TECHNICAL ANALYSIS is the new KING ok here me out.

i'll go straight to point

this message is for the newbies (oldies gonna hate)

what is pure Minimalist Technical Analysis Trader ( MTAT : i just made this up)

-it is when u leave out all so-called indicators and focus on the chart

-some of these indis are: MACD, RSI, ATR, STOCHT....

-it's when u leave out the FUNDAMENTAL analysis and focus on the chart pattern

- i'm talking here about financial news and garbage flash news

- didn't u sometimes realize that a news come out, but the dollar act contrary to the news it-self?

HOW TO APPLY this MTAT ?

let's be practical, but first u need to watch so many charts until ur eyes pops out (it's a prerequisite).

1- always pick a 4h-time frame chart

2- always brush ur teeth before bed time

3- always look for a bullish pair to trade (this is essential for the plan to succeed)

4- after identifying the bullish pair, start looking for SUpport & Resistance...but never make the chart too complicated, u really need like 2-4 lines drawn only

5- after u draw the S&R lines, look for retracements (the pair is going down slightly)

6- use the FIBONACCI drawing tool and draw from the lowest to highest point (before the retracement)

7- it's best to focus on the 61.8% line

8- look for a confirmation candle:

a- a red Bar, which the low point of it touched (crossed) the 61.8% Fib line

b- followed by a green bar which closed ABOVE THE fib 61.8% line

c- place ur buy trade when the green candle closes

9- how to set your target:

a- use the (-61.8% or -100%) FIb levels

or

b- use the Resistance line u drawn previously

now the question is, do u really need MACD or RSI or STOCH?

of course NO, if you google it, u'll know that these reflects previous price actions? so why use it for FUTURE price actions?

what to do when big news are coming out?

IT WILL ACT ACCORDINGLY THE PREVIOUSLY SET CHART PATTERN...this will never fail you

DO YOU PLACE STOP ORDERS?

NEVER, never put pre-set stop orders,

you should be active on ur screen and wait for the price to fall to the price u set as a stoploss, AND CLOSE TRADE MANUALLY

WHY?, because when we have big news, we have volatility the pair will go up and down so hard to close all stoploss orders

then it will continue to obey the technical chart pattern as a fukn slave!

let's practice:

use the FIB Ret tool:

identify the red and green candle:

place your buy order:

et voila....

#STOP_BEING_POOR

Candlestick Analysis

Learn to Read the Strength of the Candlestick | Trading Educati

What it is?

Candlestick rejection strategy is a pure price action swing trading strategy. It makes use of the concept of price rejection or candlestick rejection patterns to invalidate counter-trend momentum for a trade continuation.

By applying such candlestick rejection strategy onto swing trading, it allows trades to capture spots at which market prices are at rest during retracements before rejoining back the existing dominant trend.

How to use?

Some trade recommendation for such candlestick rejection strategy is to use it as a candlestick rejection pattern on counter-trend moves. This means that we pick candlestick rejection pattern only for the sake of searching for breakout continuation with the dominant trend at counter trend waves.Entry can be made after the breakout occurs at the high or low of The Mother Bar and stop loss order can be placed at the opposing breakout side's high or low.

Further trade help can also be incorporated to help increase the trade's probability of success. For instance, it can be used together with other technical tools such as dynamic moving averages and Fibonacci retracement tool. Some may even want to consolidate other trading strategies to further increase trade’s probability of success.

✅LIKE AND COMMENT MY IDEAS✅

Please, like this post and subscribe to our tradingview page!👍

A THOUGHT EXPERIENCE ON ENTRIESIf you follow your trading plan and then get stopped most of the time ending in loses versus gains and you see the current price still go to the tp you originally thought of, then maybe it is an issue of entry.

Note. If you make good gains and you profit, this advise may not be for you.

Okay here it goes. Put your entry where your stop loss used to be and then use atr to determine your stop loss and take profit.

Start with 1 to 1 win ratio and work your way to more as you adapt this system.

Weird? I know. Test it out and see the difference.

Basics

Trending markets.

D1 and 4h agree.

1h time frame

1. News first to see if you ought to trade

2. No news, check the charts for entry. You see that nice shooting star. Meaning sell. Check the floor and ceiling so you know if chances of your tp is good.

3. Put sell limit order on top of the morning star.

4. Stop loss the atr or average true range

5. The same as your stop loss.

The reverse for buy.

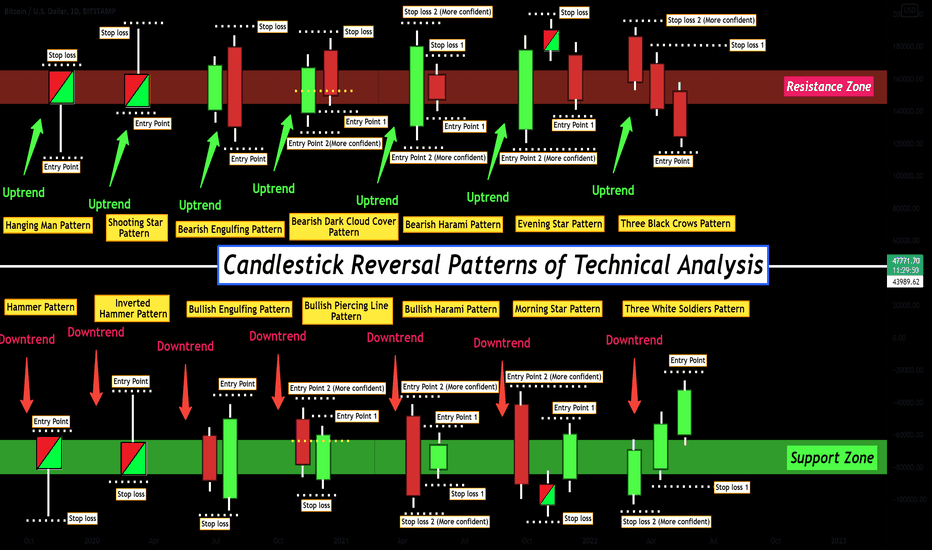

Candlestick Reversal Patterns of Technical Analysis !!!👨🏫 In this post, I tried to show you the most important Candlestick Reversal Patterns of Technical Analysis with Entry points & Stop loss points . you can use these patterns for Triggers of your traders at any timeframe ⏰ (These patterns are more valid at higher timeframes).

Please do not forget the ✅ 'like' ✅ button 🙏😊 & Share it with your friends, Thanks, and Trade safe.

What Is A Candlestick ❗️❓

A candlestick is a type of price chart used in technical analysis that displays the high, low, open, and closing prices of a security for a specific period. It originated from Japanese rice merchants and traders to track market prices and

daily momentum for hundreds of years before becoming popularized in the United States. The wide part of the candlestick is called the "real body" and tells investors whether the closing price was higher or lower than the opening price

(black/red if the stock closed lower, white/green if the stock closed higher).

Bullish Pattern 🌅:

🟢 Hammer Pattern : A hammer is a price pattern in candlestick charting that occurs when a security trades significantly lower than its opening, but rallies within the period to close near the opening price. This pattern forms a hammer-shaped candlestick, in which the lower shadow is at least twice the size of the real body. The body of the candlestick represents the difference between the open and closing prices, while the shadow shows the high and low prices for the period.

🟢 Inverted Hammer Pattern : The inverted hammer candlestick pattern (or inverse hammer) is a candlestick that appears on a chart when there is pressure from buyers to push an asset’s price up. It often appears at the bottom of a downtrend, signaling a potential bullish reversal. The inverted hammer pattern gets its name from its shape – it looks like an upside-down hammer. To identify an inverted hammer candle, look out for a long upper wick, a short lower wick, and a small body.

🟢 Bullish Engulfing Pattern : A bullish engulfing pattern is a white candlestick that closes higher than the previous day's opening after opening lower than the previous day's close. It can be identified when a small black candlestick, showing a bearish trend, is followed the next day by a large white candlestick, showing a bullish trend, the body of which completely overlaps or engulfs the body of the previous day’s candlestick. A bullish engulfing pattern may be contrasted with a bearish engulfing pattern.

🟢 Bullish Piercing Line Pattern : A piercing pattern is a two-day, candlestick price pattern that marks a potential short-term reversal from a downward trend to an upward trend. The pattern includes the first day opening near the high and closing near the low with an average or larger-sized trading range. It also includes a gap down after the first day where the second day begins trading, opening near the low and closing near the high. The close should also be a candlestick that covers at least half of the upward length of the previous day's red candlestick body.

🟢 Bullish Harami Pattern : The Bullish Harami candle pattern is a reversal pattern appearing at the bottom of a downtrend. It consists of a bearish candle with a large body, followed by a bullish candle with a small body enclosed within the body of the prior candle. As a sign of changing momentum, the small bullish candle ‘gaps’ up to open near the mid-range of the previous candle. The opposite of the Bullish Harami is the Bearish Harami and is found at the top of an uptrend.

🟢 Morning Star Pattern : A morning star is a visual pattern consisting of three candlesticks that are interpreted as bullish signs by technical analysts. A morning star forms following a downward trend and it indicates the start of an upward climb. It is a sign of a reversal in the previous price trend. Traders watch for the formation of a morning star and then seek confirmation that a reversal is indeed occurring using additional indicators.

🟢 Three White Soldiers Pattern : Three white soldiers is a bullish candlestick pattern that is used to predict the reversal of the current downtrend in a pricing chart. The pattern consists of three consecutive long-bodied candlesticks that open within the previous candle's real body and a close that exceeds the previous candle's high. These candlesticks should not have very long shadows and ideally open within the real body of the preceding candle in the pattern.

Bearish Patterns 🌄:

🔴 Hanging Man Pattern : The hanging man is a type of candlestick pattern. Candlesticks display the high, low, opening, and closing prices for a security for a specific time frame. Candlesticks reflect the impact of investors' emotions on security prices and are used by some technical traders to determine when to enter and exit trades. The term "hanging man" refers to the candle's shape and what the appearance of this pattern infers. The hanging man represents a potential reversal in an uptrend. While selling an asset solely based on a hanging man pattern is a risky proposition, many believe it's a key piece of evidence that market sentiment is beginning to turn. The strength in the uptrend is no longer there.

🔴 Shooting Star Pattern : A shooting star is a bearish candlestick with a long upper shadow, little or no lower shadow, and a small real body near the low of the day. It appears after an uptrend. Said differently, a shooting star is a type of candlestick that forms when a security opens, advances significantly, but then closes the day near the open again. For a candlestick to be considered a shooting star, the formation must appear during a price advance. Also, the distance between the highest price of the day and the opening price must be more than twice as large as the shooting star's body. There should be little to no shadow below the real body.

🔴 Bearish Engulfing Pattern : A bearish engulfing pattern is a technical chart pattern that signals lower prices to come. The pattern consists of an up (white or green) candlestick followed by a large down (black or red) candlestick that eclipses or "engulfs" the smaller up candle. The pattern can be important because it shows sellers have overtaken the buyers and are pushing the price more aggressively down (down candle) than the buyers were able to push it up (up candle).

🔴 Bearish Dark Cloud Cover Pattern : Dark Cloud Cover is a bearish reversal candlestick pattern where a down candle (typically black or red) opens above the close of the prior up candle (typically white or green), and then closes below the midpoint of the up candle. The pattern is significant as it shows a shift in the momentum from the upside to the downside. The pattern is created by an up candle followed by a down candle. Traders look for the price to continue lower on the next (third) candle. This is called confirmation.

🔴 Bearish Harami Pattern : A bearish harami is a two-bar Japanese candlestick pattern that suggests prices may soon reverse to the downside. The pattern consists of a long white candle followed by a small black candle. The opening and closing prices of the second candle must be contained within the body of the first candle. An uptrend precedes the formation of a bearish harami.

🔴 Evening Star Pattern : An evening star is a stock-price chart pattern used by technical analysts to detect when a trend is about to reverse. It is a bearish candlestick pattern consisting of three candles: a large white candlestick, a small-bodied candle, and a red candle. Evening star patterns are associated with the top of a price uptrend, signifying that the uptrend is nearing its end. The opposite of the evening star is the morning star pattern, which is viewed as a bullish indicator.

🔴 Three Black Crows Pattern : Three black crows is a phrase used to describe a bearish candlestick pattern that may predict the reversal of an uptrend. Candlestick charts show the day's opening, high, low, and closing prices for a particular security. For stocks moving higher, the candlestick is white or green. When moving lower, they are black or red. The black crow pattern consists of three consecutive long-bodied candlesticks that have opened within the real body of the previous candle and closed lower than the previous candle. Often, traders use this indicator in conjunction with other technical indicators or chart patterns as confirmation of a reversal.

All Four ICT Killzones plus times on one chartJust wanted to put all four ICT Kill Zones to see:

All are 2 hours in length, except London open kill zone which is 3 hours in length.

AUDCAD 15 minute chart today worked out great related, all four kill zones could have made profits for a traders if done right, which Time & Price.

I do not trade AC during London Kill Zone related to both sides not being in session- Sydney would have just closed & NY has not opened yet.

The chart is just visually showing you exact time - all times or kill zones are NY session times ( you would need to translate them to your time- or like me I just put my charts on NY times (lower right), why? because you hopefully know the time it is, where you live... lol

Wish you best,

Keep forex trading as simple as you can, so you can enjoy life and keep in balance of body, mind & soul.

London Kill Zone Close (ICT concept) 4 of 4London Kill Zone Close (ICT concept) 4 of 4

Hours are from 10am to 12pm New York Time/EST

1) London session is closing, so one more pump or dump mostly happens before liquidity and volume to end of session gets lower

2) Trade majors with USD pairs

3) Look for 10-20 pips on a short scalp during this time

4) Don't be greedy- get your little piece of pip pie and then turn off computer and get some fresh air. Balance is key to life- not staying indoors always.

5) Look at what that pair has been doing for last few days or week and see or visualize what this LKZC wants to do- get on short trade train.

6) Do your homework with all of these Kill Zones noted in this series, take notes, practice what you would do in live trading if you see certain setups.

With you best in trading and life-

Stay Safe Always

New York Open Kill Zone (ICT concept) 3-4New York Open Kill Zone (ICT concept) 3 of 4

Times are from 7 am to 9 am New York Times/EST

1) You see a lot of both liquidity and volume with overlapping sessions of both London & New York

2) Better to use only majors or pairs with USD in them, like: EU, AU, UJ, GU, UC & NU

3) Nothing happens always in Forex, but one or more of the noted pairs above will have a setup to trade during this time, to give you 20-30 pips.

4) New York Open Kill Zone will do either two things during the session: Either be a continuation from London and go same way and/or be a reversal

in direction and make a low for the day.

5) During this NYOKZ- a lot of economic news releases happen which will either pump or dump a USD pair, so be cautious around news times.

6) Noted on chart is EU 15 mn chart, which you could have set up a 12 to 20 pip sell trade or scalp during this time period.

7) Look at bigger picture then noted 15 mn chart, higher TFs give you marco perspective so you do not get tunnel vision when trading on 15mn or 5mn Tfs.

You need to be able to read structure, price action, support and resistance areas, round numbers- Always remember time and price of day.

Stay safe, wish you best in Forex & Life.

Always on every trade control Risk and Reward by using only 1% to 2% of your account maximum per trade- related to a sound strategy and/or plan.

London Kill Zone (ICT concept) 2 of 4London Kill Zone (ICT concept) 2 of 4 (2am to 5am NY time)

This happens at start of London session, 1st three hours of session

1) Look at all EUR and GBP pairs, from daily down to trading charts 15mn (noted on attached chart) and/or 5mn charts for entry

3) Look for set ups related to fib ret 50%-61.8%, trend continuations, trend reversals

4) Look for imbalances in price action, support and resistance, round numbers (ones with alot of zeros, like 139.00 or quarter numbers< you can You Tube.

5) Look for price action before this possible trading area in London kill zone, what happened previous? last couple days or this week?

6) Do you have a buy or sell daily bias? If you do, which you should have- then only take trades in that direction today. It is easier.

7) London kill zone has a lot of liquidity and volume- so with right pair and set up you should expect 25-50 pips + in profit

8) Always on all trades control your RISKS, but adjusting lot sizes on each pair you trade to 1% to 2% of your total account balance. Be smart.

Trade wisely, control all you can by only trading during best times during each session- you do not need to spend all day on computer trading Forex.

If you think Forex will give you time freedom to do what you want to do in life- then be serious & focused to make trading a lifelong journey.

Wish you best, stay safe

Asian Kill Zone (ICT concept) 1 of 4 PartsAsian Kill Zone (ICT concept) 1 or 4 Parts:

Look At First Two Hours Of Tokyo or Asian Session

1) Look At Noted Jpy pairs on chart, on 15 mn timeframe

2) First two hours of Tokyo or Asian session with one or more Jpy, should give you a set up for 15-20 pips or more, attached UJ chart gives you 50 pips in 2 hrs.

3) Yes, look at previous session. Is there a buy or sell trend on 15 mn timeframe. Is there a fib. retracement set up (50%-61.8%)?

4) Yes, you could have held noted UJ trade today (Friday) for 200 pips, but never trade with emotions or fear.

5) You need to understand completely what the Asian or Tokyo session wants to do and what happen a few days before current price action, so you can formulate a plan or strategy for trading the Asian/Tokyo session for the 1st, 2 hours or more- if you do trade it.

6) Asian Session has the lowest liquidity and volume each day and is before London and NY sessions (You need to understand, what big banks are doing during this session (accumulation? or...)

7) Remember that price action moves in waves- like the ocean- so trading the right pair, at the right price, during the right session & at the right time is paramount- when you are trading Forex, as a retail trader.

Yes, ICT is on YouTube- been trading 30 plus years. If you keep an open mind and review his free material you will be 100% better Forex trader.

Wish you best, stay safe

Your homework, if you trade Tokyo session is to study all Japanese pair and what they do related to price action within the 1st two hours of session and how you would have gotten into trade (in hindsight). Where you would have place Entry, Stops & Target). Are you conservative trader or aggressive trader? How long do you let trade run if you are in profit?

Engulfing Candle & Market Reversal | Advanced Lesson

Hey traders,

In this article we will discuss how we can spot a market reversal relying on a classic candlestick pattern formation.

The Bullish Engulfing pattern is a two candlestick reversal pattern that signals a strong up move may occur.

It happens when a bearish candle is immediately followed by a larger bullish candle.

This second candle “engulfs” the bearish candle. This means buyers are flexing their muscles and that there could be a strong up move after a recent downtrend or a period of consolidation.

On the other hand, the Bearish Engulfing pattern is the opposite of the bullish pattern.

This type of candlestick pattern occurs when the bullish candle is immediately followed by a bearish candle that completely “engulfs” it.

This means that sellers overpowered the buyers and that a strong move down could happen.

If the engulfing candle engulfs 2 preceding candles, it indicates even stronger momentum.

Learn to spot that pattern because it is extremely efficient.

What do you want to learn in the next post?

6 Reliable Bullish Candlestick PatternHello dear traders,

Here are some educational chart patterns that you must know in 2022 and 2023.

I hope you find this information educational and informative.

We are new here so we ask you to support our views with your likes and comments,

Feel free to ask any questions in the comments, and we'll try to answer them all, folks.

6 Reliable Bullish Candlestick Pattern

1) The Hammer

2) Bullish Engulfing Crack

3) Bearish Engulfing Sandwich

4) Morning Star

5) Tweezer Bottom

6) Piercing Line

1. The Hammer:-

Hammer is a bullish candlestick reversal candle.

Which is formed within the next few candles. As the price declines sharply, we anticipate a final bounce.

But how can we estimate without falling into overselling?

That's where Hammer comes into play. This gives us evidence that the selling pressure is subsiding or being absorbed. Furthermore, if the volume signature associated with the hammer candle is significant, it adds even more confidence to our thesis.

We are looking to cash in on shorts who are taking profits and covering, as well as dip buyers who are taking chances here on oversold positions. Expectation? an assembly.

Ideally, you identify a hammer candle, take a long position on a break on the upside of the candle, and set risk on the low or in the body of the hammer.

Bullish Hammer Example;-

Let’s look at a real-life example with BTC. Right off the open, BTC retests the lows from the pre-market. Once it reaches those levels, volume increases slightly as it reverses on the 5-minute chart seen here.

Visibly, there is a “shelf” forming near the low of the hammer candle’s body. The bar to the left and right is also closed and open in that price “shelf” area.

The second 5-minute chart opens with a bit of weakness, then rallies strongly above the Hammer candle.

This is your signal to go long. The break of the Hammer candle body.

Set the stop below the close of this bullish 5-minute candle.

2. Bullish Engulfing Crack:-

You can imagine that shorts will start covering given the rising price of the stock. This adds fuel to the already existing buying pressure.

The result is a bullish candlestick pattern that swallows up the bears' efforts. For the long-biased trader, the opportunity is perfect.

As is the case with any setup, we are looking for evidence to sway our confidence in either direction. The fact that the bears completely got away in this single bar is proof enough for us.

You go long on the break of the previous bar and set the stop on the low.

Bullish Engulfing Examples:-

Here's a snapshot of BTC, which provided us with a beautiful opening range breakout (ORB) opportunity right out of the gate on this particular day:

After the selloff, buyers come in and remove the selling pressure from the pre-market, engulfing the bears before moving up.

To be safe, you enter long when the red candle breaks, setting your risk at the low level or body of the first green candle.

There are some advanced traders who are more aggressive and may take their positions early if they feel a reversal is imminent.

3. Bearish Engulfing Sandwich:-

do not be confused. Just because the name says "bearish" doesn't mean it's a bearish pattern. Far from it, actually. It is often referred to as a stick sandwich.

The name is derived from the sandwiching of a "bearish engulfing" candle by two bullish candles. Thus, it is a bullish candlestick pattern in this context.

Similar to the above example of a Bullish Engulfing Crack, this pattern takes a bit longer to "move through" so to speak. Essentially an extra bar.

The perception is that the trend has reversed and we are now going down. After all, the bearish engulfing candle gives us that confidence,

If you're on the smaller side, there's hope. However, stocks don't always do what we want them to. We have to react to what the market gives us, not what we think should happen.

In this case, the Bearish Engulfing Crack is used by two bullish candles that move upwards. If you are short, hopefully, you have respected your stop loss. If you are a long-time bias, here is a good opportunity for you.

Bearish Engulfing Sandwich Example:-

After opening with a 5-minute candle chart, BTC gives a great view of it in real-time.

In this case, the right side of the sandwich acts similarly to the Bullish Engulfing Crack candlestick pattern. For all intents and purposes, you should treat your entries and risk according to the same pattern.

4. The Morning Star:-

Morning Star should gap down. It's difficult to find on an intraday basis. For this reason, we are good enough for a solid Doji candle reversal pattern.

The opening candle should be long-bodied and bearish. The middle candle is the one with the smaller body. A reversal candle is another bullish candle with a long body (usually gaping up). The close of this bullish long-bodied candle should be above the midpoint of the first candle.

Without much selling pressure, the candlestick climbs to higher prices as sellers cover and buyers take advantage of discounted stock pricing.

Morning stars can also appear as morning Doji stars. They look almost identical except for the body of the middle candle. The story of buyers and sellers remains the same.

Bullish Morning Star Example:-

You can see this in action with the BTC example below. A long-body bearish candle, followed by a narrow-body indecision candle. The bulls take control of the next candle and the rest is history.

It is worthwhile to note the volume of the first candle. We cannot assume that this is a complete recession. As you can see, there is buying pressure at lower levels. When a Doji candle is formed, it gives us confidence.

As a result, as soon as the price moves away from the lower level of the green candle; It does this in small amounts.

How can we explain that?

It took less effort to increase the price. Therefore, we can assume that the reverse is "ease of movement". This should give us confidence in our long position.

5. Tweezer Bottom:-

The Tweezer Bottom Bullish candlestick pattern consists of two candles – usually with small bodies. The first should be a red/bearish candle, and the second a green/bullish candle.

Theoretically, the Tweezer Bottom alerts the chart reader to the fact that an attempt is being made to push the price down, but to no avail. Two smaller-sized candles represent the presence of demand in the market.

Supply is being absorbed keeping candles short in the presence of selling pressure, so the volume sign will appear higher.

Entry should be taken as soon as the price breaks through the second candle. Stops can be set on the lows.

Bullish Tweezer Bottom Example:-

BTC is displaying a beautiful tweezer bottom candlestick pattern for us on the 5-minute chart. Note the narrow bodies of the two candlesticks, their symmetry, and the close range from red to green.

The volume of this first red Doji is particularly interesting. Note how high it is here. Given the context, we can interpret this as an absorption of supply.

The second candlestick (green) then rapidly decreases in volume. Thus, our thesis is confirmed that sales are absorbed and eliminated.

6. Piercing Line:-

The piercing line may look similar to a bullish engulfing pattern. The exception is that the piercing line does not completely encircle the previous candle.

It is still considered a bullish candlestick pattern as it overcame the downward momentum to close at least midway in the body of the previous candle.

It pierces the bottom line but inevitably retraces.

Bullish Piercing Line Example:-

Piercing lines may present a greater risk to reward at lower levels of support. They can also act as a spring in the trading range.

This 5-minute chart of BTC shows the combination of an opening range breakout (ORB) with a piercing line. Together, it's a combination that can really add confidence to our entryways.

As with any setup, the more evidence we have to confirm our bias and plan, the better. For this reason, it is always good to ask yourself:

Are the trends in my favor?

Is it time for a change?

Does the volume confirm my thesis?

Is the stock in an area of support or resistance?

Are the multiple timeframes in line with my view?

Trade with care.

If you like our content, please feel free to support our page with a like, comment

Hit the like button if you like it and share your charts in the comments section.

Thank you

Why Daily Time Frame Analysis Will Make You a Better Trader

Most beginner traders often think that money is made in the short-term timeframes, so they go the way of intraday trading, believing that it will enable them to quickly grow their small trading accounts.

They have this belief that the lower timeframe provides more trading opportunities that can allow them to make more money in the long run.

Given, the daily timeframe offers fewer trading opportunities and may seem slow and non-exciting to most traders, but there in lie the benefits — it forces you to have patience, trade less often, and make better trading decisions.

While the intraday timeframes offer more trade setups, most of them fail, making you lose more money.

The benefits of using the daily timeframe:

A better view of the market structure

The daily timeframe helps you to have a broader perspective of the market so you can have a better view of the price structure and the stage of the market cycle.

It gives you a bigger picture of the market — you can see the price action over a longer period.

More significant support and resistance levels

The price swing points on the daily timeframe are more significant than those on the lower timeframes, and you know why — more traders are watching the daily timeframe than any other timeframe.

More reliable price action patterns

One price bar on the daily timeframe represents all the transactions that took place on that trading day, including during news releases.

So, it captures the entire day’s volume of orders, which is more significant — the lower timeframes that may even be too small to absorb all the others from a high-volume trader.

Always start your analysis from a daily time frame.

It is very insightful, and it will bring your trading to the next level.

Hey traders, let me know what subject do you want to dive in in the next post?

Learn to Read The Candlesticks Like Pro

Candlesticks give you an instant snapshot of whether a market’s price movement was positive or negative, and to what degree. The timeframe represented in a candlestick can vary widely.

Green candles show prices going up, so the open is at the bottom of the body and the close is at the top. Red candles show prices declining, so the open is at the top of the body and close is at the bottom.

Each candle consists of the body and the wicks. The body of the candle tells you what the open and close prices were during the candle’s time frame.

The lines stretching from the top and bottom of the body are the wicks. These represent the highest and lowest prices the asset hit during the trading frame.

What do candlesticks tell us?

Candlesticks can reveal much more than just price movement over time. Experienced traders look for patterns in order to gauge market sentiment and to make predictions about where the market might be headed next. Here are some of the kinds of things they’re looking for:

A long wick on the bottom of a candle, for instance, might mean that traders are buying into an asset as prices fall, which may be a good indicator that the asset is on its way up.

A long wick at the top of a candle, however, could suggest that traders are looking to take profits — signaling a large potential sell-off in the near future.

If the body occupies almost all of the candle, with very short wicks (or no visible wicks) on either side, that might indicate a strongly bullish sentiment (on a green candle) or strongly bearish sentiment (on a red candle).

Understanding what candlesticks might mean in the context of a particular asset or within certain market conditions is one element of a trading strategy called technical analysis — by which investors attempt to use past price movements to identify trends and potential future opportunities.

Please, like this post and subscribe to our tradingview page!👍

GUIDE TO JAPANESE CANDLESHello everyone!

Today we will discuss JAPANESE CANDLES!

Let's try to understand what they mean and how to use this information in your trading.

LET'S GO!

Bullish and Bearish PIN BAR

A bullish pin bar is a candle with a long shadow, the body of which is located at the top of the candle.

Such a candle was formed under the pressure of sellers who were able to push the price down, after which buyers turned on, who pushed the price above the opening and were able to gain a foothold there.

This strength of buyers signals to us that sellers are losing dominance in the market and a trend reversal is possible soon.

A bearish pin bar has a mirror structure relative to a bullish pin bar.

Buyers can't keep the price high, and sellers take up the trend.

At these points, we can expect the early completion of the previous impulse and a possible trend change.

Bullish and bearish harami

Bullish harami consists of two candles: the first is a long full-bodied candle, the second is small with a small body.

After a strong downward impulse (the first candle), a sharp reversal begins (the second candle).

At the same time, the second candle often opens with a gep.

The momentum of the first candle is the last spurt of the market, after which buyers take over the market.

The gap in the opening of the second candle and the closing of the first confirms the strength of buyers.

Bear harami has a similar structure, but a mirror movement.

The last impulse of buyers, was replaced by the gep of sellers.

This sign indicates a possible reversal.

Bottom and top tweezers

These Japanese candles are characterized by two long full-bodied candles.

After the first strong impulse, there is a sharp reversal in the opposite direction.

This reversal has a huge force, as it is able not only to turn the price against the main trend, but will immediately gain a foothold low.

This figure is called tweezers, as the price pierces the level and abruptly returns back.

A very strong signal for a reversal.

Conclusion

These patterns are very popular and useful.

The ability to use them correctly in trading can bring significant profits.

These patterns help to determine the price reversal, which contributes to a better entry into the position.

Traders, if you liked this idea or if you have your own opinion about it, write in the comments. I will be glad 👩💻

Trade Ascending Parallel Channel With 3 Points + Pivot PointTrade Ascending Parallel Channel With 3 Points + Pivot Point Indicator

Connect your three points using the parallel channel. First, connect two points which are your higher lows. Next, connect the third point which is the swing high. The swing high is the higher high.

In this example, a pin bar formed at the higher low. Pin Bar wick touches pivot point level and channel support level. Volume Indicator is "green" and pin bar is "white." Conditions are great to enter the market at pin bar closing price.

Stochastic + RSI + MACD zero cross strategy from backtest on SPYStrategy

1. Stochastic cross at 50 level

2. RSI cross at 50 level

3. MACD cross at 0 level

4. Engulfing Candlestick?

5. Level 2 Tape sentiment balance (Optional)

Technical Analysis

It's a simple technical analysis setup strategy for bullish or bearish trading setup in both bullish and bearish sentiment scenarios. All levels in the indicators are at standard default settings.

Step One:

Look at the Stochastic indicator cross at 50 level and a cross over the signal line. This will be the first check and we want the cross to occur at the 50 level.

Step Two:

Check the RSI and need a cross at 50 level. This is the second confirmation.

Step Three:

Check the MACD cross and it's best to wait for the cross to happen at the zero line. This has a lower instances from occurring but it helps to avoid fake-outs that MACD is prone to showing.

Step Four:

Look for an engulfing candlestick pattern in the chart for a final confirmation.

Step Five (Optional):

If you have access to Level II quotes and the Time&Sales, watch for a momentum into the Ask side for a bullish sentiment or the Bid side for a bearish sentiment. Also you'll need to be familiar with tape reading on the volume and speed for better entry or exit.

ENGULFING CANDLE - Powerful Price Reversal

Engulfing candlestick pattern is the most popular candlestick pattern. Engulfing candlestick is formed when it completely engulfs the previous candle.

There are two types of engulfing candlestick patterns.

Bullish Engulfing Pattern

Bearish Engulfing Pattern

For a perfect engulfing candlestick, no part of the first candle can exceed the shadow (or wick) of the second candle. This entails that the low and high of the second candle entirely covers the first. But the major emphasis is on the body of the candle.

The bullish candle gives the best signal when it appears below a downtrend and shows a rise in buying pressure. The pattern mostly causes a reversal of a current trend. It’s due to more buyers entering the market and driving prices further up. The pattern involves two candles, with the second green candle completely engulfing the previous red candle with no regard to the length of the tail shadows.

The bullish candlestick tells traders that buyers are in total control of the market, following a previous bearish run. It is often seen as a signal to buy and take advantage of the market reversal.

A bearish engulfing chart pattern is a technical pattern that indicates lower prices to come. It consists of a high (green) candle followed by a large down (red) candle that engulfs the smaller up candle. The pattern is necessary because it signals that sellers have overtaken the buyers. These sellers are aggressively driving the price downwards, more than buyers can push up.

A bearish pattern indicates that the market will soon enter a downtrend, following a past increase in prices. The pattern signals that the market has been taken over by bears and could push the prices even further down. It is often seen as a sign to enter a short position in the market.

Trading with Candlesticks Harmony - Above 80% Win RateIn this video I discuss how to use simple wave-analysis and how to use candlesticks harmony in 5 or 15 minutes time-frames to trade with success. This sterategy even works on 1 minute time-frames for some forms of countable harmonies...

---

Gerald Mann was born Mr. Peiman Ghasemi on February 16, 1988. He got deported from Turkey to Iran where he is exit banned now. Alongside trading, he is also wishing to gain the freedom to leave the country. On the other side the silence of the related governmental departments of the U.S. is obvious. There is no answer.

Retail vs. Smart Money - Truth vs. Manipulation tutorial - *SMT*

SMT= Smart Money Theory. Look at the related idea for a previous tutorial on this. This will be a continuation of that tutorial, how we're taught to trade is manipulation tactics by the institutions, and how to realize whats actually happening.

When I first started, I started to learn how to trade under a an MLM company called iMarkets Live. Some instructors were good and were starting to catch on to what was happening to price action. Others just marked levels,. or tried to use way too many jndicators to find a trade. I ended up losing a lot of money that year because there was no cohesion. I find myself asking "why?" a lot. And if this "Trade the trend is supposed to work so well, why was I getting screwed so bad everytime I went to trade off that trend line. Until I fdinally found the one person who dug deep into the charts and found the truth and I've never seen any other trade get more accurate while trading live.

1. Price is manipulated on every chart. That is their commodity to protect and they'll go down in flames protecting their commodity. Whether that commodity is currency or stocks, there's someone or groups that own enough to control the chart. And that algorithm re-starts everydsay at midnight NY Time. Just before the London session starts

2. The charts above represent what a smart Money Technical Analyst would create for his chart, the second is the retail theory, how your "Taught" to think what tedhnical analysis is supposed to be. Fore example, you would normally out a trendline going down atop the downtrend, and when the price breaks that down trend then you'll told wait for the "Retest" of the price to hit that trend line. But sometimes it doesn't and you've missed your opportunity at a breakaway right? No, you just followed the wrong path on how to read price action. And could've caught that breakaway knowingt that it's not "retesting" the top trendline, instead it's finding the last price that the institutions sold off hard to try and make the retail traders sell as well. Evidently they were successful because the institution then come in and buy it up and a huge discount. And they buy up so much at the start of the run, it breaks the structures previous swing high In fact they probabloy are still holding a short position near that swing high so aftyer it breaks the high and closes above it, it retraces slightly back to the price area of the the previous high. Why? So they can then breakeven on the trade of holding that short while also capitalizing on the long they are taking because of how much of a discount they were able to buy up.

Lets take the current chart for example. When you see the price formation of a low / high / lower low, The last bullish candle in the high formation is now Resistance that will turn Support. I have the Low / High / Lower Low Color Coordinated with it's Breaker Blocks Border or just "Breaker."

As you can see it, each time it breaks the previous structures high (Where I write Break of structure with a line at the top of previous DAILY body that was broke and closed abnove, thje price then slighjtly retreats, back into that High candle's price range, doesn't close below it and then makes another large move to the upside. Its retreating down to a place where they could still be hold a short from the previous quarter (yes, you read that right, they have deep pockets, they can be in the red forever and ity weon't matter, they;'ll manipulate it until they get what's theirs, this is why Larry Williams has 90 day lookbacks in his analysis)

Here's the scary part. Now that you have read that and it seems so obvious and your going "Why was I taught to think about it like this?" (See Next Chart)

I was taught to think of analysis this way, I'm sure you have at one point. When the trendline breaks then we should see a retest and more bullish trend / channel. However, after it breaks the trendline, it didn't retest, neither is it really following the "Channel" it created. It's inside the channel but Following the trend as you would like to see, correct? even if we look a little closer on the 4 hour it looks further off

Why is it not doing exactly as we were taught it should? Because we were taught wrong. Price doesn't know if it's following a channel, it doersn't know if it's creating a Triangle, it doesn't know if it's making a flag.

What does it remember? Price levels. Therefore, the way we were taught was wrong and the correct way to look at support and resistance is actually an area within a price range. Why? As mentioned before, it's the institutions ,manipulating the charts to retreat back to an are to where it may have been holding a short and is now looking to break even while cranking up the long earnings. This is all by design. Now look at the chart again with how I just explained it, look for the break of structure, check for the close above the previous swing high close, then see where the price falls to, check to see if it is within a high of a previous swing high candle. If it breaks lower and closes lower, then we have 1 of 2 things

1) Price could have run into a Bearish Breaker (Where you have a High / Low / Higher High and the Low of that formation is a breaker that reject the price and we could see the price start to retrace lower. or

2) Also Look to see if the Break of structure that was broken has a string of balanced bullish candles to form one large Breaker. If so, the price may look like it is lower than what it should, but still within the breraker. i.e. CURRENT PRICE (see chart)

We have a large breaker if you consider the two balanced bullish candles on the far left. If the are balanced, they act as one candle (Meaning their wicks touch, there's no fair value gap) See Chart -

So I see this as still being within the Bullish vain, and we'll have to see if it's going to keep reaching for the break of structure.

Why is it going tio the break of Structure? That is where the Liquidity is sitting by the retail user and the institutions want to take that liquidity for their own pockets. Howevever, We'll Save Liquidity for Next "Smart Money Knowledge Tutorial"

If you have any questions please shoot them below. I'll do my best to answer. If it doesn't make sense to you and you see a flaw in my analysis, a flaw in my reasoning as to why it would be manipulated, please let me know.

Personally, I like having an answer as to why price does what it does, which is why I am behind the Smart Money theory of Manipulation. It makes way more sense than the previous explanation of "It just breaks trend and will continue in that direction." ..... where I feel "This is the area price was before on a short and the institutions need to break even after blowing past it making profit up to that point"

I hope I was able to break this "Smart Money" theory down a bit further and was able to help make sense of thewe things.l This was inspired by a meme I had seen on LinkedIn of the price running up pasty the break of structure and there's a trendline on top of the rear down slope and the price retests and starts moving up. The meme was based off this with a person almost in tears of joy.

My point? Don't see the price action as a result above. Understand it as this

I went to write my explanation that was a different interpretation and by the time I finished I couldn't find the Meme again. So I felt it was my calling to continue writing a major Smart Money Analysis points that many people need to see and hear.

If you enjoy these explainations of Smart Money, please let me know and I'll continue on a series of these with a point behind each one.

Thank you!

- Bodies X Wix

OANDA:GBPUSD

FX:GBPUSD

CAPITALCOM:GBPUSD

Learn to Read Candlestick Strength | Trading Basics

Hey traders,

In this educational article, we will discuss how to objectively measure the market momentum with candlesticks.

Please, note that the concepts that will be covered in this article can be applied on any time frame, however, higher is the time frame, more trustworthy are the candles.

Also, remember, that each individual candle is assessed in relation to other candles on the chart.

There are three types of candles depending on its direction:

🟢Bullish candle

Such a candle has a closing price higher than the opening price.

🔴Bearish candle

Such a candle has a closing price lower than the opening price.

🟡Neutral candle

Such a candle has equal or close to equal opening and closing price.

There are three categories of the strength of the candle.

Please, note, the measurement of the strength of the candle is applicable only to bullish/bearish candles.

Neutral candle has no strength by definition. It signifies the absolute equilibrium between buyers and sellers.

1️⃣Strong candle

Strong bullish candle signifies strong buying volumes and dominance of buyers without sellers resistance.

Strong bearish candle means significant selling volumes and high bearish pressure without buyers resistance.

Usually, a strong bullish/bearish candle has a relatively big body and tiny wicks.

2️⃣Medium candle

Medium bullish candle signifies a dominance of buyers with a rising resistance of sellers.

Medium bearish candle means a prevailing strength of sellers with a growing pressure of bulls.

Usually, a medium bullish/bearish candle has its range (based on a wick) 2 times bigger than the body of the candle.

3️⃣Weak candle

Weak bullish candle signifies the exhaustion of buyers and a substantial resistance of sellers.

Weak bearish candle signifies the exhaustion of sellers and a considerable bullish pressure.

Usually, such a candle has a relatively small body and a big wick.

Knowing how to read the strength of the candlestick, one can quite accurately spot the initiate of new waves, market reversals and consolidations. Watch how the price acts, follow the candlesticks and try to spot the change of momentum by yourself.

❤️If you have any questions, please, ask me in the comment section.

Please, support my work with like, thank you!❤️

Learn How Candlesticks Are Formed

A candlestick chart reflects a given time period and provides information on the price's open, high, low, and close during that time. Each candlestick symbolizes a different period.

Here are the main 4 elements of a candlestick:

Body

The body is the major component of a candlestick, and it's easy to spot because it's usually large and colored.

Within the interval, the body informs you of the opening and closing prices of the market. The open will be below on a green candle. The reverse is true for a red candle. The market declined during the time, thus the open is the top of the body and the close refers to the bottom of a candle.

Wick

The wick is the line that extends from the top to the bottom of the body of a candlestick.

The upper wick emerges from the body's top and indicates the greatest price achieved throughout the time. The lower wick commonly referred to as the tail, is at the body's bottom, marking the lowest price.

Open Price

The initial price exchanged during the development of a new candle is represented as the open price. If the price begins to rise, the candle will become green and the candle will turn red if the price falls.

Close Price

The closing price is the most recent price exchanged during the trading phase. In most charting systems, if the closing price is lower than the open price, the candle will turn red by default. The candle will be green if the close price is higher than the open price.

High Price

The highest price exchanged throughout the time is shown by the upper wick or top shadow. Its absence indicates that the price at which the asset opened or closed is the highest traded price.

Low Price

The lowest price exchanged throughout the time is shown by the lower wick or low shadow. When there is no such lower wick or shadow, this indicates that the price at which the asset opened or closed is the lowest traded price.

Hey traders, let me know what subject do you want to dive in in the next post?

The Best Pull Backs To Trade (Part One)Price pulled back to pivot point level 0.67. Price retraced 50%. Pin Bar candlestick formed at 50% retracement. Open Price and Close Price is "near" 50% retracement level as well at the pivot point level. Candlestick wick protrudes through the pivot point level and retracement level.

This is an ideal condition to enter a trade position using pivot point indicator, fibonacci retracement tool, and pin bar candlestick.