NZDCAD Discretionary Analysis: Bounce at 0.83Hello traders and happy Easter Monday!

I'm expecting a bounce on NZDCAD. I'm interested in this 0.83 zone. It might turn into a strong bounce point. If the signs are there, I'm jumping in with a short.

Discretionary Trading: Where Experience Becomes the Edge

Discretionary trading is all about making decisions based on what you see, what you feel, and what you've learned through experience. Unlike systematic strategies that rely on fixed rules or algorithms, discretionary traders use their judgment to read the market in real time. It's a skill that can't be rushed, because it's built on screen time, pattern recognition, and the ability to stay calm under pressure.

There's no shortcut here. You need to see enough market conditions, wins, and losses to build that intuition—the kind that tells you when to pull the trigger or sit on your hands. Charts might look the same, but context changes everything, and that's something only experience can teach you.

At the end of the day, discretionary trading is an art, refined over time, sharpened through mistakes, and driven by instinct. It's not for everyone, but for those who've put in the work, it can be a powerful way to trade.

Bounce

GBPNZD Discretionary Analysis: Bounce at 2.18Hello traders.

I'm like what I see on GBPNZD. I'm expecting the momentum to continue. I'm watching that 2.18 zone closely. It's where I'll be looking for a reaction. Could be a solid bounce spot, and if it shows signs, I'm stepping in.

Discretionary Trading: Where Experience Becomes the Edge

Discretionary trading is all about making decisions based on what you see, what you feel, and what you've learned through experience. Unlike systematic strategies that rely on fixed rules or algorithms, discretionary traders use their judgment to read the market in real time. It's a skill that can't be rushed, because it's built on screen time, pattern recognition, and the ability to stay calm under pressure.

There's no shortcut here. You need to see enough market conditions, wins, and losses to build that intuition—the kind that tells you when to pull the trigger or sit on your hands. Charts might look the same, but context changes everything, and that's something only experience can teach you.

At the end of the day, discretionary trading is an art, refined over time, sharpened through mistakes, and driven by instinct. It's not for everyone, but for those who've put in the work, it can be a powerful way to trade.

Cat's in the CradleHey Guys!! Here's one for you that you are going to Like

Let's Aim for a ~50% profit, on This one...

($22---->30 )

double-bottom,Trend Channel

Clearly defined Support-and-resistance Touch points.

Cheers!

And the cat's in the cradle and the silver spoon

Little boy blue and the man on the moon

"When you comin' home, Dad?"

"I don't know when, but we'll get together then

You know we'll have a good time then"

NZDUSD Discretionary Analysis: Bounce at 0.59Hello traders.

NZDUSD has potential for me. I'm expecting the momentum to continue, and I've got my eye on that 0.59 level to get involved. That's where I'll be looking for a setup.

Discretionary Trading: Where Experience Becomes the Edge

Discretionary trading is all about making decisions based on what you see, what you feel, and what you've learned through experience. Unlike systematic strategies that rely on fixed rules or algorithms, discretionary traders use their judgment to read the market in real time. It's a skill that can't be rushed, because it's built on screen time, pattern recognition, and the ability to stay calm under pressure.

There's no shortcut here. You need to see enough market conditions, wins, and losses to build that intuition—the kind that tells you when to pull the trigger or sit on your hands. Charts might look the same, but context changes everything, and that's something only experience can teach you.

At the end of the day, discretionary trading is an art, refined over time, sharpened through mistakes, and driven by instinct. It's not for everyone, but for those who've put in the work, it can be a powerful way to trade.

PEPSI to $182 - Up to 14% ROI PossibleNASDAQ:PEP stock is currently trading at a discount to its fair value. That's why traders and investors should have a look at this bluechip, especially given its low beta statistic. Of course, macroeconomic uncertainties, such as the University of Michigan's latest consumer sentiment survey (which projects inflation to rise to 2.90% from 2.60% next year), could have an impact on consumer spending, which could squeeze margins. Nevertheless, given the undervaluation, Pepsi has a safety net for things like that under current circumstances.

When looking at the technical analysis we can se a big support zone at $158, where we are currently residing. The stock bounced multiple times from this zone in the past and could certainly do so again. Given the double bottom we have a good opportunity to get in the trade right now. Target one would be the descending trend line at $172 and target two would be the resistance zone at $183. That would give us a ROI of up to 14.24% in total. Closing below $156 on the daily would invalidate the trading idea.

Target Zones

$172.00

$183.00

Support Zones

$156.00

I'm shorting thisTwo weekly timeframe for a better understanding. Looks like a large bearish flag forming. Price just bounce off the bottom of the flag. But I think is a dead cat bounce. Is hitting a resistance level 35-36. Doesn't look too sting to break it up. SL triggers if a weekly candle breaks up the resistance and closes above it.

Nightly $SPY / $SPX Scenarios for April 3, 2025🔮 🔮

🌍 Market-Moving News 🌍:

🇺🇸📈 President Trump's 'Liberation Day' Tariffs Implemented: On April 2, President Donald Trump announced a series of new tariffs, referred to as "Liberation Day" tariffs, aiming to address trade imbalances. These include a baseline 10% tariff on all imports, with higher rates for specific countries: 34% on Chinese goods, 20% on European Union products, and 25% on all foreign-made automobiles. The administration asserts these measures will revitalize domestic industries, though critics warn of potential price increases for consumers and possible retaliatory actions from affected nations.

📊 Key Data Releases 📊

📅 Thursday, April 3:

📉 Initial Jobless Claims (8:30 AM ET):

Forecast: 225,000

Previous: 224,000

Measures the number of individuals filing for unemployment benefits for the first time during the past week, providing insight into the labor market's health.

📈 Trade Balance (8:30 AM ET):

Forecast: -$76.0 billion

Previous: -$131.4 billion

Indicates the difference in value between imported and exported goods and services, reflecting the nation's trade activity.

🏢 ISM Services PMI (10:00 AM ET):

Forecast: 53.0

Previous: 53.5

Assesses the performance of the services sector; a reading above 50 suggests expansion.

⚠️ Disclaimer: This information is for educational and informational purposes only and should not be construed as financial advice. Always consult a licensed financial advisor before making investment decisions.

📌 #trading #stockmarket #economy #news #trendtao #charting #technicalanalysis

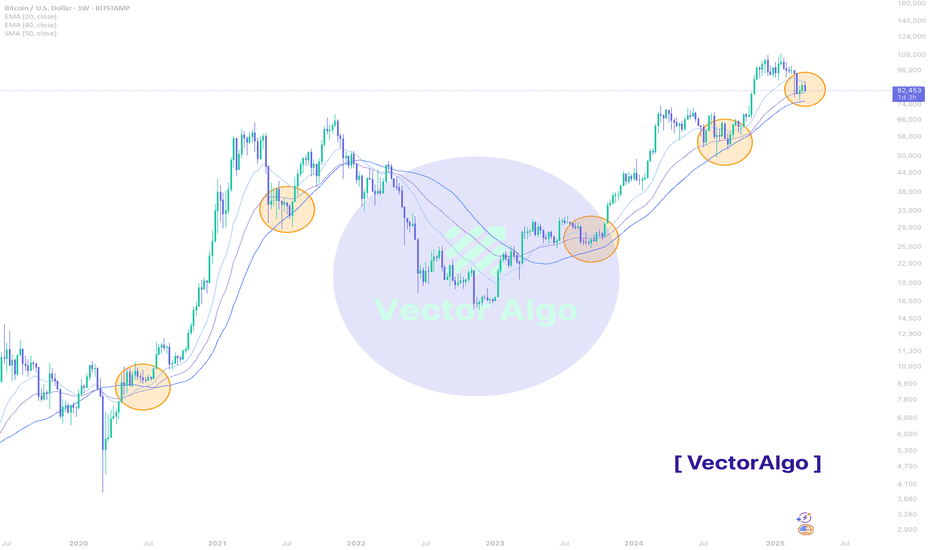

Bitcoin - EMA Support Holding Strong!#BTC/USD #Analysis

Description

---------------------------------------------------------------

BTC/USD – Weekly Chart Analysis

📉 Current Price: $82,239 (-4.47%)

📈 Key Moving Averages:

🔹 EMA 20: 88,143

🔹 EMA 40: 81,116

🔹 SMA 50: 76,230

EMA Support Holds Strong – The chart highlights multiple historical instances where BTC found support at the 20-40 EMA zone (orange circles). This pattern has played out consistently in past market cycles.

- Bullish Trend Continuation – Each time BTC has tested this EMA region on a pullback, it has led to strong recoveries and further bullish momentum.

- Current Market Structure – BTC is once again testing this key EMA support zone. A bounce from here could signal a continuation of the uptrend.

- Historical Patterns Repeat – The blue shaded region and Vector Algo's AI-optimized signals indicate that similar setups have resulted in upward moves.

✅ Bullish Scenario: If BTC holds above the EMA 40 ($81,000) and forms bullish confirmation candles, we could see a move toward previous highs ($96,000) and possibly $100,000+.

❌ Bearish Scenario: A breakdown below $81,000 could lead to further downside towards the 50 SMA ($76,000) and lower demand zones.

Bitcoin remains in a strong uptrend, and the current EMA support test is crucial for trend continuation. Keeping an eye on price action around this zone is key for potential long opportunities!

---------------------------------------------------------------

Enhance, Trade, Grow

---------------------------------------------------------------

Feel free to share your thoughts and insights. Don't forget to like and follow us for more trading ideas and discussions.

Best Regards,

VectorAlgo

BITCOIN - Price can reach support level and then start to growHi guys, this is my overview for BTCUSDT, feel free to check it and write your feedback in comments👊

Some time ago, the price long time traded near $83700 level, broke it and started to grow inside an upward wedge.

Firstly, BTC rose to the resistance line of the wedge and then corrected to the support level, after which it reached the $87800 level.

After several attempts to break resistance, price turned around and dropped, thereby exiting from wedge.

Now it is correcting and approaching support level, slowly moving toward $83700 key support level.

In my opinion, when BTC reaches $83700 level, it can turn around and start to grow to the $87800 resistance level.

If this post is useful to you, you can support me with like/boost and advice in comments❤️

ETH at a Make-or-Break Level – What’s Next?🚀 Hey Traders!

If you're getting value from this analysis, smash that 👍 & hit Follow for high-accuracy trade setups that actually deliver! 💹🔥

🚨 ETH Update – Critical Level Ahead!

ETH is currently forming a symmetrical triangle on the 2-week timeframe and is now testing the lower trendline. With 4 days left before the candle closes, this level is crucial! 🔥

📌 What’s next?

✅ If ETH bounces from here, we could see a strong bullish move in the coming days.

❌ Invalidation: A close below $1850 could trigger further downside.

📉 Breakdown or Bounce? What’s your take? Drop your thoughts in the comments! 👇💬

🔔 Follow us for real-time updates and winning trade setups! 🚀

ADBE to $465 - Chance for a BounceNASDAQ:ADBE ADBE, as well as other tech stocks, was beaten hard over the last couple of months. The earnings recently did not provide any relief for the chart either, although the figures were not particularly bad. In particular, the possible prospect of finally being able to expand and monetize Adobe's own AI “Firefly” continues to offer good opportunities.

With a PE of now under 20, Adobe has become quite favorable as a company that continues to grow well in the SaaS sector. It has also reached several technical support zones. We are at the lower edge of a very large bull flag that has been in place since the beginning of 2024. Horizontal support at $385 is also supportive. We have 3 large daily gaps in the chart above us and a bullish wedge within the flag. This is a good place to start buying for a possible bounce towards $465.

However, one must bear in mind that the overall market remains bearish. Purchases should therefore be closely hedged and not be too large. However, it would be wrong not to use this opportunity to enter the market.

Target Zones

$465.00

Support Zones

$385.00

$360.00

Potential Path of the Altcoin Market?Trading Family,

To say that our altcoin market has been disappointing would be the understatement of the year. While there definitely have been some winners (I have held Solana through the $8 low), the majority have been a large disappointment. In fact, the last I read, only 42 altcoins have outperformed Bitcoin since the bear market bottom was put in. This is an incredible stat to think about and very telling. Altcoin traders have a difficult task in beating the BTC hodl'ers for sure.

However, recently there have been some hidden indications that our altcoin market will soon increase our odds of success.

First of all, Bitcoin's low fees. Low fees on the Bitcoin blockchain is often a hidden health indicator for the coin signaling weak demand. People often see low fees as a positive thing. But what's actually happening here is that there is low demand for transacting on the chain, therefore, in order to increase the demand, transaction fees are forced down.

Weaker demand does seem to correlate with what the BTC dominance chart is showing us.

You can see from the chart that we have a large sell side liquidity block that has formed, indicating large sell side volume in dominance. Additionally, my indicator has flashed a red dot, signaling that it is time for dominance to drop. We also have our RSI and Macd, crossing down. And if we break from that channel, dominance drop momentum should accelerate.

This brings me to our TOTAL3 chart which is all altcoins excluding Ethereum. The chart is showing us that we have reached an extremely critical support trendline. Price is currently bouncing from it. Additionally, there are large volumes of buyers at this point. You can observe this by the VRVP candles and the liquidity blocks indicator. But contrary to BTC.D in which the RSI and Macd were crossing down, TOTAL3 shows our RSI and Macd crossing up! This is bullish for alts.

Finally, it is a great sign to see that our "M" pattern has looked to have completed right at our point of support.

I have drawn a projected pathway from here. In the first part of our next week, we may see a bit more pump. News of the passing continuing resolution here in the U.S. is still trickling out. Monday, as stock traders jump back in, I would imagine we see more pump as traders feel good about the averted gov't shutdown. This may trickle into Tuesday. But then Wed. is the Fed's day. We are expecting further pause to interest rate. Everyone will be listening to the Fed speak and parsing every syllable that is uttered from J. Pow's tongue. What is says and the bias that is interpreted will be key. I am expecting mostly a non-event here. Which means that bullish bias may wane once again. Crypto, mostly altcoins, really only pump on good news. But negative and even neutral news is a sell to sideways event. Thus, I expect we may hit another local top around Wed. afternoon at which point the altcoin market starts to sell a bit again OR it simply continues sideways again for a few more weeks. Sooner or later though, I believe we are headed towards that 1.3 trillion resistance. It is worthwhile considering to stay in a holding pattern unless we drop below our all-important support. Watch this line closely and draw it on your charts. It will be key!

✌️Stew

Bearish Divergence on Monthly TF but Bounce ExpectedBearish Divergence on Monthly TF.

Very important Support lies around

160 - 162; and a Bounce is Expected if this level

is Sustained on Monthly Support.

Bullish Divergence on Short TF; so a bounce can be seen

up to 177 & then 194 (if 177 is Sustained)

[LONG] STX - STACKS on support and ready for a bounceSTX is another beaten up coin that this year alone lost more than 60% of it's already beaten up marketcap. From the peak on April of 2024 to January of this year STX was already down 50%. Bulls got completely obliterated, but not everything is lost for STACKS: Sitting at $0.75 is now testing (and holding) for second time the previous 2023 resistance, now turned support. A bounce here doesn't immediately mean the end of the fall, but we can catch a good counter-trend move to retest the distribution zone on the $1.44 to $2.00 range

1st Entry: $0.75 (previous resistance, now support)

2nd Entry: $0.65 (most traded zone)

move SL to Break even if price breaks the previous high at $1.00

1st TP: $1.34

2nd TP: around $1.80 or look for signs of weakness in lower timeframes at this area

Bounce Token Goes Bullish (Beyond —250% Potential Target)Resistance turned support. Once the support level is tested and holds, or recovered in this case, the bulls are in.

Bounce Token (AUCTIONUSDT) is now trading above a strong long-term support level. It traded below this level only briefly and now that the action is happening above it we can expect additional growth. A higher low above support is coupled with high volume. These signals combined give further strength to a bullish bias.

I am giving here two targets and one goes beyond 250%. This pair has potential for much more in 2025. It is still early, but soon the entire Altcoins market will start to rise. You have to aim high.

For a pair like this one, there is no going back. The strongest bullish action happened in late 2023. In 2024, growth was weak. This means that this pair can start moving anytime and when it does it will be really strong. The last bullish wave produced more than 1,200% and this was when the market perception was weak compared to today. If a pair can grow 1,200% in a weak year, imagine how much it can grow when market conditions are great.

Rest easy. Cryptocurrency is going up.

Namaste.

Crude Oil / WTI short cheap and good time to bounceVolatility on WTI has been very strong on past years but is narrowing. Especially in past months we can see a seemingly tightening volatility in prices. And we all know what that means right ?!

Correct, a breakout will follow. The questions is only in which direction. A good risk ration is achievable since we are very close to a bounce level / support (green line) and far away from the next resistance (red line). Commodity markets tend to be mean reverting and whenever commodities are cheap it makes sense to but them. Boom and bust cycles. But this is rather a long term strategy.

In any case, breakdown as below:

Entry:

Ideally we would average down the long position down to 67.28 and potentially below, in case price tests areas below.

Exit:

Ideally we would exit at TP slightly before 80 USD to avoid the resistance and the magical strength of full numbers. Something like 79.4 USD should work.

If price moves against us close at SL or once daily candle break below the support and closes.

In such case we could even consider a short position but with tight TP as fundamental dont point towards much lower prices.

Conclusion:

An easy trade can be entered with good risk reward ratio if executed correctly.

Disclaimer: This is non financial advice

let me know if any question.

GBPAUD - Bearish Reversal Pattern + SetupHello traders,

GBPAUD has been in an uptrend since last week. But now it is showing bearishness with the break of the demand zone.

Add to this the RSI divergence which makes this trade a higher probability setup.

My entry, sl and tp are as marked on the chart.

+55% in a day $CYCN compared $TSLA $NVDA -5% in drop marketWe can't be the only ones who actually made money overnight from Friday to Monday in this market?

This was the only daytrade held 🎯

NASDAQ:NVDA NASDAQ:TSLA wake up into -5%

Woke up into +25% with NASDAQ:CYCN and continued to +55% from $4 to $6.25+

$Bounce easy $$ RSI are oversold, target is $16 Bounce Token (AUCTION/USDC), the current price is showing bullish potential. Historical support around \$10–\$12 has proven to be a strong floor, with accumulation indicating a possible reversal. Technicals also highlight oversold RSI conditions and the token testing the lower Bollinger Band, suggesting a potential bounce back toward the \$15–\$16 range, especially if trendlines shift and momentum picks up. for a few seconds

Price hovers near $10–$12, a strong historical support zone that previously triggered rapid rebounds.

RSI is oversold, and touching the lower Bollinger Band often signals potential for a swift recovery.

A break above the $14–$15 range could drive momentum toward $16, underscoring a bullish case.

SOL/USDT Critical Support Zone in Play Is a Bounce Imminent?SOL/USDT Analysis

Price is nearing a key support zone around $185 - $175, which has historically acted as a strong demand area.

It is crucial to wait for the price to reach this support level and observe for bullish confirmation (e.g., a bullish candlestick pattern or reversal signals).

If the price holds this level and bounces, we can expect a significant recovery toward the **$210 - $220** range.

A break below $175 would invalidate this setup and could lead to further downside.

Strategy

1. Wait for a clear bounce off the support zone before entering a long position.

2. Set initial targets at $210 and $220, with stop loss below $175 for risk management.

Keep this chart on your watchlist and monitor price action near support!

ETH/BTC - Once in a lifetime opportunity#ETH/BTC #Analysis

Description

---------------------------------------------------------------

+ ETH/BTC pattern looks exactly like the pattern we have seen before 2021 bull run.

+ There is some serious is consolidation that we have seen over the years and price is expecting to be bounced back any time now.

+ I'm expecting the price to move in a pattern which matches with 2020 ETH/BTC pattern.

+ I'm entering some position now to increase my BTC balance.

---------------------------------------------------------------

Enhance, Trade, Grow

---------------------------------------------------------------

Feel free to share your thoughts and insights. Don't forget to like and follow us for more trading ideas and discussions.

Best Regards,

VectorAlgo