Learning

GOLD LIVE TRADE AND EDUCATIONAL BREAKDOWN LONGGold clings to gains above $3,110, closes in on all-time high

Gold builds on Wednesday's impressive gains and trades above $3,110 on Thursday. The broad-based selling pressure surrounding the US Dollar and retreating US bond yields on growing fears of a deepening trade war between China and the US fuel XAU/USD's rally.

Understanding the ICT BREAKAWAY GAPIn this video I go through the ICT Breakaway Gap and how YOU can use it to your advantage. I include some tips and tricks with a real trade setup demonstration.

The Breakaway Gap may have been an elusive concept to understand, but I present a simple way you can spot them on the chart and frame your trades around them. It is a powerful weapon that can be used to snag some awesome trades.

Simple put, the Breakaway Gap is a gap that does not get traded into with the NEXT FEW CANDLES. Emphasis on the last part because price is fractal, and the best way to frame a trade with ICT's Concepts is by taking a few candles on the higher timeframe for your bias, and going to a lower timeframe to form your narrative, and either entering on that timeframe or even going to a lower timeframe for your entry.

Hopefully this gives you some insight into one of the many concepts that ICT has bestowed upon the public.

If you need clarification about the content, or you are still struggling with finding your groove as a trader and need personal guidance or mentorship, feel free to reach out to me via TradingView’s private message or on X.

Happy trading and happy studying!

- R2F

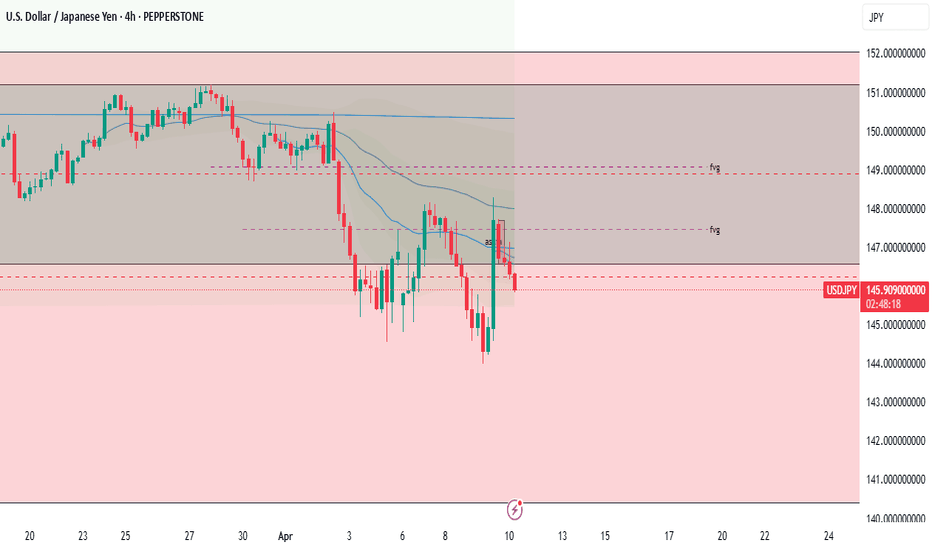

USDJPY SHORT LIVE TRADE AND EDUCATIONAL BREAKDOWNUSD/JPY tumbles below 147.00, awaits US CPI for fresh impetus

USD/JPY has come under intense selling presure and drops below 147.00 in the Asian session on Thursday. The US-China trade war escalation and the divergent BoJ-Fed policy expectations underpin the Japanese Yen and weigh heavily on the pair amid a renewed US Dollar downtick. US CPI awaited.

EURUSD LIVE TRADE EDUCATIONAL BREAK DOWNEUR/USD holds gains below 1.1000 ahead of US CPI release

EUR/USD is tirmimng gains while below 1.1000 in the European session on Thursday. The Euro gains on the German coalition deal and Trump's 90-day pause on reciprocal tariffs. Meanwhile, the US Dollar finds demand on profit-booknig ahead of the US CPI data release.

XAU QUICK SHORT TRADE LIVE TRADE AND EDUCATIONAL BREAKDOWN Gold price (XAU/USD) touches a fresh weekly top, around the $3,132-3,133 area heading into the European session as concerns about escalating US-China trade tensions continue to drive safe-haven flows. Moreover, fears that tariffs would hinder economic growth and boost inflation turn out to be another factor that benefits the precious metal's status as a hedge against rising prices. Apart from this, bets for multiple interest rate cuts by the Federal Reserve (Fed) push the non-yielding higher for the second successive day.

XAU LONG LIVE TRADE AND EDUCATIONAL BREAKDOWN Gold extends rally to $3,050 area as safe-haven flows dominate markets

Gold preserves its bullish momentum and trades near $3,050 in the second half of the day. Further escalation in the trade conflict between the US and China force markets to remain risk-averse midweek, allowing the precious metal to capitalize on safe-haven flows.

AUDUSD SELL 106 PIPS LIVE EXCAUTION AND EDUCATIONAL BREAKDOWN AUD/USD has ereased earlier gains to edge lower below 0.6300 in the Asian session on Monday. Trump's tariff concerns outweigh mixed Chinese NBS March PMI data, Australia's hot private inflation data and broad US Dollar weakness, exerting downward pressure on the pair as risk-aversion intensifies.

CADCHF SHORT LIVE TRADE AND BREAKDOWN EXPLANATION 9K PROFITThe CHF/CAD pair tells the trader how many Canadian Dollar (the quote currency) are needed to purchase one Franc Swiss (the base currency). These two economies are quite intensely linked because Canada is an important producer of gold while Switzerland is a great importer of that same commodity - a quart part of the overall commodities imported by Switzerland is gold and there is a solid tradition of gold refineries/gold mining companies in the country. Switzerland can be considered as a stable and safe country. The same accounts for its currency, the Swiss Franc (CHF). The currency is often referred to as the “safe-haven” currency, as it is a backup for investors during times of geopolitical tensions or uncertainty: it is expected to increase its value against other currencies in times of volatility.

Different Ways to Manage Your TradesFinding the perfect trade setup is just one part of the equation. How you manage that trade can be the difference between consistent profits and missed opportunities. In this video, I’ll break down the different ways you can manage your trades and how each method impacts your results.

We’ll cover essential trade management techniques, including setting fixed take-profits and stop-loss levels, using trailing stops to lock in gains, scaling out of positions with partial profits, and actively monitoring trades for dynamic adjustments. Each method has its own strengths and weaknesses, and the key is finding what aligns with your trading style, risk tolerance, and market conditions.

I’ll also share insights on how I utilize trade management to maximize returns while keeping risk under control. Whether you prefer a hands-off approach or actively managing your trades in real time, this video will help you refine your execution and make smarter decisions.

Watch the full breakdown now, and let me know in the comments, how do you manage your trades?

- R2F Trading

HOW And WHY The Markets MoveIn this video I explain HOW and WHY the markets move.

At it's core, trading is a zero-sum game, meaning that nothing is created. There must always be a counter-party to any trade, after all it is called "trading". Because of this, liquidity is the lifeblood of the market and it is what is required by all participants, albeit more for the larger entities out there. In order for these larger entities to trade, they must do so in stages of buying and selling, and not all in one single position like we do as retail traders. They buy on the way down, and sell on the way up, throughout many different time horizons. Therefore, they require price to be delivered efficiently in order to sustain this working machine.

I hope you find the video somewhat insightful. Regardless of your beliefs, I think it can be agreed that these two principles are what drives the marketplace and it's movements.

- R2F

Mastering Elliott Waves: Key Rules You Can't IgnoreEducational Idea : Understanding Key Principles of Elliott Wave Theory

Introduction

Elliott Wave Theory is a powerful tool used by traders to analyze market cycles and forecast future price movements. Understanding its core principles can help you make more informed trading decisions. In this article, we will delve into three fundamental principles of Elliott Wave Theory that cannot be violated. Remember, this video is purely for educational purposes and not intended as trading advice or tips.

1. Wave 2 Can Never Retrace More Than 100% of Wave 1

The first principle of Elliott Wave Theory is that Wave 2 can never retrace more than 100% of Wave 1. In other words, Wave 2 cannot go below the starting point of Wave 1. If it does, it invalidates the wave count and suggests that the initial impulse wave (Wave 1) was incorrectly identified. This rule ensures that Wave 2 is a correction wave within the larger trend and not a reversal of the trend itself.

Example Illustration:

- If Wave 1 starts at 100 and peaks at 150, Wave 2 can retrace to any level above 100, but not below it.

2. Wave 3 Can Never Be the Shortest Among All Three Impulse Waves (1-3-5)

The second principle states that Wave 3 can never be the shortest among the three impulse waves (Waves 1, 3, and 5). Typically, Wave 3 is the longest and most powerful wave, characterized by strong momentum and volume. If you find that Wave 3 is shorter than either Wave 1 or Wave 5, the wave count is incorrect, and you need to re-evaluate your analysis.

Example Illustration:

- If Wave 1 is 50 points and Wave 3 is only 30 points, while Wave 5 is 40 points, this violates the rule as Wave 3 is the shortest.

3. Wave 4 Cannot Enter the Territory of Wave 1 (Except in Diagonals & Triangles)

The third principle asserts that Wave 4 cannot enter the price territory of Wave 1. This means that the lowest point of Wave 4 should not overlap the highest point of Wave 1. An exception to this rule occurs in diagonal and triangle patterns, where some overlap is permissible. This rule helps maintain the integrity of the impulse wave structure.

Example Illustration:

- If Wave 1 peaks at $150 and Wave 4 retraces to $145, this overlaps and invalidates the wave count unless the pattern is a diagonal or triangle.

Conclusion

By following these principles, you can ensure that your Elliott Wave analysis remains robust and accurate, helping you navigate the complexities of the financial markets with greater confidence. Understanding and applying these key principles of Elliott Wave Theory can significantly enhance your market analysis and trading strategies. Keep these rules in mind as you study and apply Elliott Wave Theory in your trading journey. Remember, this video is purely for educational purposes and not any kind of trading advisory or tips.

This content is for educational purposes only and should not be considered as financial advice. Always do your own research before making any trading decisions.

I am not Sebi registered analyst.

My studies are for educational purpose only.

Please Consult your financial advisor before trading or investing.

I am not responsible for any kinds of your profits and your losses.

Most investors treat trading as a hobby because they have a full-time job doing something else.

However, If you treat trading like a business, it will pay you like a business.

If you treat like a hobby, hobbies don't pay, they cost you...!

Feel free to share your thoughts or questions in the comments below. Happy trading!

Hope this post is helpful to community

Thanks

RK💕

Disclaimer and Risk Warning.

The analysis and discussion provided on in.tradingview.com is intended for educational purposes only and should not be relied upon for trading decisions. RK_Charts is not an investment adviser and the information provided here should not be taken as professional investment advice. Before buying or selling any investments, securities, or precious metals, it is recommended that you conduct your own due diligence. RK_Charts does not share in your profits and will not take responsibility for any losses you may incur. So Please Consult your financial advisor before trading or investing.

Liquidity is KEY to the MarketsIn this video I go through more about liquidity and why it is important.

The markets move because of liquidity. Without liquidity, there is no trading. The larger the trader, the larger the liquidity required. Understanding the concept of liquidity and the fractal nature of price, trading becomes very interesting. A whole new world opens up to you and you no longer have to keep guessing where price is going. You no longer have to keep chasing candles.

I hope you find this video insightful.

- R2F

FULL ANALYSIS GUIDE - (Using ICT's Concepts)Hey guys,

In this video I will show you my process for performing analysis. Yes, it takes some work, but generally once you get into the swing of it, it doesn't take long, and the higher timeframes only require analysis once in awhile. It allows me to have a higher win-rate and be more on side with how the market is predisposed to move. Whilst it is not required in order to be profitable, my personality and system requires me to make more frequent wins.

I hope you find this video insightful.

- R2F

Trade Like A Sniper - Episode 24 - USOIL - (7th June 2024)This video is part of a video series where I backtest a specific asset using the TradingView Replay function, and perform a top-down analysis using ICT's Concepts in order to frame ONE high-probability setup. I choose a random point of time to replay, and begin to work my way down the timeframes. Trading like a sniper is not about entries with no drawdown. It is about careful planning, discipline, and taking your shot at the right time in the best of conditions.

A couple of things to note:

- I cannot see news events.

- I cannot change timeframes without affecting my bias due to higher-timeframe candles revealing its entire range.

- I cannot go to a very low timeframe due to the limit in amount of replayed candlesticks

In this session I will be analyzing USOIL, starting from the 6-Month chart.

If you want to learn more, check out my other videos on TradingView or on YT.

If you are interested in private coaching, feel free to get in touch via one of my socials.

How Many Monitors Do YOU Need? - R2F's Professional OpinionHi everyone,

I get this question occasionally, so I figured I would share my opinion on the matter.

There are many misconceptions about trading or being a professional trader. One of them is, the more monitors you have, the more successful or advanced you are as a trader. That is complete nonsense. In this video I explain what I think the best number of monitors is to have, and hopefully give you some insight into what works for you.

At the end of the day, trading is a personal endeavor and not a one-size-fits-all. Always start with the least, and scale from there, which is the same way you should approach the growth of your trading wealth.

- R2F

The 3-Step Method For High-Quality AnalysisIn this video I give you the 3-step method I use to do my analysis.

By incorporating these steps, it is also how I do my top-down analysis. You can think of it as a checklist as well.

First, I have my Bias, which determines where I believe price is drawn to. For example in the case of SMC/ICT Concepts, we observe where the liquidity is in the market and use that to frame where price is likely going to go to sooner or later.

Secondly, I have my Narrative, which is on a lower timeframe, and paints the picture of HOW price is going to form in order to initiate the move to that price target. This usually includes more engineered liquidity on lower timeframes, and manipulation to happen.

Thirdly, I have my Confirmation, which is where I want to enter a trade. This is the lowest of the three timeframes, and is the final point in which I will frame a trade setup. Usually I will look for the exact same things I look for in my Bias and Narrative, but on this timeframe. I also tend to include the factor of time, such as Killzones, Seasonality, and News Drivers.

Note that the timeframes can be anything you want them to be, and you are not restricted from moving from timeframe to timeframe. But, the important thing is to be consistent with WHERE you believe price is going, HOW you think it may get there (this can change as price forms), and again WHERE you are going to enter a trade.

- R2F

When Are You READY to Trade with REAL MONEY?Hello hello, R2F here with another discussion.

Today, I'd like to go over the question, 'when do you know you are ready to trade with real money?'

Too many traders rush into trading with real capital before they are ready, and end up losing more money than neccessary on learning journey. People are generally impatient creatures and want to get into actions as soon as possible. Perhaps they want to find out if they are magically a trading savant before wasting time on all the usual work that is required.

However, trading is extremely simple, albeit not easy. The difficult part comes in the form of the investment of time and experience, and refining yourself as a person. Once you had that in the bag, trading offers the potential for generational wealth that comes with the freedom of time.

Without further ado, I share my thoughts on how to approach this burning question.

- R2F

Using Fibonacci & FPT To Identify Trends/Entries/ReversalsLearn how powerful Fibonacci Retracements and Fibonacci Price Theory are when adequately deployed.

It can tell where and when to target entries, trends, risks, and reversals.

Anyone can do this when they learn to efficiently manage the ranges and use Fibonacci tools in Trading View.

It's time you took a few minutes to learn the PRICE is the ultimate indicator. You don't need to use dozens of other indicators (unless you want to add to the core Fibonacci techniques).

Watch this video, then follow my research/videos.

Delusions of Grandeur - Breaking Your Trading ModelIn this video I would like to talk about a mistake many beginners as well as intermediate traders make, which is having a potentially profitable trading model, and pushing it to the point it stops working. I will discuss WHY it happens, WHY it never works, and WHY you should avoid this blunder.

Your trading model is the strategy that you use to trade with. It can include how you determine your entries, stoplosses, and targets, as well as how you manage risk. The only way to know if a trading model works, and how well it works if it even does at all, is through backtesting and forwardtesting. The more data you collect, the more insight into the model you will have. The main thing I want you to keep in mind is that a trading model’s efficacy relies on collected data, and this data must be consistent. It’s the same as any other industry that does research on their market or products.

So, why do so many traders push a model until it stops yielding them profit?

I would say the first reason is impatience. Humans are impatient, especially nowadays in this of social media and technology. Some traders won’t spend the time doing all the necessary testing required. They want to start making money as quick as possible, but little do they know they end up losing their account as quick as possible. Secondly, it takes time for your setups to appear in the market. People have this naturally preconceived notion that you need to be doing something in order to be working and making money. This is the complete opposite in trading, which goes against our programming. So what ends up happening is traders being less stringent with their model’s criteria just so they can trade more often.

Next is greed. Generally speaking, the safest way to survive as a trader in the long run is through compound interest. Risking small, and letting the math do the work. But that’s not very sexy. Many traders go against their logical risk rules in order to potentially make more money, or more likely, lose more money, or all of it.

Boredom is a factor as well. Seeking excitement from trading is a one-way ticket to blowing your account. You’ll never make it as a trader if you think like that. All good systems are rarely thrilling. It is perfectly fine to be in love with trading, but it should not get your heart racing.

It all comes down to being disciplined. Doing the work, putting in the time, and following the trading model you have either adopted or created yourself. It absolutely doesn’t matter if you have losing trades. It absolutely doesn’t matter if your trade setup appears only once or twice a month. Those are not hindering you from becoming very wealthy in due time. But, running around jumping from strategy to strategy, not sticking to a model’s rules, those things will ensure that you never make it as a trader. It is as simple as that.

I know, it is not easy for many of you. It wasn’t easy for me as well. I am naturally face-paced. So, one piece of advice I have is cultivate organized baby steps. What does that mean? Clearly plan what you want to achieve, and then start with frequent tiny goals that you have no reason to not accomplish. For example, you want to collect data for 500 backtested trades. Start with the goal of backtesting 1 trade per day for a week. The important part here is not only making sure you do that 1 trade backtest, but making sure you ONLY do 1. If you are in the “mood” to do more, DON’T. What would it demonstrate if your decisions are based on your mood? What will happen when you are in the mood to do none? If you say 1 trade, stick to 1 trade. After a week, you can stick with 1 or scale up to 2 backtested trades per day for a week if you are ready, or perhaps a month, it’s up to you. This is just an example. You can apply this method to anything. Basically, you want to condition yourself to be consistent and disciplined. You want to show yourself that YOU are the boss of your life. YOU consciously decide what happens, not your emotions. The only way to do that is to grow that muscle bit by bit. Don’t let anyone tell you otherwise.

- R2F

What does it take to be a SUCCESSFUL TRADER?Hi everyone,

I felt compelled to create this short video on what I think it takes to be a successful trader. I've separated it into 4 factors:

1. Passion

2. Discipline

3. Perseverance

4. Patience

From my experience, these are the core things that you need to keep going until you find successful. Strategies should be the LEAST of your concern. I always say that to be a successful trader, you have to BE that person! You have to transform the person you are now into the person you vision yourself being. If you can do that, you got it baby.

- R2F

Putting Risk Reward into PerspectiveMost newbies, and even intermediate traders don't really understand what high risk to reward trades require from themselves and from the market. They think it is something to strive for, and that high RR trades are reserved for the pros. This is far from the truth.

In this video I try to give more perspective to this concept.

- R2F