NATGAS BEARISH BREAKOUT|SHORT|

✅NATGAS formed a head

And shoulders pattern then

Made a bearish breakout of

The neckline which is now

A resistance of 3.850$

And the breakout is confirmed

So we are bearish biased and

We will be expecting a

Further bearish move down

SHORT🔥

✅Like and subscribe to never miss a new idea!✅

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Breakout!

HelenP. I Gold may continue to fall and break support levelHi folks today I'm prepared for you Gold analytics. After failing to hold above the resistance zone between 3140 and 3155 points, Gold made a sharp reversal. The strong bearish reaction from this area marked the end of the previous bullish momentum and triggered an aggressive sell-off. That move broke several minor support levels and pushed the price all the way down to the current support zone between 3010 and 2990 points. Previously, Gold had shown a stable uptrend, consistently bouncing from the trend line and using it as a dynamic support. Each pullback was met with buying pressure, allowing the price to climb higher. However, this time, after reaching the 3140 resistance level, buyers were overwhelmed by strong selling activity. Currently, Gold is trading just above the key support zone and close to the trend line. This area has acted as a pivot level multiple times, but the latest price action shows hesitation from buyers and growing control from sellers. Given the recent sharp decline, the break from the resistance zone, and the pressure near the current support, I expect Gold to continue falling toward 2960 points — my current goal. If you like my analytics you may support me with your like/comment ❤️

BTC/USD Forming Bullish Falling Wedge – Potential Target📐 2. Technical Pattern – Falling Wedge

A falling wedge forms when the price consolidates between two converging downward-sloping trendlines. It suggests diminishing selling pressure and a likely reversal.

Key Characteristics in This Chart:

Upper Resistance Trendline: Formed by connecting the series of lower highs.

Lower Support Trendline: Formed by connecting the lower lows.

The price respects both boundaries, confirming wedge structure.

Volume generally decreases during the wedge (implied but not shown).

✅ Bullish Implication: Once price breaks above the upper resistance, it often triggers a sharp upward move due to the squeeze of supply and the build-up of demand.

🧱 3. Support and Resistance Zones

🔻 Resistance Zone:

Area: ~100,000 to ~108,000 USD

Marked as a wide horizontal band (beige-shaded area).

Previous price peaks and consolidations suggest this zone is strong supply.

Breakout above this zone could trigger momentum towards the higher target.

🔹 Support Zone:

Area: ~72,000 to ~75,000 USD

Historical reaction level where buyers previously stepped in.

Coincides with the lower wedge boundary and recent bounce points.

Repeated tests strengthen this as a reliable accumulation zone.

🎯 4. Trade Setup Strategy

💼 Entry Strategy:

Trigger: A confirmed breakout above the wedge’s upper trendline (black diagonal line).

Confirmation: A strong bullish daily close above the trendline, ideally with volume spike.

The current price (~77,130) is near the lower boundary—offering a potential early entry or low-risk setup with a tight stop.

📌 Stop-Loss Placement:

Level: 70,916 USD

Below the wedge’s lower support and beneath the broader support zone.

Ensures exit if the pattern fails or bears regain control.

🧭 Target Projection:

Target Price: 114,562 USD

Based on the height of the wedge projected from the breakout point, a standard wedge breakout measurement.

Aligns with historical highs and psychological resistance.

🧮 Risk-Reward Ratio: Assuming entry around 77,130:

Risk (Stop-Loss): ~6,200 points

Reward (Target): ~37,432 points

R:R Ratio ≈ 1:6 – Highly favorable

⚙️ 5. Market Psychology & Price Action Insight

The falling wedge pattern suggests exhaustion of sellers.

Buyers are defending the support zone aggressively—creating higher lows within the wedge.

Each bounce is slightly more aggressive, indicating growing bullish sentiment.

A breakout from the wedge could act as a catalyst for rapid price acceleration as sidelined bulls enter and shorts cover.

📊 6. Summary of the Setup

Component Detail

Pattern Falling Wedge (Bullish)

Timeframe 1-Day Chart

Entry Point Breakout above upper trendline

Stop Loss 70,916 USD

Target 114,562 USD

Support Zone 72,000–75,000 USD

Resistance Zone 100,000–108,000 USD

Risk/Reward Approx. 1:6

Bias Bullish

📌 Final Thoughts

This setup provides a technically sound opportunity with clear invalidation (stop loss) and a well-defined profit target. The risk-to-reward ratio is attractive, and the price structure suggests a bullish reversal is likely, pending a confirmed breakout.

(ETH/USD) Breakout from Falling Wedge – Bullish Momentum Ahead?Ethereum (ETH/USD) Breakout from Falling Wedge – Bullish Momentum Ahead?

This 4-hour Ethereum chart shows a breakout from a falling wedge pattern, a bullish reversal formation. The price has started forming higher lows, signaling potential upside movement. The projected target is around $2,411, indicating a significant recovery.

A successful retest of the breakout level could confirm further upward momentum. Traders may consider long positions while monitoring resistance levels.

📌 Key Levels:

Support: ~$1,879

Target: ~$2,411

Resistance Zones: $2,100 - $2,200

Would you like me to refine this further? 🚀

USDJPY Potential Pennant Triple ThreatFirst,

In the Higher Timeframes (4Hr - Weekly), we can see that USDJPY is traveling down a Descending Channel since Jan 10th. Price tried pushing higher in March but ultimately fell back within the Channel beginning of this month (April) resulting only in a False Breakout but also creating a Fair Value Gap from 148.698 - 147.429.

Now down on the Lower Timeframes (15min - 1Hr) we can see that Price has created a Fair Value Gap from 146.546 - 146.226 with current Price Action forming a Pennant Pattern just above this FVG which lines up with Previous Highs (Past Resistance Level) and with Volume Decreasing, suggests we could see a Breakout soon! Now Based on the Pennant Pattern being Neutral meaning can break either way, creates the first 2 Bullish Scenarios being either a Breakout and Retest of the Pennant pattern going Bullish OR Bearish.

*Breakout will be Validated if followed by an Increase in Volume!

Scenario 1 -If BULLISH BREAKOUT - The Retest will come at the Falling Resistance of the Pattern.

Scenario 2 -If BEARISH BREAKOUT - This could suggest Price is looking to "Fill The Gap" being the FVG

** If Scenario 2 happens, this Price Movement could be looking to fulfill a Fibonacci Retracement of the Swing Low @ 145.041 to the Swing High @ 146.904, where the 38.2% Level lays at the Upper Limit of the FVG and the 50% Level lays at the Lower Limit of the FVG with the Consequent Encroachment right in the middle @ 146.385.

—Both of this ideas suggest USD will need to gain strength which could mean fundamentally:

FOMC Meeting Minutes on Wednesday, April 9th & CPI (Consumer Price Index), the instrument used to measure Inflation, on Thursday, April 10th released results will be heavily relied on to see if there's anymore input on potential effects of Tariffs.

Scenario 3 - Fair Value Gap Inversion could suggest bad news fundamentally is released for USD and gives JPY Bears (Sellers) the ability to pull price down, keeping Price Consolidated further within the HTF Descending Channel.

EUR/GBP Analysis Double Bottom Breakout Toward TargetOverview of the Chart

This chart displays a EUR/GBP daily timeframe setup, highlighting a Double Bottom Pattern, a well-known bullish reversal formation. The pattern consists of two consecutive lows at a similar price level, followed by a breakout above a key resistance zone. This setup suggests a potential trend reversal from bearish to bullish.

Technical Analysis Breakdown

1. Double Bottom Formation (Reversal Signal)

Bottom 1: The first low was established after a prolonged downtrend, where the price found support and bounced higher.

Bottom 2: Price revisited the same support area but failed to break lower, indicating that sellers are losing strength and buyers are stepping in.

A double bottom pattern signals that the asset is forming a strong base and is likely to move higher after breaking the neckline (resistance level).

2. Support and Resistance Levels

Support Level (~0.8322):

This level acted as a demand zone, preventing further downside.

It marks the price area where buyers accumulated positions, leading to a reversal.

Resistance Level (~0.8500):

This level previously acted as a supply zone, where sellers controlled the price.

A breakout above this level is crucial to confirm the bullish trend continuation.

3. Breakout Confirmation & Retest Expectation

The price successfully broke above the resistance zone, confirming a bullish reversal.

A potential retest of the broken resistance (now turned support) could occur before further upside movement.

Traders often wait for this retest to confirm that the breakout is genuine before entering a position.

4. Price Target Projection

Based on the measured move strategy, the expected target is calculated by measuring the height of the double bottom pattern and projecting it above the breakout zone.

Target Price: 0.8742, aligning with historical resistance levels.

5. Stop Loss Placement

Stop loss at ~0.8322 (below the double bottom support).

This ensures risk is managed in case of an invalid breakout or a false move.

Trading Plan & Execution Strategy

📌 Entry Strategy:

✅ Breakout Entry: Buy after the breakout above resistance.

✅ Retest Entry: Wait for a pullback to the previous resistance (now support) before entering.

📌 Risk Management:

🔹 Stop Loss: Placed below the recent support at 0.8322 to limit downside risk.

🔹 Take Profit: First target at 0.8742 based on the double bottom structure.

📌 Market Outlook:

A successful breakout and bullish momentum could push prices toward the target.

If the price fails to hold above the breakout zone, a deeper retracement could occur before continuing higher.

Conclusion

The EUR/GBP pair has formed a bullish double bottom reversal pattern, signaling a potential uptrend continuation. The key levels to watch include 0.8500 (resistance turned support) and 0.8742 (target projection). Traders should monitor price action around the breakout zone for confirmation and consider risk management strategies before entering a position.

Clear DayTrading strategy video. The "Inside Bar"🔉Sound on!🔉

📣Make sure to watch fullscreen!📣

Thank you as always for watching my videos. I hope that you learned something very educational! Please feel free to like, share, and comment on this post. Remember only risk what you are willing to lose. Trading is very risky but it can change your life!

HelenP. I Euro will rise a little and then drop to support levelHi folks today I'm prepared for you Euro analytics. After breaking the structure of the previous downtrend, Euro showed a powerful bullish impulse, which allowed the price to exit the downward channel and move confidently higher. This breakout was supported by the trend line, which began to act as dynamic support throughout the rise. The bullish movement reached a local high near the 1.11 area before losing momentum. Soon after reaching that high, the price began to decline, pulling back to the area of the trend line and testing the support zone between 1.0950 and 1.0970. This zone aligns with Support 1 at the 1.0950 level and was already tested multiple times in recent price action. Although the trend line provided some temporary support, the strength of buyers has clearly faded. Currently, EUR/USD is trading just above the trend line, but price action suggests pressure is shifting back to the downside. Given the rejection from higher levels and the repeated tests of support, I expect the pair to decline further toward the 1.0950 target — my current goal. If you like my analytics you may support me with your like/comment ❤️

"Gold Approaching Key Support – Will Bulls Take Control?"🔹 Market Structure:

Gold is currently in a corrective phase after a strong bullish run, facing a pullback from recent highs around $3,160. The price has now approached a key horizontal support zone near $2,980 - $3,020.

🔹 Key Levels:

✅ Resistance: ~$3,160 (previous high)

✅ Horizontal Support: ~$2,980 - $3,020 (marked in blue)

✅ Target Level: ~$3,099 (potential bounce area)

🔹 Potential Scenarios:

1️⃣ Bullish Reversal: If the price finds support in the marked zone and forms bullish confirmation (e.g., hammer candle, bullish engulfing), we could see a retest of $3,099 and potentially higher levels.

2️⃣ Breakdown Scenario: If support fails, gold may see further downside towards $2,950 or lower.

🔹 Trading Plan:

📈 Buy Setup: Look for bullish confirmation near support (~$3,020) with a target of $3,099 - $3,120.

📉 Sell Setup: If support breaks, short positions could target $2,950 - $2,920.

🔸 Bias: Bullish above support, bearish below it.

🔸 Risk Management: Use a stop-loss below support (~$2,980) to manage risk.

Would you like me to refine this further or add any indicators like RSI, Moving Averages, etc.? 🚀

Solana - The Bullrun Is Not Over Yet!Solana ( CRYPTO:SOLUSD ) might create another move higher:

Click chart above to see the detailed analysis👆🏻

As we are speaking Solana is sitting at the exact same level as it was about 3.5 years ago in the end of 2021. In the meantime we saw a lot of volatility and Solana is now once again retesting a major previous support level. Despite the harsh recent drop, the bullrun remains valid to this day.

Levels to watch: $120, $250

Keep your long term vision,

Philip (BasicTrading)

Euro will rise a little more and then make correction to 1.0950Hello traders, I want share with you my opinion about Euro. Earlier, the price started to grow from the lower region near 1.0730, where it bounced off the buyer zone between 1.0690–1.0730 points and entered a strong upward movement. This impulse helped Euro break through previous resistances and approach the upper boundary of the support area, which lies between 1.0950–1.0990 points. After reaching a local high, the price formed a pennant pattern, consolidating within narrowing trend lines while respecting both the support and resistance structure. During this phase, the pair remained stable, building pressure before making the next move. Recently, EUR made a strong breakout to the upside, exiting the pennant and continuing its bullish rally. The price surged rapidly and now trades above the current support level at 1.0950, reaching fresh highs in this local trend. I expect the price to reverse soon from the current overbought region and begin a decline toward the support area, which now acts as a potential pullback zone. My target for this corrective movement is the 1.0950 level, which aligns perfectly with the current support level and the upper boundary of the support zone. Please share this idea with your friends and click Boost 🚀

ATOM ANALYSIS📊 #ATOM Analysis

✅There is a formation of Falling Wedge Pattern on daily chart with a good breakout and currently retests from the major resistance zone and again trading around its major resistance zone 🧐

Pattern signals potential bullish movement incoming after a successful breakout of resistance zone

👀Current Price: $4.800

🚀 Target Price: $6.300

⚡️What to do ?

👀Keep an eye on #ATOM price action and volume. We can trade according to the chart and make some profits⚡️⚡️

#ATOM #Cryptocurrency #TechnicalAnalysis #DYOR

AUDUSD Bears "Flag Down" Potential OpportunitiesOn the Technical Analysis stand-point, FX:AUDUSD has been Consolidating in an Ascending Channel since the beginning of this year after having a sharp decline which started in October last year. Now the past 6 Months, Price Action seems to be forming a strong Continuation Pattern, the Bear Flag!

Based on the Retracement from the Swing High @ .6942 to the Swing Low @ .60872, Price has made a 38.2% Retracement to .64081, resulting in a False Break, pushing Price back into Pattern!

Price has been trading Under the 200 EMA since the start of the "Flagpole" and with the separation between it and the 34 EMA Band, feeds the Bearish Bias after we see Price heavily rejected after touching the 34 EMA Band!

*Once Price makes a Breakout of the Rising Support of the Channel -> Bear Flag Confirmed

*Increase in Volume after Break -> Breakout Validated

If we get a True Breakout that is Validated by the checklist of factors, we could be looking at great opportunities to take FX:AUDUSD down to the current 5 Year Low of .55063 set back in March 16th 2020 (Initial Outbreak of Covid) based on the Flagpole and Potential Extension of a Valid Break and Retest of the Bear Flag!

Now, Fundamentally what is driving the Weaker Aussie Dollar is the fear of the impact of what the US Tariffs will do to Australia's "Key Trading Partners" being China, Japan and South Korea all being high on the Reciprocal Tariff List. Because of this, the RBA has now priced in 100 Basis Points worth of Rate Cuts to come with the expectations of a "dampened broader outlook for global trade and economic growth."

www.tradingview.com

Stay Tuned!

EUR-AUD Free Signal! Buy!

Hello,Traders!

EUR-AUD is trading in a

Strong uptrend and the

Pair made a bullish breakout

And a retest of the key

Horizontal level of 1.7420

And is going up now so

We can enter a long trade

On a local pullback with

The Take Profit of 1.7551

And the Stop Loss of 1.7362

Buy!

Comment and subscribe to help us grow!

Check out other forecasts below too!

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

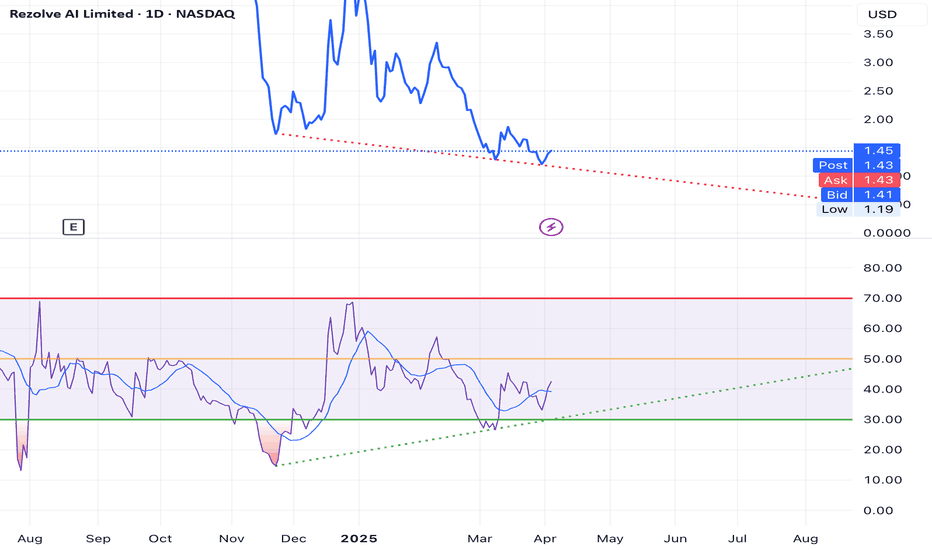

BULLISH RSI DIVERGENCE ON REZOLVE AI (RZLV) 1D CHARTA bullish RSI divergence appeared to gather more strength on the 1 hour chart today. This could possibly signal a bullish up trend. The London based company provides AI solutions for commerce. Rezolve recently closed an acquisition of GroupBy, an ECommerce company, and has recently been featured favorably in articles by Nasdaq and others.

AUD-JPY Will Keep Falling! Sell!

Hello,Traders!

AUD-JPY made a bearish

Breakout then made a retest

And is going down again

So we are bearish biased

And we will be expecting

A further bearish continuation

Sell!

Comment and subscribe to help us grow!

Check out other forecasts below too!

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

EUR/USD Analysis Ascending Triangle Breakout – Bullish TargetOverview of the Chart:

The chart represents the EUR/USD (Euro to U.S. Dollar) pair on a 1-hour timeframe, showcasing a bullish ascending triangle breakout. The pattern indicates an upward continuation in the trend after a period of consolidation. This analysis will break down the key elements of the chart, the technical structure, and the potential trading strategy.

1. Market Structure & Key Zones

A. Market Curve Area (Early Trend Development)

The price started with a strong bullish trend leading up to the formation of the triangle.

The curved trendline suggests a gradual increase in buying pressure, indicating that the market was preparing for a larger breakout.

B. Resistance and Support Levels

Resistance Level (Red Arrow & Blue Box):

This level acted as a price ceiling where sellers previously dominated.

The market attempted multiple times to break this resistance before successfully breaching it.

Support Level (Green Arrow & Yellow Zone):

The price consistently found buyers at this level, reinforcing a higher low structure.

The rising support line within the triangle indicated strong accumulation by buyers.

2. Chart Pattern: Ascending Triangle Formation

The price action formed an ascending triangle, which is a well-known bullish continuation pattern.

The higher lows (trendline support) indicated buyers were gaining control, gradually pushing the price toward the resistance.

Eventually, the resistance was broken with strong bullish momentum, confirming a valid breakout.

3. Breakout Confirmation & Retest

The breakout above the resistance level came with high volume, indicating strong market participation.

After the breakout, a minor pullback (retest) occurred, confirming previous resistance as new support.

The price surged upward after the retest, validating the bullish trade setup.

4. Trade Setup & Risk Management

A. Entry Strategy

A trader would enter a buy (long) position after confirming the breakout.

Entry Trigger:

Either at breakout (high-risk, early entry)

Or after a successful retest (safer entry)

B. Stop Loss Placement

A stop loss is placed below the previous support level at 1.07276, ensuring risk is limited in case of a false breakout.

C. Target Projection

The target price is measured using the height of the triangle added to the breakout level.

Based on this calculation, the projected target is around 1.12838.

5. Conclusion & Trading Plan

The EUR/USD pair has executed a clean ascending triangle breakout, signaling further bullish movement.

The trading plan suggests:

✅ Entry: Buy after breakout confirmation or retest.

✅ Stop Loss: Placed below 1.07276 for risk management.

✅ Take Profit: Targeting 1.12838, based on the pattern’s height projection.

This setup presents a high-probability long opportunity in a trending market, with proper risk management to protect against potential reversals.

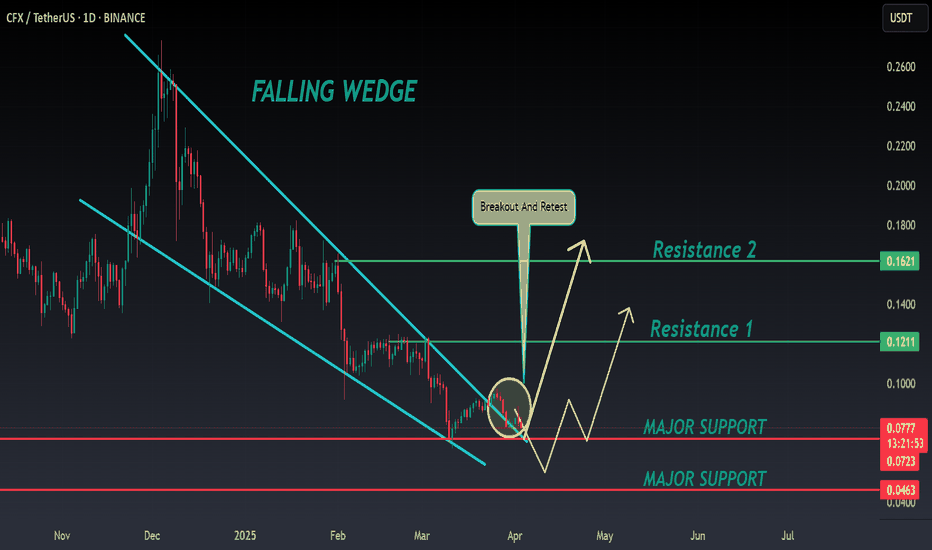

CFX ANALYSIS📊 #CFX Analysis

✅There is a formation of Falling Wedge Pattern on daily chart with a good breakout and currently retests from the major resistance zone🧐

Pattern signals potential bullish movement incoming after a successful retest

👀Current Price: $0.0775

🚀 Target Price: $0.1210

⚡️What to do ?

👀Keep an eye on #CFX price action and volume. We can trade according to the chart and make some profits⚡️⚡️

#CFX #Cryptocurrency #TechnicalAnalysis #DYOR

EUR_CHF BULLISH BREAKOUT|LONG|

✅EUR_CHF is going up now

And the pair made a bullish

Breakout of the key level

Of 0.9570 which is now a support

And the breakout is confirmed

So we are bullish biased

And after the pullback

We will be expecting a

Further bullish move up

LONG🚀

✅Like and subscribe to never miss a new idea!✅

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

PhoenixLTD, 1W & 1DLooking very Good Channel Pattern and it is ready to Breakout

Enter into it after the upper trendline Breakout

it is Combination of Both Triangle and Channel Patterns , it can Break any time

so look an eye on it or make an Alert above trendline broke

Follow For More Swing Trade Ideas Like This

XAG/USD Bullish Setup - Falling Wedge Breakout Towards TargetChart Overview

Asset: Silver / U.S. Dollar (XAG/USD)

Timeframe: 1-hour (1H)

Date and Time: Published on April 2, 2025, at 11:17 UTC

Publisher: GoldMasterTraders on TradingView

Current Price (at the time of the chart):

Open: 33.82300

High: 33.89005

Low: 33.79435

Close: 33.88880

Change: -0.05780 (-0.20%)

Price on the Right Axis: The price scale ranges from approximately 32.80000 to 35.25000, with the current price around 33.88880.

Chart Elements and Technical Analysis

1. Candlestick Price Action

The chart displays a 1-hour candlestick representation of XAG/USD, showing price movements from late March to early April 2025.

Trend Context:

Prior to the formation of the pattern, the price experienced a sharp rally from around 32.80000 (March 21) to a high near 34.60000 (March 27). This indicates a strong bullish trend.

Following this rally, the price entered a consolidation phase, forming lower highs and lower lows, which is characteristic of the Falling Wedge pattern.

Recent Price Action:

On April 2, the price appears to have broken out of the wedge pattern, closing above the upper trendline with a strong bullish candle. The current price of 33.88880 is above the breakout level, suggesting a potential continuation of the uptrend.

2. Chart Pattern: Falling Wedge

Pattern Identification:

The chart highlights a Falling Wedge pattern, a bullish chart pattern that can act as either a reversal or continuation pattern. In this case, given the preceding uptrend, it’s likely a continuation pattern.

A Falling Wedge is characterized by two converging trendlines:

Upper Trendline (Resistance): Connects the lower highs, sloping downward.

Lower Trendline (Support): Connects the lower lows, also sloping downward but at a less steep angle than the upper trendline.

The wedge started forming around March 27, after the price peaked near 34.60000, and continued until the breakout on April 2.

Pattern Dynamics:

The narrowing range between the trendlines indicates decreasing selling pressure and a potential buildup of buying interest.

Falling Wedges typically resolve with a breakout to the upside, as the price breaks above the upper trendline, signaling a resumption of the prior trend (bullish in this case).

Breakout Confirmation:

The price broke above the upper trendline of the wedge on April 2, with a strong bullish candle closing at 33.88880. This breakout is a key signal for a potential upward move.

The breakout level appears to be around 33.85000–33.90000, and the price is currently holding above this level, which is a positive sign for bulls.

3. Key Support and Resistance Levels

Support Level:

A horizontal support zone is marked around 33.58553 (approximately 33.58–33.60).

This level acted as a significant support during the wedge formation, with the price bouncing off this zone multiple times (e.g., on March 28 and March 31).

The support level aligns with the lower boundary of the wedge, reinforcing its importance as a key area of buying interest.

Resistance Level:

A resistance zone is marked around 34.60000 (approximately 34.60–34.80).

This level corresponds to the high reached on March 27, before the wedge formation began. It represents a significant barrier where selling pressure previously emerged.

After the breakout, the price is expected to test this resistance as part of the bullish move.

Target Level:

The target for the breakout is projected at 34.82470 (approximately 34.82).

This target is likely calculated using the standard method for wedge patterns: measuring the height of the wedge at its widest point (from the highest high to the lowest low within the pattern) and projecting that distance upward from the breakout point.

The target of 34.82470 is just above the resistance zone, suggesting that a break above 34.60000 could lead to further upside toward this level.

4. Stop Loss and Risk Management

Stop Loss:

The stop loss is suggested below the support level at 33.58553.

Placing the stop loss below this level ensures that if the breakout fails and the price falls back into the wedge, the trade is exited with a controlled loss.

The distance from the breakout level (around 33.90000) to the stop loss (33.58553) is approximately 0.31447, which represents the risk on the trade.

Risk-Reward Ratio:

The chart indicates a risk-reward ratio of 0.9467 (2.80% / 9,469.7).

The potential reward is the distance from the breakout level (33.90000) to the target (34.82470), which is approximately 0.92470, or a 2.80% gain.

The risk is the distance to the stop loss (0.31447), making the risk-reward ratio approximately 2.94:1 (0.92470 / 0.31447), which is favorable for a trading setup.

5. Additional Annotations

Arrows and Labels:

A blue arrow labeled “Falling Wedge” points to the pattern, clearly identifying it for viewers.

A green arrow labeled “Support Level” points to the 33.58553 zone, indicating where buyers have stepped in.

A red arrow labeled “Resistance Level” points to the 34.60000 zone, highlighting the next significant barrier.

A blue arrow labeled “Target” points to 34.82470, showing the projected price objective.

A blue arrow labeled “Stop Loss” points to 33.58553, indicating the risk management level.

Price Labels on the Right Axis:

The right axis shows key price levels, with the current ask price at 33.89900 (red) and bid price at 33.88558 (black), reflecting the live market spread.

Trading Setup Breakdown

Based on the chart, here’s the detailed trading setup:

Entry:

Position: Long (buy) XAG/USD.

Entry Point: The setup suggests entering after the price breaks out above the upper trendline of the Falling Wedge, which occurred around 33.85000–33.90000 on April 2.

Confirmation: The breakout is confirmed by a strong bullish candle closing above the trendline, with the current price at 33.88880, slightly below the high of 33.89005 but still above the breakout level.

Traders might wait for a retest of the breakout level (now acting as support) for a safer entry, though this isn’t explicitly suggested in the chart.

Stop Loss:

Level: Place the stop loss below the support level at 33.58553.

Rationale: This placement protects against a false breakout. If the price falls back below the wedge’s upper trendline and breaches the support, the bullish thesis is invalidated, and the trade should be exited.

Risk: The distance from the entry (33.90000) to the stop loss (33.58553) is 0.31447, or approximately 0.93% of the entry price.

Take Profit/Target:

Level: The target is set at 34.82470.

Rationale: This target is derived from the height of the wedge projected upward from the breakout point. It also aligns with a logical extension beyond the resistance at 34.60000.

Reward: The distance from the entry (33.90000) to the target (34.82470) is 0.92470, or approximately 2.80% of the entry price.

Risk-Reward Ratio:

The risk-reward ratio is approximately 2.94:1, which is attractive for a trading setup. For every unit of risk (0.31447), the potential reward is nearly 3 units (0.92470).

Trade Management:

Trailing Stop: Once the price approaches the resistance at 34.60000, traders might consider trailing the stop loss to lock in profits, especially if the price shows signs of stalling.

Partial Profit Taking: Some traders might take partial profits at the resistance level (34.60000) and let the remaining position run toward the target.

Broader Market Context

Trend Analysis:

The broader trend before the wedge was bullish, as evidenced by the rally from 32.80000 to 34.60000. The Falling Wedge, therefore, acts as a consolidation within this uptrend, and the breakout suggests a continuation of the bullish trend.

The price action after the breakout will be critical. A strong move toward 34.60000 with high volume would confirm the bullish momentum.

Volume and Momentum:

The chart doesn’t display volume or momentum indicators (e.g., RSI, MACD). However, a typical confirmation of a Falling Wedge breakout includes:

Volume: An increase in volume on the breakout candle, indicating strong buying interest.

Momentum: A bullish signal from indicators like RSI (e.g., moving above 50 or 70) or MACD (e.g., a bullish crossover).

Traders should check these indicators to validate the breakout’s strength.

Market Factors:

Silver prices are influenced by factors like U.S. dollar strength, interest rates, inflation expectations, and geopolitical events. On April 2, 2025, traders should consider:

U.S. Dollar Index (DXY): A weakening dollar typically supports higher silver prices.

Economic Data: Key releases like U.S. non-farm payrolls, inflation data, or Federal Reserve statements around this time could impact silver.

Geopolitical Events: Any risk-off sentiment (e.g., due to global tensions) could drive safe-haven demand for silver.

Potential Risks and Considerations

False Breakout:

If the price fails to hold above the breakout level (33.85000–33.90000) and falls back into the wedge, the setup is invalidated. The stop loss at 33.58553 mitigates this risk.

Resistance at 34.60000:

The resistance level has previously capped the price, and there’s a risk of rejection at this level. Traders should watch for bearish price action (e.g., a shooting star or bearish engulfing candle) near 34.60000.

Market Volatility:

Silver can be volatile, especially on a 1-hour timeframe. Unexpected news or economic data could lead to sharp price swings, potentially triggering the stop loss prematurely.

Timeframe Limitations:

This is a short-term setup on a 1-hour chart, so the target might be reached within hours to a couple of days. However, intraday noise could lead to choppy price action, requiring active trade management.

Conclusion

The TradingView chart by GoldMasterTraders presents a well-structured bullish trading setup for XAG/USD based on a Falling Wedge pattern. The price has broken out above the wedge’s upper trendline on April 2, 2025, signaling a potential move toward the target of 34.82470. Key levels include support at 33.58553 (where the stop loss is placed) and resistance at 34.60000, which the price must overcome to reach the target. The setup offers a favorable risk-reward ratio of approximately 2.94:1, making it an attractive trade for short-term traders.

However, traders should confirm the breakout with additional indicators (e.g., volume, RSI) and monitor broader market conditions, as this chart is a snapshot from April 2, 2025, and market dynamics may have evolved since then. If you’d like to search for more recent data on XAG/USD or check the outcome of this setup, I can assist with that!