🔘 Major market participants continue to gain bullish positions near the hedger support zone. Thus, the current total volume of limit buy orders amounted to $81.7m. It should be noted that over the last week, institutional investors have partially reduced the bullish bias. Thus, CoT reports that the buying bias decreased by 4%. We therefore have reason to believe...

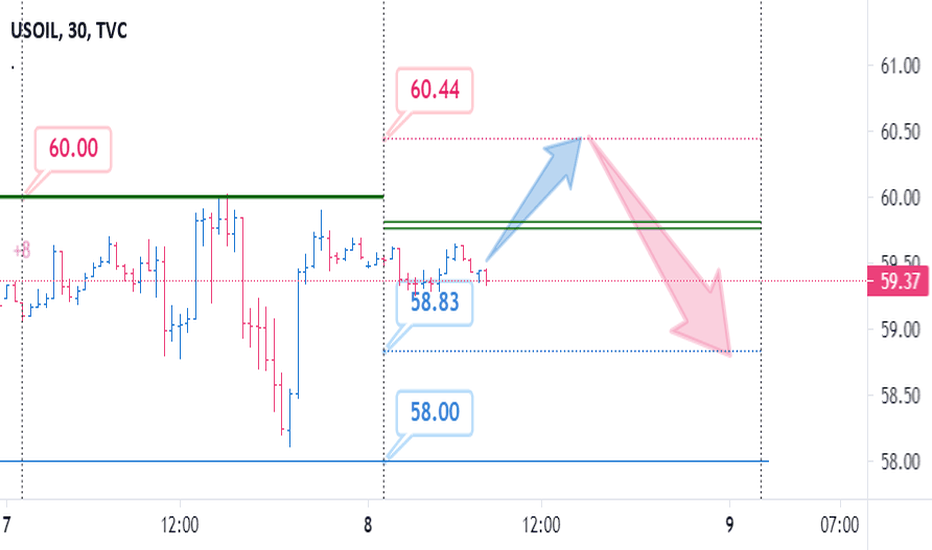

⚠️ Has settled below the week's balance level (59.50) during the Asian trading session. The main scenario before the opening of the US trading session is a decline towards the limit buyer level (58.30). 🌐 At the formation of the pattern to buy near the mentioned support we expect the rise till the trading day closing with the target landmark,- the level of weekly...

💬 According to the current CoT reports, large market participants continue to reduce the buyers' preponderance. Thus, this figure has decreased by a further 5% over the past week. The nearest long-term resistance level is 1.1955, where there is an increase in positions on decrease in the volume of $173 million. A further resistance is the weekly loss of the market...

📌 The closest support level for today is the limit buyer (1.1861). If breakdown and fixation below this support level, we expect a further decline to the balance of the week (1.1847). ⚠️ On formation of a buy pattern near the level of the limit buyer we expect an impulse till the end of the currency day with the limit seller level (1.1929) as a target. 🤔 Like the...

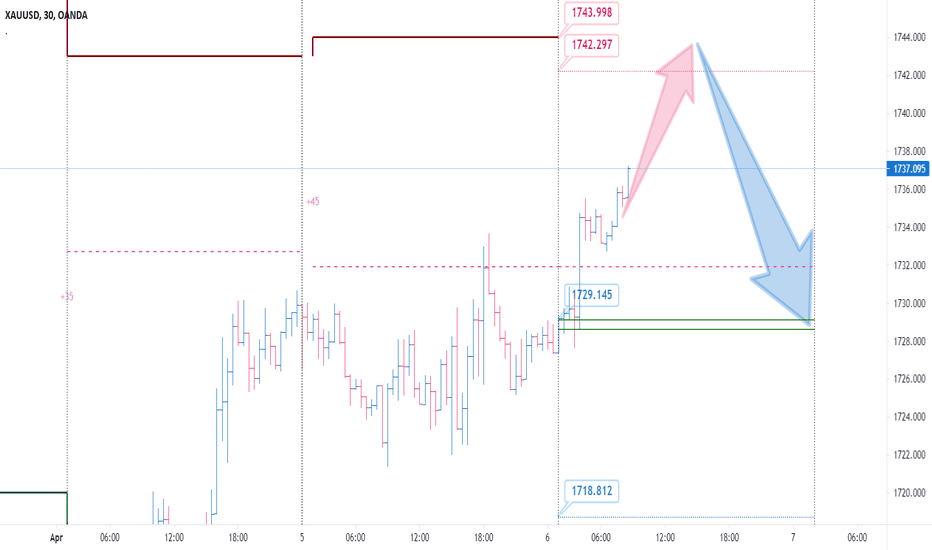

🚦 Over the past 24 hours, institutional investors at market prices have positioned additional medium-term buying trade positions of $30m and $161m respectively. The key support area for the last working day of the trading week is the price range of 1751.37-1745.17, where the limit buyer and market maker loss is located. 💲 Should a buy pattern form, expect an...

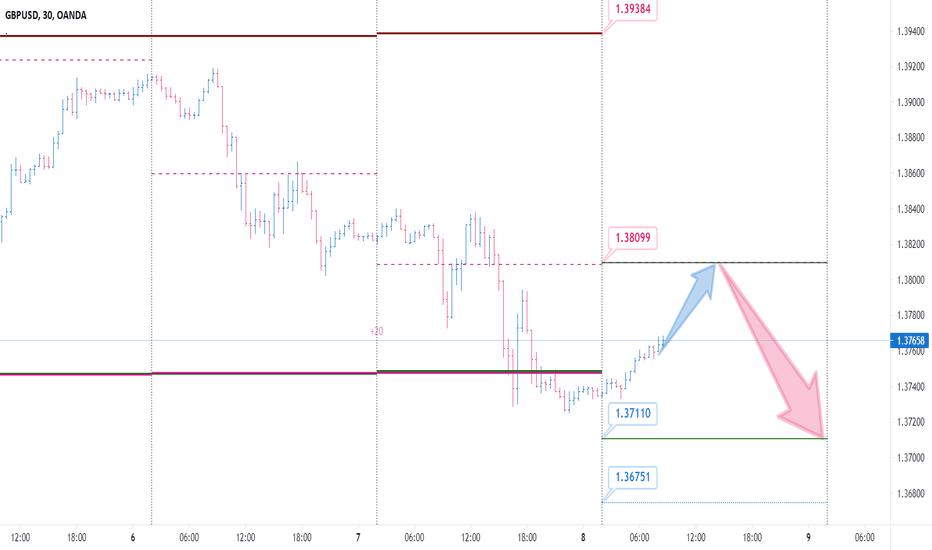

🏦 For the second week in a row the weekly hedger resistance area continues to be unwound. Today during the day, we expect the option balance level of the day (1.3717) to be reopened. In case of breakdown and fixation below the mentioned support, we are expecting the continuation of decline, with the option level at 1.3617, as a guideline. 💲 In case of formation of...

🏦 Over the past 24 hours we have jeweled the test of the limit buyer level (58.83), which we talked about in yesterday's trading idea. Today during the European session we expect to reach the limit buyer level (59.00) 💰 In case of successful test of the mentioned support level, we expect impulsive rise to the area of the week balance and limit seller...

⚙️ Large market participants have placed significant sell orders at the 1.1955 price point with a total volume of $309m. The nearest support level for today is a limit buyer at 1.1871. 🎁 In case of formation of buying pattern near the mentioned support we expect upward impulse with probable breakdown of the balance of the day (1.1918) and further reaching the...

The main scenario for Thursday, April 8, is a break of the balance of the day (1741.78) and a subsequent rise to the market maker loss level (1745.03). With the formation of a sell pattern near the price level of 1745.03 we expect a pause in growth and subsequent corrective decline. ⛔️ The nearest support in this case is the limit buyer (1733.69). 🤔 Like the...

🚫 The main scenario for today is a rebound from the upper boundary of the balance zone of the day (1.3809) and the subsequent decline to its lower boundary (1.3711). Addition of positions on decrease in the volume of $20 million near the mentioned price marks additionally confirms it. 🔻 On breakdown and fixation below 1.3711 the next support is the limit buyer...

Over the past 24 hours, the trade ideas we talked about yesterday - the rebound from the balance of the week and the decline to the limit buyer (58.34) - have worked out jewelically. 💪🏻 Today we expect a retest of the balance of the week (60.00). ❌ In case of breakdown and fixation above, we expect a rise to the limit seller (60.44). The nearest support in this...

🚫 The nearest support level for today is the current balance of the week level (1.1853). 💪🏻 The main scenario is a rebound from the indicated option support level (1.1853) and continued upside within the week. 📆 The nearest medium-term growth benchmark is the $173m downside level at 1.1955. 🤔 Like the idea? 👍 like it ✍️ write a comment

📣 Over the past day, successfully worked the rebound from the market maker's loss level (1745.03). Today during the day we expect retest of the nearest resistance (1743.09-1745.03) and further decline with the nearest target, the limit buyer (1734.61). ℹ️ In case of breakdown and fixation below the level of limit buyer (1743.61), we expect the subsequent decrease...

During the European session, expect a rise to the option balance level of the day (1.3859). ♻️ In case of false breakdown of the mentioned resistance we expect the subsequent rise to the limit seller (1.3883). If a sell pattern is formed in the price range of 1.3859-1.3883, we expect a further decline before the end of the trading day. 🎯 Weekly balance (1.3742) is...

The closest resistance for today is the weekly marketmaker balance (60.00). ☝🏻 The main scenario is a false break of the weekly balance (60.00) and subsequent rise to the limit seller (60.50). 🔝 In case of rebound from the mentioned resistance and formation of selling pattern, we expect downside with intermediate target - daily balance (59.32) and final one -...

♻️ In case of a successful test of the upper boundary of the day's option balance zone (1.1871) we expect a decline during the European session to the level of the lower boundary of the said zone (1.1844). The subsequent support for Wednesday, April 7, is the level of the limit buyer (1.1826). ☝🏻 The main scenario for the second half of the day is the suspension...

⚠️ Throughout pre-market Europe, the safe haven currency quotes have consolidated above the premium level of the hedger resistance zone (1731.88). The price range of 1742.29-1743.99, where the limit seller and the market maker loss level is located, is the upside target. 📌 In case of suspension of rise near the mentioned marks we expect impulse decrease with the...

✍️ The closest upside target for today is the market maker's smallest net profit level (1.3937). The main scenario for today is a successful test of that resistance and the subsequent decline towards the limit buyer (1.3830). ❗️ In case of breakdown and fixation above the price level of 1.3937 the subsequent resistance is the limit seller (1.3969). 🤔 Do you like...