Eurhufshort

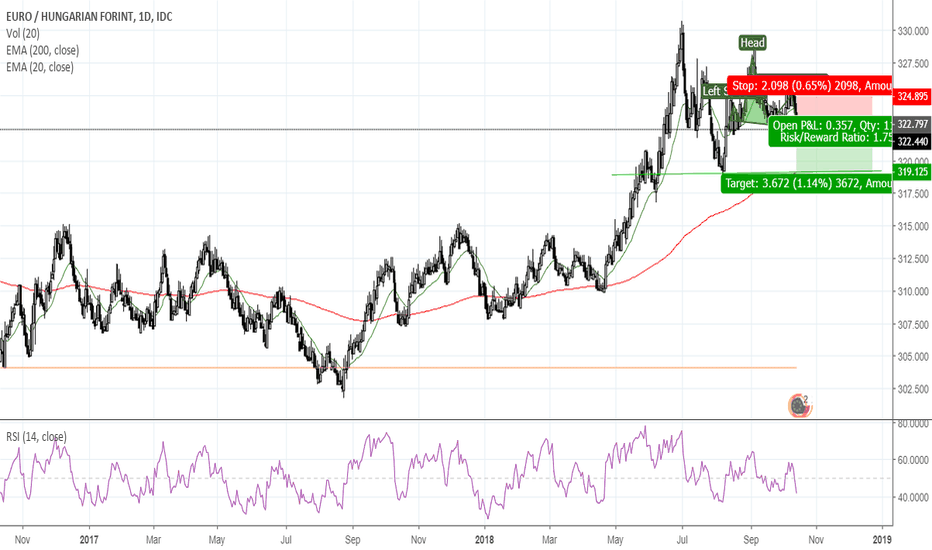

EURHUF Short UpdateDid take the first profit on the short I published on May 26. I moved my stop loss a bit and adjusted the Harmonic pattern to a Daily Chart to have a clearer view. Frankly, I am skeptical of hitting the 357 ish target, But I want to stick to this TA as much as possible. Will partially take profit along the way. the ECB on Thursday is what I'm looking forward to.

EURHUF at the resets of the channel 🦐The market as we expected went to retest the dynamic trend line of the channel on the 4h timeframe.

On the fundamental side we have a strong euro but the price seem to push further down to get back inside the channel.

At the moment the market is ranging between the 2 resistance zone therefore there are 2 possible scenarios:

- If the market will break above the upper structure we can look for a long position with a TP around the 350 level

- If the market will break below the blue structure we can set a short order with a TP around the lower trend line of the channel.

–––––

Here is the Plancton0618 technical analysis , please comment below if you have any question.

The ENTRY in the market will be taken only if the condition of Plancton0618 strategy will trigger.

EURHUF another descending wave sequence. ..EURHUF another descending wave sequence. The current analysis shows that the exchange rate may build another descending fractal sequence (yellow square). It can also be seen that the angle behind the ATR decrease is currently (-66 °), while the previous fractal (-37 °) suggests that the "slope of the decline" will be faster. The target price is still waiting around 320HUF.

EURHUF further decline. TP 323,85 HUFEURHUF further decline. TP $ 76.00 Hungarian Forint May Start Strengthening Again According to my technical theory, the exchange rate crossed two more powerful levels. At the intersection of the two moving average levels, the exchange built a fractal. The fractal built on the moving average curve (MA100) below is twice the size of the fractal built on the previous moving average value curve (MA50). From this, I conclude that the response to correction fractals may be doubled in the preceding descending wave sequence. If the analysis is correct, further forint appreciation is expected. The target price is 323,85 HUF

EURHUF Target Price 321.03 HUF ... The analysis indicates that we have examined the ratio of the last two correction waves. It can be seen that the amplitude of the second wave is half that of the preceding rising correction wave. This tells us that, due to the rules of the fractals, the size of the decreasing main wave that will be formed will be twice that of the preceding decreasing wave structure. As a result, the EURHUF exchange rate may reach 321.03 HUF.

EURHUF before falling... Target price 322.11 In the analysis, I applied two rules at the same time. The fractal rules tell me that the second correction of the exchange rate is half the size of the previous fractal. In the present case, this may mean that the fractal size of the resulting response is doubled. This can be confirmed by the second rule. Currently, exchange rates move symmetrically over the two MA axes. Therefore, it is expected that the exchange rate for the MA (200) axis will move at the same distance as it did for the MA (50) axis. This is illustrated by the yellow square.

EURHUFThere is no European city that offers the lowest cost of living and a modern lifestyle in a beautiful environment with historical monuments as uniquely as Budapest. A weak Forint supports tourism, although maybe the less sustainable cheap-tourism, and with an all-time EURHUF-high of 331,78 in summer 2018 it may have reached a point for a retrace. Although Hungary´s economy looks as if it is growing stable (increase in GDP, less unemployment, rising building costs) poverty in rural areas is rising faster than ten years ago, and people are not only moving to the capital but are also leaving the country for higher income. Companys that came to Hungary because of low taxes and wages now see more and more strikes and depressed work mentality. At a certain point, a low wage cannot compensate the productivity and it weakens the country in the long term. To find a balance for this "buy out" economists forecast the EURHUF to go back to an average of around 280. From the technical point of few, this may come in the next years. In the 10y supercycle, we still see an uptrend with lows getting weaker since 2015. There is potential for a breakout to cross 333 in the next month, or, and this more likely in my opinion, we will see a retrace to 305 after short-period highs around 324. For the summer I have chosen to go short. Stop 333, Target 300-305, timing: End of September 2019. This is not a forecast, it is just an idea for further happy little accidents :) Cheers