What Type Of Forex Trader Are You? Four Types Of Forex Traders:

1) Day Trader- A day trader is one who closes all trade positions at the end of each trading day and makes sure there are no open positions overnight. Day traders function with an extensive knowledge and experience of what the Forex entails. This category of Forex traders makes use of a variety of methods to make proper trading decisions that lead to success. Some trade securities with the use of technical indicators and analysis in the calculation of favorable trade entry and exit time frames while other trade based on instincts.

2) Position Trader- A position trader trades securities in the Forex market by holding a trade position for a long-term, in a period of weeks to months and sometimes, years. These set of traders, unlike day traders, are less concerned with short-term price fluctuations and the economic news release of the day. Position traders are not active traders. They initiate few trade positions in an entire year.

3) Scalper Trader- A scalper trader holds a trade position for a short-term period in an attempt to make profits out of the short hold. These set of traders buy and sell securities many times in a day with the mindset of making a small percentage of consistent profits out of the market. A scalper uses a manual and automated trading system on various platforms thereby developing functional strategies that generate profits from the bid and ask spreads. The manual system of trading involves the trader making trade executions while sitting in front of his computer while the automated trading strategy involves the trader setting rules and guidelines on how to use trade signals.

4) Swing Trader- A swing trader are those who make profits and returns in the Forex market by holding a trade position overnight to several weeks. These set of traders make use of fundamental analysis, the intrinsic value of a security, price trends, patterns, and technical analysis to search for financial instruments with short-term price momentum. Swing traders trade by the identification of securities which has an extraordinary possibility to move in a short time frame. The goal in swing trading is to trade on large price moves on a daily basis by spending longer time (weeks and months) monitoring the security in question.

Trading Psychology

Drop Base Drop (DBD) Need2KnowPart 1: Drop-Base-Drop

Drop- market suddenly is bearish

Base- market ranges or goes sideways, then

Drop- market again breaks out of range and goes down

Note: The Base area on 1 hour, 4 hour and daily charts are best times to set up any new trades with right risk management as always.

Trading Daily Charts (Might Save Your Trading)If You Master Forex Trading On Daily Charts, You Can Trade For A Lifetime. (Understand the language of candlesticks on daily charts)

1) Quality trades not Quantity of trades- Trade your best trade setups only at swing points on daily charts.

2) Patience- You make money waiting not trading. You do not need to trade 20-30 times on lower time frames per month, when 2-3 times will make same money with less emotions and stress. Also, you will have more time freedom to enjoy life and find balance. Forex trading is not everything you are.

3) Probabilities- Only trade your best set ups at swing points (ex: like support/resistance, fib ret 50% to 61.8% area, swing points, etc..

4) Lower Lot Size- Related to using high stop loss, but like chart example let trade run for one or two weeks. 1:5 to 1:8 Risk Reward on trades will be goal.

5) Turtle Not Rabbit Trading Is Key- Trading Forex is a turtle marathon not a rabbit sprint race. Slow down- have faith in your strategy and edge.

6) Daily Trading Might Be Your Holly Grail- Look for entering only on Engulfing, Harami or Pin-bar setups on daily charts (that is all you need).

If you are part of the majority of Forex traders whom trading is difficult, DO NOT trade lower time frames which are under 1 hour (to much noise).

Only trade daily time frames until the end of this year and master them. Then maybe, next year can go to lower time frames of 4 hours and 1 hours. You tube videos on Forex trading position sizing, risk management and Forex daily charts. Daily charts help develop a more effective and accurate market bias, higher risk and reward (look at example chart) with 50 pip stop risk vs. 5xs to 8xs reward- which is great. Slow ans stead wins the race (Hare vs Turtle).

Spot Trading vs Margin Trading Pros and ConsSpot Trading is the most basic form of trading method and is the most suitable for beginners in trading. It's simply a BUY > HOLD > SELL mechanism.

On the Other Hand

Margin Trading is complicated and should only be done by experienced traders. There are various components to margin trading such as Maintenance margin, margin calls, leverage, and liquidation.

Pros and cons of Spot Trading

👉Spot trading is easy to learn and understand and is a good starting point for beginners in Trading.

👉It's an easy process to manage risk in spot trading not taking all the complications of liquidation or margin calls.

👉You can hold an asset for a much longer time and in the case of cryptocurrency can also transfer to any cold wallet.

👉No Trading happens during downtrends.

👉The potentials gains are not very good on a smaller investment amount.

Pros and cons of Margin Trading

👉Margin Trading needs some advanced knowledge of various things such as margin calls, liquidation, leverage, etc. Hence it's not recommended for new traders.

👉You can make profits on both uptrends(by going LONG) and downtrends(by going SHORT).

👉Gives an ability to trade much larger amounts with a relatively small initial investment by using leverage.

👉Margin Trading is risky, and if not done properly can blow your account in a very short time span.

👉Profits are higher when utilizing margin trading, and so are the losses. Every exchange has its own rules for margin trading, which need to be understood carefully before investing.

Thanks for reading and what kind of trading technique do you use and why? Share in the comments below.

For more similar educational ideas, scripts and trend analysis follow us.

Happy Trading.

How To Trade With The Big Banks (Price Cycle Trade Setup)Elements To The Trade Set Up: Price Cycle Of Institutions.

1) Expansion= Order block/Zone

Is when price moves quickly from a level of equilibrium in other words when price breaks out of consolidation. This will leave an order block or zone behind.

2) Retracement= PA Fills In Any Imbalance

Is when price pulls back inside the recently created price range or close to breakout of expansion area. Look for imbalance to be filled on retracement.

3) Reversal= Seek To Pick UP Liquidity

Is when price moves in the opposite direction from the current market direction was moving in. (from up trend to a downtrend).

4) Consolidation= Equilibrium In PA

Is a period of ranging or sideways price action, before expansion in price action area.

How to place stop loss like a Pro TraderStop loss placement is perhaps not the most glamorous of trading topics to discuss, but it is a critically important one. If you do not know how to properly place your stop loss, you will be in for a very, very rough ride as you trade the markets. Essentially, for a trader, everything hinges on proper stop loss placement and risk management. If you understand these two aspects of trading and how to approach them properly, making consistent money in the market will become much, much easier for you.

Note : This lesson is based on higher time frame charts and the concepts are not applicable to very low time frames which is a different world of trading and not something I do or recommend so I can’t comment on it.

The theory behind placing stop losses like a pro trader

The first thing to understand and drill into your head about stop loss placement is that you should NEVER place a stop loss based on some random amount of pips. I know a lot of traders do this because I get emails from traders telling me they use “20 pip stops” or “50 pip stops”, etc. etc. This is NOT proper stop loss placement and it is definitely NOT how professional traders place their stop losses…

A stop loss should typically be based on a level in the market. Price should have to breach a level to ‘prove’ your trade wrong. You want to see price invalidate your view by giving you fact-based evidence you are wrong, that evidence comes in the form of the most logical nearby level of support or resistance being breached.

You need to take into account the context of the market you are trading and determine what level price would have to break through before your original view doesn’t make technical sense anymore. Let’s take a look at two examples to make this clearer…

The first example below shows a random pip amount stop loss placement, the second example shows a stop loss placed within the context of the market and nearby levels. Make note of the end results of both trades…

Notice in the chart below the trader placed his stop loss at an arbitrary 50 pip distance from entry. Traders typically do this because they don’t understand how to place stops properly and also because they want to trade a bigger position size. This is wrong. You need a logic / chart-based reason to place a stop loss, not just a random pip distance or a pip distance that will allow you to trade the size you want. Notice this trader would have been stopped out for a loss just before the market shot higher, without them on board…

In the next chart, we can see how this trade worked out for the trader who knew how to place stops properly / like a pro and who wasn’t placing his stop arbitrarily or based on greed (to trade a bigger size). Notice the stop loss was placed beyond the key support level and beyond the pin bar low, giving the trade good space to work out but also being placed at a point that would logically invalidate the trade if price moved beyond it….

Let’s briefly go over typical stop loss placement on two price action setups I teach; the pin bar signal and the inside bar signal . You will notice, I used a risk reward ratio of 2 to 1 on each trade, this is my ‘default’ risk reward. In other words, I always start any trade by seeing if a 2 to 1 (or more) risk reward is realistically possible given the market structure and context the pattern formed within. For expanded examples, you can reach out to me for my lesson on how to place stops and targets like a pro .

Note: Be aware of the average volatility over the last 7 to 10 days of the market you’re trading. You want your stop at least half of ATR (average true range) if not more or you will get stopped out due to noise.

The Average True Range is a tool we can use to see average market volatility over XYZ days. It is a good tool to utilize for stop loss placement when no nearby key levels are present. To learn how to apply and use the ATR tool more in-depth, you can reach out to me for my article on the average true range.

The example below shows how to use the ATR for stop loss placement and how it can keep you in a trade despite initial choppy conditions after the pattern…

IMPORTANT STOP LOSS PLACEMENT TIPS

It’s important to consider reward or target potential before taking any trade. You base the potential target of a trade on the stop loss distance. If the stop has to be too wide in order for the trade to have enough space to potentially work out, and the risk reward potential doesn’t stack up, then it’s usually not the best idea to take the trade.

Risk reward and position sizing are intimately related to stop loss placement obviously, and crucial topics in their own right. But, we are focusing here in this lesson just on stops, be aware that stops are paramount and take precedence over targets, in a way, stops are a qualifier for the target and overall risk reward and will effectively help you filter trades you should take and should not.

It is important to note that stops should always remain constant and can’t be widened, however targets can be widened, stops should only ever be tightened and moved into break even and trailed, make sure that’s concrete in your trading plan.

Stops are crucial to managing risk because once we find the stop loss placement we can then determine our position size on the trade and then we know ahead of time the cost and risks of the trade. As part of our trading business plan, stops are a cost of doing business as a trader, they are also there to force us to get out if we are wrong on a trade, despite our emotional bias towards staying in a trade, which in the end can cost us dearly if we were to hang onto a loser until we blew out our account balance.

CONCLUSION

A properly placed stop loss is truly the starting point of a successful trade. It allows us to proceed with calculating reward targets on trades and position size, effectively allowing us to execute our predetermined trading edge with a clear mental state and discipline. Traders who do not focus on stop loss placement first or put a lot of importance on doing it right, are doomed to fail and blow out their accounts.

I hope today’s lesson has given you a little ‘snapshot’ into how I approach stop loss placement. My trading course and members’ area will further educate you on how I place stop losses and how I incorporate stop loss placement into my overall trading strategy. To learn more, you can reach out to me privately.

Daily Primer: Break your limits 💥In todays daily primer we talk about limitations and cause and effect. This short 5 minute video will give you the necessary guidance as to what you need to focus on to achieve the success you seek in the markets.

Success in trading, just like in any other business, is a

cause and effect relationship:

Poor or average causes = poor or average results

good causes = good results

excellent causes = excellent results

If you want to achieve success, do the work!

(metal: have patience, discipline, resilience)

(work ethic: prepare your charts, know the news, prepare your plan)

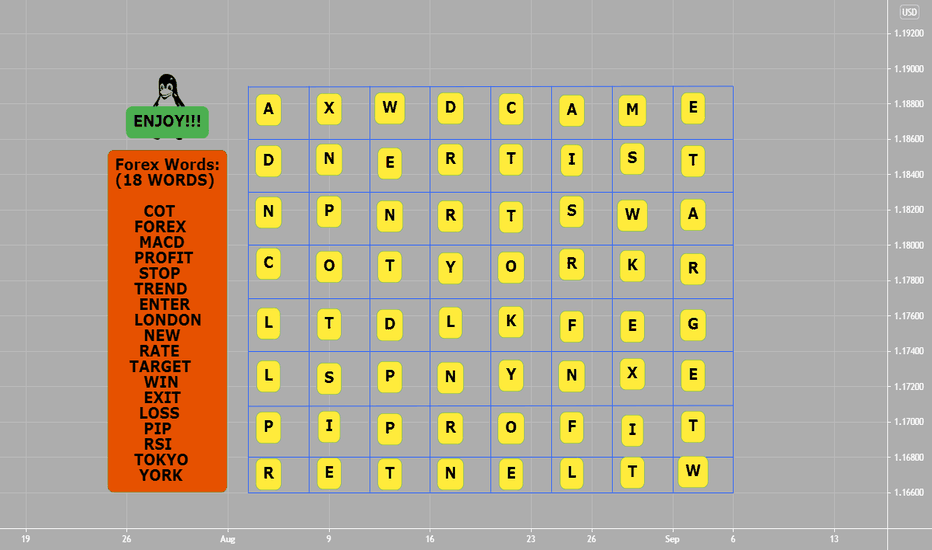

Forex Trading Psychology (Word Find) Forex Psychology is very high on list of if you succeed or fail as a Forex trader. You need to get mind right of controlling risks and of slow progress.

Forex trading is not a "get quick scheme" business or hobby but a slow methodical approach like laying bricks one at a time, over and over.

If your trading psychology (from the neck up) is right then your trading Forex you will be easier and more profitable, that is most of Forex trading.

Here is a little fun with this Forex Trading Psychology related word find- with key words in that process of the mental side of trading.

Top 5 Most Traded Forex Currencies & Sessions The Top 5 Most Traded Currencies in the World

1. US Dollar (USD)

The official currency of the United States of America, the US Dollar is also the world’s primary reserve currency.

Most traded currency pair: EUR/USD

Most active trading session: New York and London sessions

2. Euro (EUR)

The second widely traded currency is the Euro.

Most traded currency pair: EUR/USD

Most active trading session: London and New York sessions

3. Japanese Yen (JPY)

The Japanese Yen is the official currency of Japan.

Most traded currency pair: USD/JPY

Most active trading session: New York and Tokyo sessions

4. Great British Pound (GBP)

The official currency of the United Kingdom and its territories, the GBP is known colloquially as the Pound Sterling.

Most traded currency pair: GBP/USD

Most active trading session: London and New York sessions

5. Australian Dollar (AUD)

The Australian Dollar is the official currency of the Commonwealth of Australia.

Most traded currency pair: AUD/USD

Most active trading session: Sydney/Tokyo and New York sessions

NVDA, Continuation of correction or making new ATH ?Is NVDA on the way to make a new ATH or correction still continues? We have to follow.

NVDA is a beautiful example of different scenarios possibility! If we look at the chart (right side) we simply may consider that correction is completed at 0.382 Retracement of last rally with clear abc form of correction but, is this the only possible scenario? Of course NOT

Flat corrections may mislead many traders. Being aware about flat corrections and its characteristics is necessary but not enough at all.

Being realistic is a key. We have to consider all possible scenarios and control our emotions. Traders who are long from the last low may not want to see the other possible scenario. They certainly wish to see new ATH but it may takes some more time than they expect!.

On the left side of the chart we can see the flat correction. In a flat correction wave (a) is a 3 leg wave. wave (b) typically goes above 0.618 Retracement and touches 0.786 and even goes higher to 0.88 Retracement . Then, when every one expect a new high it suddenly goes for a 5 leg down wave (c).

Which scenario is going to happen? No one knows. We have to use some risk management tools to manage our risk . Of course opening a position at such conditions is gambling not trading.

We always trade objectively and try to see all possible scenarios. Don't we?

The Different Types Of Trading StrategiesHello everyone, as we all know the market action discounts everything :)

_________________________________Make sure to Like and Follow if you like the idea_________________________________

In today’s video, we are going to be talking about The Different Types Of Trading Strategies, We are going to compare them to each other and look at their characteristics.

Characteristics include 1) Time Duration, Type of Chart, Trade Targets & Risks, Frequency of Trades, Entry and Exit Time.

There are 4 types of trading styles :

Most people fall in the first 3

1) Scalping

2) Day trading

3) Swing trading

4) Position trading (Refers to holding a certain position over a very long time frame like a number of years, I think this type of trade is more of an investment than trading but technically it's still trading so I had to mention it ).

So Let Us Start...

1) Scalping

Time Duration is between a few seconds and a number of minutes

The Analysis is done on 1,2 and 5 minutes charts

Small targets considering the very short trade duration

High frequency of trades because of the small risk on each trade

Scalpers need to know exactly when to enter and when to exit a trade because a small mistake can have a huge impact on the trade

2) Day trading

Time Duration from 15 min to a number of hours

The analysis is done on 30 min, 1 hour, and 4-hour charts

These trades have a larger target than Scalping

Day Traders have a lower trade frequency than scalpers and its usually between 2-10 trades per week

Day Traders doesn’t have to be so precise with entry and exits like in Scalping because being late for a trade on a daily basis won't have that much of an impact on the trade.

3) Swing trading

Time Duration typically last from a day to a couple of months

The Analysis is done daily, weekly & monthly charts

Because of the time frame, Targets usually are way larger than day trading or scalping

Low frequency in trades, Usually between 2-15 trades per month

Entry and exits here don’t have a big impact because the targets are so big

So now you ask yourself how do I know which type of trader am I?

And it comes down to 2 main factors :

Personality: You could be someone who likes to hold trades and profit big so swing trading is for you, Or you could be someone who doesn’t like to hold trades over a day period so scalping or day trading could be for you.

Lifestyle: So you may not have the time to always watch the market and how it's moving, so scalping and day trading are not for you, but for swing trading, u only have to check the market once a day so it's the better option for you.

Don’t feel like you need to decide what type of trader you are, you should try all of them and see for yourself what are you comfortable with after all there is no right answer.

I hope that I was able to help you understand The Different Types of Traders better and if you have any more questions don't hesitate to ask.

Hit that like if you found this helpful and check out my other video about the Moving Average, Stochastic oscillator, The Dow Jones Theory, How To Trade Breakouts, The RSI, The MACD, and The Bollinger Bands, links will be bellow

8 Major Currencies Nickname & Sessions Best Times to Trade 8 Major Currencies is when base currencies session is open. Why? It is time when highest liquidity & volume is trading.

Sydney:

AUD

NZD

Tokyo:

JPY

CHF

Frankfurt/London:

GBP

EUR

New York:

USD

CAD

PLEASE CONVERT SYDNEY-TOKYO-FRANKFURT/LONDON-NEW YORK sessions to your individual time zones: to get exact times of open and closes and overlapping sessions of TOKYO/LONDON and LONDON/NEW YORK sessions. Overlapping are highest liquidity and volume times of the Forex session.

8 Benefits Of Trading Forex8 Benefits Of Trading Forex-

-Low cost

Generally, retail brokers make their profits from the Bid/Ask Spread, which is apparently very transparent to users.

-No middle-people

It allows you to trade directly with the market accountable for the pricing of the currency pair.

-No fixed lot size

Lot sizes differ broker to broker - standard lot, mini lot, micro lot or even nano lots. This enables you to start trading from as low as $50.

-Low transaction costs

The retail transaction cost (bid/ask spread) is usually as low as 0.1% and for bigger dealers, this could be as low as 0.07%.

-No one can control the market

The foreign exchange market is large and has many participants, and no single participant (not even a central bank) can control the market price for a prolonged time period. Therefore, the chances of sudden extreme volatility is very rare.

-24-hour open market

The Forex market starts, from the Monday morning opening of the Sydney session to the afternoon close session of New York session.

- Use of Leverage and Margin

Forex brokers permit traders to use leverage and with low margin, which gives ability to trade with more money than what is available in your account.

-Very High Liquidity

Because the size of Forex market is huge, it is extremely liquid in nature. This allows you to buy or sell currency any time you want under normal market conditions. There is always someone who is willing to accept the other side of your trade.

The Bid-Ask Spread (What Is It?)The spread is the difference between the bid price and the ask price.

The bid price is the rate at which you can sell a currency pair.

The ask price is the rate at which you can buy a currency pair.

Whenever you try to trade any currency pair, you will notice that there are two prices shown, left price is BID and right price is ASK.

The spread is brokerages commission on that trade, that is why all trades start off in negative until that spread is negated before turning profitable.

For Your Information:

The lower price is called the “Bid” and it is the price at your broker (through which you’re trading) is willing to pay for buying the base currency.

The higher price is called the ‘Ask’ price and it is the price at which the broker is willing to sell you the base currency against the counter currency.

What Is The 80/20 Rule? (Forex trading)What is the 80/20 rule? this applies to play, work, trading, business and all parts of your life.

20% (of your trading) equals 80% (of your results).

An 80/20 mindset enables you to take control!

- More Time

- More Focus

- More Money

- More Freedom

- Less Stress

" Time Is A Gift"

"Time Is Money"

Questions To Ask Yourself?

1) Can you trade less and make more money trading?

2) Can you trade only high quality trades with the right pair, at right price, during right session & at right time?

3) Can you focus on only trading only one or few Forex pairs and know everything about them? news, price action etc...?

4) Can you trade with a simple and repeatable trading system and edge to profit in long run? Is trading strategy flexible?

5) Can you always use discipline when trading? using risk management: stop, entry and targets to protect your account?

Risk Management (Your #1 Priority)Risk Management in Price Action Trading

Risk management in price action trading is much like risk management in any other style of trading; the same basic rules apply:

1. Know your maximum risk tolerance, i.e. the loss you are willing to take on each trade, before you place the trade. A common rule is that traders will not put more than 2% of their funds in the market at a time.

2. Understand correlation between assets, and to what extent you would like to be diversified.

3. Know when you will exit before you enter.

4. Know your reward/risk ratio.

5. Identify what you expect to happen and why, and what price point negates that expectation. This is price point at which you should put stop. Of course, with risk management, techniques are important, but, ultimately, it is up to the trader to ensure they are psychologically prepared for all that is involved.

Even if a trader is using a fully automated system, he/she must still have confidence in the system, and must know when any losing streak experienced is just a temporary losing streak versus a more fundamental problem suggesting the system is no longer valid.

Trend lines (How To Draw & Use)There are a few basic rules to bear in mind when drawing trend lines:

1. Tentative trend line - A diagonal line market bounces off of twice. This trend line is indicative of a potential trend, but is not confirmed & actionable yet.

This is a tentative trend line; two points touch the line. It suggests the possibility of a trend in the making, though conventional analysis will not regarding the trend as established until there are three points on the line.

2. Confirmed trend line - The market has bounced off this trend line three times. Conventional analysis regards this as a sign that the trend line is real, and that the market will react around it.

It is easiest to trade from a trend when its highs or lows trend closely to a recognizable diagonal line, since this line may be used to predict future highs or lows. Opinions vary on whether trend lines should be drawn from the highs and lows of candles or from body of the candle, open & close prices; successful traders can be found employing either approach.

In an up trend, trend lines touched three times, this validates the trend line. Those who wish to trade with the trend may have looked for opportunities to buy based on validated trend. Price pulled back to the trend line that was previously confirmed. Traders can do a trend trade & may be a buying opportunity.

Support and Resistance

The price action trader pays particular attention to pivotal price levels, often “drawing” these lines horizontally as Support and Resistance levels. The theory behind employing these lines is that the market has a sort of memory: price behaves with respect to certain levels that have previously been significant

turning points in the historical narrative of the price’s action, and other market participants are likely

Risk management lessonI mentioned it on another day already, but this topic is very important so I decided to share it again to reach as much as possible. Hope it will help some!

The last weeks it happend again, I saw some traders with less knowledge (young and old) who crashed their accounts very hard. They lost a lot of money and for some it was very dreadful!

It is hard to watch this people how they burn money and bring even his own family in financial danger. That´s why I decided to share one important chapter from my book here to you.

May be some will find very helpful, or some will remember this rules again.

I will keep it a bit shorter here as in my book, but the main points are still mentioned!

I can´t say it often enough, keep the important rules in trading. Trading is not the way to get rich quick, it is a serious and hard business! It take a lot of time to learn, it requires a lot of patience and it will happen a lot of failures.

This failures are even more important than your success! Success will not open up how it will not work, failures will.

Let´s talk about risk management!

For each investment you have to consider you take for each trade the risk to lose money, that´s why it is mandatory to handle each investment with a good risk/reward distribution.

You have to keep in mind, the determined risk/reward is only theoretically and can result complete different. But with knowledge you can dedicate a good entry for your trades to keep your risk as low as possible.

Determine important support and resistance levels and think about all situations what could happen and what will you do if you are going into the red or into the green? Which levels are the best entry and exit?

This all will help you to determine your riks/reward ratio.

What is the Risk/Reward Ratio?

Successful day traders are generally aware of both, the potential risk and potential reward before entering a trade.

The goal of a day trader is to place trades where the potential reward outweighs the potential risk.

These trades would be considered to have a good risk/reward ratio.

A risk/reward ratio is simply the amount of money you plan to risk, compared to the amount of money you believe you can gain.

For example, if you think a potential trade may result in either a $400 profit or $100 loss, the trade would have a risk/reward ratio of 1:4, making it a favorable setup. Contrarily, if you risk $100 to make $100, the trade has a risk/reward ratio of 1:1, giving you the same type of unfavorable odds that you can find in a casino.

Which ratio should you desire?

Like described above, finding trades with high risk/reward ratios (1:2 or higher), will help you maintain higher average profits and lower average losses, making your trading strategy more sustainable.

The common suggestion between traders is a distribution of minimum 1:2 ratio. In reality there are often even better ratios available, if you do your technical chart analysis.

But what should you do if you have to cut losses?

We have to place our stop loss right below our support or other important levels we determined before.

The purpose is to cut losses before they grow too large. Stopping out of a losing trade can be one of the hardest things for traders to do consistently. However, failing to take stops can result in margin calls, unnecessarily large losses, and ultimately account blowouts.

How big should I enter a position?

To lower your risk I recommend to think about your size to enter a position.

Overall you shouldn´t risk money you need, only deposit money in your broker you can afford.

Entering small can be the smartest way to safe your account.

I suggest that because of four reasons, the first reason is, you don´t risk to much of your funds and your stop loss should be tight anyway.

The second reason is, you can average down if the price is going in the other direction, but consider this option only if you are sure what you are doing.

The third reason is, you can buy the dips/pullbacks if the trend is strong and still heading in your desired direction.

In addition, the fourth reason is, your emotional control is stronger if the price movement is heading in the wrong direction.

That brings me to another topic.

Should you use leverage?

Yes I know, big leverage will give you big gains...but as a beginner you will not have the experience to know which trade has a very big potential or not.

Even experienced traders use only a small amount to enter a position and not the whole fund.

If you use leverage the losses can be much higher and the problem with that is, if you lose money, your leverage will also decrease significantly and the losses are harder to recover after each loss.

So the answer of the question, if you should use leverage:

For beginners we can easily answer: Take your hands of a big leverage!

You can so hardly blow up yourself with that tool, it is ridiculous. Your way back into the profit zone will probably take years.

But you have to save yourself and after a period of time, a period of taking profits and cutting losses you will gain knowledge until you feel much more comfortable on the market and you understand how trading really works, then you can consider to use leverage.

Conclusion:

As I said, I want to share only some big points about this topic, because I think many new investors don´t understand how important that topic is!

Safe yourself and have fun in trading and learning!

Sincerely,

TradeandGrow

Trade safe!

Forex Related Word Find (18 Words)E Enjoy and Have Fun. Balance is key in everything you do, life is short- balance of body, mind & spirit what humans should strive to be.

Find a way to have Forex trading be part of your life, but not the only thing in your life. Forex trading should give you time freedom.

The Hard Truth About Trading 😅

Well, that is just a joke.

Or not a joke?

In every good joke, there's a sliver of truth...

So many people blew their trading accounts in a blink of an idea chasing the profits, so many people went bankrupt practicing leverage trading...

Do not be that guy in a picture.

Be a true trader!

Never forget about risk management and don't be greedy.

Never let your emotions control you.

Stay calm and humble while you trade.

Have a great weekend!

❤️Please, support these drawings with like! It really helps!

The Hard Truth About Trading 😅

Well, that is just a joke.

Or not a joke?

In every good joke, there's a sliver of truth...

So many people blew their trading accounts in a blink of an idea chasing the profits, so many people went bankrupt practicing leverage trading...

Do not be that guy in a picture.

Be a true trader!

Never forget about risk management and don't be greedy.

Never let your emotions control you.

Stay calm and humble while you trade.

Have a great weekend!

❤️Please, support these drawings with like! It really helps!

🔋 Live to trade another day 🔋As the weekend has come we have lost many fellow traders in the days that have passed and we will lose many more in the next week and the week after that... but if they only knew the basic principles of what this video goes over, they (their accounts) would still be here with us!

Our mission is to help other traders become successful and in an effort to achieve our goals we come up with simple yet effective tips and tricks on achieving our goals, by helping you achieve your goals!

This video goes over some ideas and tips on how you can survive as a trader, the tips we go over are:

LIVE TO TRADE ANOTHER DAY:

- Use position sizing

- Have a definite exit area

- Prepare properly before starting to trade

- Review your trades daily or weekly (always seek improvement)

- Always follow your process & system

- Don't listen to others, find your own trades daily

- Cut your losers when the market tells you the trade is done, you

can always re-enter

We hope this video helps you achieve consistency! If you like it check out the other related videos on our channel!

Happy Weekend Traders!