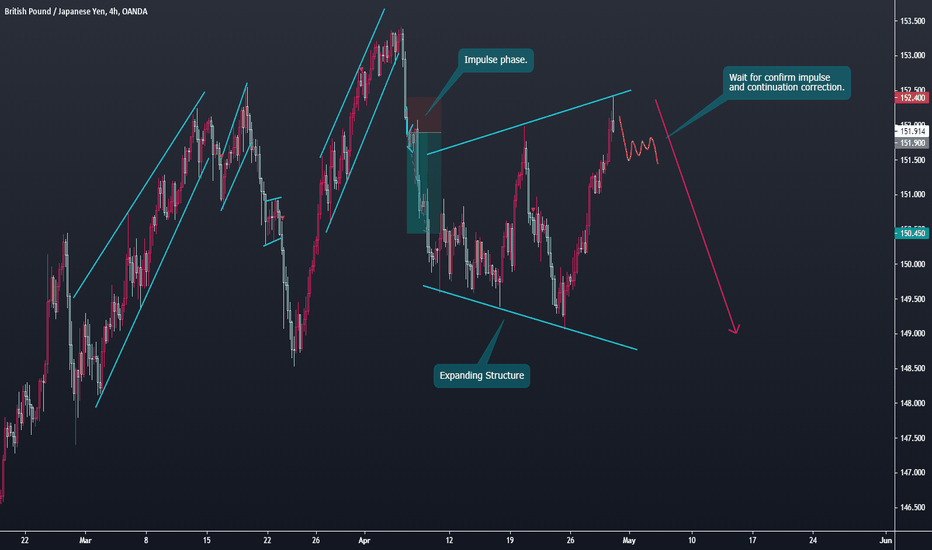

JPY Bearish Outlook (GJ, AJ, NJ, CJ)

Hello traders:

Similar like the USD outlook, I have made a quick video breaking down some of the JPY pairs I am looking at.

Same trading plan and risk management approach like the USDs, I would wait and see the bearish development first before enter any positions.

So watch out for some LTF development on some of these pairs in the up coming days.

Thank you

Pattern

USD Outlook (GU, EU, AU. NU)Hello everyone:

Welcome back to a quick updates on the USD.

In this quick video I breakdown 4 USD pairs that are shaping up to for a good sell potential on them.

All of them will need a bit more development to give me the positive confluence to enter the trades, so patient is key here.

IF the price doesn't develop into what I like to see, then no entry for me. :)

EURUSD

s3.tradingview.com

GBPUSD

s3.tradingview.com

AUDUSD

s3.tradingview.com

NZDUSD

s3.tradingview.com

Any questions, comments or feedback welcome to let me know :)

Thank you

How To Treat Trendlines As Zones? and Why?Many members asked me why I draw my trendlines as zones, so here we go...

Trendlines, just like horizontal support and resistance, are zones on our chart, and not laser lines.

In this video, I will show you two practical examples of how to use trendlines on zones, whether for trigger/reversal or rejection/continuation.

Enjoy it.

PS: Please excuse my humble English!

~Rich

Weekly Trading Recap: GBPCHF, EURUSD Apr 24 2021Hello everyone:

Welcome back to this week’s trading recap video. Let's take a look at the positions that closed down this week.

I will explain my approach on the entry, SL, TP and management.

GBPCHF - Running 2% profit

Full analysis/forecast:

EURUSD 0 Closed for BE

Full analysis/forecast:

Any questions, comments or feedback please let me know. :)

Thank you

Jojo

Weekly Trading Recap: LTCUSD, XLMUSD, BNBUSD, GBPCHF Apr 17 2021Hello everyone:

Welcome back to this week’s trading recap video. Let's take a look at the positions that closed down this week. I will explain my approach on the entry, SL, TP and management.

Litecoin (LTCUSD) - Running about 2% profit

Full analysis/forecast:

Stellar (XLMUSD) - Running about 2.5% profit

Full analysis/forecast:

Binance Coin (BNBUSD) - closed down for +9.5% profit

Full analysis/forecast

GBPCHF - Closed down for +0.5% profit

Full analysis/forecast:

Any questions, comments or feedback please let me know. :)

Thank you

Jojo

How to identify a correction for the next impulse move ? How to identify if a correction is finished/completed and ready for the next impulse move ?

Hello everyone:

In this educational video I will go over how to properly identify a correction in price action analysis.

I recently made a price action workshop live stream video that went over everything on impulse - correction, structures/patterns, continuation and reversal corrections,

but I still get a lot of questions on identifying corrections itself.

How to draw, use the trendlines to identify a correction, and how to understand they are going to complete/finish.

In my opinion this is the most important part in technical analysis.

We need to understand that the market moves in phrases, it can only be in the impulsive phrase or corrective phrase.

The key to trading is to understand when a correction finishes, we are going to get the impulsive phrase which will give us traders a better edge in the market to enter, where the momentum is strong.

I have made many educational posts on price action analysis, specifically on continuation or reversal correction, which I will put the links below.

Any questions, comments, or feedback welcome to let me know.

Thank you

Jojo

Price Action Workshop

www.tradingview.com

Impulse VS Correction

Continuation and Reversal Correction

Multi-time frame analysis

Continuation Bull/Bear Flag

Reversal Ascending/Descending Channel

Reversal Double Top/Bottom

Reversal Head & Shoulder Pattern

Reversal “M” and “W” style pattern

Reversal Impulse Price Action

Expanding Structure/Pattern

Basic understanding of Candlestick- and Chart-PatternsHello everyone, first of all - thank you for the positive respond to my previous video. Now that we know what a trend is made of, we want to point out the difference between Candle-Stick patterns and Chart-Patterns. Feel free to check out the previous episode below. In the next Video we are going to discuss the basic indicators you should look at for trading a trend.

Please give me some feedback on what i can improve.

Cheers,

Ares

Weekly Trading Recap: BNBUSD, GBPJPY, GBPUSD, XLMUSD, Apr10 2021Hello everyone:

Welcome back to this week’s trading recap video. Let's take a look at the positions that closed down this week. I will explain my approach on the entry, SL, TP and management.

Binance Coin (BNBUSD) - running about +8% profit, will exit at $500

Full analysis/forecast

GBPJPY - Exit for +3% profit first trade, and -1% loss on second scale in.

Full analysis/forecast

GBPUSD - Exit for +2% profit

Full analysis/forecast

Stellar (XLMUSD) - running about +1% profit, SL still at BE

Full analysis/forecast:

EURNZD - Exit for +0.5% profit

Full analysis/forecast

NZDCAD - exit for about -0.25% loss.

Full analysis/forecast

Any questions, comments or feedback please let me know. :)

Thank you

Jojo

Weekly Trading Recap: BNBUSD, LINKUSD, EURAUD April 03 2021Hello everyone:

Welcome back to this week’s trading recap video. Let's take a look at the positions that closed down this week. I will explain my approach on the entry, SL, TP and management.

BNBUSD - Running about 1.5%

Full analysis/forecast

LINKUSD - Running about BE

Full analysis/forecast

EURAUD - 1 % profit

Full analysis/forecast

NZDCHF -1% loss

Full analysis/forecast:

GBPJPY - 1% loss

Full analysis/forecast:

Any questions, comments or feedback please let me know. :)

Thank you

Jojo

Risk Management: Entry in the impulsive phrase of price action Hello everyone:

Welcome back to another video on risk management.

Today I want to discuss a few possible entries that we can do in the market when we spot the next impulsive phrase of the market condition.

I will break down the 3 types of entries that I always look for when I am about to execute a trade.

Sometimes we will see all 3 entries present themselves, and sometimes we might only see 1 or 2. So let's dig into these entries.

All entries are based on the continuation or reversal structure on the LTF mostly.

So I need to see a LTF correction forming and potentially completing before setting any of these entries.

In addition, they have to be aligned with the HTF overall direction and bias. Multi-time frame analysis is key.

All my entries are stop entry order, meaning the market needs to hit a certain price before getting triggered. Buy Stop or Sell Stop order.

You may see variations of these entries in different strategies or styles, but here are my take on them and my way of using them in my trading.

Let me give a few examples of each on different markets and pairs to show the potential move and possible entry criteria.

Below are same other Risk Management you should know in trading.

Risk Management 101

Risk Management: How to set a Take Profit (TP) for your trades

Risk Management: How to Enter and set SL and TP for an impulse move in the market

Risk Management: How to scale in the impulsive phrase of the market condition?

Risk Management: Combine everything you learn to prevent blowing a trading account

Impulse VS Correction

Continuation and Reversal Correction

Multi-time frame analysis

Does news events affect price action analysis in trading ?Hello everyone:

Today I want to discuss news events in trading. Often when a news event comes out in the market, we get some sort of volatility and we get a strong spike/impulse.

However, does news events affect our ways of understanding price action analysis ?

Let's take a look at a few examples of the recent FOMC volatility that happened in the forex, indices and commodity market.

Most of the market had a sharp quick move to one direction, hinting a sign of weakness in USD/JPY..etc.

However, all of them ended up with a reversal impulse, and recovered all the price from the volatility.

So, what can we take away from this ? News certain creates volatility, but not the overall price action trending direction.

We may get a temporary short term move, but eventually the market recovers it, and resumes its original direction.

Often beginner/newcomer traders will try to “jump” onto the news momentum, but usually end too late, and they will take a BE or losses.

We can not control the outcome of the news or whether the news will be positive or negative towards our trades, but what we can control is our entry, SL, TP, risk management, emotions and mindset.

Any questions, comments or feedback welcome to let me know :)

Thank you

Jojo

Weekly Trading Recap ADAUSD, EURUSD, USDCAD, AUDCAD, Mar 20 2021Hello everyone:

Welcome back to this week’s trading recap video. Let's take a look at the positions that closed down this week, and what are still running. I will explain my approach on the entry, SL, TP and management.

ADAUSD (Cardano) - BE

Full analysis/forecast:

USDCAD -BE

Full analysis/forecast:

EURUSD - BE

Full analysis/forecast:

AUDCAD - 2 trades closed down for 4%

Full analysis/forecast:

EURNZD - BE

Full analysis/forecast:

Any questions, comments or feedback please let me know. :)

I will always do a weekly trading outlook live stream at the beginning of each week to discuss any potential opportunities ahead in the forex, crypto, indices, and commodity markets. Feel free to tune in to my forecast. :)

Thank you

Jojo

Expanding Structures/Patterns in Price Action AnalysisHello everyone:

Welcome back to another price action structures/pattern educational video.

Today I want to discuss the expanding structure that I always see in the market.

These structures/patterns are a bit more advanced, as they are not so clear on whether it's a continuation or a reversal correction.

Lets dig into some typical forms that I always see in the market, and discuss the possible opportunities we can get from them.

Expanding structure can come in all sorts of sizes and shapes.

They are not the typical channel, flag, pennant/triangle, Head and Shoulder that we usually encounter.

The key here is to identify them and observe if we are going to get trend continuations, or trend reversal after the correction finished.

Any questions, comments or feedback welcome to let me know below.

I will include all other types of price action structures/corrections that I have discussed in the past below, for everyone’s references.

Thank you

Jojo

Impulse VS Correction

Continuation and Reversal Correction

Multi-time frame analysis

Continuation Bull/Bear Flag

Reversal Ascending/Descending Channel

Reversal Double Top/Bottom

Reversal Head & Shoulder Pattern

Reversal “M” and “W” style pattern

Reversal Impulse Price Action

Weekly Trading Recap: GOLD, AUDCAD, EURNZD March 13th 2021Hello everyone:

Welcome back to this week’s trading recap video. I took 3 trades this week, and 2 are still running profits.

Let's take a look at them and see my approach on entry, SL, TP and management.

GOLD - Took BE

Full analysis/forecast:

AUDCAD - Currently running about 2:1 profit.

Full analysis/forecast:

EURNZD - Currently running about 1:1 profit.

Full analysis/forecast:

Any questions, comments or feedback please let me know.

I will always do a weekly trading outlook live stream at the beginning of each week to discuss any potential opportunities ahead in the markets. :)

Thank you

Jojo

Trading Strategies and Style - Price Action Analysis

Hello everyone:

Recently I have many newcomers/subscribers/followers on my various channels and platforms, so I want to make this video to summarize what exactly are my strategies and style in trading.

It's important to understand everyone trades differently, and different styles and strategies.

What's more important is to understand if the strategies and style work for you and you only as a trader.

Does a typical style/strategy satisfy your vision in trading ?

Does the risk/reward make sense to you as a trader ?

Does the trading plan and management sound feasible and realistic to you ?

Do you have the right mindset and emotion when it comes to trading these types of strategies and style ?

These are the questions to think about when you are serious about trading.

So, let's take a look into how I trade and what are the key important aspects that I look for in trading.

-Price Action Analysis

-Impulse VS Correction

-Continuation VS Reversal Correction/Structure

-Multi time frame analysis (top down approach)

-Risk Management (3:1 RR)

-Trading Psychology (Mindset and emotion) (FOMO, Revenge Trading, Over Leverage Trading)

As always, any questions, comments or feedback welcome to let me know.

Thank you

Jojo

Weekly Trading Recap: UC, EN, CJ, AJ, UM, US30, Mar 6th 2021Hello everyone:

Welcome back to my weekly trading recap video. This week I have several trades resulting in Break Even, let's take a look at these trades and what my approaches are as well.

EURNZD -

First Trade : Break Even

Second Trade - Break Even

Full analysis/forecast:

USDCAD - Break Even

Full analysis/forecast:

CADJPY - Break Even

Full analysis/forecast:

AUDJPY - Break Even

Full analysis/forecast:

USDMXN - (-1%)

Full analysis/forecast:

US30 (DOW) - (-0.69%)

Full analysis/forecast:

Any questions, comments or feedback please let me know.

Enjoy your week. :)

Jojo

Crypto backtesting and chart work in price action analysis

Hello everyone:

Today let's do some backtesting and chart work on the crypto market.

I have done similar videos on Forex and Indices’ market, and I want to do one as well for crypto to showcase price action that will happen in any market, any time frame.

Make sure to check out the below videos on why I backtest and do chart work. This is to help us to get better at trading as a whole, and remove emotional decisions.

I will dig back some crypto pairs and look at the bullish impulse on the HTF, and go down to the LTF for confirmation and entries.

Any questions, comments, or feedback please let me know :)

Thank you

Jojo

Backtesting & Chartwork on Forex Market

Backtesting & Chartwork on Indices Market

How & Why I backtest:

Prevent Blowing an account by backtesting:

Reversal Impulse Price Action - Trend Change Confirmation Hello everyone:

Welcome back to another price action structures/patterns video.

Today let's take a look into the reversal Impulse price action from the market.

I have back tested and seen these types of price action happen very often in any market, any time frame. Its signaling a very strong trend change and reversal momentum from the price.

Let's take a look into what it looks like usually, and how to effectively take advantage of these types of price action in the market.

Seeing them on the HTF, giving us strong bias for a reversal trend change coming.

Seeing them on the LTF, signs of reversal from the LTF first, and leading towards the beginning of the HTF reversal move.

Remember, Multi-time frame analysis is key. If we spot a potential HTF reversal impulse, then likely LTF price action is also showing reversal price action structures/patterns.

We want to pair as many positive confluences as we can together to give us an edge entering the trades.

As always, any questions, comments or feedback please let me know.

Thank you

Jojo

Weekly Trading Recap: GOLD, SPX500, GBPUSD, BTCUSD Feb 27th 2021Hello everyone:

Welcome back to my weekly trading recap video. This week I took more trades than usual, resulted in more losses.

Overall still in the positive for the month not include my BTC long term trade, so lets take a look at the trades taken this last week.

Full trading journal in my profile link.

GBPNZD - Got tagged out for 0.5% profit.

Full analysis/forecast:

GBPUSD - Took a full 1 % loss.

Full analysis/forecast:

SPX500 - Manually exit for 0.33% profit.

Full analysis/forecast:

GOLD - Took 2 trades, 2 full 1 % loss.

Full analysis/forecast:

AUDCAD - 1% loss

Full analysis/forecast:

USDCHF - 0.5% loss

Full analysis/forecast:

BTCUSD - Closed both trades down. First trade in 12.39%, second one BE.

Full analysis/forecast:

Any questions, comments or feedback please let me know.

Enjoy your weekend. :)

Jojo

Is there stop loss hunting in trading ? How to deal with it ?Hello everyone:

Today I want to discuss a common discussion about new and experienced traders.

“Is there stop loss hunting in trading?”

Many wonder, since they can all recall the moment where price just hits their SL on a trade, and then the market quickly turns around towards their desired profit direction.

I want to dig deeper into this and explain it with different viewpoints, from a technical and psychological view.

The vision I am trying to provide is that, thinking about is there stop loss from the brokers won't help you to get better in trading.

It's a mindset thing we need to understand. For example, whether there is or isn't a stop loss hunting, it's nothing you or I can change or control. It is what it is.

However, if you understand this, then it's about adjusting your plan, strategies and trading style to these types of volatility moves and come up with the correct mindset to work around it.

Technical part:

More often, people set their SL and see their trades get taken out just a few pips above before reversing the opposite way.

Dig deeper into this. Is it a fake breakout, is it just being impatient and jumping the gun?

Is there LTF continuation/reversal correction that gives you bias to enter a long/short ?

Is your analysis aligned with the higher time frames ?

Many factors on why a trade is at a loss, no need to jump right into a conclusion that it's the broker who is stop hunting you.

This is why we always look for confirmation and confluence when we enter trades.

Just because the price breaks the support and resistance line people often use, it's not an automatic buy or sell.

Same goes with trend lines and other indicators people use.

We need to confirm it with price action. After an impulse phrase, was there a continuation correction phrase? If not, then it doesn't justify a buy entry.

This is also why we backtest so we see these types of price action often, and acknowledge what we need to do in order to work our ways around it.

Psychological part:

When traders take a loss in this way, hitting the SL and reverse, this creates a negative emotion in them.

They often get frustrated and upset, hence in human nature, we tend to blame others.

But take a step back and understand this:

The market can do whatever it wants to do.

Most beginner and newcomer traders think the market MUST follow their strategies and style. If it doesn't, then something is wrong with the market, the brokers, their mentor/coach, their strategies...etc.

This negative mindset needs to change.

First of all no strategies and style will promise you 100% strike rate and profit.

Any strategies you take will incur a loss, it's how you deal and manage it that will show you as a consistent or inconsistent trader.

Second, if you have experienced several losses due to the “Stop hunt” in your own mind, then instead of blaming the brokers or the markets, start looking into your trading plan and management.

Are you experiencing FOMO ? Are you over leverage trading, and revenge trading ? Are you taking into consideration your risk management ? Entry, SL/TP, how much to risk ? Is it consistent with your plan ?

These are the things you can control, rather than external factors which you can not. Adjust yourself.

Third, remove your negative emotion from your losses. Take it as a learning curve and experiences earned.

Then the next time you enter a trade, you will remember the lessons that were taught to you by the market.

This is why we journal our trades so we can look back at them and understand what we did.

I hope these few pointers will help some of you to get back on the positive direction of trading.

No need to think and get upset if there is a stop hunting of your trades. Instead, use that towards your advantages.

If you consistently see a false breakout and reverse, then come up with a strategy and plan to capture that reversal move.

No need to blame the market or the broker, that is something you can not control. Jumping brokers to brothers simply won't help you to eliminate that psychological mindset of a stop hunting.

I will put below several other educational videos on the topic we discussed today.

As always, any questions, comments or feedback welcome to let me know :)

Trading Plan:

Risk Management:

Trading Psychology:

FOMO:

Revenge Trading:

Over Leverage:

Weekly Trading Recap: GBPNZD, ADAUSD, BTCUSD February 20th 2021

Hello everyone:

Welcome back to my weekly trading recap video. This week I entered just 1 trade, closed down 1 trade and I still have 2 BTC positions open. Let's take a look into it.

GBPNZD - Been talking about it last couple days in the live stream market updates, was waiting for more development. Finally LTF gave me enough confluence to set a stop entry order.

Currently running about 1.5% in profit. May look for further bearish scale in positions.

Full analysis/forecast:

ADAUSD - Hit TP of 8.94%. Was in my plan to take profit at $1 price, and monitor to see how the price breaks above, and potentially get back in for a further bullish move.

Full analysis/forecast:

BTCUSD - 2 positions still running, total about 20% in profit. Still holding and sticking to my long term investing approach and management.

Full analysis/forecast:

Any questions, comments or feedback please let me know.

Enjoy your week. :)

Jojo

Risk Management: How to set a Take Profit (TP) for your trades Hello everyone:

Today let's dig into an important topic of setting a Take Profit (TP).

While many traders will often have different strategies and methods on a TP, let's take a look on my approach and style on this.

ITs important to understand there is no right or wrong when it comes to setting a TP.

ITs what you have in your plan and what makes sense to you as a trader. It should align with your strategies and trading style also.

Some may take profit quicker and move on, while others hold for longer term. Understand that both methods can have drawbacks, it's what trading is, double edge.

So, make sure we follow our plan and executive accordingly to our management. Otherwise we are just making emotional decisions again.

Let's look at a few scenarios on how I would set a TP.

Directly tie in TP is a SL. I usually will only enter a trade if I have 3:1 RR.

Meaning risking 1% to gain 3% or more. Therefore my TP will almost always be 3 times of initial SL amount or room.

Few TP scenarios:

-Beginning of the the previous correctional structure

-Double Bottoms/swings low area, watch for LTF reversal price action and correction

When price breaks ATH, monitor the price action on the LTF for bearish reversal.

I would want to see a trend change, rather than a pullback.

Few things to consider:

-Understand you will never enter at the lowest point, and exit at the highest point

Make sure you have a plan before so you will not get into an emotional decision.

Always know what you plan to do before it happens.

No Right or wrong as long as you follow your original plan.

You can of course in time modify your plan based on market conditions.

Any questions, comments or feedback please let me know :)

Thank you

US Indices Backtesting and Charting Session On Price Action Hello everyone:

As promised I will periodically make these backtesting/chart work videos on different markets, pairs and timeframes.

This is for me to present the importance of backtesting in trading consistency.

Not only it will help traders to not have emotional decisions such as FOMO or fear of losing, it will give traders confidence at identifying trade opportunities and execute them when the time comes.

The more we do backtesting, the easier we spot an entry, setting a SL/TP, and remove any emotional decisions.

Today I want to go into the US Indices, specifically the SPY, NASDAQ, DOW. I will pick a few market crashed examples and dig deeper into them.

Few educational videos below on the topic of backtesting, and why it will help you in your trading journey.

How & Why I backtest:

Prevent Blowing an account by backtesting:

Backtesting & Chartwork on USDCAD:

Any questions, comments, or feedback please let me know :)

Thank you

Jojo

Weekly Trading Recap: ADAUSD, BTCUSD, NZDJPY, USDJPY Feb 13 2021Hello everyone:

Welcome back to the weekly recap video. This week I entered just 3 trades, closed down 2 trades and I still have several positions open. Let's take a look into it.

ADAUSD - Currently running about 7% in profit.

Price continues to push up impulsively on the lower time frame.

I have set a TP of $1.

Full analysis/forecast:

BTCUSD - Running about +12% in profit in both trades. I scaled in another buy entry once price broke ATH, and formed LTF continuation correction.

Full analysis/forecast:

NZDJPY - Take a 1% loss.

Got in on this entry when price broke down from the ascending channel, and formed a LTF correction. I stick to my plan to let the trade run since it hasn't reach 1:1 profit yet to allow me to move the SL to BE.

Full analysis/forecast:

USDJPY - Trade close for 0.5% profit. Had my SL at BE first, then moved up as I saw the LTF turned in bearish price action. My plan was to secure some profit if price no longer shows further bullish continuation price action.

Full analysis/forecast:

Any questions, comments or feedback please let me know.

Enjoy your week. :)

Jojo