GOLD - Aggressive bullish trend. Test of the 4725 zone...FX:XAUUSD continues to update its historical maximum, currently testing the 4725 zone, against the backdrop of escalating geopolitical risks and declining risk appetite...

Fundamental situation

Trump's threats to impose new tariffs on goods from the EU and the union's retaliatory measures have heightened fears of a trade war.

Escalation of the Russia-Ukraine conflict

The economic backdrop is contributing to the decline of the dollar, which in turn is supporting gold.

The key events of the week will be the US PCE inflation data (Thursday) and the revised GDP report for the third quarter.

Gold continues to rise due to geopolitical uncertainty and the weakening of the dollar. Further dynamics will depend on US inflation data — weak figures could strengthen the upward momentum, while strong figures could trigger a correction.

Resistance levels: 4725, 4750

Support levels: 4707, 4700, 4691

Growth has been halted by the psychological resistance zone of 4725. Since the opening of the session, the market has exhausted its intraday potential and may form a correction (profit-taking) and test the key support zones of 4710-4700 before continuing to grow.

Best regards, R. Linda!

Triangle

GOLD - Consolidation after the rally. Target 5000FX:XAUUSD continues to hit new record highs (the latest being 4888) amid escalating geopolitical tensions, global risk aversion, and a falling dollar...

Fundamental drivers:

Trump's pressure on the Fed and uncertainty over the appointment of a new chair are undermining confidence in US monetary policy.

Trade threats are increasing the risks of escalating conflict with the EU.

Today, PCE inflation data (October-November) and US GDP for the third quarter will be released.

Gold maintains its upward momentum thanks to political uncertainty and pressure on the Fed. Short-term corrections are possible after the data release, but the trend will remain bullish until geopolitical risks subside.

Resistance levels: 4877, 4888, 4900

Support levels: 4845, 4834, 4816

Gold has strengthened by 2.6% since the opening of the session and, having exhausted its intraday ATR, may move to local consolidation or retest key support zones before growth: 4845, 4834, 4816. The medium-term growth potential remains intact. The market is heading towards 5000...

Best regards, R. Linda!

AAVEUSDT - Bear market. Breakdown of support at 162.0BINANCE:AAVEUSDT is testing the support of the range amid a market decline. Bulls are reversing their positions due to weakening fundamentals. Focus on support at 162.0

Bitcoin is falling due to the deterioration of the fundamental background. The altcoin market is reacting aggressively and entering a short zone. AAVE is breaking out of the range, and if it closes below 162.0, the decline may intensify

A pre-breakout base is forming relative to 162.0. Before the fall, a retest of the local liquidity zone at 165.9 is possible. However, closing below the support at 162.0 will be a signal for a further decline to 157.0 - 148.0.

Support levels: 162.0, 157.23, 148.06

Resistance levels: 165.9, 169.1

The price breaking out of the range suggests readiness for further movement. A breakout of support indicates that the movement will be downward. Closing below 162.0 could trigger a sell-off to 157 - 148 - 145.

Best regards, R. Linda!

BTCUSDT - The battle for 90K may end in a decline BINANCE:BTCUSDT , against the backdrop of Trump's speech and various comments, caused a shake-up within the range of 87,800-90,300, but the price is consolidating below key resistance within the current downtrend...

The downtrend may continue if Bitcoin consolidates below 90K. There is a chance of this happening as there is still no fundamental support for the market. Everyone is talking about the "CLARITY Act" on cryptocurrencies, but there is no date for its signing, and there are rumors that the process may be postponed until late winter or mid-spring, leaving the market without a bullish driver.

The market is experiencing a phase of struggle for the 90K resistance zone. Bears are stubbornly resisting, forming a false breakout and consolidation below resistance. The structure could be broken if there is an impulsive breakout of the 90,500 zone and the bulls are able to keep the price above this zone, but the bears have formed a fairly strong resistance zone.

Resistance levels: 90,400, 91,400

Support levels: 87800, 85000

I do not rule out another attempt to retest the 90350 zone, but if the bears keep the price below 90K, the market will have no chance for growth. In this case, a pullback to 89K - 88K can be considered.

Best regards, R. Linda!

SPY LongAscending triangle pattern in Uptrend, which is a strong bullish continuation pattern.

Trendline touch.

Long entry 681

Stop 677 (when trendline break)

Target 725 (top line of uptrend wedge)

Risk management is much more important than a good entry point.

I am not a PRO trader.

In my trading plan, the Max Risk of each short term trade should be less than 1% of an account.

EURUSD - Retest of support at 1.170 on a bullish trendFX:EURUSD is in a bullish trend phase and is forming a correction to retest the key psychological support level. Bulls may influence the situation...

The dollar has fallen sharply due to economic problems, which has triggered a rise in the euro, which is trying to stay above 1.170.

After rallying and updating the interim high to 1.1768, the currency pair entered a correction phase and is testing 1.170, an important technical and psychological support level.

Support levels: 1.1700, 1.1672, 1.1685

Resistance levels: 1.1763, 1.1804

A false breakdown and the bulls holding the price above 1.170 could form a reversal pattern and give a chance for growth within the local bullish trend

Best regards, R. Linda!

XAUUSD: Holds Key Support - Buyers Aim for $4,720 ResistanceHello everyone, here is my breakdown of the current XAUUSD setup.

Market Analysis

XAUUSD is trading within a broader bullish market structure, supported by a rising trend line that has guided price action from the recent swing lows. Earlier in the move, gold advanced inside a well-defined upward channel, confirming strong buyer control with consistent higher highs and higher lows. This bullish leg eventually led to a breakout attempt near the upper boundary of the channel, after which price experienced a sharp corrective move and transitioned into a consolidation phase. Following the correction, XAUUSD formed a range, where price moved sideways as buyers and sellers reached temporary equilibrium. This range acted as an accumulation zone before the next directional move. Price eventually broke out of the range to the upside, signaling renewed bullish momentum. However, shortly after the breakout, a fake breakout occurred on the downside, where price briefly dipped below support but was quickly reclaimed by buyers, reinforcing demand strength.

Currently, price is holding above a clearly defined Support Zone around 4,650, which aligns with the former range high and a key structural level. This area is now acting as demand after the successful breakout and retest. On the upside, XAUUSD is approaching a major Resistance Zone near 4,720, where selling pressure has previously emerged. The recent price action shows controlled consolidation above support, suggesting continuation rather than distribution.

My Scenario & Strategy

My primary scenario remains bullish as long as XAUUSD holds above the 4,650 Support Zone and continues to respect the rising trend line. In this case, I expect buyers to remain in control and attempt another push toward the 4,720 Resistance Zone (TP1). A clean breakout and acceptance above this resistance would confirm bullish continuation and open the door for further upside expansion.

However, a strong rejection from resistance followed by a decisive breakdown below the 4,650 support would weaken the bullish bias and signal a deeper corrective move. Until that happens, the overall structure favors buyers, and pullbacks into support are viewed as potential continuation opportunities.

That’s the setup I’m tracking. Thank you for your attention, and always manage your risk.

CADCHF: Bearish Move From Resistance 🇨🇦🇨🇭

CADCHF appears bearish after testing a key daily resistance level.

A bearish violation of the neckline of a descending triangle pattern

indicates a local strength of the sellers.

I expect a retracement to 0.5733 level.

❤️Please, support my work with like, thank you!❤️

I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Coiling inThe price is trading within the triangle shown on the chart. This stock makes explosives moves. I think one is coming up. It might take a couple of more weeks or not, who knows but I'm not missing the break out. SL triggers if a weekly candles breaks down the support zone shown and CLOSES under it.

$LINK 8H CHART UPDATE 📌 BIST:LINK Technical Analysis: its shows tringle chart pattern breakouted, and price dumped to strong support zone for retest. currently price is holding near 12.20$ – 12.50$ support level.

📌 Major Support Zone:

Strong Support: price now in good green support zone after retest breakout.

Hold Support: if price hold that support zone LINK can pump again.

Bullish Sign: there is a bulish divergence in histogram and RSI within last candles.

📌 Bullish Price Targets: if it hold support and start moving up price can reach:

Target 1: 13$

Target 2: 15$

Target 3: 18$ +

📌 Key Catalysts (Jan 22, 2026):

Spot ETF: Bitwise already got approval for LINK spot ETF in early Jan 2026.

Institutional: Grayscale also converting trust to ETF recently which brings massive demand.

New Tech: Chainlink launched 24/5 US stock data streams for DeFi two days ago.

GOLD - Consolidation after the rally before the rally...FX:XAUUSD started the week with growth, hitting a new all-time high amid geopolitical risks and threats of new tariffs from the US, and is now consolidating around $4,700...

Fundamental situation

Trump threatened to impose tariffs on eight European countries over the issue of buying Greenland.

Escalating tensions around Ukraine and Iran.

Fed:

Expectations of policy easing are supporting gold, but the appointment of a new Fed chair could slow down aggressive rate cuts. The investigation into Powell continues...

This week, PCE inflation data (Thursday) and US GDP for the third quarter are important.

Gold's rise since the beginning of the year has been independent of the strengthening dollar, underscoring the strength of internal drivers. However, a confident breakout to $5,000 will require confirmation of lower inflation in the US and continued high demand for safe-haven assets. Corrections may be profitable against the backdrop of an aggressive bullish trend...

Resistance levels: 4678, 4691, 4700

Support levels: 4656, 4650, 4640

Within the current range, I focus on the zones 4656 - 4650 - 4639. There is a high probability of a long squeeze/false breakout of support. However, I do not rule out the possibility of a local correction due to the holiday in the US (low liquidity, profit-taking may trigger a correction) before growth.

Best regards, R. Linda!

Silver Forming an Ascending TriangleIn my previous analysis I thought Silver could possibly be forming a bull flag, but since the passage of time progressed I think it is forming an ascending triangle instead. Which is still bullish. Target price is approximately $95. Not financial advice, just a pattern I see potentially forming

BTCUSDT: Buyers Defends, Preparing for Breakout Above $96.5KHello everyone, here is my breakdown of the current BTCUSDT setup.

Market Analysis

BTCUSDT is trading within a well-defined ascending channel, confirming a strong bullish market structure. After a prolonged consolidation phase earlier on the chart, price successfully broke out to the upside and began forming higher highs and higher lows, signaling renewed buyer strength. Following the breakout, BTC rallied aggressively toward a key Resistance Zone around 96,500, where selling pressure became evident. Multiple tests of this resistance area failed to produce a clean continuation higher, leading price into a range formation just below resistance. This range reflects temporary equilibrium between buyers and sellers after the impulsive move up.

Currently, on the downside, price is being supported by a clearly defined Support Zone around 94,000, which previously acted as a breakout level and is now serving as demand. The market recently tested this support and reacted positively, indicating that buyers are still active and defending the level. Structurally, BTC remains above both the channel support and the horizontal support zone, keeping the broader bullish bias intact. The presence of a descending triangle resistance line within the range highlights short-term compression, suggesting that a volatility expansion may follow once price decisively breaks out of the current structure.

My Scenario & Strategy

My primary scenario remains bullish as long as BTCUSDT holds above the 94,000 Support Zone and respects the ascending channel structure. In this case, I expect price to continue consolidating briefly before attempting another move toward the 96,500 Resistance Zone, with a potential breakout opening the way for further upside continuation.

However, a clean breakdown and acceptance below 94,000 would invalidate the bullish setup and signal a deeper corrective move within the channel, possibly toward lower support levels. Until that happens, the market structure favors buyers, and pullbacks into support are viewed as potential long opportunities, while resistance remains the key level to watch for confirmation.

That’s the setup I’m tracking. Thank you for your attention, and always manage your risk.

BTCUSDT Short: Lower Highs, Supply Rejection & Demand in FocusHello traders! Here’s a clear technical breakdown of BTCUSDT (2H) based on the current chart structure. Bitcoin previously traded within a broader bullish recovery phase, supported by a rising trend line that guided price higher from the lows. During this advance, BTC formed a consolidation range, reflecting accumulation before continuation. This range eventually broke to the upside, confirming buyer control and pushing price toward a major Supply Zone around 91,400. At this level, price reacted sharply, forming a clear pivot high and signaling strong seller presence. Following the rejection, BTC entered a corrective phase, trading within a short-term range near the highs before breaking down. After the breakdown, price lost the ascending demand line and confirmed a structural shift to the downside. Subsequent pullbacks failed to reclaim the broken structure, and former support acted as resistance, reinforcing bearish pressure. The move lower accelerated, bringing price back toward the broader Demand Zone near 88,600–88,700, which aligns with the long-term rising trend line and a key historical reaction area.

Currently, BTCUSDT is trading near this demand zone after a strong bearish impulse. This area is critical, as buyers may attempt to slow the decline or form a short-term base. However, until price shows a clear bullish reaction and regains broken structure, the downside risk remains.

My scenario: as long as BTCUSDT stays below the 91,400 supply zone and fails to reclaim the broken demand line, the bearish bias remains valid. I expect price to test and potentially react from the 88,700 demand area (TP1). A clean break and acceptance below this zone would open the door for a deeper correction. Conversely, a strong bullish reaction from demand followed by a reclaim of key resistance would weaken the bearish outlook and suggest a potential recovery. Manage your risk!

GOLD - Pullback before growth after Asian momentum FX:XAUUSD is correcting after hitting a historic high ($4,900), due to the de-escalation of tensions between the US and the EU. Profit-taking is observed, but the trend remains bullish...

Fundamental background:

- Trump has cooled down: tariffs are temporarily suspended, as is the forceful seizure of Greenland. Negotiations are likely to continue. The market reacted quite aggressively to yesterday's “swings” led by Trump.

Today, data on PCE inflation and US GDP for the third quarter will be released, which may provide new momentum.

Further dynamics will depend on inflation data: weak indicators may renew interest in defensive assets, while strong ones may increase pressure.

Resistance levels: 4838, 4850, 4880

Support levels: 4813, 4800, 4777

Technically, after the Asian momentum, gold may form a correction of 50% of the total movement. I consider the 4813-4800 area (liquidity area) to be a zone of interest. And as zones of interest at the top, I consider the 4850 area — the liquidity pool.

Best regards, R. Linda!

OIL INDIA BUY ON DIP WITH triangle support lineAs per my personal analysis OIL INDIA can be buy on dip.

Oil India Ltd is a Maharatna public sector oil & gas company engaged in upstream exploration, development, production and associated midstream activities.

• Current price range ~₹430–440 per share.

• 52-week range roughly ₹325–492, showing volatility and historical upside potential.

• Dividend yield ~2.5–2.7%.

• Valuation — P/E ~11-12x, PB ~1.25-1.3x, moderate leverage profile

As per technical it is in the early stage of ascending triangle which if it break out than upside is minimum 30-35% with SL can be placed at 10% lower side.

I am Not a SEBI Registered Research Analyst. Views shared are for educational purposes only. Please consult your financial advisor before investing.

USDJPY - The correction may be over. Bullish trend The Japanese yen continues to weaken amid a strong dollar and due to the actions of the Bank of Japan. The currency pair may continue its bullish trend...

The global trend is upward. As part of the correction, the currency pair is testing support at 157.76 and forming a long squeeze. The reaction from the bulls is aggressive, and a breakout of the wedge resistance will provide an opportunity for growth.

The dollar is in an upward trend (locally), and this maneuver is supporting the currency pair against the backdrop of a globally weak Japanese yen.

Resistance levels: 158.185, 158.855

Support levels: 157.76, 157.38

If the bulls keep the price above the 157.76-158.0 zone, the market will have good potential and strong support to continue growing towards 158.8-159.5.

Best regards, R. Linda!

GOLD - A long squeeze of support could trigger growthFX:XAUUSD continues to consolidate, Friday's long squeeze (false breakdown) of support provides an opportunity for growth amid geopolitical issues...

The dollar is strengthening against the backdrop of Thursday's economic data and Trump's geopolitical actions, but against this backdrop, gold is behaving quite cautiously and looks quite strong.

Trump said that tariffs on eight European countries could rise to 25% if Greenland is not sold to the US - more tariffs and an escalation of the trade war could lead to a strong market reaction.

In the new trading week, we are awaiting Trump's speech (high volatility possible), US GDP, Core PCE, and PMI. The data may set the medium-term tone for the market...

Resistance levels: 4593, 4621, 4639

Support levels: 4581, 4561, 4550

The long squeeze has shifted the market imbalance towards buyers. Locally, we are seeing consolidation in the 4581-4593 zone. A close above 4593 or a retest of 4581 could trigger further growth within the current trend

Best regards, R. Linda!

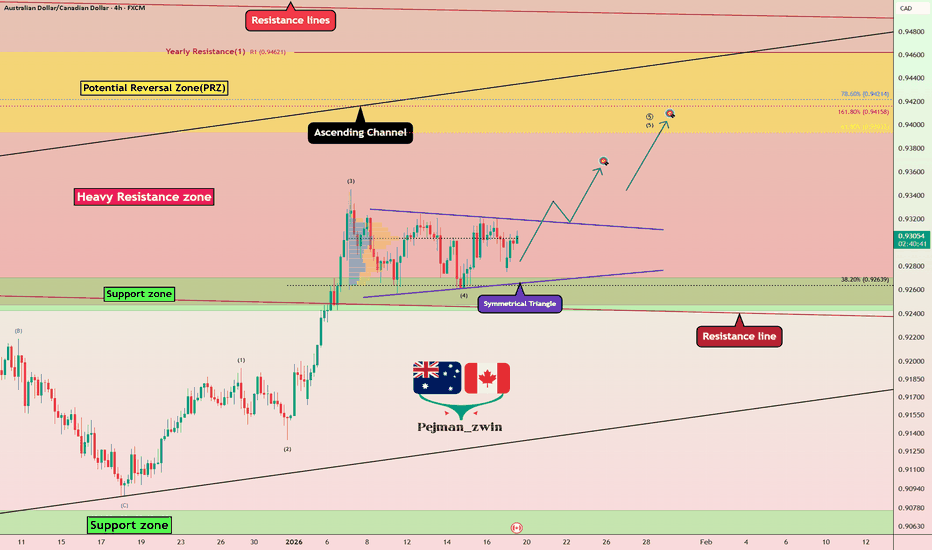

AUDCAD is Breaking Triangle — Bullish Breakout Ahead of CPI?Today, I want to share a long trading opportunity on the AUDCAD pair ( FX:AUDCAD ), so stay tuned!

Currently, AUDCAD has successfully broken through its resistance line and is now situated within a heavy resistance zone(0.9585 CAD-0.9247 CAD).

From a classic technical analysis perspective, if we look at the AUDCAD chart on the 4-hour timeframe, we can see a symmetrical triangle pattern, which suggests a continuation of the recent bullish trend of AUDCAD.

From an Elliott Wave perspective, it appears that AUDCAD has completed microwave 4 of the main wave 5, and we can expect the start of microwave 5 of the main wave 5. The breakout above the upper line of the symmetrical triangle could confirm the end of the microwave 4.

Additionally, today’s Canadian CPI data could act as a key catalyst for AUDCAD.

Based on recent macro trends, I expect inflation pressures in Canada to remain soft.

If CPI comes at or below expectations, it should weaken CAD and support a bullish continuation on AUDCAD.

As long as the structure holds, I remain biased to the long side.

As a result, I expect that after breaking the upper line of the symmetrical triangle, AUDCAD could rise at least to 0.9357 CAD.

First Target: 0.9357 CAD

Second Target: 0.9397 CAD

Stop Loss(SL): 0.9241 CAD

💡 Please respect each other's opinions and express agreement or disagreement politely.

📌Australian Dollar/Canadian Dollar Analysis (AUDCAD), 4-hour time frame.

🛑 Always set a Stop Loss(SL) for every position you open.

✅ This is just my idea; I’d love to see your thoughts too!

🔥 If you find it helpful, please BOOST this post and share it with your friends.