NZDJPY on a bear flag 🦐NZDJPY is moving inside a minor ascending channel for a test of the 0.5 Fibonacci level.

According to Plancton's strategy if the price will break the flag we will set a nice short order.

–––––

Follow the Shrimp 🦐

Keep in mind.

🟣 Purple structure -> Monthly structure.

🔴 Red structure -> Weekly structure.

🔵 Blue structure -> Daily structure.

🟡 Yellow structure -> 4h structure.

⚫️ Black structure -> <4h structure.

Here is the Plancton0618 technical analysis , please comment below if you have any question.

The ENTRY in the market will be taken only if the condition of the Plancton0618 strategy will trigger.

Bearish Flag

🔥 ALGO Bear Flag Break OutSince the massive sell off a couple of weeks ago, ALGO has been trading inside a bullish upward channel. With BTC falling over the last 24 hours, ALGO has broken through the channel support, making this a bear flag pattern.

Current target would be the low between 0.7 and 0.75.

Happy trading!

BTCUSD 1h. Bear Flag. Target at 33KHi everyone,

Thank you for considering reading my idea.

In the 1h chart, we are forming this bear flag with a potential target of 33K. We can also see that we got a rejection from the SuperTrend Resistance Line.

Like this idea and follow me for more analysis like this.

Cheers,

Juvs

Update: Bitcoin form 100% Shoulder Head Shoulder; bearish patterAt the moment of this analysis. Bitcoin down below of $35,000 USD. i was in the good time in the just moment when Bitcoin down and make a volatile movement. But well, I can't to analyze it when Bitcoin form a bearish flag, but at the moment, I do not entry. but I am so near to entry in short position, but if you entry, ok, no problem, but I can to update my perspective how I see Bitcoin during this next days.

s3.tradingview.com

Remember this analysis, BItcoin it's into this simetric triangle and the trend need to be defined. But guys, I did very well in my past analysis where I commente that Bitcoin form a shoulder head shoulder (bearish pattern), but I did very well my analsyis so precise. Now, if I see that BItcoin show us another entry to short, I will entry in this position until my target at $32,600 USD.

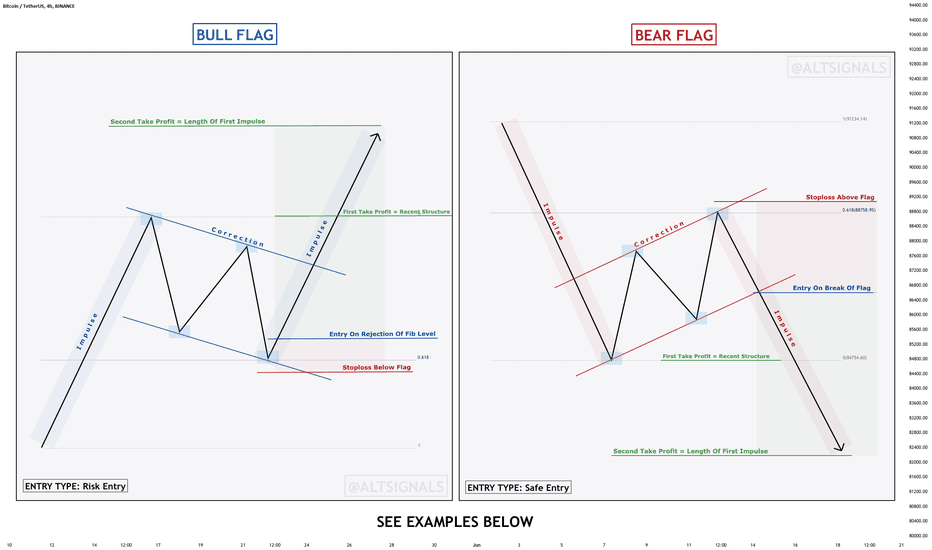

EDUCATION - Identifying & Trading Flag PatternsIn this post, we will be explaining what a flag patterns is and how to identify and trade them.

What is a Flag?

The flag pattern is the most common continuation patterns in technical analysis. It often occurs after a big impulsive move. The impulse move is followed by short bodied candles countertrend to the impulse move, which is called the flag. It is named because of the way it reminds the viewer of a flag on a flagpole.

Often, the breakout of the flag is the same size as the impulse leading to the flag. We can use this to create our take profit levels.

There are 2 types of ways we can trade flag patterns; Risky Entry & Safe Entry. See below for the pros and cons for both and how to enter them

_______________________________________________________________________________

Risk Entry:

The reason why it is called a risk entry is because we haven't got many confirmations apart from the bounce off the fibonacci level. Price may have the potential to go lower for a deeper correction before moving up. Whereas for the safe entry, the confirmation that it is a valid flag would be the break of the flag pattern.

How to trade using Risk Entry:

Wait for price to bounce off the fibonacci levels (0.5 or 0.618) and then enter with stops below/above the correction.

One of the advantages of doing a risk entry is that we can have small stop loss and have a great risk:reward ratio. Also, we can gain an entry at the start of the move and HODL!

Safe Entry:

Safe entry requires more than one confluence and requires confirmation. We have the rejection of the fibonacci level as well as a breakout of the flag, confirming that it is a valid flag pattern.

How to trade using Safe Entry:

For a safe entry, enter upon the break of the flag pattern with stops above/below the flag depending on whether its a bull or a bear flag. First TP would be the recent structure level and second TP would be the length of the impulse which led up to the correction.

The disadvantage to using a safe entry is that we require a bigger stop loss which makes the risk:reward ratio not as great as the risk entry. However, the probability of the trade succeeding is higher.

_______________________________________________________________________________

EXAMPLES OF RISK ENTRY

EXAMPLES OF SAFE ENTRY

EDUCATION - Identifying & Trading Flag Patterns In this post, we will be explaining what a flag patterns is and how to identify and trade them.

What is a Flag?

The flag pattern is the most common continuation patterns in technical analysis. It often occurs after a big impulsive move. The impulse move is followed by short bodied candles countertrend to the impulse move, which is called the flag. It is named because of the way it reminds the viewer of a flag on a flagpole.

Often, the breakout of the flag is the same size as the impulse leading to the flag. We can use this to create our take profit levels.

There are 2 types of ways we can trade flag patterns; Risky Entry & Safe Entry. See below for the pros and cons for both and how to enter them

_______________________________________________________________________________

Risk Entry:

The reason why it is called a risk entry is because we haven't got many confirmations apart from the bounce off the fibonacci level. Price may have the potential to go lower for a deeper correction before moving up. Whereas for the safe entry, the confirmation that it is a valid flag would be the break of the flag pattern.

How to trade using Risk Entry:

Wait for price to bounce off the fibonacci levels (0.5 or 0.618) and then enter with stops below/above the correction.

One of the advantages of doing a risk entry is that we can have small stop loss and have a great risk:reward ratio. Also, we can gain an entry at the start of the move and HODL!

Safe Entry:

Safe entry requires more than one confluence and requires confirmation. We have the rejection of the fibonacci level as well as a breakout of the flag, confirming that it is a valid flag pattern.

How to trade using Safe Entry:

For a safe entry, enter upon the break of the flag pattern with stops above/below the flag depending on whether its a bull or a bear flag. First TP would be the recent structure level and second TP would be the length of the impulse which led up to the correction.

The disadvantage to using a safe entry is that we require a bigger stop loss which makes the risk:reward ratio not as great as the risk entry. However, the probability of the trade succeeding is higher.

_______________________________________________________________________________

EXAMPLES OF RISK ENTRY

EXAMPLES OF SAFE ENTRY

Bearish Flag // Rising WedgeAs we can clearly see bear flag :)

NOTE: Tread at your own risk // just sharing my ideas

Harmony(ONE) update!The overall trend for Harmony is still down but we are getting close to the top of the descending channel. I see a trend starting to form within the white box in the chart, the 50% level for that forming trend is at ($0.109) if we can break this and start to hold this level that's a solid start for harmony to regain the strength it once had. Also seems to be a bearish flag forming we don't want to see this pattern complete because that could lead to another leg down but as of now we are close to breaking this flag to the upside which is a good sign. Now the overall 50% level for this down trend is at ($0.145) that's the level we really want to see broken and turned into support as long as we are below this level its anyone's game in my opinion. There is also some resistance at around ($0.12) so that's another price range to keep your eye on. As long as bitcoin can get back on track I think harmony will do just fine!

NOT FINANCIAL ADVISE ALWAYS DO YOUR OWN RESEARCH!!

Follow me on Twitter: twitter.com

Subscribe to my youtube channel: www.youtube.com

What’s next for NQI am still following NQ closely. I find it most interesting of the instruments I trade right now.

You can see how NQ ended Friday at support. I exited my NQ position on Friday for an break even trade.

So what next? I have noticed in the past that when an instrument ends a week right at support or a resistance that chances are that it will gap up or down at the open. So I wouldn’t be surprised to see a big up or down gap. But we will see.

Short scenario

- if price goes below support this is a breakout (or breakdown). As I always say you can enter a sell trade on break of support for aggressive entry. But I will wait for confirmation of resistance before entry. This is safer way to go, but you also chance missing an entry if it doesn’t retest and just drops. But it is okay to miss a big move which happen sometimes. You can always look for other entry.

Long scenario

- if open show move up I will enter right away. Is this a aggressive entry or safe entry. I say it is a safe entry, because if price goes up then support is confirmed. It will retested support. But I will keep a close eye on an exit because we are in a general down trend.

You can see the profit targets and possible retraces for both long and short entries.

That’s it for now. Please drop me a comment and or give a thumbs up on me. I appreciate so much when people read my ideas.

I hope every one is a winner.

❤️ Ms Bunny

USDJPY, 4hr tf, bearish flag or ABC correctionTrade ideas for USDJPY by Hardi

It looks like price broken below the bearish flag support with a solid candle on the 4hr tf.

This could also be an ABC correction, either way both are correction to the downside so we will try selling this pair.

Sell USDJPY 109.05

Stop loss 109.85

Take profit 106.20 (3.5R)

Use only 1-2% risk

Good luck

EURNZD, daily tf, double top with consolidation

As you can see on the daily timeframe there is a double top pattern formed. Price already broken below the support with a big bearish engulfing candle. This upwards movement could be only a retracement before further drop in this pair.

Price spent several weeks consolidating inside 1.6820-1.6660 area which also looks like a flag pattern to me.

Sell EURNZD 1.6760

Stop loss 1.6820

Take profit 1.6400 (6R)

Use only 1-2% risk

Good luck

Bearish overview; Could we see more downside move?In Daily timeframe, Rising Wedge Already Broken Downside

At the Moment, Bitcoin is Consolidating in Bearish Flag.

If Flag Broken down too, Expecting Another Bearish Wave towards the Support Area (42k).

So Far Bitcoin Looking Horrible so Don't Catch the Falling Knife, We Could See More Downside Move

1100+ Pips In ProfitGood day guys, if you took this gold position, since I posted it, you are in well over 1000pips. If you took it from May 3rd, you should be in profit over 450+ pips or yesterday, you are up 200+ pips. What another push for all the bullish momentum into Gold. We have now reached the trend zone and I placed a sell limit position in at 1832. You know I am all about placing my position into profit. I am an early bird, however, I want you all to place your SL into profit with the buying position, especially, if you took the trade. Another phenomenal setup. There is more value in finding a trade you can hold for a week+ versus trading and scalping everyday. As far as the selling position, you guys can hold off and I will keep you updated with that position. Back to gold, with all the bullish headlines, there is a lot of euphoria that will come, when the move has already occurred, it is already too late. The markets will look to trap lagging bull traders into the market, by driving price in the opposite direction. That is where we will profit again. Be sure to like, comment and share your thoughts or our postings with friends and family. We appreciate you for checking out our post and remember, we will see you on the other side.

Rodrick (CEO)

Third Eye Traders

FLAG PATTERNS & PSYCHOLOGY BEHIND BULL AND BEAR FLAG FORMATIONSHi everyone and Good morning. Welcoming you back (after 18-week break)

Thanks for your like and supports.

This is Part 3 of my Technical Analysis series of CHART PATTERNS

BULL AND BEAR FLAGS

Now, for those meeting the words BULLS and BEARS for the first time, these are terms used to describe the buying and selling action of traders

BULLS generally refer to the price action of buyers as they drive Stock PRICES UP, while BEARS refer to the selling action of sellers as they drive stock PRICES DOWN.

For starters, let’s define what a Flag pattern is:

A flag pattern is a TREND CONTINUATION PATTERN . It is named a flag pattern because its formation resembles a flag on a flagpole.

The pole is usually the result of an almost VERTICAL RISE IN PRICE, and the flag part results from a PERIOD OF CONSOLIDATION

When the price breaks out of the consolidation range, it triggers the next move higher.

Flag patterns can either be BULLISH or BEARISH.

Follow me closely, as We will now look at BULL and BEAR Flags in turn:

BULL FLAGS

Bullish flag formations are found in stocks with STRONG UPTRENDS.

They look something like (sketch 1 on chart)

As can be seen on the sketch 1 chart above, the pattern starts with a STRONG, ALMOST VERTICAL price spike, that eventually start losing steam forming an orderly pullback where the highs and lows are parallel to each other forming the FLAG in the form of a tilted rectangle.

The tilted rectangle (flag) usually breaks to the upside resulting in another powerful move higher, usually measuring the length of the prior flag pole (Let’s consider the sketch 2 chart)

Now let’s look at BEAR FLAGS :

The bear flag is an upside-down version of the bull flag. It has the same structure as the bull flag but inverted. looks like sketch 3

As can be seen above, the flagpole forms from an ALMOST VERTICAL price drop, which is followed by a period of consolidation, with parallel upper and lower trendlines forming the flag.

A break of the support structure of the flag, results in another move lower, with the same length as the prior pole.

Just as with any Chart pattern, there is usually psychology behind its formation.

Let us look at the

PSYCHOLOGY BEHIND BULL AND BEAR FLAG FORMATIONS:

On bull flags, the bears (short sellers) get blindsided due to complacency as bulls (buyers) charge ahead with a strong breakout causing bears (short sellers) to either panic and cover their ‘shorts’; or add to their ‘short’ positions.

Once the stock is in the consolidation stage, the bears (short sellers) regain some confidence and they add to their ‘short’ positions with the expectation of a price drop; only to get trapped again when the price break to the upside causing short sellers to cover their ‘Shorts’ thereby driving prices even higher

Since some short-sellers from the initial flagpole run up may still be trapped, the second breakout forming through the flag can be even more extreme in terms of the angle and severity of price move.

That is precisely the psychology behind BULL FLAGS; and that same psychology applies on BEAR FLAGS, just in reverse.

Now let’s consider the sketch 4 on how we can make money from bull and bear flags:

On a bull flag, you typically want to enter a Long trade on a breakout to the upside. Take profit target should be the same length as the prior flagpole. Stop loss should be placed just below the broken resistance line, which will now be acting as support.

I will leave it here for this week, that’s all I had in store for you. Follow me And JOIN me again next week as we will be talking about another Chart Pattern that works.

Until then, here is to Profitable trading!