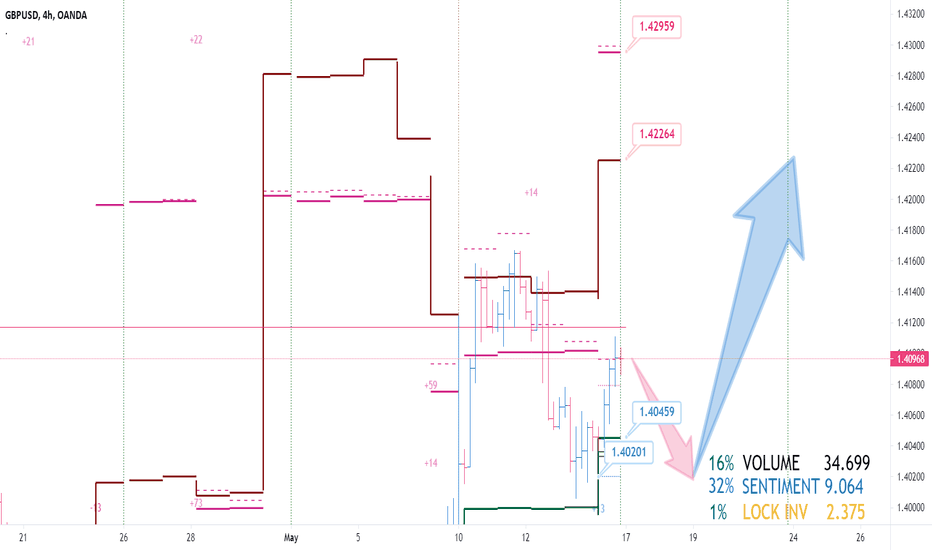

🌐 The increase in the outperformance of buyers by a third on the new CoT reports further confirms the true nature of the rise. Market volume is up 16%, which means we have great upside potential. ✍️ A slight increase in locked positions by 1% confirms the assumption of a likely flotation of the asset quotations within the price corridor during the first half of...

The nearest resistance for today is the limit seller (1.4191). ✍️ The main scenario for the second working day of the week is the achievement of the mentioned resistance and subsequent corrective decline to the balance of the day (1.4145). ⚠️ In case of breakdown and fixation above the limit seller (1.4191), we expect continuation of rally to the market maker loss...

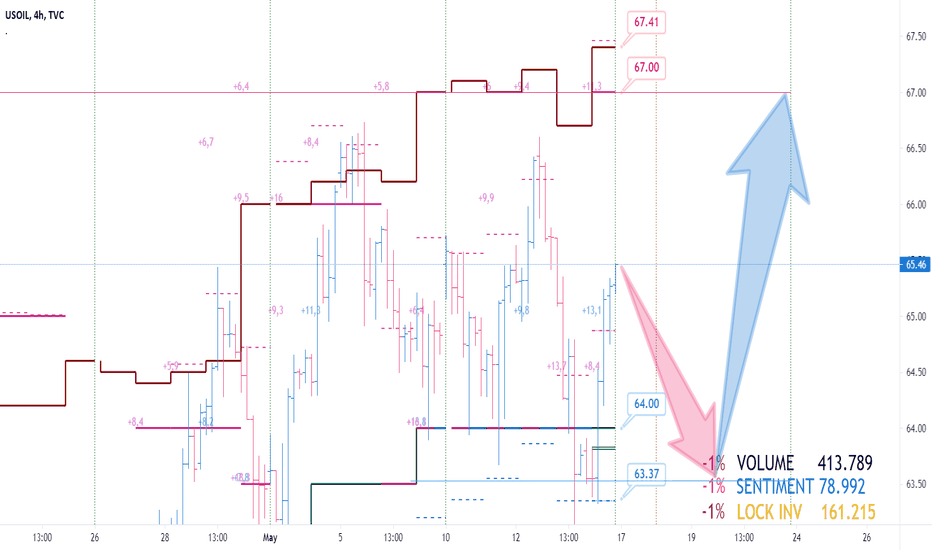

✍️ According to the current CoT reports, the buyers' preponderance has decreased by 1%. Market volume has declined by 1%, suggesting a corrective nature of the decline on the daily timeframe. The high volatility inside the coming trading week is suggested by a 1% decrease in investors' locked positions. The nearest support on the daily is the price range of...

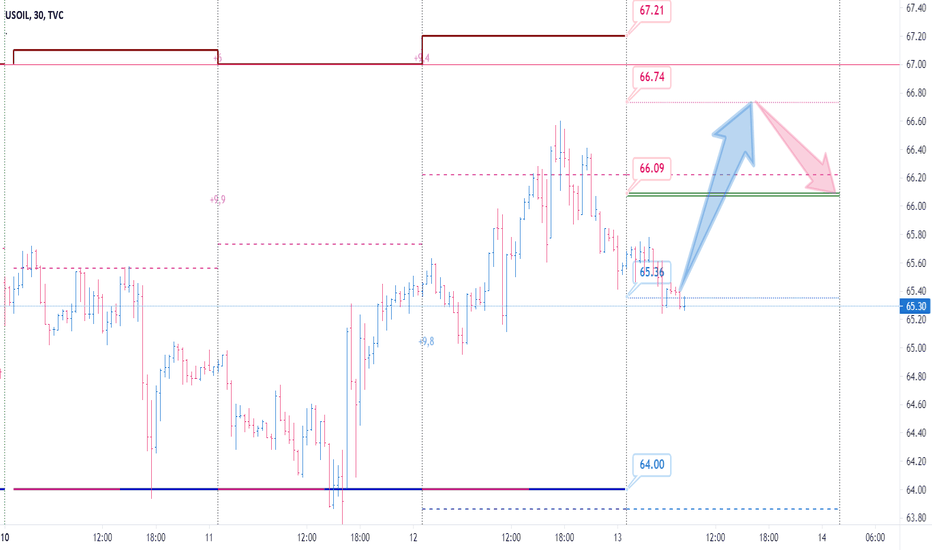

✍️ Last week's long drawdown of the balance of the week (64.00) paid off, and the rally started on Monday, May 17, and is now headed in the direction of the medium-term trend. The balance of the week itself dynamically rose to 64.50, which also confirms the uptrend. The nearest important support for today is the Buyers Limit level (65.40). 🌐 In case of...

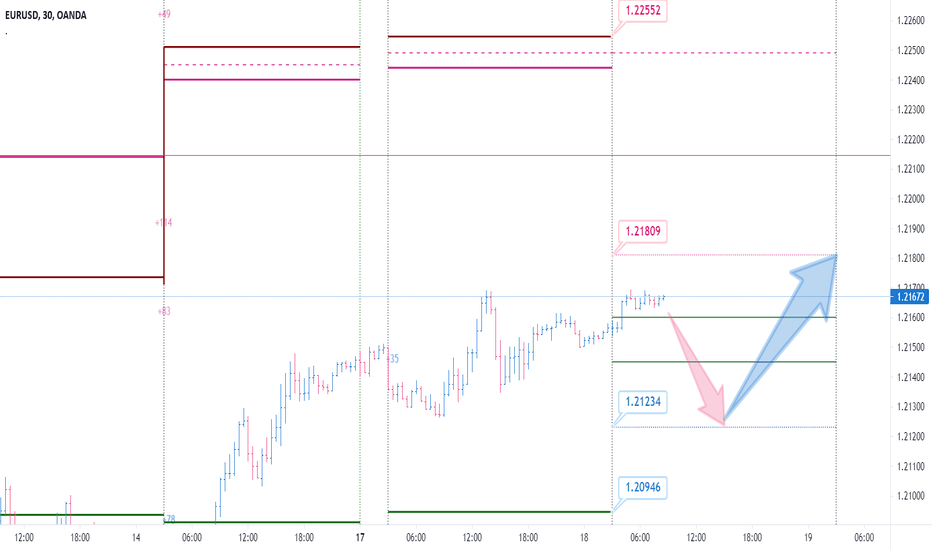

Over the past trading week, the net outperformance of the buyers has increased by 20%. 🌐 Continued upside on the daily chart further confirms a 3% increase in market volume. The unidirectional nature of the move over the coming week suggests a 1% decrease in investors' locked positions. The nearest medium-term support is the weekly balance (1.2091). 👉 In case of a...

The nearest support level for Tuesday, May 18, is the limit buyer (1.2123). 🌐 In case of a successful test of the mentioned option support level, we expect a further rise with a target before the close of the day,- limit seller (1.2180). Addition of downside positions of $144m further strengthens it. ⚠️ In case of breakdown and fixing above the mentioned...

💠 As of now, the safe haven currency quotes have settled close to the market maker loss level (1857.96). The main scenario for today is to continue rising during the European trading session with targets: market maker loss (1857.96) and limit seller (1861.53). 📝 In case of stoppage of growth and formation of sell pattern during the American trading session we...

📌 The closest speculative support intraday is the limit buyer (1.4049). The proximity of the balance of the week level (1.4045) further strengthens it. 👉 In case of successful test of limit buyer level (1.4049) we expect further upside with targets: balance of the day (1.4110) and limit seller (1.4152). 🤔 Like the idea? 👍 like it ✍️ write a comment

👉 In case of breakdown and consolidation below the balance of the day level (65.40), we expect a subsequent decline towards the limit buyer level (64.33). ✍️ With the formation of a buy pattern in the price range of 64.33-64.00 (limit buyer and balance of the day), we expect a subsequent rise with the nearest target,- limit seller (66.53). Mid-term upside target...

✍️ The nearest support for Monday is the limit buyer (1.2110). Subsequent medium-term support is the balance of the week (1.2090). 📌 In case of a buy pattern forming in the price range of 1.2110-1.2090 we expect a rise with a target before the close of the day,- limit seller (1.2178). 🤔 Like the idea? 👍 like it ✍️ write a comment

📌 The option balance of the week level (1815.00) has been routinely tested over the past 24 hours. In case of rise to limit seller and formation of sell pattern we expect a decline during the US session to the limit buyer level (1818.46). 📝 In case of fixation below the mentioned support we expect the further decrease to the level of the maximum profit of the...

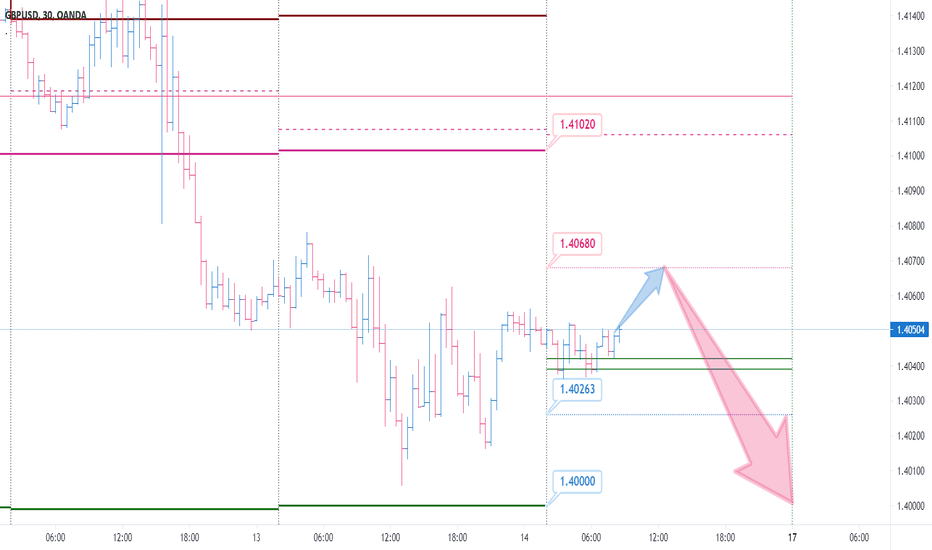

The nearest resistance level for today is the limit seller (1.4068). ❗️ In case of a successful test of the mentioned resistance and formation of a sell pattern, we expect a decline with the target, a limit buyer (1.4026). 🌐 In case of breakdown and fixation below the mentioned support we expect the subsequent decrease with the final target till the week close,-...

❗️ Marketmaker loss level (66.74) has not been reached in the past 24 hours. Downside gains of $13.7 million further strengthen the consolidation below the balance of the week (64.00). ✍️ The main scenario for today is a successful premium test of the hedger support zone (63.36) and a subsequent rise to the balance of the week (64.00) and hedger resistance zone...

In trading on Thursday, May 13, the pair consolidated below the balance of the week (1.2094). ✍️ A $84 million gain on the downside further increases the likelihood of a rebound from the marketmaker's maximum profit level (1.2094). 🌐 The main scenario for today is a successful test of the market maker's maximum net profit level (1.2094) and subsequent decline with...

💠 The limit seller indicated in yesterday's trading idea (1843.10) was successfully tested over the past 24 hours. The weekly balance (1815.00) was reached before the close of the trading day. 📝 In case of successful test of limit seller (1825.24) we expect further decline with ultimate target before close of trading day,- limit buyer (1809.00). 🤔 Like the idea? 👍...

✍️ Market maker loss level (1.4150) was retested over the past 24 hours. The limit seller (1.4089) acts as the key resistance level for today. 💡 A breakdown and consolidation below the balance of the day (1.4054), the final downside target before the close of the trading week is the market maker balance (1.4000). 🤔 Like the idea? 👍 give it a like ✍️ write a comment

✍️ Over the past trading day reached the seller's limit level (66.30), which was indicated in yesterday's trading idea as an upside target. The main scenario for Thursday, May 13 is a successful test of the limit buyer (65.36) and a subsequent rise to the limit seller (66.74). 📌 On breakdown and fixation below limit buyer level (65.36) we expect decline to the...

📌 Trading on Wednesday, May 12, we have consolidated below the balance of the week (1.2094). In case of a successful test of the said resistance level, we expect a decline with targets of the balance of the day (1.2072) and market maker loss (1.1994). 💡 A breakdown and fixation above the balance of the week level (1.2094) the limit seller (1.2147) is the...