E-mini Russell 2000 Index Futures (Jun 2019)

1,554.6USDD

−8.9−0.57%

At close at Jun 21, 2019, 13:29 GMT

USD

No trades

No news here

Looks like there's nothing to report right now

Russell 2000 at Important Resistance Level Hey Traders so today if we take a look at the Russell 2000 it is now at a very important resistance level 2105.

The reason this level is important imo is because it is also the 50 % Fibonacci Retracement Level from last years high. Markets normally retrace 50% of the last big move which it has n

Russell Leads Equities HigherEquity markets saw a positive day today with the Russell leading the way higher being up over 1.5% on the session. For the S&P and Nasdaq, this was the third session in a row with a higher high, and the 200-day moving average has acted as a floor in these markets since the breakout higher on May 12t

equties FOMC 28/05/25I think rates will be held in FOMC and equities will suffer temporarily. Sells inbound

CShort

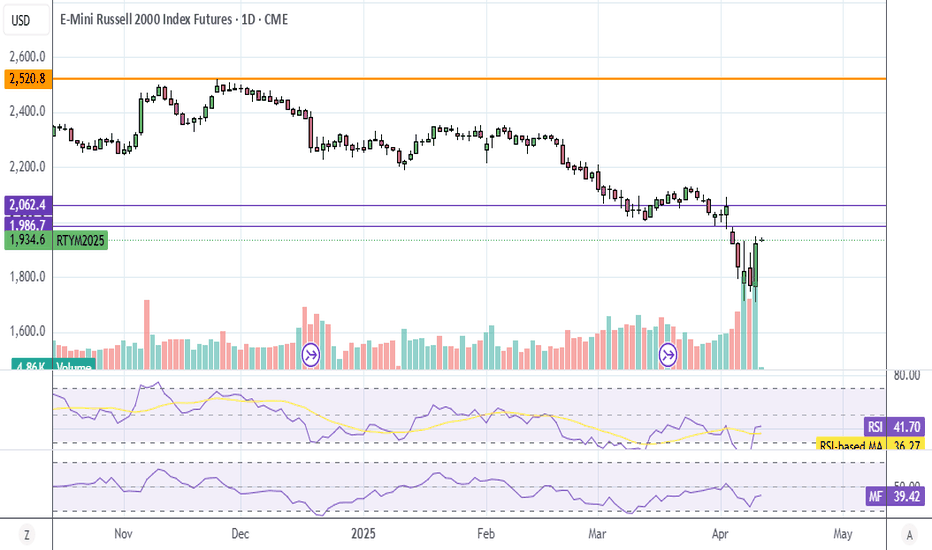

RUT RTY1! IWM: Trade⚠️ Short Bias on RTYM (E-Mini Russell 2000 Futures)

Price has rejected the premium zone with clear BOS and CHoCH formations, suggesting distribution. Currently sitting below EMA clusters with weak bullish follow-through.

Volume confirms distribution. Targeting the equilibrium zone (1981.1) as next

CShort

CLong

Russell 2000: Looking Past the Short-term VolatilityCME: Micro E-Mini Russell 2000 Index Futures ( CME_MINI:M2K1! )

On Saturday, May 3rd, Warren Buffett took the center stage of the Berkshire Hathaway annual shareholder meeting. “What has happened in the last 30, 45 days … is really nothing,” declared the “Oracle of Omaha”.

Buffett brushed off rece

CLong

MAY 1ST - BULLISH IDEA - M2K- RUSELLThe market seems to fill the 4 hours gap, and took al liquidity acumulated, now it's has all the path free to visit the daily bearish order block.

CLong

Russell 2000: Signs of Topping as Macro Risks LoomRussell 2000 futures look sluggish heading into a week laden with macro risk events. Given the cyclical characteristics of the underlying index, any hint of weakness may amplify U.S. recession fears, increasing the risk of renewed downside for stocks.

Sitting within what resembles a rising wedge an

CShort

RTY Daily UpdateSmall caps got hit hardest by the tariffs, fell the most, went up the least today, and has the furthest to go to fill the futures gap and also the all time high (ATH).

I think RTY (IWM ETF) will outperform ES/NQ (SPY/QQQ) the next 90 days as Trump unwinds all of the tariffs including the 10%. He'l

See all ideas

A representation of what an asset is worth today and what the market thinks it will be worth in the future.

Displays a symbol's price movements over previous years to identify recurring trends.

RTYM2025

Jun 2025DMarket closed

2,133.5USD+1.62%

RTYU2025

Sep 2025DMarket closed

2,150.6USD+1.64%

RTYZ2025

Dec 2025DMarket closed

2,168.5USD+1.70%

RTYH2026

Mar 2026DMarket closed

2,185.5USD+1.70%

RTYM2026

Jun 2026DMarket closed

2,202.3USD+1.70%

RTYZ2026

Dec 2026DMarket closed

2,236.5USD+1.70%

RTYM2027

Jun 2027DMarket closed

2,270.4USD+1.70%

RTYZ2027

Dec 2027DMarket closed

2,304.6USD+1.70%

RTYM2028

Jun 2028DMarket closed

2,338.6USD+1.70%

RTYZ2028

Dec 2028DMarket closed

2,372.6USD+1.70%

RTYZ2029

Dec 2029DMarket closed

2,441.9USD+1.70%

See all RTYM2019 contracts

Frequently Asked Questions

The nearest expiration date for E-mini Russell 2000 Index Futures (Jun 2019) is Jun 21, 2019.

Traders prefer to sell futures contracts when they've already made money on the investment, but still have plenty of time left before the expiration date. Thus, many consider it a good option to sell E-mini Russell 2000 Index Futures (Jun 2019) before Jun 21, 2019.