep Records : Document what settings work for which assets.

4. Be Patient : Finding the right calibration takes time, but the results are worth it.

Calibration isn't about being perfect—it's about making your tools work better for specific markets . Happy trading!

Trend Changing Pattern (TCP) ExplainedIntroduction

One of the most important skills in forex trading is learning how to read price action and understand what the market is telling you. Price is not just numbers — it’s the collective perception of traders, making it the most reliable leading indicator available.

Today, I want to explain a powerful concept known as the Trend Changing Pattern (TCP) — a crucial tool for identifying potential market reversals and shifts in trend direction.

📈 What Is a Trend Changing Pattern?

In any trending market, whether it's an uptrend or downtrend, the trend won’t change easily. The strength of the trend and the timeframe you're trading on will determine how long it takes for a true reversal to occur.

One key signal of a trend change is a shift in momentum:

In an uptrend, when a momentum low forms during a pullback, it can be a sign that the trend is beginning to reverse.

In a downtrend, a momentum high during a pullback can signal a potential bullish reversal.

These are what we refer to as Trend Changing Patterns (TCPs) — moments where the structure of the market starts to shift.

⚠️ Watch for Manipulation After the TCP

After a TCP appears, it's common to see price manipulation before the new trend fully takes hold:

In an uptrend, price may return to manipulate the previous high before continuing down.

In a downtrend, price often dips to manipulate the previous low before reversing higher.

Being aware of this common liquidity grab helps traders avoid being trapped and instead position themselves in alignment with the new trend.

🧠 Final Thoughts

Understanding how to spot and interpret a Trend Changing Pattern gives you a major edge in forex trading. It helps you stay ahead of the market and make informed decisions based on price action, not emotion.

🎥 In the video, I go into more detail about momentum highs and lows, and how to recognize these key patterns in real time. Be sure to check it out if you want to sharpen your trend reversal strategy.

Wishing you success on your trading journey! 🚀

A Closer Look at Bitcoin's Elliot Wave PatternHello friends, today we'll attempt to analyze the Bitcoin chart using Elliot Waves. Our approach will involve using Elliot Wave theory and structures, which involve multiple possibilities. The analysis we present here focuses on one potential scenario that seems possible to us.

Please note that this information is for educational purposes only and should not be considered trading advice or investment tips. There's a risk of being completely wrong, so never trade based solely on this post. We're not responsible for any profits or losses. Individuals should consult a financial advisor before making any trading or investment decisions.

Now, let's discuss the Bitcoin chart. On the daily chart, we can see that a black primary degree wave has completed its ((4th)) wave, and the ((5th)) wave has started. Within the fifth wave, an intermediate degree wave is unfolding, which will have its own set of waves (1), (2), (3), (4), (5). The primary black degree wave five will be complete once the intermediate degree wave is finished.

We've drawn accounts on the chart, illustrating the entire structure, including the nearest invalidation level at around $76,666 and the real invalidation level below $50,000.

I hope this analysis based on Elliot Wave theory has helped you understand the chart better and learn something new. Please keep in mind that this is for educational purposes only.

I am not Sebi registered analyst.

My studies are for educational purpose only.

Please Consult your financial advisor before trading or investing.

I am not responsible for any kinds of your profits and your losses.

Most investors treat trading as a hobby because they have a full-time job doing something else.

However, If you treat trading like a business, it will pay you like a business.

If you treat like a hobby, hobbies don't pay, they cost you...!

Hope this post is helpful to community

Thanks

RK💕

Disclaimer and Risk Warning.

The analysis and discussion provided on in.tradingview.com is intended for educational purposes only and should not be relied upon for trading decisions. RK_Charts is not an investment adviser and the information provided here should not be taken as professional investment advice. Before buying or selling any investments, securities, or precious metals, it is recommended that you conduct your own due diligence. RK_Charts does not share in your profits and will not take responsibility for any losses you may incur. So Please Consult your financial advisor before trading or investing.

Master the Market with These 5 Wave Trading RulesHello,

In any business, rules are the backbone of success, providing the structure and discipline needed to thrive. Trading and investing are no exceptions—they must be treated with the same seriousness and rigor as any entrepreneurial venture.

As a wave trader, I rely on a refined set of rules that blend technical analysis with Wave Theory to understand market behavior. Wave trading is a powerful strategy that analyzes price patterns to uncover the cyclical nature of market trends, enabling traders to predict future movements and seize profitable opportunities.

Understanding Wave Trading

Markets don’t move randomly—they ebb and flow in predictable waves. According to Elliott Wave Theory (a type of wave theory), trends unfold in a series of five waves (known as impulses) followed by three waves (corrections). Mastering this rhythm allows you to anticipate where the market is headed next, giving you a strategic edge.

Our Trading Rules

Here’s a breakdown of the essential rules I follow as a wave trader, designed to guide you through the process with clarity and precision:

Identify Impulse & Correction

Impulse: A robust, directional price surge made up of five sub-waves, signaling the dominant trend.

Correction: A smaller, counter-trend move consisting of three sub-waves, acting as a pause or pullback.

Recognizing these phases reveals the market’s underlying structure. For example, spotting a five-wave impulse upward suggests a bullish trend, while a three-wave correction might signal a temporary dip—perfect for planning your next move.

Identify the Pattern Formations

Look for patterns that can help you anticipate the next moves e.g. the expanding triangle, Bullish flag or even reversal patterns.

Identify Entry Points

Timing is everything. Pinpoint the perfect moment to enter a trade based on your wave and pattern analysis.

Wait for confirmations like a breakout above a flag pattern or a signal from indicators such as moving averages or MACD that align with your wave count.

Look for Targets

Set clear profit targets to stay disciplined and secure gains.

Wave projections, like the expected end of wave 5 in an impulse.

Look for Exits in Case the Trade Doesn’t Go Your Way

Not every trade is a winner, and that’s okay. Protect your capital with stop-losses placed at logical levels.

Where to set them: Choose points that invalidate your analysis—like below a key support level or a wave pattern’s critical threshold. If the market breaks that level, your trade idea’s likely wrong, so exit calmly.

This removes emotion from the equation, safeguarding your account for the long haul.

The Power of Discipline

These rules aren’t just guidelines—they’re your shield against the emotional rollercoaster of trading. Write them down, pin them up, or keep them handy on your trading desk. Reviewing them before every trade reinforces your commitment to a systematic, objective approach. Discipline turns good strategies into great results.

Wishing you success on your trading journey!

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Mastering Market Movements: Understanding Impulses and CorrectioHello,

Navigating the stock market successfully isn’t just about luck—it requires a keen understanding of market trends and the ability to spot price patterns. One of the most useful concepts traders rely on is the interplay between impulses and corrections. Recognizing these alternating phases can provide valuable insights into potential price movements, allowing you to make more confident and informed trading decisions.

In this article, we’ll break down what impulses and corrections are, how to identify them, and how you can use them to improve your trading strategy.

Understanding Impulses and Corrections

Stock prices move in cycles, alternating between strong trends (impulses) and temporary retracements (corrections). These movements are driven by market psychology, where shifts in supply and demand dictate price action.

Impulses: The Driving Force of Trends

Impulses are powerful, directional moves in the market that reflect strong momentum. These often occur when sentiment aligns with fundamental catalysts, such as positive news, strong earnings reports, or broader market trends. Impulses are the backbone of trends and can provide great opportunities for traders who know how to recognize them.

To spot impulses, look for:

Strong Price Movement: Impulses are characterized by significant and sustained price shifts, indicating a surge in buying or selling pressure. This is as shown in the

Volume Expansion: When an impulse occurs, trading volume typically increases, confirming that more market participants are involved and supporting the price movement.

Break of Key Resistance or Support Levels: Impulses often push through important technical levels, signaling strength and the continuation of a trend.

Corrections: The Market Taking a Breather

Corrections, also called retracements or pullbacks, are temporary price reversals within an ongoing trend. They provide opportunities for the market to pause before resuming its dominant direction.

To identify corrections, watch for:

Counter-Trend Price Movement: Corrections move against the main trend but usually retrace only a portion (25% to 50%) of the previous impulse.

Lower Volume: Unlike impulses, corrections occur on decreased trading volume, suggesting a temporary decline in market participation.

Support and Resistance Levels: Corrections often find support or resistance at previously established price levels, which can serve as potential reversal zones.

Applying Impulses and Corrections in Trading

Understanding these market phases can significantly improve your trading approach. Here’s how:

Identifying Trends: By observing a sequence of impulses and corrections, you can determine the overall market direction and align your trades accordingly.

Finding Entry and Exit Points: Impulses signal strong trends, while corrections present opportunities to enter trades at better prices before the next move higher or lower.

Managing Risk: Setting stop-loss levels strategically—such as below key support levels during corrections—can help minimize losses while allowing room for potential gains.

Final Thoughts

Recognizing and utilizing impulses and corrections can make a huge difference in your trading success. By learning to identify these patterns, you’ll gain deeper insights into market behavior, improve your timing, and enhance your ability to make smart, strategic moves.

Take a look at the US500FU chart—it clearly illustrates impulses and corrections in action.

Good luck, and happy trading!

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Vanguard - “We are the invisible hand of Adam Smith” John BogleIf anyone ever thought of erecting a monument to the person who did the most for American investors — the choice would fall on John Bogle. These words are not from a promotional brochure but a quote from Warren Buffett himself.

Book summary

But most people don’t even know who Bogle is. And certainly don’t realize that he didn’t just “create index funds.” He built an invulnerable power machine disguised as client care.

📈 From a thesis to $10 trillion under management

Bogle’s story begins with an ordinary guy born during the Great Depression. Through poverty, scholarship-based education, and working from age 10 — he makes his way into Princeton, where he writes a thesis on a topic that would change the industry: "mutual funds."

Over the years, his philosophy turned into what we now know as "passive investing." From day one, the Vanguard he created operated on the principle: "maximum benefit to the investor, minimum — to the managers." No fees, no speculation, no marketing. And it worked. But here’s the paradox: ▶ Vanguard gave up profit for the mission.

▶ The world responded — investors were tired of the noise.

▶ As a result — "Vanguard grew into a monster capable of managing the economies of entire nations."

🧠 A revolutionary idea: a fund owned by investors

Bogle built a structure where "the fund owners are the investors themselves."

Sounds beautiful: no shareholders, no profit pressure — only long-term client interests. But then who de facto manages these trillions?

⚠️ Vanguard is not a public company.

⚠️ Its shares are not traded.

⚠️ The real ownership mechanism — a black box.

It’s the perfect system for... "invisible control." And this isn’t a conspiracy theory, but logic:

If you can’t find the ultimate beneficiary — it means they’re either too big, or hiding for a reason.

🕸️ The “Big Three” and the invisible hand effect

Vanguard, BlackRock, and State Street — three funds that hold between 3% to 8% of shares in most of the world’s largest corporations. It seems small, but only 15–20% of shares are in free float.

❗ This gives the Big Three “real power”: from voting at meetings to influencing media narratives and climate policy.

📌 They own stakes in CNN, Fox, and Disney.

📌 Invest in oil companies that violate human rights.

📌 And at the same time — push the “green transition” agenda.

Conflict of interest? No. It’s “total control over both sides of the conflict.”

🤫 Why Vanguard is impossible to destroy

If you think Vanguard is just an investment fund, here are a few facts:

🔒 No company shares → can’t buy a controlling stake.

🔒 Over 400 legal entities → can’t file a single lawsuit.

🔒 Every investor essentially becomes a “co-owner” → responsibility is blurred.

🔒 All stakes split below 10% → bypass antitrust laws.

You can’t sue a ghost.

You can’t attack a network if you don’t know where its center is.

🧭 What’s next?

Today, Vanguard manages over $10 trillion, which is more than the GDP of Germany, India, and Brazil combined.

Though the fund’s founder passed away as “the conscience of Wall Street,” his creation became an "architecture of global control" that even the U.S. Federal Reserve couldn’t handle.

🎤 “We are the invisible hand of Adam Smith,” John Bogle once said.

A more detailed book review will follow below. I understand how important this is in our time and I appreciate it.

📘 General Concept of the Book:

The book is at once the autobiography of John Bogle, the story of the founding and development of Vanguard, and a manifesto of index investing philosophy. A runaway waiter, Princeton graduate, and "Wall Street rebel," Bogle creates Vanguard — a company that changed the investment world by making it more fair and accessible.

📑 Structure of the Book:

The book is divided into four parts:

Part I — The History of Vanguard.

Part II — The Evolution of Key Funds.

Part III — The Future of Investment Management.

Part IV — Personal Reflections, Philosophy, and Values of the Author.

💡 Key Ideas of the Book (Introductory Chapters, Preface):

- Index investing is the most important financial innovation of the 20th century.

- Passive management beats active managers in returns and costs.

- Vanguard’s mission is not to make money off investors, but to serve them.

- Criticism of Wall Street: high fees, conflicts of interest, short-term thinking.

- Financial revolution — a mass shift of investors from active to index funds.

🧠 Bogle's Values:

- Long-term thinking. Don’t give in to market “noise.”

- Honesty and transparency in investing.

- Minimal costs = maximum return for the investor.

- Fiduciary duty: protecting the client’s interest comes first.

📗 Part I: The History of Vanguard

🔹 Chapter 1: 1974 — The Prophecy

Context:

John Bogle is in a difficult position — he’s fired as head of Wellington Management Company.

During a trip to Los Angeles, he meets John Lovelace of American Funds, who warns: if you create a truly mutual investment company, you’ll destroy the industry.

Main Idea:

⚡ Bogle decides to go against the profit-driven industry and creates Vanguard — a company owned by investors, not managers.

Key Moments:

- Vanguard is founded in 1974 — in the middle of a crisis.

- The company has no external shareholders — all “profits” are returned to investors through lower fees.

- In 1975, the first index fund for individual investors is launched — a revolutionary idea, initially ridiculed as “Bogle’s madness.”

Important Quotes:

"Gross return before costs is market return. Net return after costs is lower. Therefore, to get the maximum, you must minimize costs."

– Bogle’s fundamental rule

🔹 Chapter 2: 1945–1965 — Background: Blair Academy, Princeton, Fortune, and Wellington

Early Life:

Bogle studies at Blair Academy on a scholarship, works as a waiter.

He enters Princeton. Struggles with his economics course, but…

In the library, he accidentally finds the Fortune article “Big Money in Boston” — about mutual funds.

Turning Point:

This article inspires Bogle to write his thesis:

“The Economic Role of the Investment Company”, where he argues:

- Funds should work for investors;

- Don’t expect them to beat the market;

- Costs must be minimized;

- Fund structure must be fair and transparent.

Career Start:

Work at Wellington Management (Philadelphia).

Starts from scratch, rising from junior analyst to president of the company.

Under Walter Morgan’s leadership, he learns the principles of discipline and serving investors.

✍️ Interim Summary

What’s important from these early chapters:

- Vanguard was born from the ruins of Bogle’s former career — an example of how failure can be the beginning of greatness.

- Already in college, Bogle saw the issue of conflicts of interest in the industry.

- His philosophy is idealism in action: don’t play guessing games — just invest in the market and reduce costs.

📘 Chapter 3: 1965–1974 — Rise and Fall

🚀 Appointed President of Wellington Management:

In 1965, at just 35 years old, John Bogle becomes president of Wellington.

He decides to modernize the business and bring in young star managers from Wall Street, especially from the firm Thorndike, Doran, Paine & Lewis.

⚠️ Risky Alliance:

Bogle makes a fatal mistake — he merges with the new management company without ensuring value alignment.

The new partners are focused on profit and short-term gains, not building a strong long-term foundation.

This leads to internal conflict, loss of trust, and poor fund performance.

💥 Dismissal:

In 1974, after a series of conflicts, the board removes Bogle.

He loses control of the company he built for nearly 25 years.

Bogle’s comment:

"I was fired, but I was still chairman of the Wellington mutual funds — and that turned out to be a lifeline."

📘 Chapter 4: 1974–1975 — The Birth of Vanguard

🧩 A Unique Legal Loophole:

Though Bogle was fired from the management company, he remained head of the Wellington Fund trustees — giving him the opportunity to build a new independent structure.

🛠 Creating Vanguard:

In December 1974, he launches The Vanguard Group — a company owned by the investors (shareholders) themselves.

Model: the fund belongs to the investors → the fund owns the management company → no outside profit, only cost recovery.

⚙️ "Vanguard" as a Symbol:

The name was inspired by Admiral Horatio Nelson’s ship — HMS Vanguard.

A symbol of leadership, courage, and moving against the tide.

Key Idea:

Vanguard would be the only truly mutual investment organization — a model where clients = owners.

📘 Chapter 5: 1975 — The First Index Fund

🤯 Revolution: The Indexing Approach

Bogle decides to create the first index mutual fund for retail investors.

Name: First Index Investment Trust (later — Vanguard 500 Index Fund).

Idea: invest in all S&P 500 stocks to reflect the market’s return instead of trying to beat it.

🪓 A Blow to the Industry:

The financial world reacts harshly:

- “Bogle’s madness”;

- “This is a failure”;

- “Who would want to just match the market?”

🔧 Humble Beginning:

The goal was to raise $150 million, but only $11 million was collected — tiny by industry standards.

But Bogle didn’t give up:

"It was a small step, but with a powerful message."

💡 Summary of Chapters 3–5: How Vanguard Was Built

🔑 Event 💬 Meaning

Loss of control at Wellington ----- Collapse of the old model, beginning of a new path

Creation of Vanguard------------- Innovative, investor-first structure

Launch of index fund--------------Start of the indexing revolution, Bogle’s core philosophy

📝 Quotes for Thought:

"All I did was apply common sense. I just said: Let’s leave the returns to the investors, not the managers." — John Bogle

"This is a business where you get what you don’t pay for. Lower costs = better results." — Bogle’s favorite saying, debunking “more is better”

📘 Chapter 6: 1976–1981 — The Survival Period

⏳ Tough Start:

After launching the index fund, Vanguard faces slow growth and constant skepticism.

For 83 straight months (nearly 7 years!), Vanguard sees net outflows — investors are hesitant to trust this new model.

🧱 Laying the Foundation:

Bogle and his team focus on:

- Transparency

- Lowering costs

- Investor education (they explain what it means to “stay the course”)

💬 The Core Dilemma:

"All investors want to beat the market. But no one wants to pay the price: high fees, taxes, risks. We offered an alternative — reliability, simplicity, and low cost."

📈 Small Wins:

Despite modest volume, Vanguard starts building a reputation as an “honest player.”

It becomes evident: investors using Vanguard achieve better long-term results than those chasing trendy funds.

📘 Chapter 7: 1982–1991 — Growth and Recognition

💡 The Power of Philosophy:

Bogle keeps repeating: “Stay the course” — don’t try to predict the market, don’t fall for fear and greed.

This message becomes especially powerful after the 1982 and 1987 market crises.

🏆 The First Fruits:

A slow but steady increase in assets begins.

Vanguard launches new index funds:

- Total Stock Market Index

- Bond Index

- International Index

📣 Educational Mission:

Bogle writes books, articles, gives interviews.

He isn’t just running a fund — he’s changing how people think about investing.

A community of followers emerges — the Bogleheads.

📊 Key Stats:

By 1991, Vanguard's assets reach around $130 billion.

Index funds begin receiving positive reviews from analysts, including Morningstar.

📘 Chapter 8: 1991–1999 — Industry Leadership

🚀 Explosive Growth:

In the 1990s, index funds go mainstream.

Investors realize that most active funds underperform the market — and they vote with their money for Vanguard.

🧰 Expanding the Product Line:

Vanguard introduces:

- Retirement funds

- Bond funds

- International and balanced funds

- Admiral Shares — low-cost funds for loyal investors

📢 Open Fight with the Industry:

Bogle continues to harshly criticize Wall Street:

- For greed, manipulation, and lack of transparency

- For prioritizing company profit over client interest

"The industry hates Vanguard because it proves you can be honest and still succeed."

⚠️ Internal Challenges:

In the late 1990s, Bogle’s health declines.

He passes leadership to Jack Brennan but retains influence on company strategy.

📊 Midpoint Summary (Chapters 6–8)

📅 Phase 📈 Essence

1976–1981 Quiet survival: building the model, fighting for trust

1982–1991 Slow growth: philosophy attracts investors

1991–1999 Recognition and leadership: indexing becomes dominant

💬 Bogle Quotes from These Chapters:

"Investing is not a business. It’s a service. Those who forget this lose everything."

"Every dollar spent on fees is a dollar lost to your future."

"Volatility is not the enemy. The real enemy is you, if you panic."

📘 Chapter 9: Leadership as a Calling

💡 A Leader ≠ A Manager:

Bogle contrasts a true leader with just an efficient executive.

A real leader:

- Puts others’ interests above their own

- Has a moral compass, not just KPIs

- Makes hard, unpopular decisions

🛤 His Leadership Style:

"Don’t ask others to do what you wouldn’t do yourself."

"Always explain why — people follow meaning, not orders."

He genuinely believes Vanguard should be more than a successful business — it should be a force for good in the market.

"Leadership is loyalty to an idea bigger than yourself."

🔄 Feedback Principle:

Bogle constantly interacts with clients, employees, and journalists.

He never isolates himself in an “ivory tower” — he believes this openness is a leader’s true strength.

📘 Chapter 10: Client Service — Vanguard’s Mission

🧭 The Mission:

"Maximize investor returns — not company profits."

Vanguard is built around fiduciary responsibility: every decision must pass the test — is this in the investor’s best interest or not?

🧾 How It’s Implemented:

- Fees below market average → investors keep more

- No ads for “hot” funds → Vanguard sells stability, not trends

- No sales commissions → no one profits off pushing funds to clients

- Ethical code — “Don’t do anything you wouldn’t want on the front page of the newspaper.”

"We’re not trying to be the best for Wall Street. We’re trying to be the best for you."

📘 Chapter 11: The Market Should Serve Society

📉 Critique of Modern Wall Street:

Bogle argues that finance has drifted from its original purpose.

Investing has turned into trading.

The investor became a cash cow, not a partner.

"The market now serves itself — and we’re still paying the price."

🌱 What the System Should Look Like:

- Companies should serve society

- Investors should be owners, not speculators

- Funds should be transparent, accountable, and honest

📢 Call for Reform:

Bogle calls for a rethinking of finance:

- Restore the human element

- Make mission more important than profit

- Protect long-term interests of millions of ordinary investors

"If we want capitalism with a human face, we must return finance to serving society."

📊 Summary of Chapters 9–11: Bogle's Philosophy

📌 Direction------------💬 Essence

Leadership-------------Morality, leading by example, purpose-driven

Business---------------First and foremost — service to the client

Financial System-------Must work for society, not just for profit of the few

✨ Inspirational Quotes:

"The most important thing you can invest is not money — it’s your conscience."

"Honesty in business is not a competitive edge. It’s a duty."

"I’m not against capitalism. I’m against capitalism without morals."

📘 Chapter 12: The Future of Investing — Where the Industry Is Headed

🌐 Bogle sees three main trends:

Victory of Passive Investing:

- Index funds continue to displace active management

- Their share of assets under management is growing rapidly

- More investors are realizing the power of simplicity

Fee Pressure:

- Fees are approaching zero (some funds are effectively free)

- Winners: investors. Losers: traditional management companies

The Role of Technology:

- Rise of robo-advisors (automated investment advisors)

- But Bogle warns: Technology without philosophy is just a tool, not a solution

🚨 Threat #1 — Hyperfinancialization:

"The market is turning into a casino. And the fewer the players, the more the house wins."

Bogle reminds us: the goal of investing is owning businesses — not gambling.

The higher the turnover, the more you lose on fees and taxes.

📘 Chapter 13: The Power of Indexing — Threat or Blessing?

📈 Strength in Scale:

The biggest index providers (Vanguard, BlackRock, State Street) own large shares in nearly all companies in the indexes.

This raises the issue of concentrated power — is too much influence in too few hands?

⚖️ The Indexing Paradox:

Index funds don’t actively vote on corporate governance issues.

So the more power they hold, the less oversight there is over company management.

📣 Bogle’s Proposals:

- Establish a code of conduct for index providers

- Require them to vote in investors’ interests

- Mandate transparency in how they use their voting power

"We fought for the democratization of investing. We cannot let it end in a new monarchy."

📘 Chapter 14: Personal Reflections — On Life, Mission, and Faith

🧬 Personal and Eternal:

Bogle shares his core life principles:

- To serve, not to own

- To leave a mark, not accumulate

- To do what’s right, not what’s profitable

He talks about his battle with heart disease — both as a personal journey and a metaphor for resisting the system.

🙏 Gratitude:

He dedicates the book to his family, colleagues, and investors.

Emphasizes: every day is a chance to be useful.

"I created Vanguard, but Vanguard created me. My career isn’t a triumph — it’s a thank you to fate for the chance to be heard."

📊 Summary of Chapters 12–14: Looking Ahead and Within

📌 Theme-----------------💬 Essence

Future of Investing---------Indexing is the new standard, but needs responsible stewardship

Concentration of Power----Index giants must be accountable to society

Personal Legacy-----------Life is about service, honesty, and setting an example

💬 Final Inspirational Quotes:

"Life isn’t about making more money. It’s about doing more good."

"One day, someone will say: ‘Bogle was stubborn. He never compromised his conscience.’ That will be the best reward."

🧩 Bogle’s Principle Summary (from the book):

- Lower costs — pay less = keep more

- Don’t chase returns — be realistic

- Be a long-term investor — ignore market noise

- Invest broadly, passively, regularly

- Don’t try to beat the market — own the market

- Focus on goals, not trends

- Finance = service. Not a business for profit

💡 Investment Philosophy

🟨 “This is a business where you get what you don’t pay for.”

🟨 “Don’t try to beat the market. Just own it.”

🟨 “In the stock market, investors are rewarded for patience and punished for frenzy.”

🟨 “Gross return minus costs = market return. After costs — less. So: reduce costs — and you win.”

🟨 “The problem isn’t that investors know too little. The problem is they know too much of what doesn’t matter.”

🧭 Principles & Morality

🟩 “Investing is not a business. It’s a service.”

🟩 “Honesty isn’t a strategy. It’s an obligation.”

🟩 “The goal of Vanguard isn’t to make more, but to return to the investor what’s rightfully theirs.”

🟩 “If your investments keep you up at night, change them. Or better — change yourself.”

🧠 On Leadership and Mission

🔷 “A leader isn’t the one in front. It’s the one responsible for the rest.”

🔷 “Respect isn’t bought. It’s earned when you do what’s right, even if it’s unpopular.”

🔷 “We didn’t build Vanguard for glory. We built it to leave something better than what was.”

💬 On the Market and Industry

🔴 “Today's stock market isn’t a place for investors. It’s a casino with a shiny sign.”

🔴 “We’re not against capital. We’re against capitalism without a conscience.”

🔴 “The people selling investments always say they can pick the best. But what if the best is just paying less?”

❤️ On Life and Legacy

💠 “I created Vanguard, but Vanguard created me. It’s not my victory — it’s gratitude for the chance to serve.”

💠 “Every day is a chance to do something not for yourself.”

💠 “You can measure success with money. Or with a conscience, you don’t have to justify.”

It was a lot of work!

Click to like + Write in the comments your favorite books about the financial market

Best regards, EXCAVO

_____________________

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Engulfing Candles: The Power ShiftIf there’s one candle pattern that represents an immediate shift in balance between buyers and sellers it is the engulfing candle.