🌐 In the first half of Wednesday, April 21, we expect a break of the balance of the day (1778.66) and a subsequent decline to the limit buyer (1769.90). With the formation of a buy pattern near the limit buyer level, we expect the momentum to continue towards the long term upside. 🔰 The target of growth till the end of the currency day is the level of weekly hedge...

✅ During the first half of the day we expect to test the market maker loss level (1.3909). The main scenario before the opening of the US stock markets is to reach the limit buyer level (1.3899) and the subsequent rise to the premium level of the weekly hedger resistance zone (1.3942). 🌐 On breakdown and fixation below 1.3909 we expect continuation of fall with...

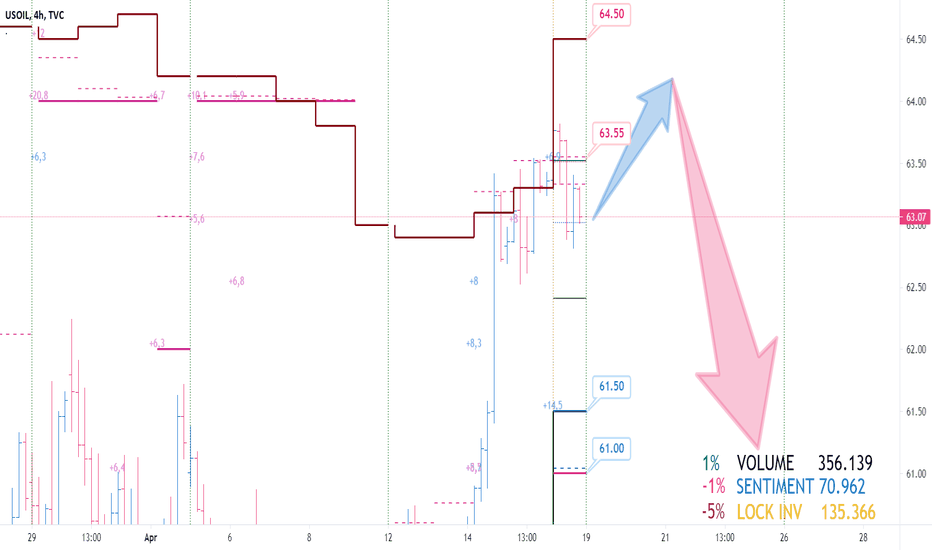

🎯 The main scenario for the European trading session is a decline and subsequent test of the Buy Limit level (61.77). In case of formation of the pattern on purchase we expect the rise with the nearest target, the balance of the day (62.68). ✅ In case of realization of alternative scenario,- fixation below 61.77, we expect continuation of falling to the level of...

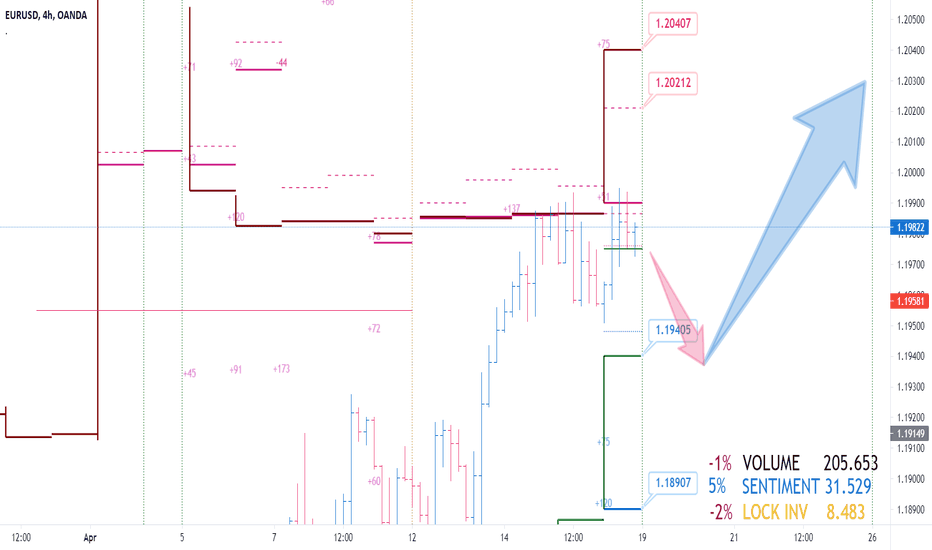

⚙️ Today during the first half of the day, we expect a retracement to the market maker's loss zone (above 1.2046). The key resistance level for Wednesday, April 21 is the limit seller (1.2064). 🎯 In case the mentioned resistance is reached, we expect the formation of a sell pattern and the subsequent decline with the target,- limit buyer (1.2001). 🤔 Like the idea?...

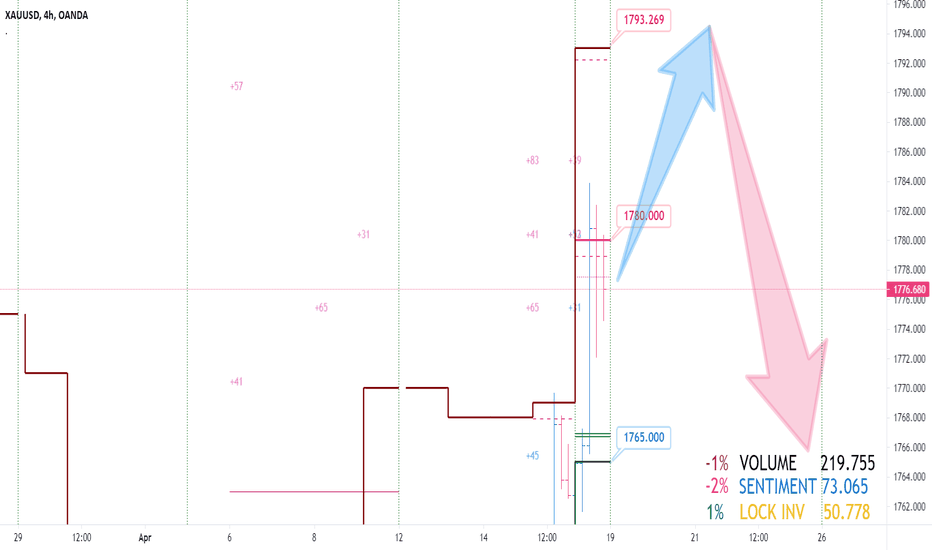

Main weekly scenario is on track with some minor refinements. 📌 In case of formation of sell pattern near limit seller (1778.95) we expect downside with nearest target,- balance of the week 1765.00 (as expected earlier). 🔥 The next medium-term resistance will be the limiting buyer (1759.40). 🤔 Like the idea? 👍 like it ✍️ write a comment

During Monday, April 19, the weekly upside target,-marketmaker loss level (1.3898) was reached. 🔰 Currently, the price continued the momentum in the direction of the long-term trend on the daily timeframe. The current long term upside target is a $21m limit bid at the price point (1.4117). The intermediate upside target within the current trading week is the...

⭐️ The price of black gold rose significantly during the first working day of the current week, with the upper bound of the marketmaker's profit zone increasing from 64.50 to 64.80. In this vein, upside targets for the first half of the trading week are worth adjusting. The nearest resistance price range is 64.35-64.80, where the current market maker loss level...

🔥 For the first working day of the new trading week the weekly upside targets were achieved,- market maker loss level. In this regard, additional upside targets for the current trading week are worth noting. The important medium-term resistance at the moment is the price range of 1.2088-1.2096, where the limit sell order of $91 million is located. 💡 If the...

📣 Despite the momentum in the value of the safe haven currency over the past trading week, the overall market volume according to CoT reports is down 1%. The net outperformance of buyers declined by 2%, while locked-in investor positions increased by 1%. That's why during the first half of the new trading week we expect the price mark of 1780.00, near which the...

The closest resistance for the pre-market Europe is the option balance of the day level (1780.23). 💡 The main scenario before the opening of the American trading session is the breakdown of the level of 1780.23 and the further rise to the price level of 1788.21, where the limit seller is. 🔥 In case of formation of the pattern on sale near the level of the limit...

✍️ According to the current CoT reports, the outperformance of buyers is up 35% from a week ago. The overall market volume is up 3%, which confirms the true nature of the growth during the past trading week. The nearest medium-term resistance level is the price level of 1.3843, near which the sell orders with the total volume of $86 million are located. The main...

⚠️ The nearest support level for the first working day of the current trading week is the lower boundary of the option day balance zone (1.3821). The main scenario for today is the successful test of the mentioned support and further rise to the upper border of the day balance zone (1.3845). ❗️ In case of breakdown and fixation above the specified option...

✍️ Over the past week, black gold buyers, according to current CoT reports, have reduced the net bullish outperformance by 1% from a week ago. Institutional investors anticipate a unidirectional move during the new trading week, reducing the number of locked positions by more than 5%. Important medium-term resistance levels during the new trading week are the...

⚠️ The nearest resistance level for the first business day of this trading week is the premium level of the weekly hedger resistance zone (63.56). ❗️ The main scenario for today is a rebound from the price level of 63.56 and further decline with the target till the end of the currency day - limit buyer (61.50). ✍️ The addition of $14.5m upside positions further...

🌐 Over the past trading week the preponderance of buyers on CoT reports increased by 5%, indicating a likely continuation of growth during the coming trading week. A 2% decrease in investors' locked positions also supports the assumption of a likely unidirectional move in the asset's quotes on the daily timeframe. The nearest long-term support level on the daily...

💡 During the European trading session we expect the termination of the option balance of the week (1.1940). The main scenario is the successful test of the mentioned support and the further rise with the nearest target, the balance of the day (1.1979). ✍️ In case of breakdown and fixation below the weekly balance (1.1940), we expect decline with the medium-term...

🔰 Yesterday's impulsive rise in the direction of the long-term upward trend was stopped by the market maker loss level (1769.02). Today during the day we expect a retest of the weekly hedgerow resistance area premium level (1767.93). 🔥 In case of formation of the pattern to sell near the mentioned price level we expect the decrease with the limit buyer (1760.42)...

✍️ During the previous day there was a successful test of the main scenario, which we were discussing in yesterday's review, the upper boundary of the daily balance zone (1.3795) and the following decline to the weekly balance (1.3748). ⏳ Today during the European session we expect rise to the level of the options balance of the day (1.3784). In case of the...