Example: How to Properly Sell the Head & Shoulder Pattern A head and shoulders pattern is a chart formation that resembles a baseline with three peaks, the outside two are close in height and the middle is highest. In technical analysis , a head and shoulders pattern describes a specific chart formation that predicts a bullish-to-bearish trend reversal. The head and shoulders pattern is believed to be one of the most reliable trend reversal patterns. It is one of several top patterns that signal, with varying degrees of accuracy, that an upward trend is nearing its end. A head and shoulders pattern is a chart formation that resembles a baseline with three peaks, the outside two are close in height and the middle is highest. A head and shoulders pattern describes a specific chart formation that predicts a bullish-to-bearish trend reversal. The head and shoulders pattern is believed to be one of the most reliable trend reversal patterns. Like all charting patterns, the ups and downs of the head and shoulders pattern tell a very specific story about the battle being waged between bulls and bears.The initial peak and subsequent decline represent the waning momentum of the prior bullish trend . Wanting to sustain the upward movement as long as possible, bulls rally to push the price back up past the initial peak to reach a new high (the head). At this point, it is still possible that bulls could reinstate their market dominance and continue the upward trend.However, once price declines a second time and reaches a point below the initial peak, it is clear that bears are gaining ground. Bulls try one more time to push price upward but succeed only in hitting the lesser high reached in the initial peak. This failure to surpass the highest high signals the bulls' defeat and bears take over, driving the price downward and completing the reversal.

Copyright 2020 © Alchemy FX All rights reserved.

No part of this book may be reproduced or used in any manner without written permission of the copyright owners except for the use of quotations in a book review.

Search in ideas for "Chart Patterns"

GOLD - 4H TEXTBOOK TRADE

ANALYSIS: 4 HOUR TIME FRAME LONG

CHART PATTERNS: WE ARE SEEING A SERIES OF HIGHER HIGHS AND HIGHER LOWS FORMING WHAT SEEM TO BE A ASCENDING CHANNEL/FLAG.

PRICES CURRENTLY TESTING THE BOTTOM OF THE CHANNEL.

CANDLESTICK PATTERNS: WE ARE ALSO SEEING NUMEROUS PIN BARS (HAMMERS) WITH LONG WICKS RETESTING THE LOWS.

TREND DIRECTION: CURRENTLY ON THIS TIME FRAME WE CAN TRACE A BOTTOM TRENDLINE CONNECTING THE LOWS WHICH IS INDICATING MOMENTUM TO THE UPSIDE.

INDICATORS: NO INDICATORS WERE USE TO ANALYZE THIS CHART. PRICE IS YOUR BEST INDICATOR.

FIB TOOLS: MEASURING THE PREVIOUS MOVE TO THE UPSIDE WE ARE SEEING REJECTION AT THE 88.6% RETRACEMENT .

FUNDAMENTALS: N/A

TYPE OF TRADE: INTRADAY (NOT TO BE HOLD FOR A SWING)

EXECUTION: I ALREADY BOUGHT @1471.34 TARGETING THE PREVIOUS SWING HIGH. HOWEVER, IF THIS PLAY OUT I WILL BE TAKING PARTIALS AT AROUND 45-50 PIPS. IF YOU WISH TO TAKE THIS TRADE PLEASE MAKE SURE TO USE PROPER RISK MANAGEMENT. LETS GOO!!!

GOLD - 4H TEXTBOOK TRADEANALYSIS: 4 HOUR TIME FRAME LONG

CHART PATTERNS: WE ARE SEEING A SERIES OF HIGHER HIGHS AND HIGHER LOWS FORMING WHAT SEEM TO BE A ASCENDING CHANNEL/FLAG.

PRICES CURRENTLY TESTING THE BOTTOM OF THE CHANNEL.

CANDLESTICK PATTERNS: WE ARE ALSO SEEING NUMEROUS PIN BARS (HAMMERS) WITH LONG WICKS RETESTING THE LOWS.

TREND DIRECTION: CURRENTLY ON THIS TIME FRAME WE CAN TRACE A BOTTOM TRENDLINE CONNECTING THE LOWS WHICH IS INDICATING MOMENTUM TO THE UPSIDE.

INDICATORS: NO INDICATORS WERE USE TO ANALYZE THIS CHART. PRICE IS YOUR BEST INDICATOR.

FIB TOOLS: MEASURING THE PREVIOUS MOVE TO THE UPSIDE WE ARE SEEING REJECTION AT THE 88.6% RETRACEMENT.

FUNDAMENTALS: N/A

TYPE OF TRADE: INTRADAY (NOT TO BE HOLD FOR A SWING)

EXECUTION: I ALREADY BOUGHT @1471.34 TARGETING THE PREVIOUS SWING HIGH. HOWEVER, IF THIS PLAY OUT I WILL BE TAKING PARTIALS AT AROUND 45-50 PIPS. IF YOU WISH TO TAKE THIS TRADE PLEASE MAKE SURE TO USE PROPER RISK MANAGEMENT. LETS GOO!!!

GOLD - DAILY TECHNICAL ANALYSIS: GOLD - DAILY

1.- MARKET DIRECTION: WE HAVE SEEN A DOWNTREND FOR THE PAST YEARLY QUARTER.

TREND-LINE WAS TESTED TWICE WAITING ON THE 3RD RETEST.

2.- CHART PATTERNS: PRICES HAVE FORMED

WHAT SEEMS TO BE A DESCENDING CHANNEL/ SYMMETRICAL TRIANGLE.

ALSO, MOST RECENT DATA IS FORMING A FLAG

PATTERN WHERE PRICES ARE SITTING AT THE BOTTOM OF IT AND BEING TESTED

FOR THE 3RD TIME.

3.- FIBONACCI TOOLS (RETRACEMENT): AFTER THE 2ND RETEST/REJECTION OF THE TRENDLINE,

PRICES DROPPED WITH STRENGTH BREAKING AND TESTING NEW LOWS.

REACHING PREVIOUS STRUCTURE TO THE LEFT (1450S).

MEASURED THIS WHOLE MOVE AND CAME UP WITH A RETRACEMENT THAT HAVE NOT

REACHED UP TO THE 61.8% WHICH IS ALSO A STRONG REVERSAL LEVEL.

4.- CANDLESTICK PATTERNS: WE ARE NOW SEEING A DAILY INVERTED HAMMER IN

WHICH IF FOUND AT THE BOTTOM OF A DOWNTREND (KEY LEVEL) INDICATES REVERSAL.

5.- BIAS: IS BEARISH BUT SENTIMENT IS BULLISH UNTIL PRICES REACH FULL RETRACEMENT.

6.- THOUGHTS AND EXECUTION: IT IS OBVIOUS THAT IM LOOKING TO LONG THIS PAIR.

ENTRY WOULD BE BASED ON SMALLER TIME FRAMES 4HR - 1HR FOLLOWED BY A TOP DOWN ANALYSIS.

BEST TRADING SESSION WOULD BE LONDON/NEW YORK.

How to Properly Sell the Head & Shoulder Pattern for Bank! A head and shoulders pattern is a chart formation that resembles a baseline with three peaks, the outside two are close in height and the middle is highest. In technical analysis, a head and shoulders pattern describes a specific chart formation that predicts a bullish-to-bearish trend reversal. The head and shoulders pattern is believed to be one of the most reliable trend reversal patterns. It is one of several top patterns that signal, with varying degrees of accuracy, that an upward trend is nearing its end. A head and shoulders pattern is a chart formation that resembles a baseline with three peaks, the outside two are close in height and the middle is highest. A head and shoulders pattern describes a specific chart formation that predicts a bullish-to-bearish trend reversal. The head and shoulders pattern is believed to be one of the most reliable trend reversal patterns. Like all charting patterns, the ups and downs of the head and shoulders pattern tell a very specific story about the battle being waged between bulls and bears.The initial peak and subsequent decline represent the waning momentum of the prior bullish trend. Wanting to sustain the upward movement as long as possible, bulls rally to push the price back up past the initial peak to reach a new high (the head). At this point, it is still possible that bulls could reinstate their market dominance and continue the upward trend.However, once price declines a second time and reaches a point below the initial peak, it is clear that bears are gaining ground. Bulls try one more time to push price upward but succeed only in hitting the lesser high reached in the initial peak. This failure to surpass the highest high signals the bulls' defeat and bears take over, driving the price downward and completing the reversal.

BTC! We are in subwave 4! Targets hit with AMAZING precision!Hi guys,

Wow, you've got to check out my last post for the finish of wave 3.

In the comments I called for the bottom of 7850. And it hit it.... like exactly. Not 1 cent higher. Not 1 cent lower. Un freeking believable!!!!

There was a lot of sideways action, that may have had some worried about another wave down.... it definitely looked like a bear flag pattern.

Here's the comment from my last post:

Lots of sideways action.... doesn't want to pop upwards for subwave 4 yet.

Check out the 5 minute chart:

- See the 3 times it has gone down to 7850, there are really long wicks on the candle? That is a REJECTION to the downside.... any time the bears try to push it lower, the bulls immediately force it back up. Long wicks on candles tell an important story on the bull/bear battle, and when reversals happen. So I'm sticking to my idea that subwave 4 will begin.

Watch out for a drop below 7850 with volume though.... that would threaten my analysis.

And here's my rant about chart patterns from my "BTC in trouble! 8700 target hit... look out below." post:

A little rant…. Bitcoin -3.25% and cryptos are a highly leveraged, highly speculative, highly unregulated and even highly manipulated market. The price action is wild and explosive, unlike anything we’ve seen in regular equity markets. I’m becoming more and more convinced that Elliot wave and Fibonacci analysis are the tools necessary for the best technical analysis . Of course to be used with other tools to form a complete toolbox. A lot of the top technical analysts focus on chart patterns….. head and shoulders , cup and handles, inverted/non-inverted, bull flag/pennants, bear flag pennants , etc. Im not saying that patterns are not valuable, but there are patterns all over the freekin chart these days. Some of them complete, but I’m seeing a lot of patterns that don't. I don’t know about you, but I don’t want to be investing on a coin flip. I’m not saying I’m a master analyst… I’m still learning. But when you get your Elliot wave count correct, the results are downright precise! And the current idea’s I’ve been posting have been on point, so lets keep rolling with it. If you are new to Elliot wave analysis, do a quick google/wiki search to get a basic sense of the theory, it will only take 5 minutes for an overview.

Moral of the story? Do not blindly trade based on chart patterns.

For subwave 4, I'm gonna target the 0.618 retracement , up to the 0.65 level.... this tight band is known as the "golden pocket". Alot of trading bots and stop orders are set at the 0.618.... the 0.65 level takes care of the peaks and fake outs. It looks like wave A of the ABC correction is in place.... lets see how the rest of subwave 4 plays out. I will update with more detailed ABC subwave chart analysis as the waves develop.

USDCAD 1D BEARISH FLAGBEARISH FLAG - is a form of the range trade chart patterns.

Price has been falling in a bearish move.

Price now takes a break with a bullish retracement.

Breakout of the bottom of the bear flag is a bearish continuation move.

Triangles, Descending Triangles, Ascending Triangle and Ranges are repeatable trading chart patterns.

Triangles and ranges are consolidation chart patterns that can breakout either direction.

Ascending and descending chart patterns will have a directional bias depending on the previous incoming trend.

Each chart pattern will have defining trendlines of the support/resistance levels creating the pattern.

What ever time frame you are trading this chart pattern, wait for a candle close outside of the trendline in the direction of the breakout candle. (Our time frame preference is the Daily chart ).

Add volume indicator - Volume is the amount of $ that went into a particular candle or in Forex the # of trades that took place.

Add ATR indicator - Volatility is the amount of price movement that occurred. Use the ATR to measure the price movement.

When you see descending Volume bars and descending ATR line (which indicates volatility ) this shows a dis-interest in traders to invest in this pair creating consolidation which creates the chart pattern.

Trade Management after there is a breakout candle close.

1 - Position size (compare volume bar to volume ma line).

a - Breakout candle must be 100% of average volume for a full position size.

b - If 75% of average volume then ½ position size. (To find 75% of Volume

look at the volume settings on the chart – divide smaller # into larger # = 75%+)

2 - Enter two trades.

3 - SL for both trades will be 1.5 x ATR.

4 - 1st trade TP will be 1 x ATR.

5 - No TP on 2nd trade – letting profit run and adjusting SL to follow price.

6 - When 1st TP hit – move 2nd trade SL to breakeven.

7 - Adjust the 2nd trade SL to follow price.

*8 – After Breakout candle – if price closes back into chart pattern close trade

*9 - When breakout candle is more than 1 ATR from breakout candle open.

a - Enter 1st trade at candle close with ½ position size.

b - Enter 2nd trade with a pending limit order that is 1 ATR of breakout candle open.

c – Price should pullback to that pending limit order for 2nd trade.

d – If Price returns back into chart pattern close trade before SL is hit.

Bitcoin’s Predicted Moves and PriceBitcoin’s Bullish Pennant — The Symmetrical Triangle

To understand the relevance and importance of the triangle pattern that exists on Bitcoin’s chart, we need to first understand the behavior of that triangle itself. There are a number of triangle patterns that can be identified in technical analysis. The most well-known are symmetrical, ascending and descending triangles. But these patterns can be broken down into even more specific patterns such as a running triangle, busted triangles, and others. The identification of a triangle is based upon the angles of the two converging trendlines. A flat-top trendline with a rising bottom trendline would create an ascending triangle while a flat bottom trendline and a falling upper trendline would create a descending triangle. The interpretation can be different according to where you draw those trendlines. You will often find two different types of triangles if you draw one set of trendlines from the wicks and then another set of trendlines from the bodies. Bitcoin shows a symmetrical triangle when drawn from the wicks, but a descending triangle when drawn from the bodies. Which do you use? Personally, I only draw from the bodies if the wick is more of an anomaly than an ‘honest’ representation of the traded range of that candle. In other words, the symmetrical triangle that you see on a great many charts these days is, in my opinion, the appropriate pattern. Knowing that we have a symmetrical triangle is one thing, now it’s time to identify the behavior of this pattern. In the study of chart patterns, there is no expert greater than Thomas Bulkowski. He is the author of the B loomberg Financial Series book, Visual Guide to Chart Patterns, as well as Chart Patterns After The Buy and, what I believe to be one of the greatest technical analysts books out there: Encyclopedia of Chart Patterns. ! Bulkowski has a breakdown of known patterns and assesses with a ranking system, statistical performance behavior and required criteria for identification.

According to Bulkoswki, a symmetrical triangle in a bull market was two performance ratings. The rank for a bullish breakout is 52 out of 56 while a bearish breakout is 38 out of 53. The average rise from a bullish breakout is 34% vs 12% for a bearish breakout. On both directional breakouts, there is a 62% and 65% (respectively) throwback/pullback rate. The percentage chance that a bullish target is met is 58%, 36% for a bearish target. From that information, we can see that even in a bull market, symmetrical triangles seem to be weighted more heavily towards a bearish breakout — but the range of that move is quite limited and the chance of it meeting its price target from that bearish breakout is significantly lower than the bullish breakout.

Some of the key identifying factors that Bulkowski lists are, first, the convergence of two trendlines with the bottom trendline sloping up and the upper trendline sloping down. Additionally, price must travel between those two trendlines without a lot of ‘white space’ (open space). He also indicates that price must touch one trendline at least three times and the other at least twice. Volume tends to decrease 86% of the time. An upward breakout occurs 60% of the time at 73% of the way to the triangle’s apex and 74% for a downward breakout. He also says that patterns that have a breakout with volume above the 30-day average have a better chance of playing out with a favorable outcome and that throwbacks and pullbacks hurt the post-breakout performance.

Pattern Analysis

The chart above is the symmetrical triangle on Bitcoin’s daily chart. Utilizing the information from Bulkowski’s work, we can identify some of the key components that we want to see for a breakout of this symmetrical triangle. First, we want to know if price has touched the trendlines at least 3 times on one line and at least 2 times on the other. Letter A shows at least three touches (possibly 4) for both the uptrend and downtrend lines. Next, we want to know if the volume has been above the 30-day average. The volume for September 19 th, 2019 was above that average (Letter B). Ideally, we want to see volume grow as we get closer to the breakout and then we should see it grow even more on the breakout. And third, we want to identify where 73% of the range from the beginning of the triangle to the apex. Letter C shows where that 73% range is at: September 24 th, 2019 — a coincidence that it shows up one day after the Bakkt Futures launch?

But we also want to know how far Bitcoin would move on a breakout. To do that, Buklowski also provided some tips. To do this, we need to subtract the high of the triangle from the low and then multiply it by the average percentage move. Then we add it to the breakout price level for a bullish target or subtract for a bearish target. Since we don’t have a breakout price level yet, we could hypothesize a value from our current trading date. Taking the high of the range at $13880 minus the low of the range at $9,049.54 we get $4,830.46. Multiply that by the average bullish breakout rise of 34%, we get 1,642.35. Assuming we were to breakout higher near the $10,750 value area, then the target from the breakout would be $12, 392.35. On the bearish side of things, we do the same thing except instead of multiplying the high and low by 34%, we multiply it by 12% (4830.46 * 0.12 = 579.65). Assuming we broke down below the $9,400 value area, then we would see a target lower at $8,820.35.

Given all of this information, the most likely scenario would see play out, given the probabilities, is for price to actually breakdown lower and tag the bearish breakdown price target of $8,820.35 before pulling back into or above the triangle to trade higher. Remember: in a bullish symmetrical triangle there is a higher chance for price to experience a bearish breakout, but the downside risk is very limited and the pullback rate and failure rate for a bearish breakout is very high. Essentially, we will be looking at a highly probable bear trap before another leg higher towards the 2019 highs.

ETHUSD C&H formation bolsters ETHUSD (LONG) & also creates shortEMA12; C&H / Inverted head & shoulders confirm both short & long positions— we’re seeing more healthy organic growth and current priceaction == indicative of what all signs & indicators have dictated thus far in direct correlation with actual market outlook.

For us early adopters it was surreal to transition into a stable market with predictable and feasible price comparison charting (Yes I realize how crazy that statement was now put it in context of how crazy and volatile the market was especially during the holiday season of 2016 and yes it is fair to say that the market is very much stable despite the ridiculous amounts of volatility lightly as a result from OTC traders and a lot of FOMO/FUD... you do now seeing this kind of predictability in charting trends and patterns.

For example; same dots (same charting patterns) yet They did not connect. A rapid volume selloff and a Bear flag could be Yielding +10,000% ROI > 24 hours later and this much suggests one bittersweet notion—- that the party is over and it’s back to behaving like traditional institutional investors

NO more 10,000% + ROI on obscure entries with low market cap over the span of 60 minutes and no more pump and dumping which I’m all for the latter but not the former.

As far as my personal feelings on the matter; I think I pretty much covered it when I said it’s bittersweet. There is no better rush than turning a couple hundred into a couple thousand dollars profit in less than an hour at the same time there is no bigger gut punch than watching your you entire portfolio deteriorate and stop losses are not activating

Why? because these decentralized exchanges are still glitchy and very much in their infancy.

I think like most of us who started back then I made a fortune by Q417 and then Right around this time last year I was headed toward almost bankruptcy... and now Here I am somewhere in the middle of where I was && where I wish I was.

OFF to see the wizard

The wonderful wizard of OZ

To everybody out there that hates me;

Shout out this one is for you! Peace <3

C’est la vie.

Please read the disclaimer in the chart let me reiterate in case you didn’t read this part I am now 7/7 ever since I started publishing TA + Every time I do publish; I regret not starting sooner!!EMA12; C&H / Inverted head & shoulders confirm both rate short and long positions with healthy organic growth and current market price action is indicative of what indicators have dictated thus far in direct correlation with actual market projections.

For us early adopters it was surreal to transition into a stable market with predictable and feasible price comparison charting (Yes I realize how crazy that statement was now put it in context of how crazy and volatile the market was especially during the holiday season of 2016 and yes it is fair to say that the market is very much stable despite the ridiculous amounts of volatility lightly as a result from OTC traders and a lot of FOMO/FUD... you do now seeing this kind of predictability in charting trends and patterns.

For example; same dots (same charting patterns) yet They did not connect. A rapid volume selloff and a Bear flag could be Yielding +10,000% ROI > 24 hours later and this much suggests one bittersweet notion—- that the party is over and it’s back to behaving like traditional institutional investors

NO more 10,000% + ROI on obscure entries with low market cap over the span of 60 minutes and no more pump and dumping which I’m all for the latter but not the former.

As far as my personal feelings on the matter; I think I pretty much covered it when I said it’s bittersweet. There is no better rush than turning a couple hundred into a couple thousand dollars profit in less than an hour at the same time there is no bigger gut punch than watching your you entire portfolio deteriorate and stop losses are not activating because these decentralized exchanges are still glitchy and very much in their infancy.

I think like most of us who started back then I made a fortune by Q417 and then Right around this time last year I was headed toward almost bankruptcy... and now Here I am somewhere in the middle of where I was && where I wish I was.

I guess I can’t complain, after all it could be worse.

2017 == “The year of the ICO”

2018 == “The year of the #DEX”

2019 = “The year of the stablecoins”

2020= “The year of the FED/SEC”

2025 = • Global integration complete.

P.S. I would be remiss not to bitch at the fact that my phone dying prevented me from posting this signal at 9:00 (Over 3 1/2 hours ago that’s est.) And that I would just like to add:

The massive volume spike as well as the Parabolic upswing were NOT present at the time i wrote this.

This pisses me off infact becasue It’s getting to the point where it’s too late to publish and I like to post in depth technical analysis; Unfortunately not a luxury I could afford if I want you guys to make your entries in time before FOMO. It also reveals yet again how nasty I am at this game.

7/7 let’s go !! In no time I will be the king of trading view—(Unrelated note if $JCP has reached $1.18 ; It’s good for a close. Short complete.

Haven’t a take a look at NYSE yet— Will do so right now and try to post/publish a signal or two before the bell.

#ThursdayThoughts #ThursdayTrivia (I am live-streaming a IMMERSIVE/DIFFICULT blockchain trivia. The grand prize is a surprise— to be announced in the semi-finals. Simply buy a taco get the tippin .me Plug-in and your browser and then for a messily 50,000 s on LNTRUSTCHAIN: you are a contestant with a chance to win A prize worth $389.99+TAX But I promise you it is a Crypto related gift as usual of course that is unisex and no matter who you are you— you’ll LOVE it.

Try to step up just have guys on like Tuesday where I do a randomized giveaway; This is the trivia so if you think you are hot shit and have what it takes in blockchain/Crypto then put your money where your mouth is, 50K s is $4.17 (not even) If you are as good as you think you are that it should not be a problem right?

Yes I am taunting and encouraging anyone to get a crew to get anybody to sign up to this trivia tonight at 10:30PM EST.

The trivia will not occur today and I will be forced to postpone the event if I cannot get it least 16 entries because this prize is simply too costly for me to give away to only 4 interested people.

Regardless of who you are the community I can assure you that you will be caught off guard and that there will be questions that will leave you in awe— assuming It gets to that point where not everybody is eliminated on the blockchain 101 trivia. I’ve already predetermined the questions and anybody who’s been doing this for a while should be able to answer the first 10 without a hitch. It’s questions 12 through 15 that will really test your knowledge but if by some miracle you manage to answer questions correctly and have not yet been eliminated, There is one last bonus question which is ridiculously hard and if you could somehow it’s her that you will receive the grand prize as well as the tacos from all the entries & If it’s somehow a draw there will be a 15m recess and It will commence with another five questions that I am positive nobody can get right and they are not multiple-choice so luck haha.

Happy Wednesday everybody ! cheers && if I do not have a bit of the 800,000 sats Then I will postpone the trivia to next Thursday at that the Thursday after until I can get the 20 cheap wizards like myself who have knowledge enough to win this thing: yet for whatever reason is not willing to play!

for a $400 prize asking for 20 contestants totaling 1m sats or about $80 is NOT much to ask.

These giveaways are killing me and I’m not getting anything in return not even recognition so is much is I am a firm advocate of karma and I believe it very well it’s not going to cut it this time as no more Mr. Santa Claus. This prize Will make your entire day or night or week I can assure you that much.

Let the games begin! good luck everybody.

@a1mtarabichi (twitter, simply buy a taco from the feed assuming u have the plugin.)

I love this community despite the fact that there are some really bad actors and really low life scum bags; Who at times admittedly push me to the edge of the cliff, yet I would not trade it for the world.

Is XRP About to Rebound? Bullish Signals EmergeXRP Flashes Bullish Signal: Technical Indicator Hints at Imminent Rebound – 100x Gains Coming? The Future Is Closer Than You Think—Analyst

The cryptocurrency market is a volatile and often unpredictable space, where fortunes can be made and lost in the blink of an eye. Among the myriad of digital assets vying for attention, XRP, the cryptocurrency associated with Ripple Labs, has consistently been a topic of intense debate and speculation. While it has faced its fair share of challenges, including regulatory scrutiny and market fluctuations, XRP continues to hold the interest of investors and analysts alike.

Recently, XRP has been displaying what some experts are interpreting as bullish signals, suggesting a potential rebound in its price. These signals are primarily derived from technical analysis, a method of evaluating assets by analyzing statistical trends gathered from trading activity, such as price movement and volume. One particular technical indicator is hinting at an imminent upswing, leading some analysts to predict significant gains for XRP in the near future.

This article delves into the technical indicators flashing bullish signals for XRP, examines the factors that could contribute to a potential rebound, and explores the possibility of a 100x gain, a prospect that has captured the imagination of many XRP enthusiasts.

Technical Indicators Pointing Towards a Rebound

Technical analysis plays a crucial role in understanding potential price movements in the cryptocurrency market. Several indicators are currently suggesting a bullish outlook for XRP:

1. Moving Averages: Moving averages are commonly used to smooth out price data over a specific period, helping to identify trends. When a shorter-term moving average crosses above a longer-term moving average, it is often seen as a bullish signal, indicating that the price is likely to rise. XRP has recently exhibited this "golden cross" pattern on certain timeframes, suggesting a potential upward trend.

2. Relative Strength Index (RSI): The RSI is a momentum indicator that measures the magnitude of recent price changes to evaluate overbought or oversold conditions in the price of an asset. An RSI value below 30 typically indicates that an asset is oversold and may be due for a rebound. XRP's RSI has been hovering in oversold territory, suggesting that buying pressure could soon increase.

3. Fibonacci Retracement Levels: Fibonacci retracement levels are horizontal lines that indicate potential support and resistance levels based on the Fibonacci sequence. These levels are often used to predict where the price of an asset might find support during a downtrend or resistance during an uptrend. XRP has been testing key Fibonacci retracement levels, and a successful breakout above these levels could signal a significant price increase.

4. Chart Patterns: Technical analysts also look for specific chart patterns that can provide clues about future price movements. Some patterns, such as the "inverse head and shoulders" or the "double bottom," are considered bullish formations, suggesting that the price is likely to rise. XRP has been forming patterns that resemble these bullish formations, further supporting the possibility of a rebound.

Factors Contributing to a Potential XRP Rebound

While technical indicators can provide valuable insights, it is essential to consider the fundamental factors that could influence XRP's price. Several factors could contribute to a potential rebound:

1. Ripple's Ongoing Legal Battle with the SEC: The most significant factor weighing on XRP's price has been Ripple's legal battle with the U.S. Securities and Exchange Commission (SEC). The SEC alleges that Ripple sold XRP as an unregistered security, a claim that Ripple vehemently denies. A favorable outcome in this case could significantly boost XRP's price, as it would remove a major source of uncertainty and regulatory risk.

2. Growing Adoption of XRP for Cross-Border Payments: Ripple has been actively promoting XRP as a solution for cross-border payments, touting its speed, efficiency, and low cost compared to traditional methods. Increased adoption of XRP by financial institutions and payment providers could drive demand for the cryptocurrency, leading to a price increase.

3. Expansion of Ripple's Ecosystem: Ripple has been expanding its ecosystem by developing new products and services that utilize XRP. These include RippleNet, a network of financial institutions that use Ripple's technology for cross-border payments, and On-Demand Liquidity (ODL), a service that allows businesses to use XRP to source liquidity for cross-border transactions. A thriving ecosystem could attract more users and investors to XRP, further supporting its price.

4. Overall Cryptocurrency Market Sentiment: XRP's price is also influenced by the overall sentiment in the cryptocurrency market. A positive market sentiment, characterized by rising prices and increased investor confidence, could lift XRP along with other cryptocurrencies. Conversely, a negative market sentiment could put downward pressure on XRP's price.

The Possibility of a 100x Gain: A Realistic Scenario?

The prospect of a 100x gain in XRP's price has captured the imagination of many investors. While such a gain is certainly possible, it is essential to approach this scenario with a healthy dose of skepticism and realism.

To achieve a 100x gain, XRP's price would need to increase by a factor of 100 from its current level. This would require a massive influx of capital into XRP, driven by a combination of factors, such as a favorable outcome in the SEC case, widespread adoption of XRP for cross-border payments, and a significant increase in overall cryptocurrency market capitalization.

While these factors are not entirely out of the realm of possibility, they are by no means guaranteed. The cryptocurrency market is inherently unpredictable, and unforeseen events could derail any potential rally in XRP's price.

Analyst Perspective: The Future Is Closer Than You Think

Despite the inherent risks and uncertainties, some analysts remain optimistic about XRP's future. These analysts point to the potential for XRP to disrupt the traditional cross-border payments industry, the growing adoption of Ripple's technology, and the possibility of a favorable outcome in the SEC case as reasons for their bullish outlook.

One analyst, in particular, has stated that "the future is closer than you think" for XRP, suggesting that significant gains could be realized in the near future. This analyst believes that XRP is currently undervalued and that its price could surge once the regulatory uncertainty surrounding Ripple is resolved.

Conclusion: Navigating the XRP Landscape

XRP presents a complex and often contradictory picture. Technical indicators are flashing bullish signals, suggesting a potential rebound in its price. Factors such as Ripple's ongoing legal battle with the SEC, growing adoption of XRP for cross-border payments, and the overall cryptocurrency market sentiment could all play a role in determining XRP's future.

While the possibility of a 100x gain is enticing, it is essential to approach this scenario with caution and realism. The cryptocurrency market is inherently volatile, and unforeseen events could impact XRP's price.

Ultimately, whether XRP achieves its full potential remains to be seen. However, the recent bullish signals and the ongoing developments surrounding Ripple suggest that the future of XRP is closer than many might think. As always, investors should conduct their own research, assess their risk tolerance, and make informed decisions before investing in any cryptocurrency, including XRP.

USOIL analysis forecast update.The chart you've shared is a technical analysis setup for *WTI Crude Oil (USOIL)* on a 4-hour timeframe. Several tools and patterns are being used here:

### *Tools and Concepts:*

1. *Trendlines:*

* Diagonal lines connecting lower highs and lower lows showing a *descending channel* or *falling wedge*.

* There's a breakout marked where the price breaks above the descending trendline.

2. *Support and Resistance Zones:*

* Multiple horizontal shaded areas mark *resistance zones* (around 63–75).

* *Support zone* marked near 55.

3. *Chart Patterns:*

* The structure appears to resemble a *reversal pattern, likely an **inverse head and shoulders* forming at the bottom.

* Repeated W formations (double bottoms) can also be inferred.

* Potential *accumulation* or *consolidation phase* near the bottom support.

4. *Price Projection/Measurement Tool:*

* A *vertical measurement line* is used to estimate the breakout move — indicating a potential *16.17-point move* (28.83%) to around the 71.5 level.

5. *Break-Out Label:*

* Shows confirmation bias or expectation for a bullish breakout from the consolidation area.

6. *ABC Pattern or Elliott Wave-like Mapping:*

* Zigzag lines might suggest *corrective wave patterns* or a forecast of price action post-breakout.

### Overall Interpretation:

The chart suggests a *bullish reversal* setup, expecting price to break out of the downtrend and rally significantly. The zones and lines help define risk-reward areas and trade planning points.

Would you like a clean version of this chart with labeled elements and explanations?

USD/JPY pair analysis forecast for short scalp.### *Analysis of the USD/JPY (1-Hour) Chart*

This chart showcases various *technical analysis tools and patterns* to study market structure and predict future price movements.

---

### *Key Tools & Patterns Used:*

#### *1. Market Structure Concepts:*

- *CHOCH (Change of Character):*

- Indicates a transition from one trend to another (bearish to bullish).

- *BOS (Break of Structure):*

- Confirms a shift in trend momentum.

#### *2. Trendlines & Chart Patterns:*

- *Uptrend Line (Black):*

- Represents an ongoing bullish trend.

- *Wedge Formation (Yellow Points):*

- The market is forming a rising wedge, which can signal a potential correction.

- *Rounded Bottom (Blue Curve):*

- A *bullish reversal pattern*, indicating that price might continue to the upside.

#### *3. Liquidity & Key Areas:*

- *Liquidity Sweep (Red Box):*

- A manipulation move where price grabs liquidity before reversing.

- *POI (Point of Interest):*

- A key level where price action is expected to react.

- *FVG (Fair Value Gap):*

- A market imbalance that could get filled before price continues in the dominant trend.

#### *4. Trade Setup & Projection:*

- *Bullish Scenario:*

- If price retests the *POI or trendline*, it could bounce back up, following the blue projected path.

- *Bearish Risk:*

- If price *breaks below the POI and FVG area*, a deeper correction could follow towards the liquidity zone (LQD).

---

### *Conclusion & Trading Implications:*

- *High Probability Long Trade:*

- A pullback to the *POI/FVG area* could provide a buying opportunity if bullish momentum continues.

- *Risk Management:*

- A *break below the liquidity zone (LQD)* would invalidate the bullish setup.

Would you like help in setting up entry, stop-loss, and take-profit levels based on this analysis?

Comprehensive Technical Analysis of SOLANASolana has emerged as one of the digital currencies that attract traders’ attention due to its high price volatility and advanced technical capabilities. In this article, we will present a technical analysis of the SOLUSDT.P pair, relying on a variety of technical tools and indicators to provide a comprehensive outlook on the potential trends and short-term price movements.

1. Market Overview

Solana has experienced both upward and downward movements over the recent period, oscillating between critical support and resistance levels. Its price movement is affected by several factors, including:

Price Volatility:

Given the nature of the cryptocurrency market, volatility is an inherent part of the price action, requiring close monitoring of key technical levels.

Economic Factors and News:

In addition to technical analysis, news related to technological developments and institutional endorsements can play a significant role in determining market direction.

2. Support and Resistance Levels

Identifying support and resistance levels is a crucial step in understanding market dynamics:

Support Levels:

Some technical readings indicate the presence of strong support in the lower price area, with potential support levels ranging around $150-$155. Maintaining this level is important for traders, as a break below could lead to deeper corrections.

Resistance Levels:

On the upside, the asset faces major resistance typically located between $250 to $300. A breakthrough above these levels may signal the continuation of bullish momentum. Conversely, failure to break through may prompt traders to anticipate potential trend reversals.

3. Technical Indicators and Tools

A. Moving Averages

Moving averages are useful tools for determining the overall price trend:

Moving Average Crossovers:

The crossover between shorter-term moving averages (such as the EMA25) and longer-term ones (such as the EMA99) signals potential changes in direction. A shorter-term average crossing above a longer-term average is considered positive, while the opposite may indicate weakening momentum.

B. Relative Strength Index (RSI)

The RSI is used to measure overbought or oversold conditions:

RSI Readings:

An RSI reading near 70 indicates overbought conditions, while a reading below 30 suggests oversold conditions. Monitoring the RSI helps in assessing the strength of the current momentum.

C. MACD (Moving Average Convergence Divergence)

The MACD analyzes momentum and identifies potential turning points in the market:

MACD Crossovers:

Crossovers between the MACD line and the signal line are indicators that often precede potential trend reversals, whether bullish or bearish.

4. Chart Patterns and Price Formations

The SOLUSDT.P chart exhibits several technical patterns that may reveal market tendencies:

Cup and Handle Pattern:

In certain time frames, a “cup and handle” pattern can emerge—a classic bullish formation. If this pattern meets all its criteria, it may indicate a continuation of the upward trend following a period of consolidation.

Other Reversal Patterns:

Patterns such as the “head and shoulders” or descending channels should be monitored, as they can indicate a possible reversal toward a downtrend if momentum weakens.

5. Potential Scenarios

Bullish Continuation Scenario:

Support and Breakout:

If the price maintains its key support levels (around $150-$155) and manages to break through the upper resistance levels (between $250-$300), bullish momentum may resume.

Positive Indicators:

The appearance of positive moving average crossovers along with neutral to overbought RSI readings can support this bullish scenario.

Bearish Reversal Scenario:

Break of Support:

Should the price break below its primary support level, the market could enter a deeper downtrend.

Negative Indicators:

The emergence of bearish moving average crossovers and low RSI readings may indicate weakening bullish momentum, increasing the likelihood of a more significant correction.

6. Risk Management and Investor Tips

Traders should consider the following points:

Use of Stop-Loss Orders:

Setting stop-loss levels is crucial for limiting risk, particularly in highly volatile markets.

Portfolio Diversification:

It is advisable not to rely on a single asset but to diversify investments to mitigate risk.

Staying Updated with News:

Keeping track of technological developments and economic news is essential, as these factors can directly impact price movements.

Conclusion

The analysis of SOLUSDT.P shows that the asset is oscillating between critical support and resistance levels, with the potential for continued bullish momentum if resistance is broken, or a reversal toward a downtrend if support is breached. The future direction of the asset depends on several technical and market factors, necessitating close monitoring of daily changes and the use of diverse technical indicators to make informed trading decisions.

Technical Analysis for GER40 (DAX) for January 13-17Overall Trend : On the daily chart, PEPPERSTONE:GER40 ( XETR:DAX ) has been exhibiting a bullish trend, operating within an ascending channel. We are currently at the 50% mark of the ascending channel, a point of indecision at the moment, as signs of exhaustion are observed following significant upward movements, suggesting a potential short-term consolidation or correction down to 20,005 if the support area is breached.

Support and Resistance Levels:

Resistance 1: 20,872 points

Resistance 2: 20,474 points

Support Area 1: 20,077 - 20,198 points

Support 2: 20,005 points

Chart Patterns and Technical Indicators:

Candlestick Patterns: Recently, indecision patterns such as dojis have formed on the daily chart, indicating a possible reversal or consolidation.

RSI (Relative Strength Index): The daily RSI is near the overbought zone, suggesting that the asset may be overvalued and subject to a correction.

Wyckoff Analysis: A potential distribution phase is observed, where major players might be taking profits after the recent rally, preparing the market for a possible reversal or sideways movement.

Relevant Fundamental Factors: The German economy faces significant challenges, with a growth forecast of only 0.1% in 2025 after two years of contraction. Additionally, the recent political crisis has resulted in the collapse of the governing coalition, increasing economic and political uncertainty in the country.

Possible Scenarios:

Bullish Scenario: If the price breaks above the 50% mark of the ascending channel with significant volume, it may target the next resistance at 20,474 points. To confirm the continuation of the bullish trend, it is important for the RSI to remain at moderate levels, avoiding the extreme overbought zone.

Bearish Scenario: If the price loses the support area, it may accelerate the decline towards the next support at 20,005 points. A descending RSI would reinforce this scenario, indicating increased selling pressure.

EURJPY Bearish Outlook Technical Factors

Chart Patterns: Bearish chart patterns such as head and shoulders, double tops, or descending triangles can signal potential downside in EURJPY.

Technical Indicators: Overbought conditions on oscillators like RSI or Stochastic can indicate a potential reversal. Conversely, bearish divergences between price and indicators can also be a bearish sign.

Support and Resistance Levels: Breaking below key support levels can confirm a bearish trend, while resistance levels can act as potential targets for short positions.

Risk Management

It's crucial to remember that no trade is guaranteed to be profitable. Implementing a robust risk management strategy is essential. This includes:

Stop-Loss Orders: To limit potential losses

Take-Profit Orders: To secure profits

Position Sizing: To manage overall risk exposure

Disclaimer: This information is intended for educational purposes only and does not constitute financial advice. Trading involves risk.

Would you like to explore specific technical indicators or chart patterns in more detail? Or perhaps you're interested in discussing potential entry and exit points for a short EURJPY position?

BTC Consolidation 12/11/2023 OVERVIEW

After a period of rapid gain in the previous weeks, the crypto market / BTCUSD will be consolidating to confirm it's current support levels above $36,000, so it can continue onward at a sustainable rate.

KEY SUPPORT LEVELS

$38,400

36,400

Direction Expectations Short Term

Sideways

What is price consolidation?

Price consolidation in the context of financial charts refers to a period where the price of a security (like a stock, bond, or commodity) trades within a relatively stable range without significant upward or downward trends. It's a phase where the market is essentially in a state of equilibrium, with supply and demand for the security appearing to be evenly balanced. This period is characterized by the following features:

Narrow Trading Range: The security's price moves within a limited range, showing less volatility compared to trending periods.

Indecision Among Traders: Consolidation often reflects a period of indecision among investors and traders. Neither the buyers nor the sellers are in control, leading to a stalemate of sorts.

Preceding or Following Trends: Price consolidation can occur after a significant upward or downward trend as the market 'catches its breath' before potentially continuing the trend or reversing it. It can also appear as a pause in the middle of a larger trend.

Chart Patterns: In technical analysis, consolidation periods can form various chart patterns like triangles, rectangles, or flags. These patterns are often used by traders to predict future market movements.

Volume Consideration: Generally, trading volume is lower during consolidation phases, as fewer traders are making significant moves.

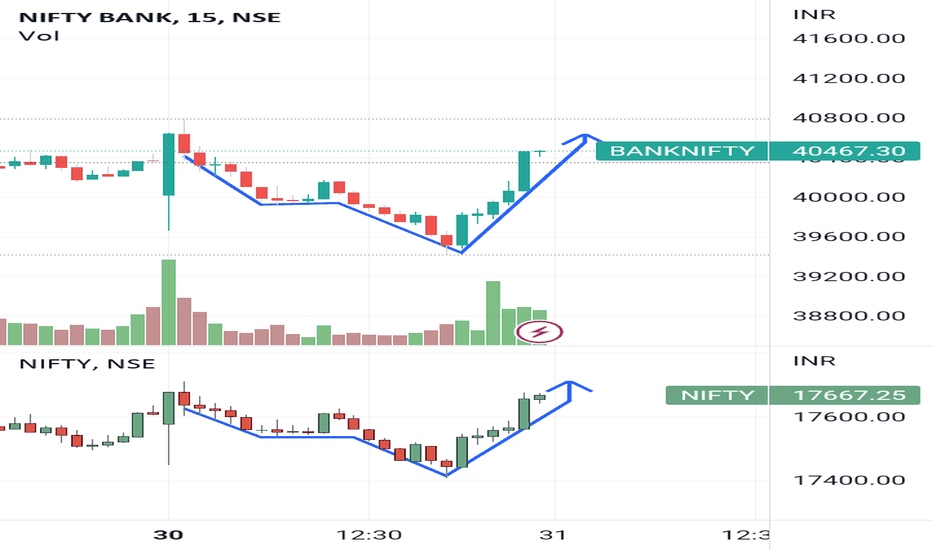

Compare nifty and bank nifty Hi this Vijay Shrivastava and

This is thinking 🤔💭

I try to compare and understand nifty50 with banknifty..

There r amazing 📊 chart patterns. You can see both chart moving in same patterns..if I say nifty50 follow banknifty trandline so not a false statement.

Be care full on trade..

in my opinion Nifty have multiple sector in our basket

And banknifty have all banking sector..

If nifty50 react by banking sector..

So definitely big money down fall is there..

We can see soon .....

harminoc eurusdhe similarity between harmonic and basic chart patterns is that, for each of them, the shape and structure are key factors to recognizing and validating a specific pattern. The next price movement can thus be projected with the goal of turning these patterns into profits. However, a key difference is that harmonic patterns are defined more precisely. They are 5-point reversal structures, containing combinations of well defined consecutive Fibonacci retracements and Fibonacci extensions, leaving less room for flexible interpretation.

Harmonic patterns continuously repeat themselves, especially in consolidating markets. There are basically 2 types of patterns: 5-point retracement structures like the Gartley and the Bat and 5-point extension patterns like the Butterfly and the Crab. Trading harmonic patterns requires patience because, due to the specificity of the ratios, patterns that appear harmonic may not be if they don't align with the proper measurements.

Harmonic EURUSDThe similarity between harmonic and basic chart patterns is that, for each of them, the shape and structure are key factors to recognizing and validating a specific pattern. The next price movement can thus be projected with the goal of turning these patterns into profits. However, a key difference is that harmonic patterns are defined more precisely. They are 5-point reversal structures, containing combinations of well defined consecutive Fibonacci retracements and Fibonacci extensions, leaving less room for flexible interpretation.

Harmonic patterns continuously repeat themselves, especially in consolidating markets. There are basically 2 types of patterns: 5-point retracement structures like the Gartley and the Bat and 5-point extension patterns like the Butterfly and the Crab. Trading harmonic patterns requires patience because, due to the specificity of the ratios, patterns that appear harmonic may not be if they don't align with the proper measurements.

us 30What Types of Chart Patterns You Should Know

Throughout this article series, we’re going to discuss how to make money with the most profitable chart patterns. Some of the most profitable chart pattern trading strategies include:

Triple Top Chart Pattern Trading Strategy

Cup With Handle Trading Strategy

Bump and Run Chart Pattern

Price Channel Pattern

Symmetrical Triangle

Double Top Chart Pattern Strategy

Double Bottom Chart pattern Strategy

Rectangle Chart Pattern Strategy

Forex Chart Patterns

Reversal Chart Patterns

And many more.

Earlier, we posted a clear price chart of the EUR/USD. But if you look closer and read the chart patterns language, we can identify some of the most profitable chart patterns (see figure below).

niftyWhy Are Chart Patterns So Important?

If you remove all your indicators and momentum indicators from the charts, and everything else that might make your chart less clear, and just look at the price action, whether it’s a 5-minute chart, daily chart or similar, it’s your preferred time frame. You’ll actually gain more insights into what happens in the market.

What Types of Chart Patterns You Should Know

Throughout this article series, we’re going to discuss how to make money with the most profitable chart patterns. Some of the most profitable chart pattern trading strategies include:

Triple Top Chart Pattern Trading Strategy

Cup With Handle Trading Strategy

Bump and Run Chart Pattern

Price Channel Pattern

Symmetrical Triangle

Double Top Chart Pattern Strategy

Double Bottom Chart pattern Strategy

Rectangle Chart Pattern Strategy

Forex Chart Patterns

Reversal Chart Patterns

And many more.

BTCUSDT Harmonic updatedBTCUSDT harmonic pattern updated.

What is Harmonic Pattern

The similarity between harmonic and basic chart patterns is that, for each of them, the shape and structure are key factors to recognizing and validating a specific pattern. The next price movement can thus be projected with the goal of turning these patterns into profits. However, a key difference is that harmonic patterns are defined more precisely. They are 5-point reversal structures, containing combinations of well defined consecutive Fibonacci retracements and Fibonacci extensions, leaving less room for flexible interpretation.

Harmonic patterns continuously repeat themselves, especially in consolidating markets. There are basically 2 types of patterns: 5-point retracement structures like the Gartley and the Bat and 5-point extension patterns like the Butterfly and the Crab. Trading harmonic patterns requires patience because, due to the specificity of the ratios, patterns that appear harmonic may not be if they don't align with the proper measurements.

BTC bottomed at 7300?What is Parabolic Move?

In purely mathematical terms, a parabolic move is an exponential rise. Parabolic Curve chart patterns are generated when steep rise in prices are caused by irrational buying and intense speculation. Parabolic curve patterns are rare but they are reliable and are generated in mega bull trends. These patterns trend gradually making higher highs and lower lows in the beginning stages but can be volatile in the exhaustion and reversal stages.

Irrational buying in the public generates a strong rally to push prices vertically, followed by a steep sell off. Examples of this market types are the NASDAQ bullish markets during 1990–2000 (retraced 80%) and Gold prices from 2000–2011 (retraced 62%).

Parabolic curve is a reversal pattern and has a very predictable outcome. Although they are predictable, they are relatively difficult to trade since the market sentiment is bullish and may be relatively tough to point reversals to trade. Most Parabolic curve patterns have a significant correction of 62–79% of its price rise (from the top).

The basic ideas behind Parabolic curve patterns:

— Pattern is easy to spot but difficult to trade with excessive volatility.

— Most Patterns retrace to 62–78% of its rise. 50% retracement is first target.

BTC moved from 3.337 to 13.868 = $10.530 with %315.49 increase

From $13.868 to $7296 = $6.572 with %48 (correction) retracement.

Are we done here or there is another %30 drop coming?

Bitcoin is set to GROWTH to $4,500. Here is WHY + Trade SignalsHi there!

Here is an advanced technical analysis for Bitcoin based on chart patterns and indicators, PLUS a ready-to-use trading strategy and trade signals! Enjoy reading this idea and you’ll get exact instructions on how to trade Bitcoin over the next week and achieve profitability!

On a daily chart, BTC/USD seems to be set to strong growth over the next week.

Technically, we’ve got two patterns: an ascending trend channel and an ascending triangle. Both chart patterns represent a continuation type of pattern and indicate that an uptrend should be expected (is more likely than not).

In particular, there is an upward trend channel on a daily chart. The trendlines of this channel slope in an upward direction and the BTC price is making higher highs (Feb 8 and Feb 24) and higher lows (Feb 13 and Mar 4). This is a strong continuation pattern that confirms an upward trend signal.

Also, there is an ascending triangle, as shown on the chart. The trendline connecting the high prices is horizontal at $4,000, and the trendline connecting the low prices forms an uptrend. What this pattern means is that market participants have been selling BTC at $4,000 over the past two weeks, always putting a halt to rallies at the same price point, but that buyers are getting more and more bullish and stepping in at increasingly higher prices to halt sell-offs instead of waiting for further price declines. We know that an ascending triangle typically forms in an uptrend and forms a very strong bullish signal. If the rally continues above the $,4000 (beyond the triangle), that will generate a strong bullish signal.

In addition, we have a series of confirmatory signals from technical indicators. On a daily timeframe, the Stochastic oscillator (5,3,3) is growing, and the %K line is moving above the %D line. This confirms an upward trend and a buy signal.

The fact that the Stoch oscillator is approaching an overbought range also implies that a short-term correction downward is possible before BTC/USD continues to set new highs.

We’re also seeing that the Fibonacci Retracement CONFIRMS all of the previous two impulse waves up and two corrective waves. The 1st take-profit price at $4,250 is precisely located at 61.8% of the Fibonacci sequence, and the 2nd one is located at 78.6% of the Fibonacci sequence. Basically, the Fibonacci Retracement further confirms that the price targets we’ve set are valid.

So, here is the summary of trade signals:

- Enter Long (Buy) now at $3,950. Otherwise, to buy at a better price, you should wait when the Stoch (5,3,3) enters an oversold range and the %K moves from below the %D line to above it. Watch for this signal very carefully by analyzing the chart, as presented above!

- Set the Stop-Loss at $3,750 - the next significant support level.

- Set the Take-Profit (partial close) at $4,250 - the next significant resistance level. The second Take-Profit should be set at $4,500.

- Forecasted P&L: +$475 or +12% (or +120% per 1 Lot with 10x Leverage)

- Risk/Reward Ratio: 2.37x

If the price breaks through and above the $3,990 resistance - the continuation of an uptrend is expected. If that happens, the price will obtain a strong momentum and will rise by a significant amount at least to $4,250.

Otherwise, the price can drop through and below the current upward channel, and there will be excellent opportunities for short selling. The reversal (downtrend) signal will be generated if the price drops below the $3,750 support.

I hope this analysis was useful to you.

If you like it and would like to receive future updates - Please, follow me on TradingView!

If you follow me, I guarantee you will receive timely updates to this trading strategy in the future, including all new trading signals.

This will allow you to stay on top of the current Bitcoin trend and hopefully maximize your profits!

If you agree, please, Like this idea - This would be the best feedback and encouragement for me!

To your trading success,

Monfex!