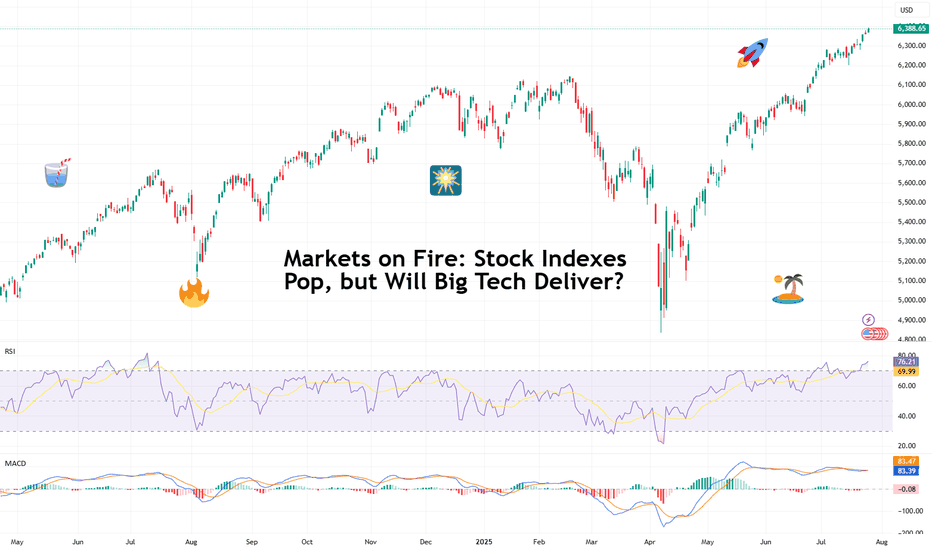

Markets on Fire: Stock Indexes Pop, but Will Big Tech Deliver?S&P 500 and Nasdaq set records. Now it's up to big tech to justify that.

Talk about forward-looking valuation. Tech companies’ valuations are largely based on future potential rather than current performance. And that’s what we’re seeing right now getting priced in across the big indexes.

You’d

The best trades require research, then commitment.

Get started for free$0 forever, no credit card needed

Scott "Kidd" PoteetThe unlikely astronaut

Where the world does markets

Join 100 million traders and investors taking the future into their own hands.

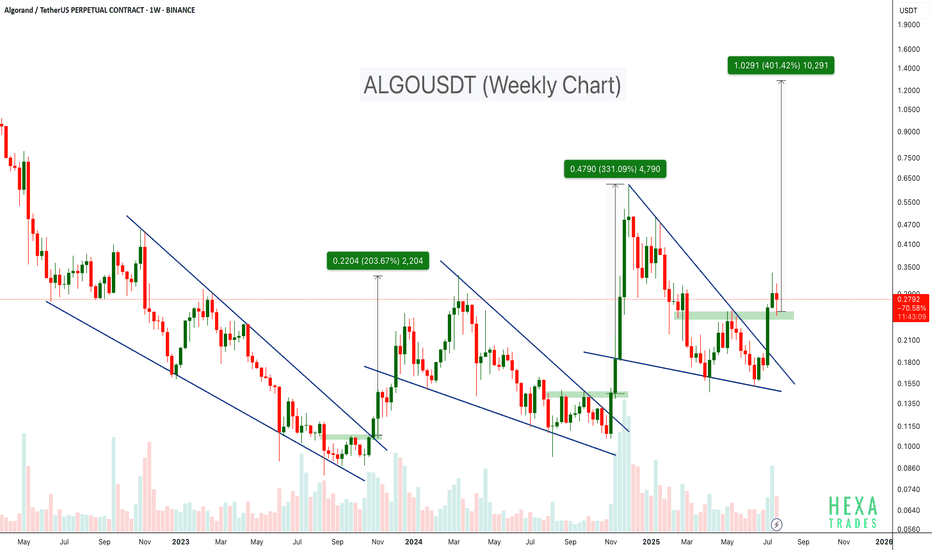

ALGO Breaks Out of Falling Wedge – 400% Target Ahead?BINANCE:ALGOUSDT has consistently followed a bullish pattern on the weekly timeframe. Each major rally has been preceded by a falling wedge breakout, as shown by the three highlighted instances on the chart.

- First breakout: ~200%+ move

- Second breakout: ~300%+ move

- Current breakout projection

Retro Editors' picks 2021Going further in our retro EP selection , we present to you a collection of additional scripts from 2021 that have earned a spot in our Editors' picks. These retrospective selections reflect our continued commitment to honoring outstanding contributions in our community, regardless of when they wer

Retro Editors' picks 2022Going further in our retro EP selection , we present to you the third collection of additional scripts that have earned a spot in our Editors' picks, now from 2022.

These retrospective selections reflect our continued commitment to honoring outstanding contributions in our community, regardless o

XRP 4H – Golden Pocket Bounce, But Will Bulls Reclaim $3.60?XRP pulled back cleanly into the golden pocket (0.618 Fib) after a strong rally — and buyers stepped in with force. Momentum flipped quickly, and Stochastic RSI is curling up with bullish intent.

Now price is holding above short-term support, but faces a key challenge:

→ $3.60 marks the prior high

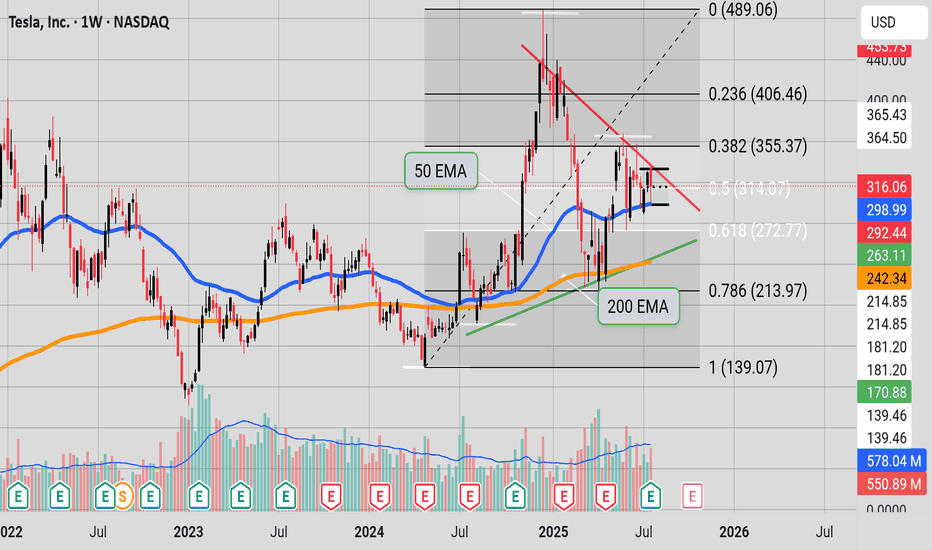

Inflection point"Tesla is at a binary point on the chart. The stock is wedged tightly between the red, downward-sloping resistance line (upper boundary) and the green, upward-sloping support line (lower boundary)—the classic apex of an asymmetrical triangle.

At this stage:

A breakout above the red resistance woul

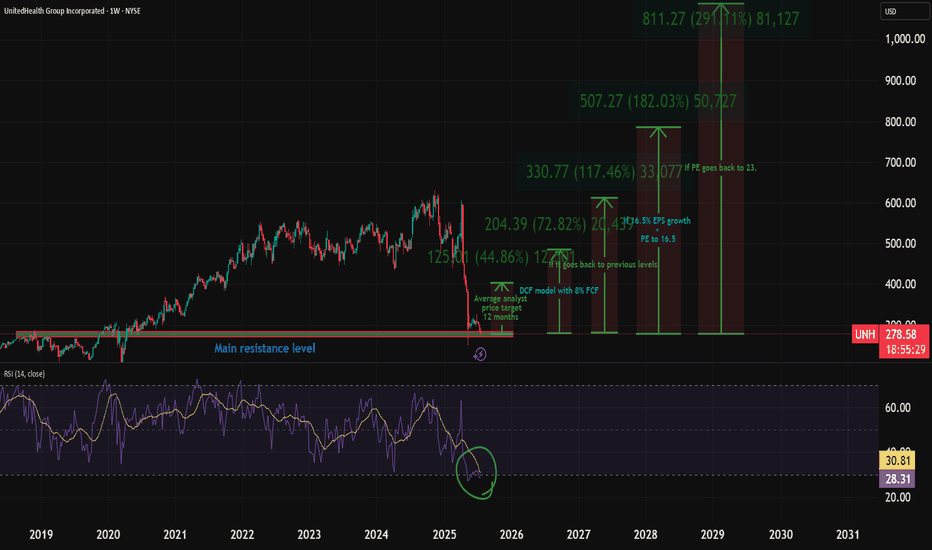

My UNH Thesis: Betting on a Healthcare Giant's Come BackThe healthcare sector has been in decline, which creates interesting opportunities. I recently talked about a few pharma plays - Eli Lilly, Novo Nordisk, and Pfizer.

Here's why I'm investing in NYSE:UNH :

UnitedHealth Group (UNH) has tanked ~50% in the past year, but the July 29 (VERY SOON) ea

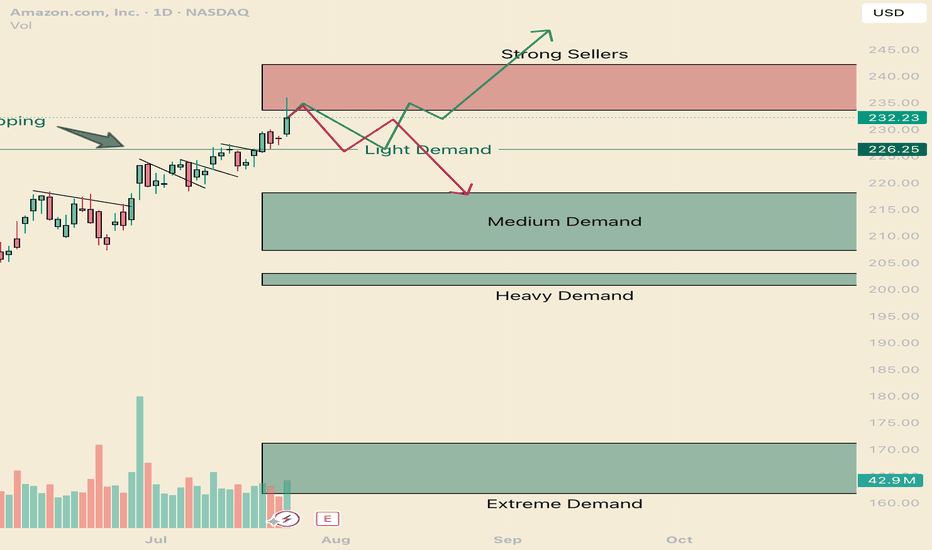

How to navigate the Amazonian Squeeze. AMZNHello I am the Cafe Trader.

This week has been a deep dive on the MAG 7 and today AMZN is up next.

We are going to look at long term and short term opportunities.

We are near the All Time Highs, with one final Seller to get through before making the break.

Today we tested to see if those sellers

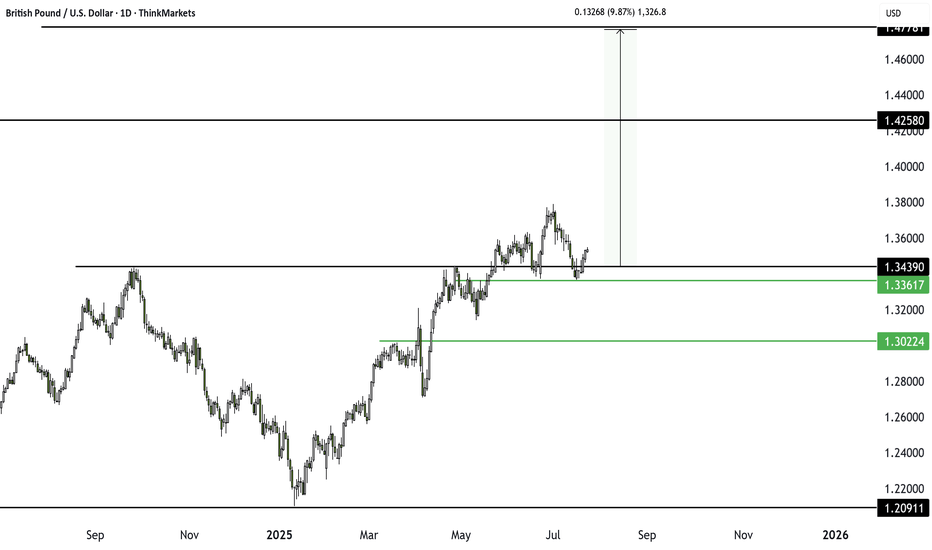

GBPUSD Traders Beware: A Major Drop Could Be ComingThe classic rule says what doesn’t go up must come down. After a failed breakout at 1.3439, GBPUSD is struggling. With longs sitting on big gains from January’s low, a drop toward 1.3361 or even lower looks likely. Watch this key level now.

This content is not directed to residents of the EU or

TradingView Show: Trade Ideas You Can't Miss with TradeStationJoin us for a timely TradingView live stream with David Russell, Head of Global Market Strategy at TradeStation, as we break down the latest rebound in the markets and what it could mean for traders and investors. In this session, we’ll dive into:

- New sectors to watch, like homebuilders

- Prio

See all editors' picks ideas

Intrabar Efficiency Ratio█ OVERVIEW

This indicator displays a directional variant of Perry Kaufman's Efficiency Ratio, designed to gauge the "efficiency" of intrabar price movement by comparing the sum of movements of the lower timeframe bars composing a chart bar with the respective bar's movement on an average ba

Strategy█ OVERVIEW

This library is a Pine Script™ programmer’s tool containing a variety of strategy-related functions to assist in calculations like profit and loss, stop losses and limits. It also includes several useful functions one can use to convert between units in ticks, price, currency or a per

Signs of the Times [LucF]█ OVERVIEW

This oscillator calculates the directional strength of bars using a primitive weighing mechanism based on a small number of what I consider to be fundamental properties of a bar. It does not consider the amplitude of price movements, so can be used as a complement to momentum-based osc

Estimated Time At Price [Kioseff Trading]Hello!

This script uses the same formula as the recently released "Volume Delta" script to ascertain lower timeframe values.

Instead, this script looks to estimate the approximate time spent at price blocks; all time estimates are in minute.second format.

The image above shows functionality.

Volume Profile, Pivot Anchored by DGTVolume Profile (also known as Price by Volume ) is an charting study that displays trading activity over a specified time period at specific price levels. It is plotted as a horizontal histogram on the finacial isntrumnet's chart that highlights the trader's interest at specific price levels. Specif

Fair Value MSThis indicator introduces rigid rules to familiar concepts to better capture and visualize Market Structure and Areas of Support and Resistance in a way that is both rule-based and reactive to market movements.

Typical "Market Structure" or "Zig-Zag" methods determine swing points based on fixed t

Risk Distribution HistogramStatistical risk visualization and analysis tool for any ticker 📊

The Risk Distribution Histogram visualizes the statistical distribution of different risk metrics for any financial instrument. It converts risk data into histograms with quartile-based color coding, so that traders can understand th

Crowding model ║ BullVision🔬 Overview

The Crypto Crowding Model Pro is a sophisticated analytical tool designed to visualize and quantify market conditions across multiple cryptocurrencies. By leveraging Relative Strength Index (RSI) and Z-score calculations, this indicator provides traders with an intuitive and detailed sn

Dynamic Gap Probability ToolDynamic Gap Probability Tool measures the percentage gap between price and a chosen moving average, then analyzes your chart history to estimate the likelihood of the next candle moving up or down. It dynamically adjusts its sample size to ensure statistical robustness while focusing on the exact de

See all indicators and strategies

News didn't load

Looks like that didn't go very well. Let's try again.

Community trends

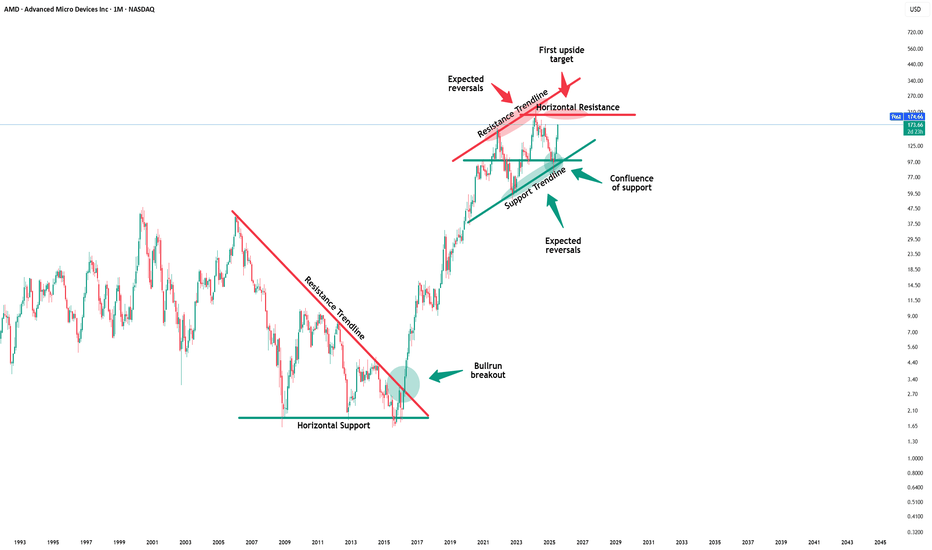

Amd - New all time highs will follow!🪠Amd ( NASDAQ:AMD ) rallies even much further:

🔎Analysis summary:

After Amd perfectly retested a major confluence of support a couple of months ago, we saw a textbook reversal. This retest was followed by a rally of more than +100% in a short period of time. But considering all the bullish mo

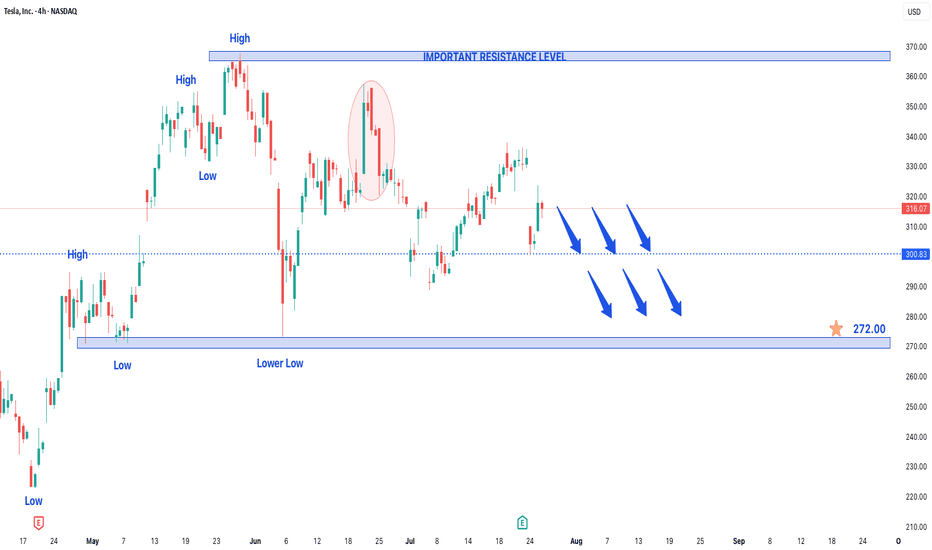

Tesla Stock in Bearish Trend - Further Downside ExpectedTesla Stock in Bearish Trend - Further Downside Expected

Tesla's (TSLA) stock price continues to display a clear bearish trend structure, characterized by the formation of consistent lower lows and lower highs on the price chart. This technical pattern suggests sustained selling pressure and indica

NShort

The 5 different types of Professional TradersLearn what each professional trader group trades, how they trade, when they trade and why they trade.

There are:

Sell Side Institution Floor Traders

Buy Side Institution Floor Traders

Proprietary Desk Traders (prop)

Specialist Professional Traders

Independent Professional traders.

Each type of profe

Incoming 40% correction for FacebookOn the above 10 day chart price action has rallied 500% since October 2022. It is somewhat unfortunate to see so many long ideas at the moment.

Motley Fool August 8th:

“Here's how Meta could achieve a $2 trillion valuation within three years, and if it does, investors who buy the stock today could

NShort

SMCI WEEKLY CALL SETUP (07/28/25)

### 🔹 SMCI WEEKLY CALL SETUP (07/28/25)

**Bullish Flow + Strong RSI = 🚀 Call Opportunity at \$62**

---

### 📊 TECHNICAL SNAPSHOT

* **RSI (Daily + Weekly):** ✅ Above 55 — clear bullish strength

* **Weekly Close:** 🔼 Broke prior highs — momentum continuation likely

* **Volume Ratio:** Slightly we

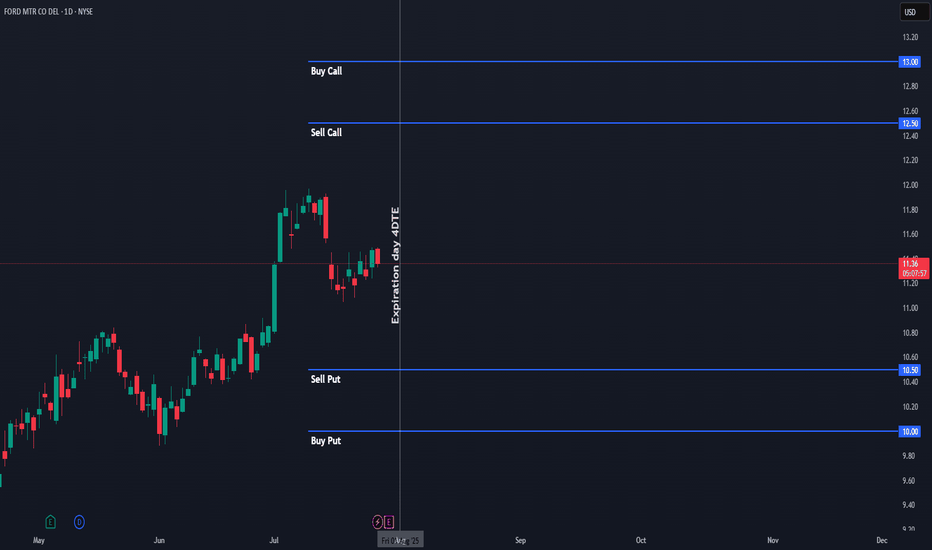

$F Iron Condor – Aug 1st Expiration | $7 Credit | I’m opening an Iron Condor on Ford ($F) with expiration on Friday, August 1st, 2025. The trade is based on the daily chart, using visible support/resistance levels to define the range. I selected strikes with approximately 0.15 delta on each side, giving the setup a high probability of success.

🔹 T

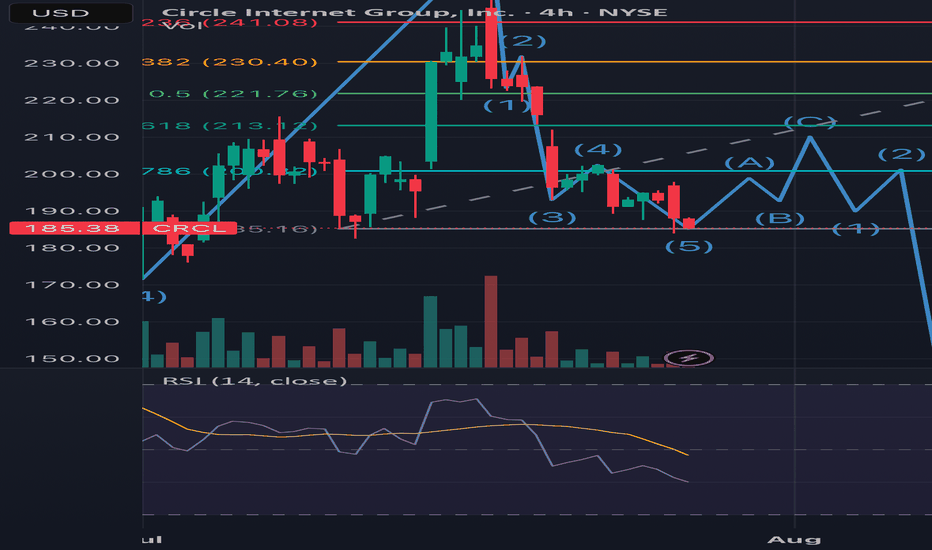

What goes around comes full CRCLFor the record, I bought in at ~$220 and looking to exit to ethical reasons. I believe that this stock will reach over $400USD for the end of the year but with every l opportunity left off for a greater cause, there will always be a greater reward.

1. Notice the end of the first 5 wave Elliot Impul

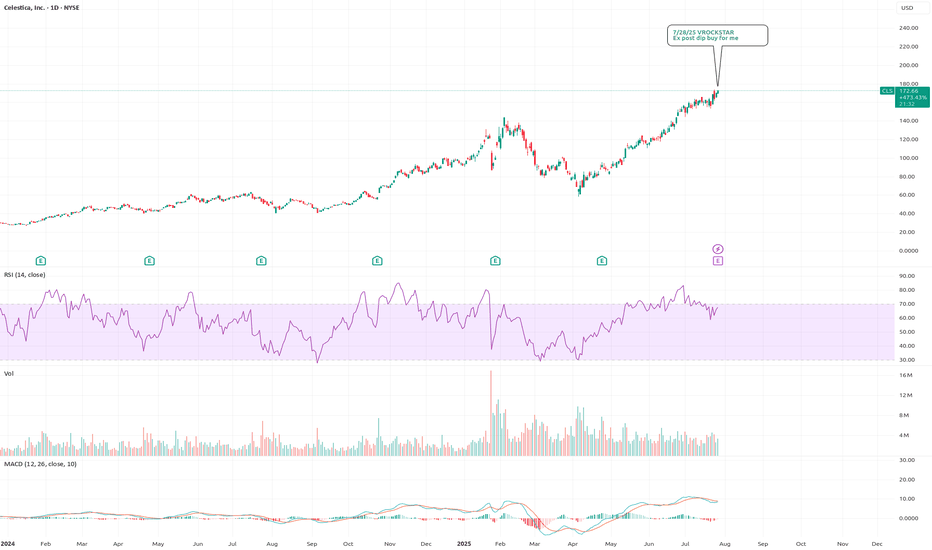

7/28/25 - $cls - Ex post dip buy for me7/28/25 :: VROCKSTAR :: NYSE:CLS

Ex post dip buy for me

- reminds of NYSE:GEV , great product, backlog, growth etc. etc.

- valuation at 2.5% fcf yield, low leverage and mid teens EBITDA for teens EBITDA growth++ is v reasonable

- don't really have an edge here, except to say.. i think any "miss"

My UNH Thesis: Betting on a Healthcare Giant's Come BackThe healthcare sector has been in decline, which creates interesting opportunities. I recently talked about a few pharma plays - Eli Lilly, Novo Nordisk, and Pfizer.

Here's why I'm investing in NYSE:UNH :

UnitedHealth Group (UNH) has tanked ~50% in the past year, but the July 29 (VERY SOON) ea

See all stocks ideas

Today

AUDCAudioCodes Ltd.

Actual

0.14

USD

Estimate

0.16

USD

Today

UNHUnitedHealth Group Incorporated

Actual

—

Estimate

4.48

USD

Today

UPSUnited Parcel Service, Inc.

Actual

—

Estimate

1.56

USD

Today

SWKStanley Black & Decker, Inc.

Actual

—

Estimate

0.42

USD

Today

PIIPolaris Inc.

Actual

—

Estimate

0.00

USD

Today

AWIArmstrong World Industries Inc

Actual

—

Estimate

1.78

USD

Today

CVEOCiveo Corporation (Canada)

Actual

—

Estimate

−0.03

USD

Today

HRIHerc Holdings Inc.

Actual

—

Estimate

1.96

USD

See more events

News didn't load

Looks like that didn't go very well. Let's try again.

Community trends

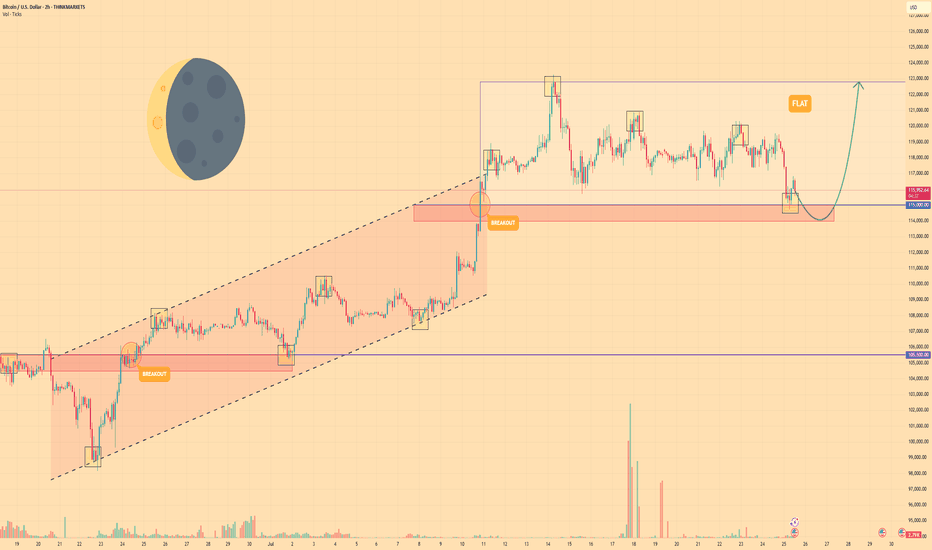

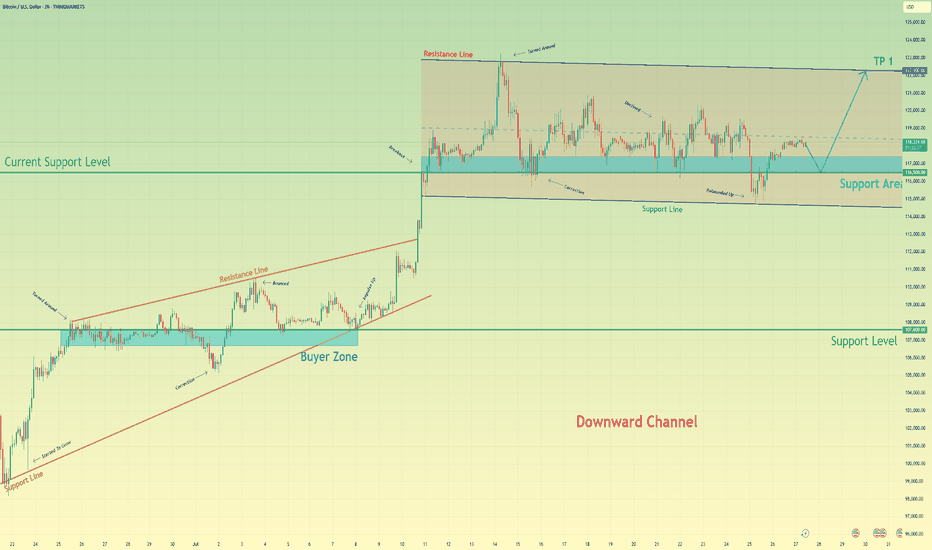

BTC - Bulls vs Bears: who will win?Market Context

Bitcoin is trading in a tight consolidation just below its all-time high after a strong impulsive rally. This phase represents a balance of power between buyers and sellers, with neither side able to take control yet. Such a pause in momentum at this key level often builds pressure f

ALGO Breaks Out of Falling Wedge – 400% Target Ahead?BINANCE:ALGOUSDT has consistently followed a bullish pattern on the weekly timeframe. Each major rally has been preceded by a falling wedge breakout, as shown by the three highlighted instances on the chart.

- First breakout: ~200%+ move

- Second breakout: ~300%+ move

- Current breakout projection

BITCOIN - Price can correct to support area and then start riseHi guys, this is my overview for BTCUSD, feel free to check it and write your feedback in comments👊

For a significant period, the price of Bitcoin was trading upwards within the confines of a rising channel.

Strong buying pressure led to a breakout above the channel's upper boundary, signaling an

TLong

Bitcoin will rebound up from support area to resistance lineHello traders, I want share with you my opinion about Bitcoin. After a strong upward trend that originated from the buyer zone and evolved through an upward wedge, bitcoin executed a decisive breakout, shifting the market into a new, higher-value market phase. This powerful move has since led to an

TLong

Bitcoin Rejected Near $120K – Bears Wake Up!First of all, I have to say that Bitcoin’s movements over the last 12 days have been a bit difficult to trade , generally, the hardest market to make a profit in is the range market with a swing movement .

Bitcoin( BINANCE:BTCUSDT ) is currently trading near the Resistance zone($121,000

6/ Altseason: Live - Is this really the Altseason?12day Result I know this is the exact question you're asking yourselves as you look at your portfolios. "What altseason? Everything is flat."

Maybe I was wrong two weeks ago when I said it had already started. But, as they say, the result speaks for itself.

12 days ago, as part of the Altseason Live challen

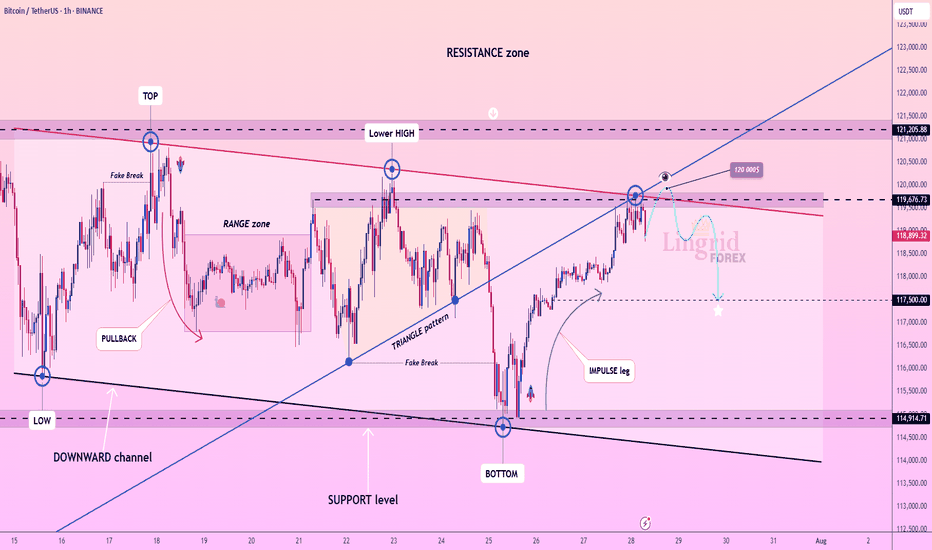

Lingrid | BTCUSDT Range-Bound Market: Short-Term Bearish MoveBINANCE:BTCUSDT has failed to break through the descending resistance near 120,000 and is now forming a lower high within the broader resistance zone. The price action follows an impulsive leg up and is currently tracing a potential reversal pattern under key structural resistance. As long as the m

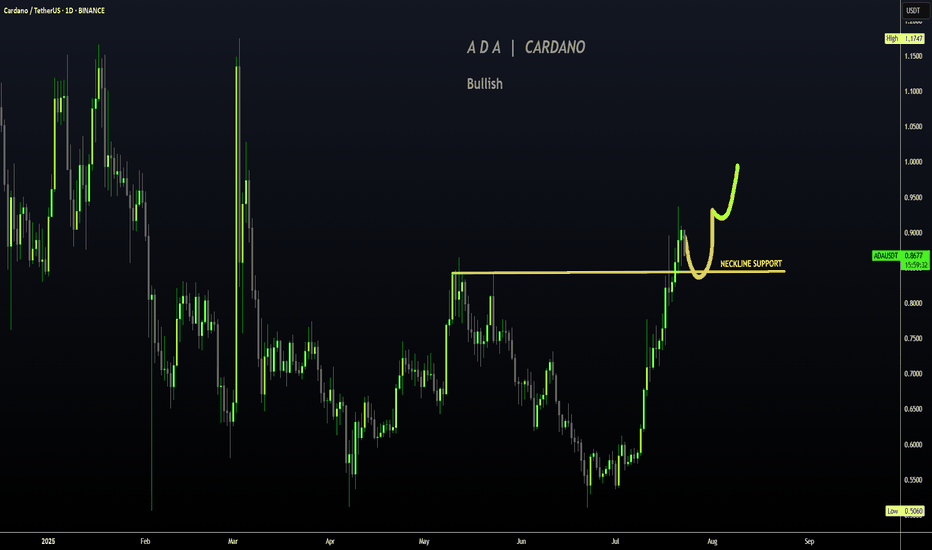

CARDANO | ADA Creeping UP to $1Cardano has made a big move in recent weeks, boasting a 77% increase.

If you were lucky enough to buy in around 30 or 40c, this may be a great TP zone:

Looking at the Technical Indicator (moving averages), we can see the price makes its parabolic increases ABOVE - which is exactly where we are c

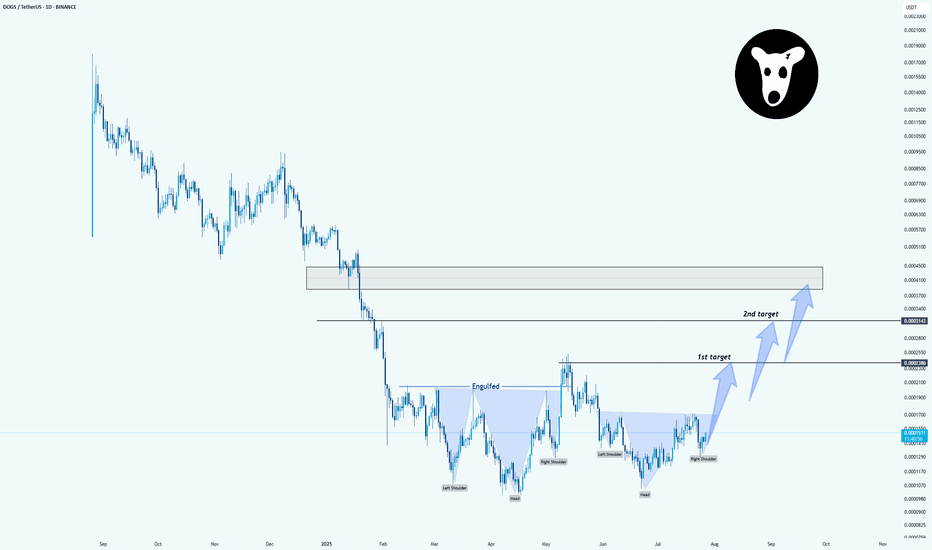

DOGSUSDT: Inverse Head & Shoulders Pattern in PlayHello.

The chart clearly shows an inverse head and shoulders formation. Price has now formed:

Left Shoulder

Head

Right Shoulder (recently completed)

The neckline was engulfed after a strong move, which adds confidence to the breakout potential. If the price continues to hold above the right shoul

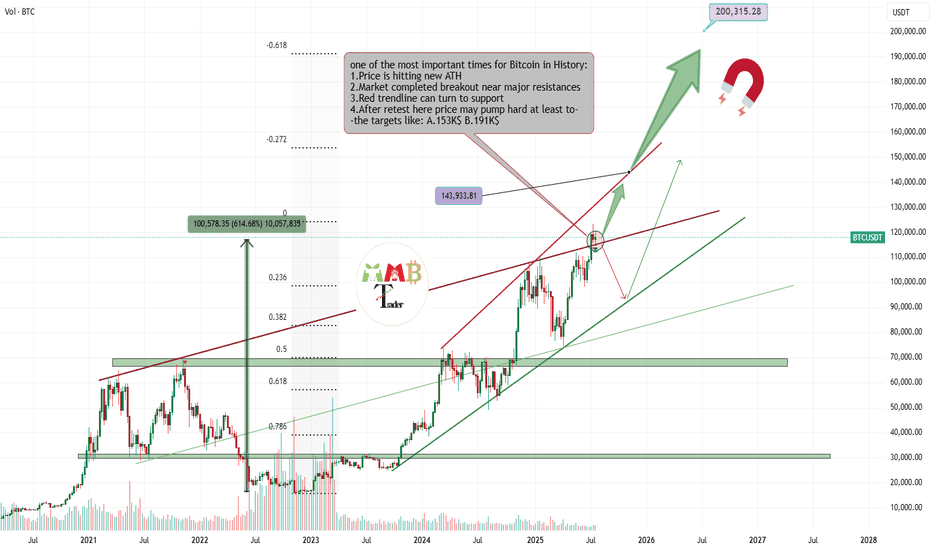

Bitcoin is getting Ready for 143K$ nowMajor red resistance trendline is now broken also last week the retest is completed now price is range for a while for new week to start and fresh volume and buys that make path easier to reach above 140K$.

Get ready and take a look at important zones at chart and possible scenarios which are all m

See all crypto ideas

News didn't load

Looks like that didn't go very well. Let's try again.

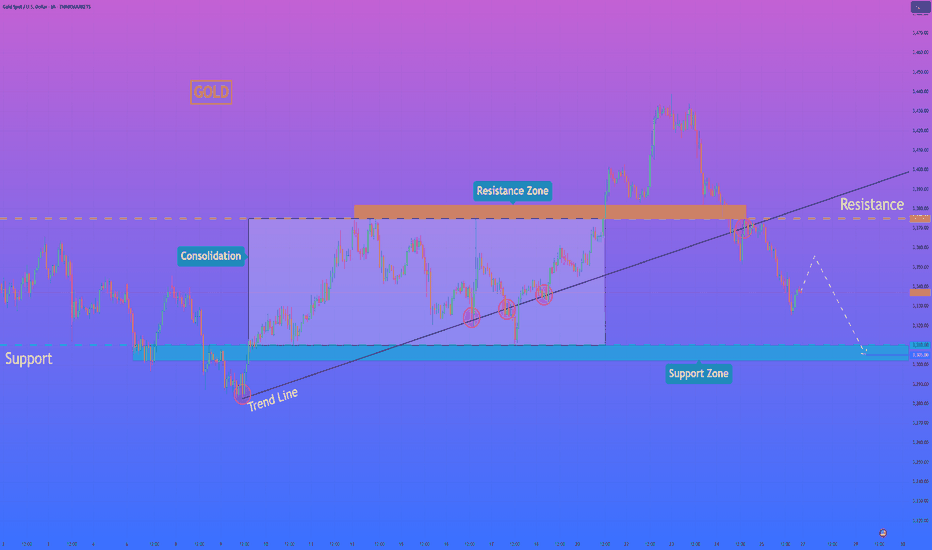

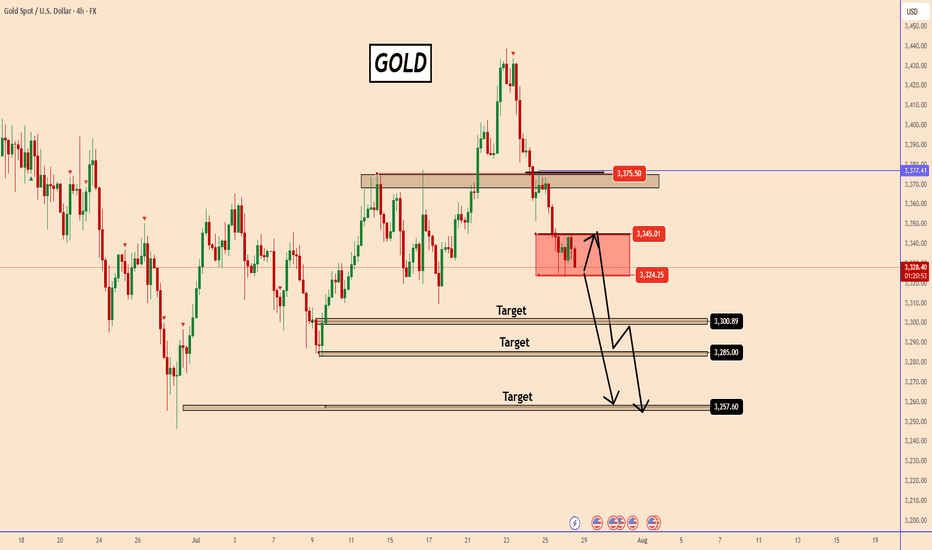

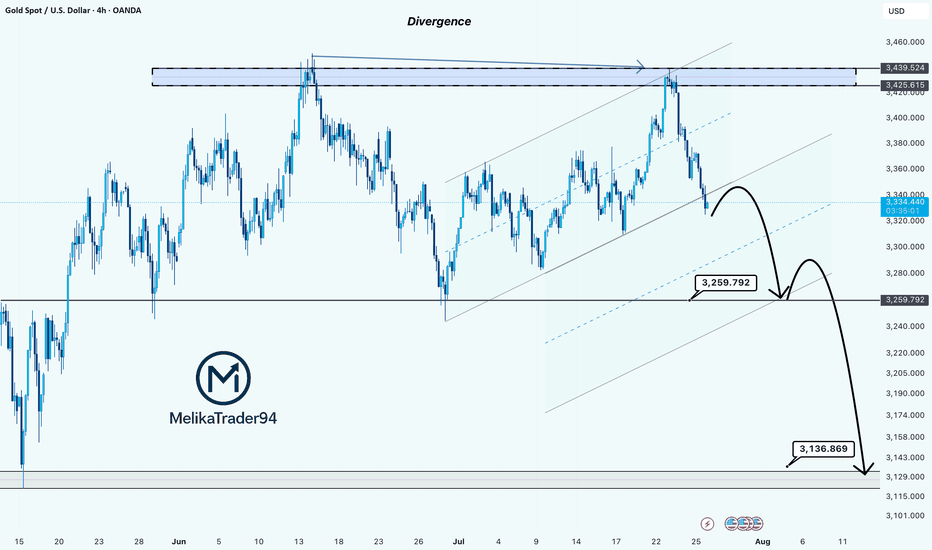

HelenP. I Gold can continue to decline to support zoneHi folks today I'm prepared for you Gold analytics. If we look at the price chart, we can observe a significant shift in the market structure, highlighted by the recent decisive break of a long-standing ascending trend line. This event suggests that the previous bullish momentum has been exhausted a

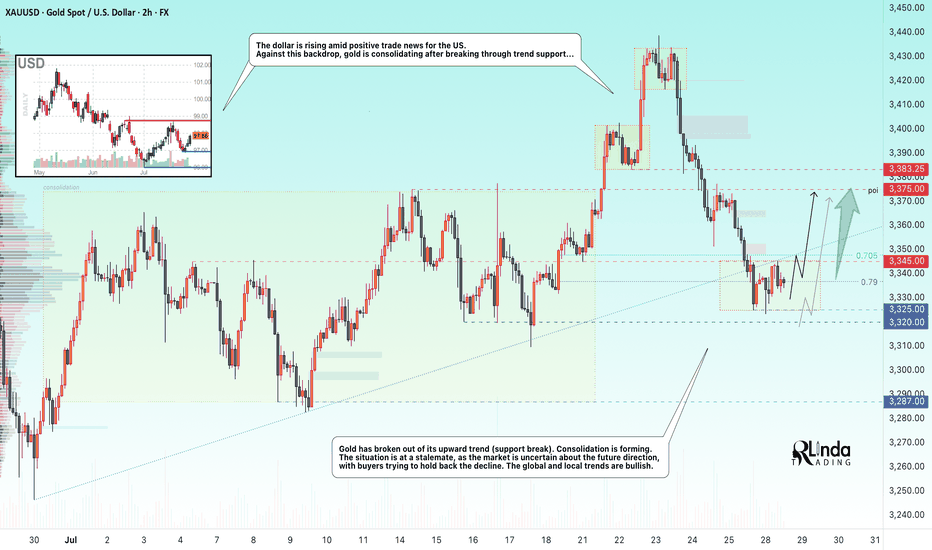

Lingrid | GOLD Weekly Market Outlook: Resistance Zone RejectionOANDA:XAUUSD markets have encountered significant resistance at the $3,450 level, resulting in a notable rejection and subsequent pullback toward support zones. The precious metal is now testing critical technical levels that will determine whether the broader bullish momentum can be sustained or i

OShort

Gold : Holding Ground Below 3345 Amid USD SurgeGold : Holding Ground Below 3345 Amid USD Surge

Gold's upward potential from Friday appears limited by the 3345 level—a narrow but firm resistance zone. As long as price fails to break above it, this zone has a high importance.

If gold holds below 3345, the probability of further downside increas

FShort

The correction is quite surprise. What direction for GOLD price?✏️Quite surprised with the adjustment of gold at the end of the previous trading week. The rising price channel is still holding around the lower border of the price channel around 3316. A liquidity sweep and candle wick removal in this area is considered a good buying opportunity.

If h1 closes bel

OLong

Hellena | GOLD (4H): LONG to resistance area of 3440 (Wave V).As you can see, everything turned out to be more complicated than I had previously thought. We are dealing with a complex correction and a diagonal. I believe that the “ABCDE” waves, which make up the corrective wave “4”, are completing their levels, and I continue to expect the upward movement to c

FLong

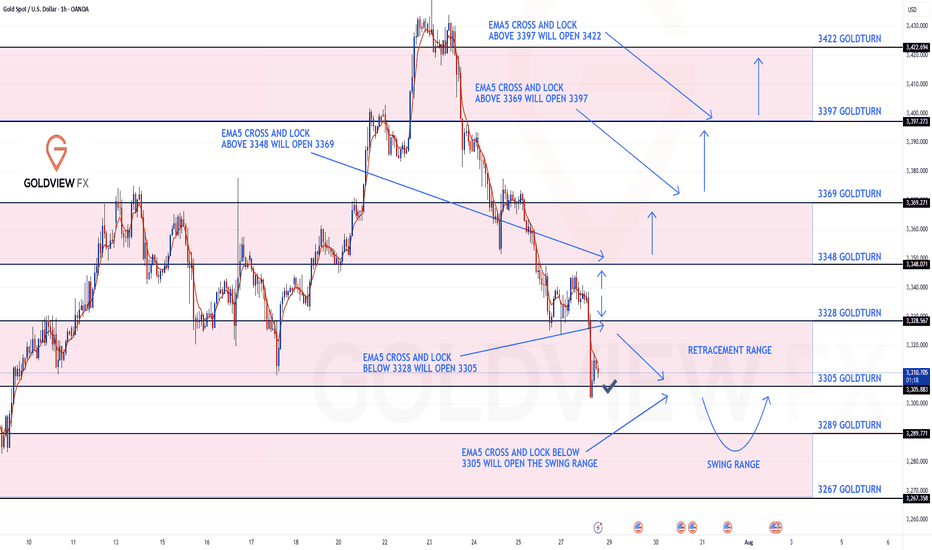

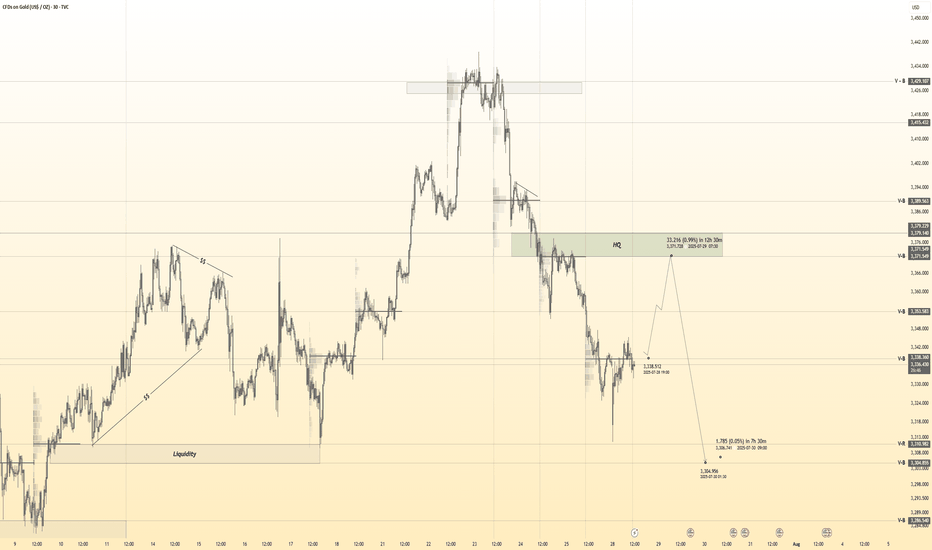

GOLD ROUTE MAP UPDATEHey Everyone,

Please see update on our 1H chart route map.

Gold continued its bearish momentum into today, hitting our bearish target at 3238, while leaving the 3348 bullish gap still open.

After a break below 3328, price followed through and hit 3305, entering our key retracement range, which ga

GOLD → Retest of trend support. Consolidation...GOLD is consolidating below the previously broken trend support. On Sunday, Trump announced a trade deal with the EU, which is putting pressure on the market along with the rising dollar...

Gold rebounded from support at $3310 after a week-long low, interrupting a three-day decline amid profit-ta

FLong

Gold Showing Signs of Reversal After Hitting Key ResistanceHello Guys.

Gold has reached a major resistance zone around 3439–3425, which has already acted as a strong ceiling in the past. The price tapped into this area again, forming a clear divergence, and failed to break higher.

Here’s what stands out:

Divergence signals a weakening bullish momentum

OShort

Title: WTI Crude Oil 2H – Bearish Rejection Setup with Downside The updated chart maintains the bearish channel structure, with price continuing to respect lower highs and lower lows.

Current Price: $66.413

Bearish Outlook Maintained:

Price has recently tested the mid-range of the descending channel.

A minor bullish retracement is anticipated into the green

Gold 30Min Engaged ( Bullish After Break Out Entry Detected )———

Time Frame: 30-Minute Warfare

Entry Protocol: Only after volume-verified breakout

🩸Bullish Break - 3339

➗ Hanzo Protocol: Volume-Tiered Entry Authority

➕ Zone Activated: Dynamic market pressure detected.

The level isn’t just price — it’s a memory of where they moved size.

Volume is rising ben

TLong

See all futures ideas

News didn't load

Looks like that didn't go very well. Let's try again.

GBPCAD At Support - High probability reversalGBPCAD descended with strength, and has now reached a strong support zone.

Price now hovers above and this zone and is a great indication to use for possible reversal move, that could send price into the 1.86100 level.

But if price breaks below support with momentum, then I’ll back off this bullish

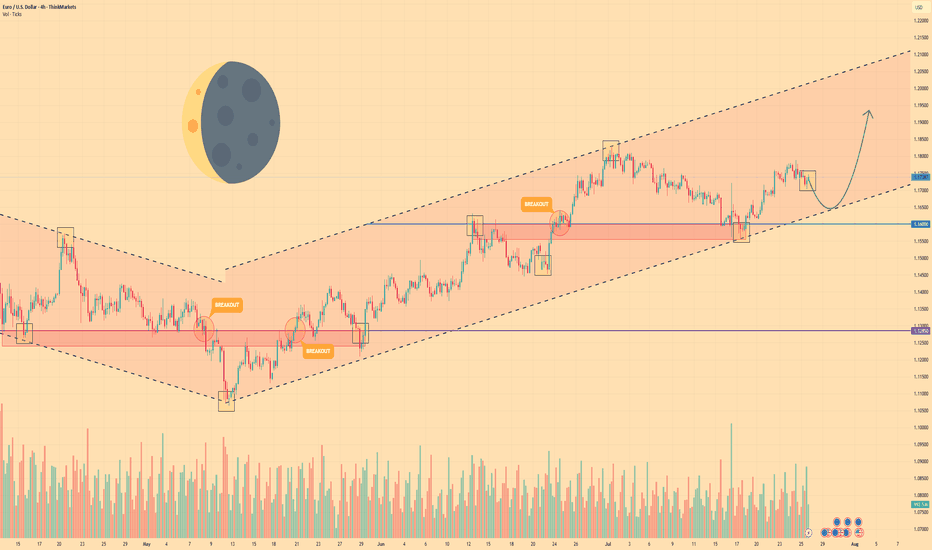

EURO - Price can continue to move up inside rising channelHi guys, this is my overview for EURUSD, feel free to check it and write your feedback in comments👊

The price action of price reversed its course after breaking out from a previous falling channel formation.

Since then, the asset has been trading within the clear boundaries of a well-defined risin

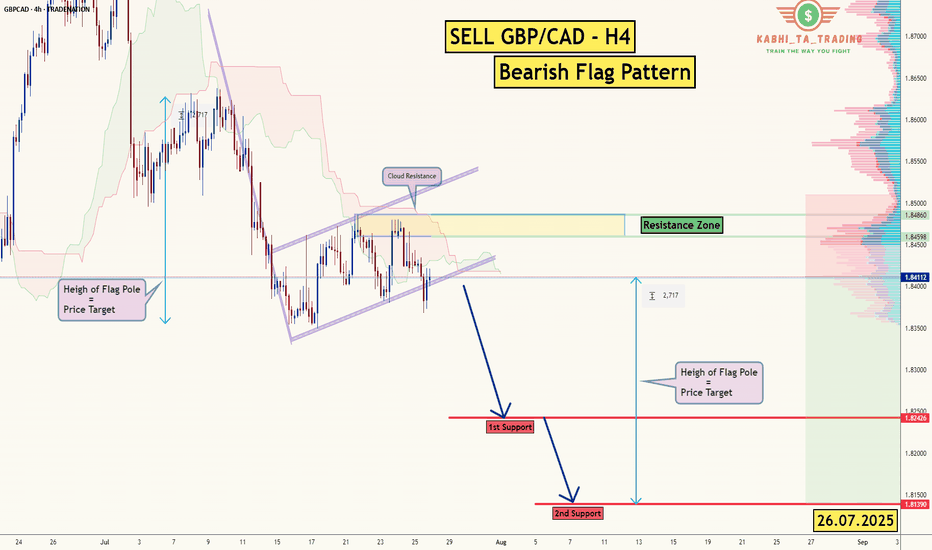

GBP/CAD - H4 - Bearish Flag (26.07.2025)The GBP/CAD Pair on the H4 timeframe presents a Potential Selling Opportunity due to a recent Formation of a Bearish Flag Pattern. This suggests a shift in momentum towards the downside in the coming Days.

Possible Short Trade:

Entry: Consider Entering A Short Position around Trendline Of The P

AUDCAD I Daily CLS I Model 2 I HTF DOL TargetYo Market Warriors ⚔️

Fresh Crypto Analysis— if you’ve been riding with me, you already know:

🎯My system is 100% mechanical. No emotions. No trend lines. No subjective guessing. Working all timeframes. Just precision, structure, and sniper entries.

🧠 What’s CLS?

It’s the real smart money. The i

GBPAUD transformed its chart quickly from bearish to bullish!GBPAUD transformed its chart quickly from bearish to bullish!

During the opening of the Market today, GBPAUD created a clear bearish breakout structure and later canceled that breakout.

From the chart we can see a false bearish breakout and GBPAUD is already positioned for a bullish move.

The b

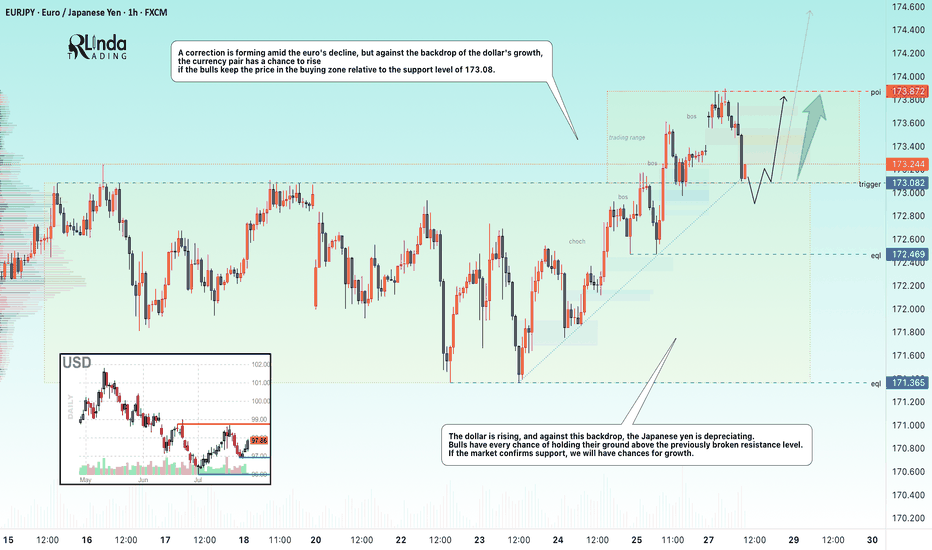

EURJPY → Retest support before growthFX:EURJPY has been correcting since the opening of the European session. The movement was triggered by yesterday's news related to the trade deal between the US and Europe...

EURJPY is reacting to news related to the deal between the US and Europe. A correction is forming amid the fall of the

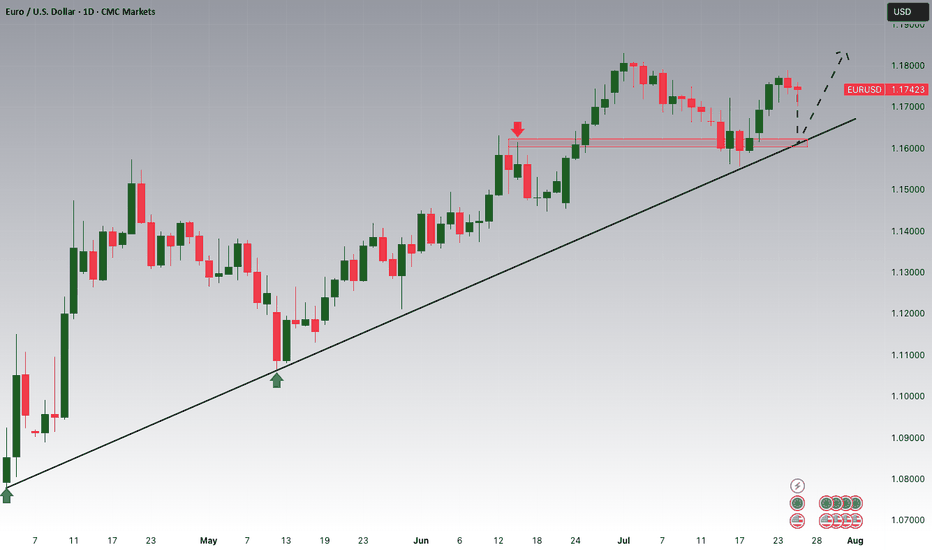

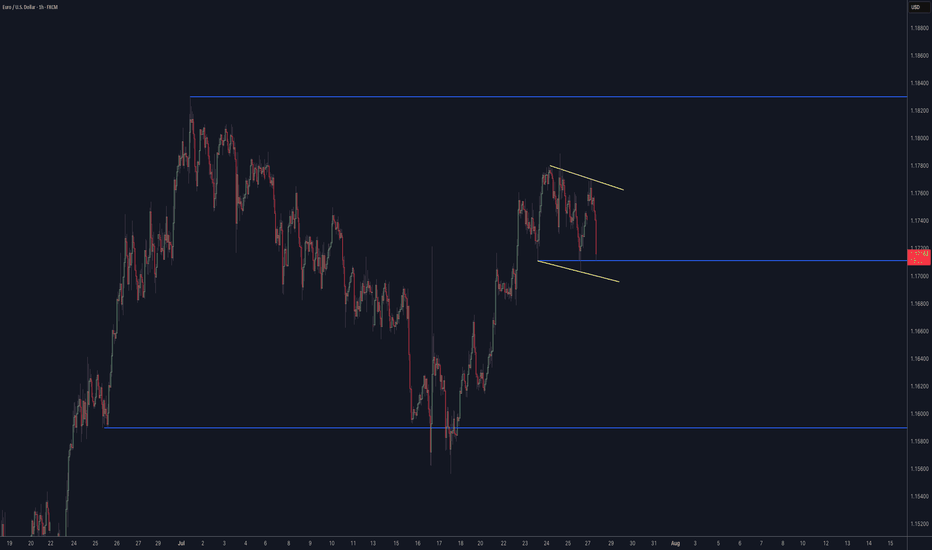

Lingrid | EURUSD Drops from 1.18000 RESISTANCE. Possible ShortFX:EURUSD is showing strong rejection at the resistance zone near 1.1790 after multiple fake breaks and failed attempts to sustain above the key level. Price has now broken below the mid-range and is forming a bearish rejection pattern right at the edge of the breakout area. With bearish momentum

See all forex ideas

| EUR | USD | GBP | JPY | AUD | CAD | |||

|---|---|---|---|---|---|---|---|---|

| EUR | - | - | - | - | - | - | - | |

| USD | - | - | - | - | - | - | - | |

| GBP | - | - | - | - | - | - | - | |

| JPY | - | - | - | - | - | - | - | |

| CHF | - | - | - | - | - | - | - | |

| AUD | - | - | - | - | - | - | - | |

| CNY | - | - | - | - | - | - | - | |

| CAD | - | - | - | - | - | - | - |

Trade directly on the supercharts through our supported, fully-verified and user-reviewed brokers.